5 Tips Arizona LLC

Understanding the Basics of Arizona LLC

Forming an Arizona Limited Liability Company (LLC) can be a straightforward process if you understand the basics. An LLC is a type of business structure that offers personal liability protection and tax benefits. In Arizona, you can form an LLC by filing the necessary documents with the state and following the required steps. It is essential to have a solid understanding of the Arizona LLC formation process to ensure that your business is set up correctly and compliant with state regulations.

Tip 1: Choose a Unique Business Name

When forming an Arizona LLC, it is crucial to choose a unique business name that complies with state regulations. Your business name must include the phrase “Limited Liability Company” or the abbreviation “LLC” or “L.L.C.” You can check the availability of your desired business name by searching the Arizona Corporation Commission’s database. Make sure to choose a name that is easy to remember, easy to spell, and reflects your brand identity.

Tip 2: Appoint a Statutory Agent

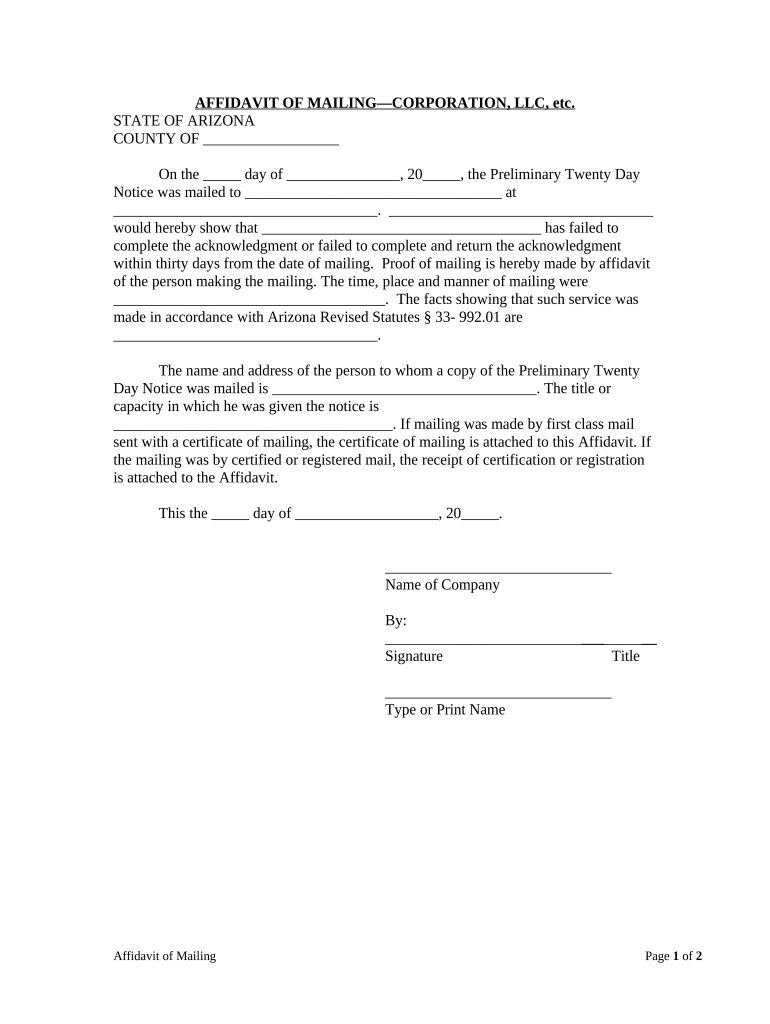

In Arizona, every LLC must appoint a statutory agent, also known as a registered agent. A statutory agent is an individual or business that receives important documents and notices on behalf of your LLC. You can appoint yourself, a friend, or a family member as your statutory agent, or you can hire a professional registered agent service. Make sure to choose a statutory agent who is reliable and can receive documents during business hours.

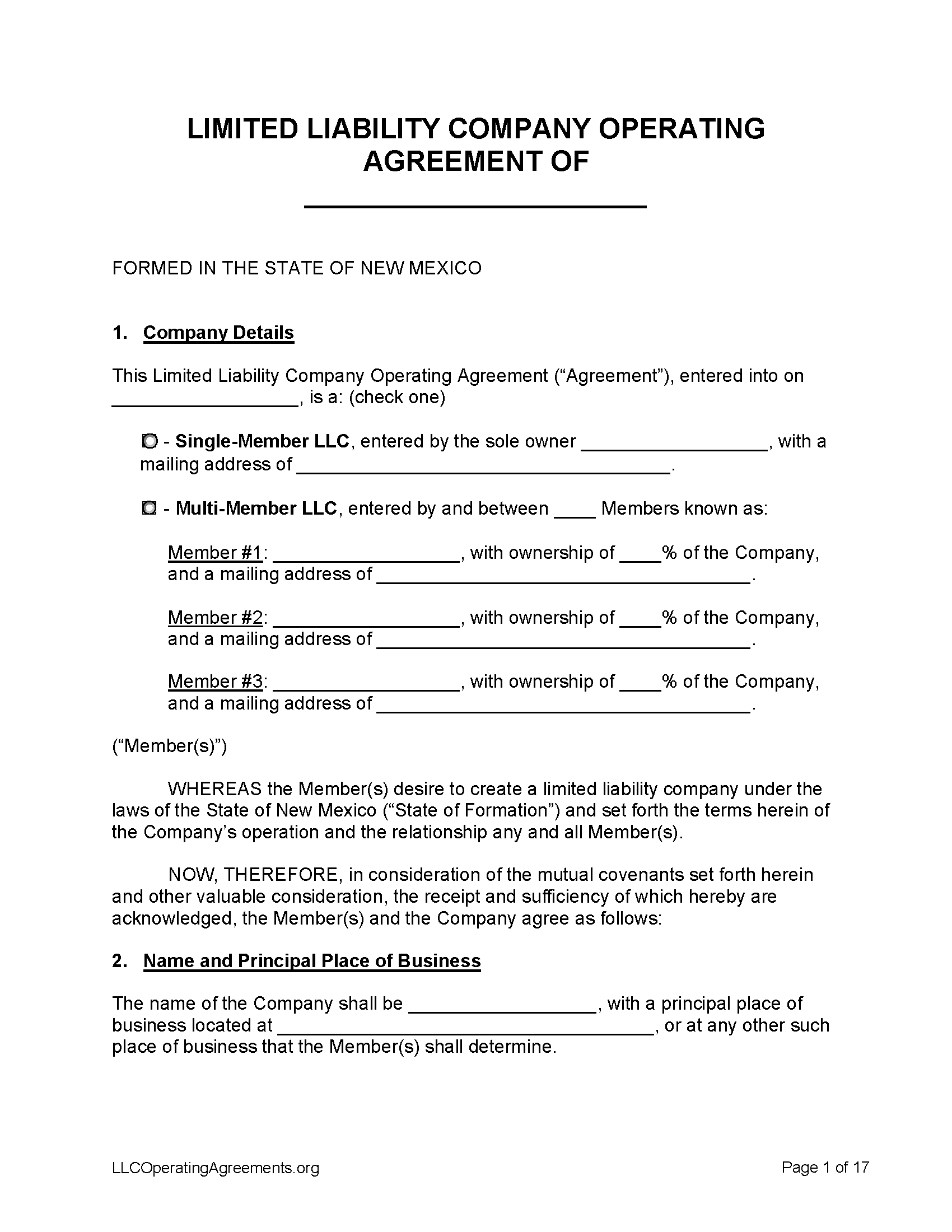

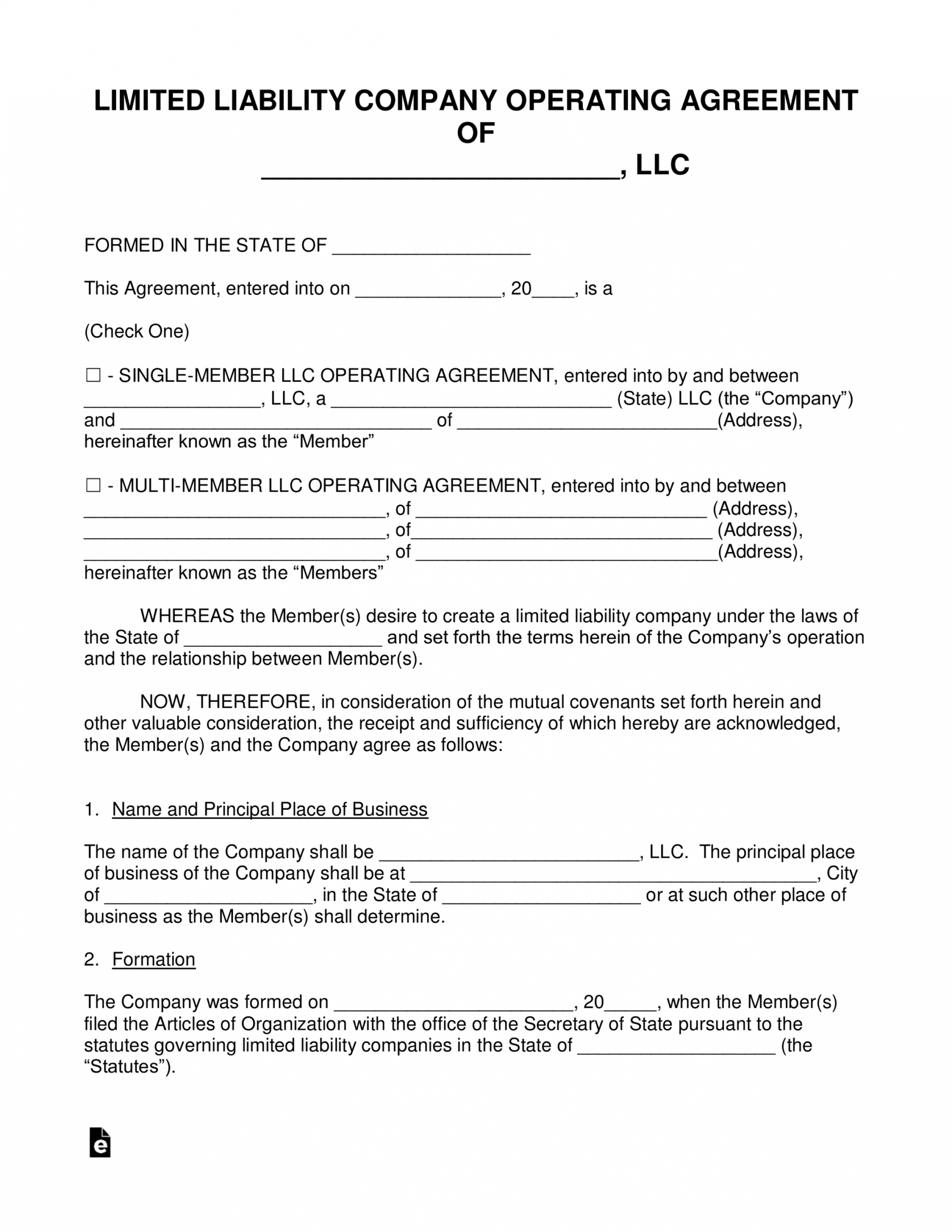

Tip 3: File Articles of Organization

To form an Arizona LLC, you must file Articles of Organization with the Arizona Corporation Commission. The Articles of Organization must include the following information: * Your business name and address * The name and address of your statutory agent * The purpose of your LLC * The management structure of your LLC You can file the Articles of Organization online or by mail, and you must pay the required filing fee.

Tip 4: Obtain Necessary Licenses and Permits

Depending on the type of business you operate, you may need to obtain necessary licenses and permits to operate in Arizona. You can check with the Arizona Department of Revenue to determine if you need to obtain any licenses or permits. Some common licenses and permits required in Arizona include: * Sales tax license * Employer identification number (EIN) * Business license * Professional license (if applicable)

Tip 5: Maintain Compliance with Arizona Regulations

To maintain compliance with Arizona regulations, you must file annual reports and maintain accurate records. You must file an annual report with the Arizona Corporation Commission, which includes information about your business, such as your business name, address, and management structure. You must also maintain accurate records, including financial statements, meeting minutes, and other important documents.

📝 Note: It is essential to maintain compliance with Arizona regulations to avoid penalties and fines.

In summary, forming an Arizona LLC requires careful planning and attention to detail. By following these 5 tips, you can ensure that your business is set up correctly and compliant with state regulations. Remember to choose a unique business name, appoint a statutory agent, file Articles of Organization, obtain necessary licenses and permits, and maintain compliance with Arizona regulations. By following these steps, you can establish a successful and compliant Arizona LLC.

What is the cost of forming an Arizona LLC?

+

The cost of forming an Arizona LLC varies depending on the type of business and the services you need. The filing fee for Articles of Organization is $50, and you may need to pay additional fees for licenses and permits.

How long does it take to form an Arizona LLC?

+

The processing time for forming an Arizona LLC varies depending on the method of filing. If you file online, your LLC can be approved in as little as 2-3 business days. If you file by mail, it can take up to 2-3 weeks.

Do I need to obtain an EIN for my Arizona LLC?

+

Yes, you need to obtain an EIN (Employer Identification Number) for your Arizona LLC if you plan to hire employees or open a business bank account. You can apply for an EIN online through the IRS website.