Filling Out Bankruptcy Paperwork

Introduction to Bankruptcy Paperwork

When individuals or businesses are facing financial difficulties, bankruptcy can be a viable option to consider. However, the process of filing for bankruptcy involves a significant amount of paperwork, which can be overwhelming for those who are not familiar with the legal and financial terminology used. The primary goal of this post is to guide readers through the process of filling out bankruptcy paperwork and to provide them with the necessary information to make informed decisions about their financial situation.

Understanding the Types of Bankruptcy

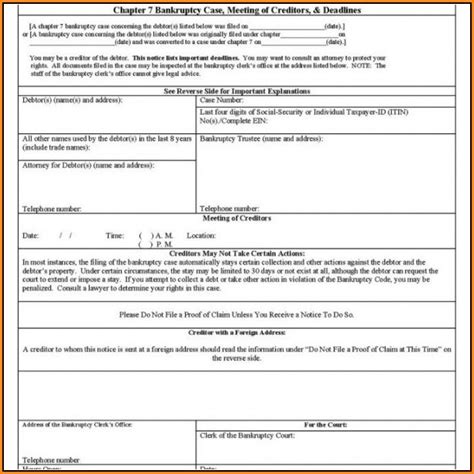

Before diving into the paperwork, it’s essential to understand the different types of bankruptcy that are available. The most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time. Businesses, on the other hand, may file for Chapter 11 bankruptcy, which allows them to restructure their debts and continue operating.

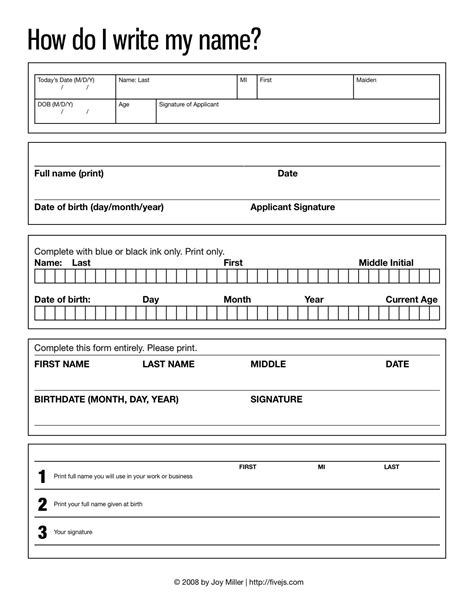

Gathering Necessary Documents

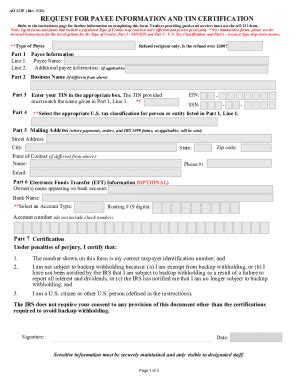

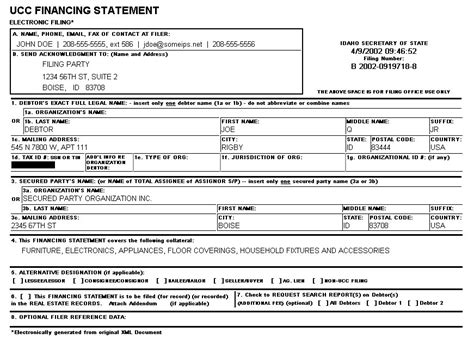

To fill out bankruptcy paperwork, individuals and businesses will need to gather a variety of documents, including:

- Financial records: This includes income statements, balance sheets, and tax returns.

- Debt information: This includes a list of creditors, the amount of debt owed, and the interest rates on each debt.

- Asset information: This includes a list of assets, such as property, vehicles, and investments.

- Expense information: This includes a list of monthly expenses, such as rent, utilities, and food.

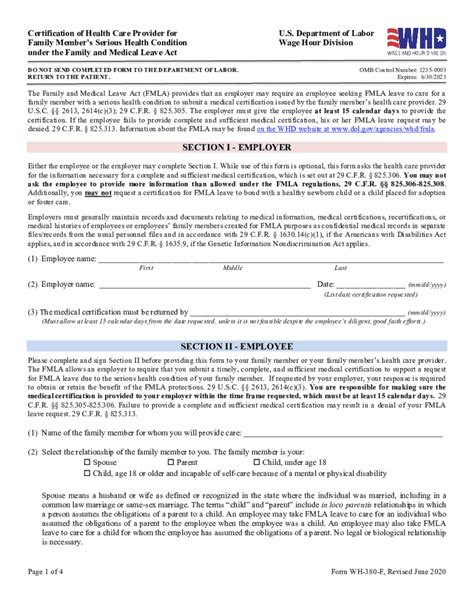

Filling Out Bankruptcy Forms

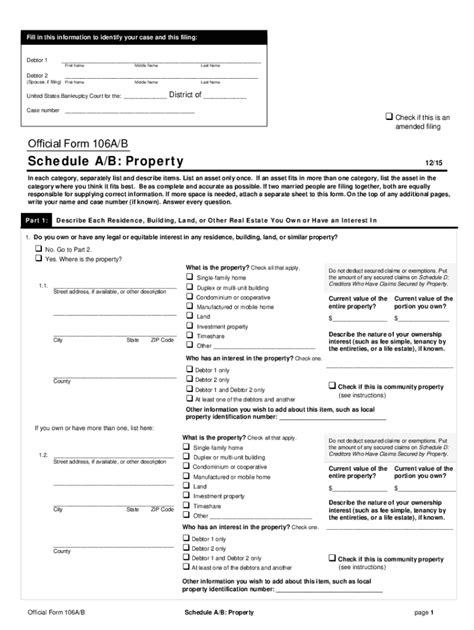

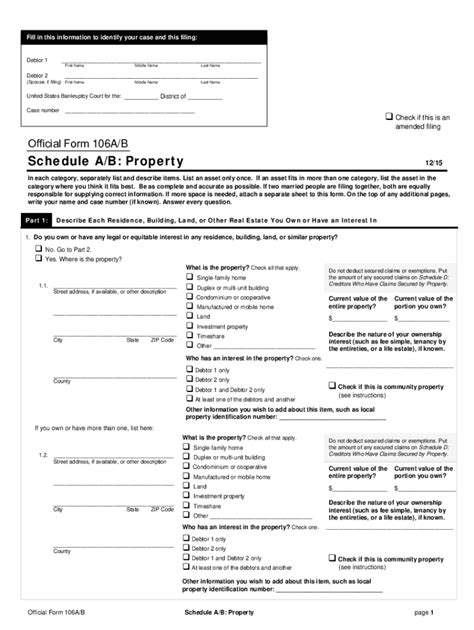

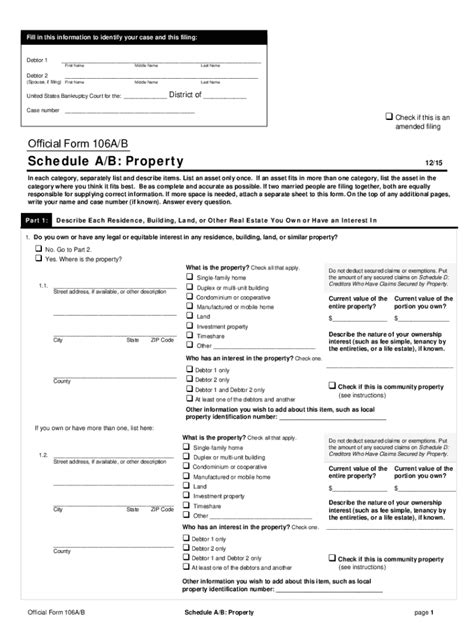

The bankruptcy forms themselves can be complex and time-consuming to fill out. The forms will require individuals and businesses to provide detailed information about their financial situation, including their income, expenses, assets, and debts. Some of the most common bankruptcy forms include:

- Voluntary Petition: This form is used to initiate the bankruptcy process and provides an overview of the individual’s or business’s financial situation.

- Schedules A-J: These forms provide detailed information about the individual’s or business’s assets, liabilities, and financial transactions.

- Statement of Financial Affairs: This form provides information about the individual’s or business’s financial transactions, including income, expenses, and debt payments.

Seeking Professional Help

Given the complexity of the bankruptcy process, it’s often recommended that individuals and businesses seek the help of a bankruptcy attorney. A bankruptcy attorney can provide guidance on the different types of bankruptcy, help with filling out the necessary paperwork, and represent the individual or business in court.

| Type of Bankruptcy | Description |

|---|---|

| Chapter 7 | Liquidation of assets to pay off debts |

| Chapter 13 | Creation of a repayment plan to pay off debts over time |

| Chapter 11 | Restructuring of debts and continuation of business operations |

📝 Note: It's essential to carefully review and understand the bankruptcy forms before submitting them to the court. Inaccurate or incomplete information can lead to delays or even dismissal of the bankruptcy case.

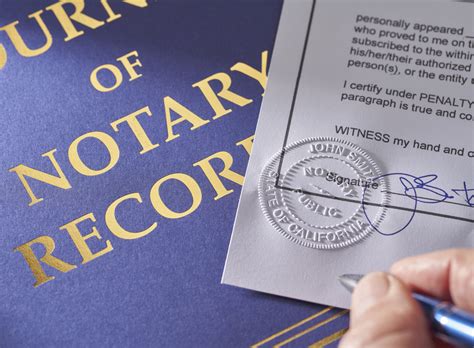

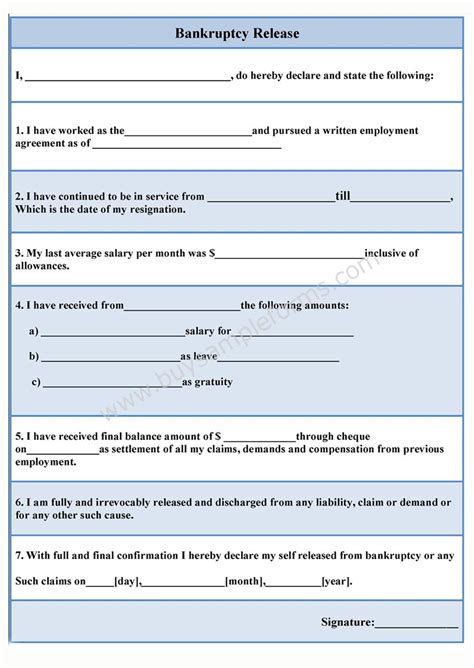

Finalizing the Bankruptcy Paperwork

Once the bankruptcy paperwork has been completed, it must be submitted to the court. The court will review the paperwork and may request additional information or documentation. If the paperwork is in order, the court will issue a discharge, which releases the individual or business from their debts.

In the end, filling out bankruptcy paperwork requires careful attention to detail and a thorough understanding of the bankruptcy process. By seeking the help of a bankruptcy attorney and carefully reviewing the necessary forms and documents, individuals and businesses can navigate the bankruptcy process and achieve a fresh financial start. The key is to be thorough, accurate, and informed throughout the process, ensuring that the paperwork is completed correctly and that the individual or business is well-represented in court. Ultimately, this will help to ensure a successful outcome and a brighter financial future.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time.

Do I need a bankruptcy attorney to file for bankruptcy?

+

While it’s not required to have a bankruptcy attorney, it’s highly recommended. A bankruptcy attorney can provide guidance on the different types of bankruptcy, help with filling out the necessary paperwork, and represent the individual or business in court.

How long does the bankruptcy process typically take?

+

The length of the bankruptcy process can vary depending on the type of bankruptcy and the complexity of the case. However, most bankruptcy cases are completed within 4-6 months.