Paperwork

Fill Out Escrow Paperwork Easily

Introduction to Escrow Paperwork

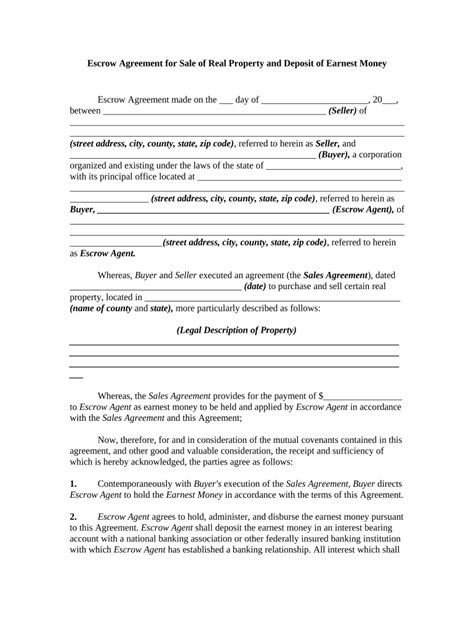

The process of filling out escrow paperwork can be a daunting task, especially for those who are new to the real estate industry. Escrow is a term that refers to a third-party service that holds funds or assets on behalf of two parties involved in a transaction. In the context of real estate, escrow is used to ensure that the buyer and seller fulfill their obligations before the transfer of ownership takes place. In this blog post, we will guide you through the process of filling out escrow paperwork easily and efficiently.

Understanding the Escrow Process

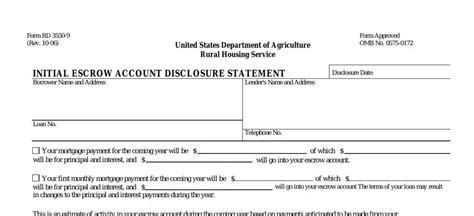

Before we dive into the paperwork, it’s essential to understand the escrow process. The escrow process typically begins when a buyer and seller agree on the terms of a real estate transaction. The buyer will deposit a portion of the purchase price into an escrow account, which is held by a third-party escrow company. The escrow company will then hold the funds until all conditions of the sale have been met, including the inspection, appraisal, and financing. Once all conditions have been satisfied, the escrow company will release the funds to the seller, and the transfer of ownership will take place.

Preparing for Escrow Paperwork

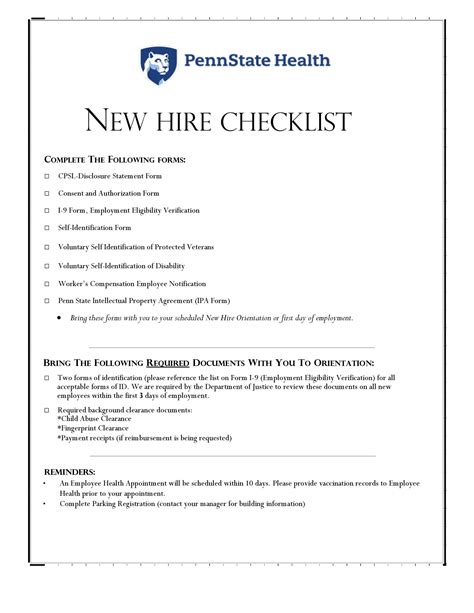

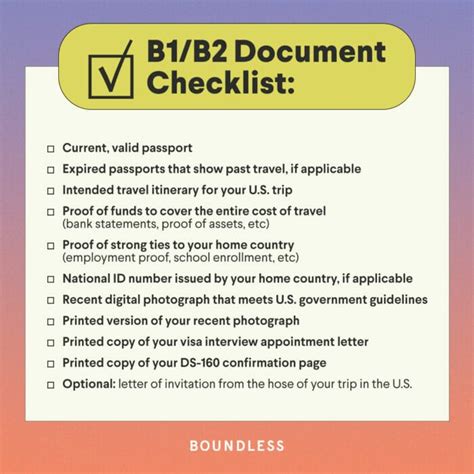

To fill out escrow paperwork easily, it’s crucial to be prepared. Here are some steps you can take to ensure a smooth process: * Gather all necessary documents, including identification, proof of income, and proof of funds. * Review the purchase agreement and ensure you understand all the terms and conditions. * Research the escrow company and their fees to avoid any surprises. * Prepare a list of questions to ask the escrow officer to ensure you understand the process.

Filling Out Escrow Paperwork

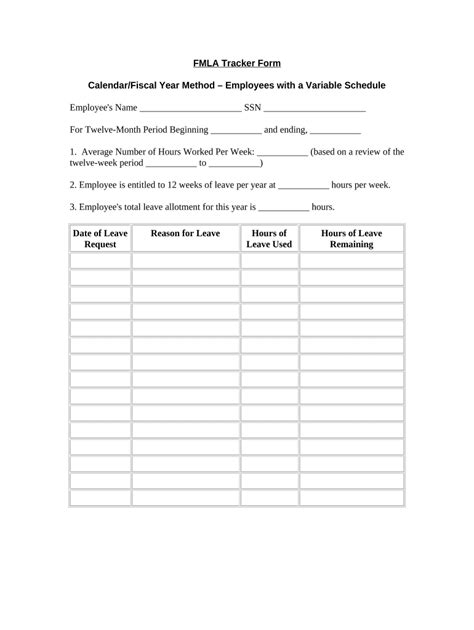

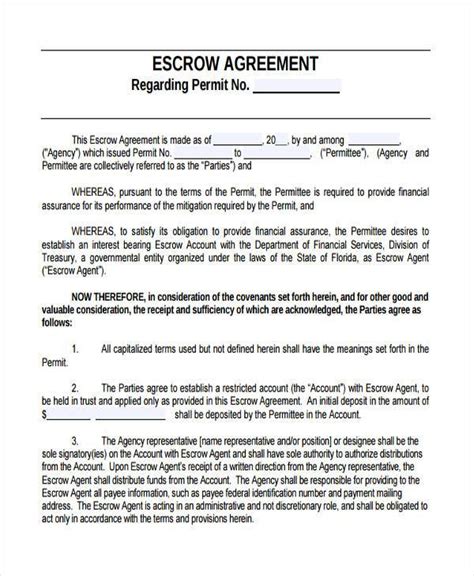

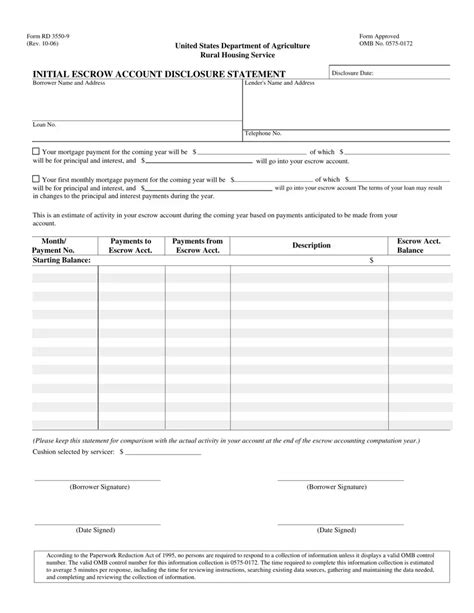

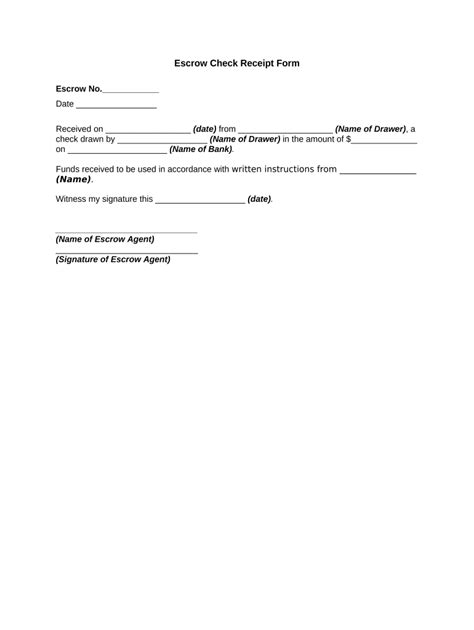

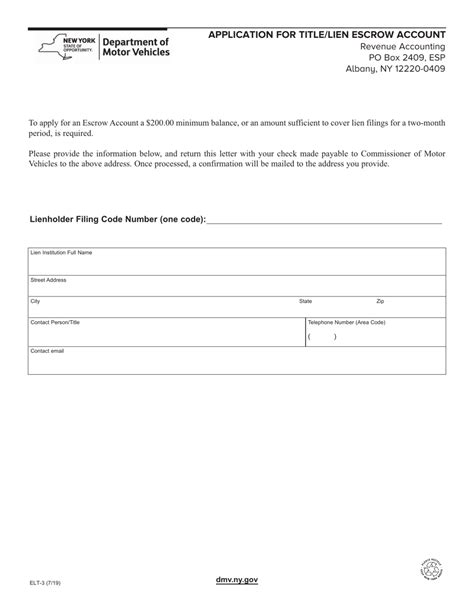

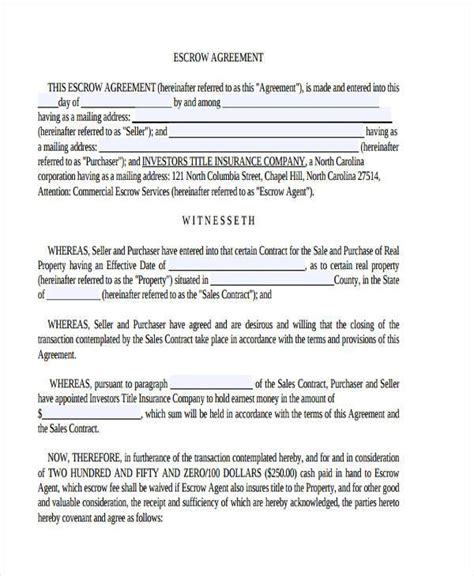

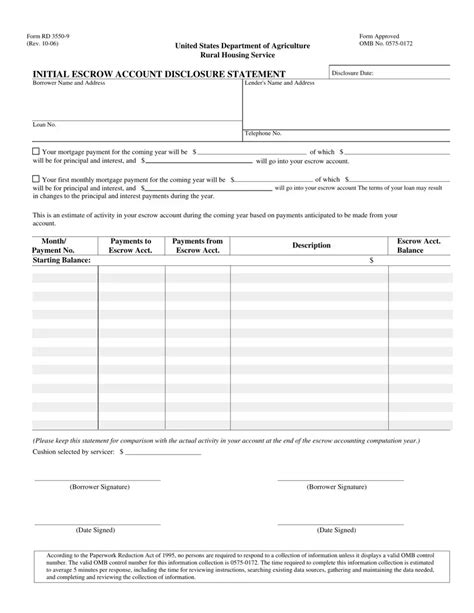

The escrow paperwork typically includes several documents, such as: * Escrow instructions: This document outlines the terms of the escrow agreement, including the amount of funds to be held, the conditions for release, and the parties involved. * Deposit receipt: This document acknowledges the deposit of funds into the escrow account. * Title report: This document provides information on the ownership of the property and any liens or encumbrances. * Insurance documents: These documents provide information on the insurance coverage for the property. To fill out the paperwork easily, follow these tips: * Read the documents carefully and ask questions if you’re unsure about anything. * Fill out the documents accurately and completely to avoid delays. * Use a checklist to ensure you’ve completed all the necessary documents.

Common Mistakes to Avoid

When filling out escrow paperwork, there are several common mistakes to avoid: * Inaccurate information: Ensure that all information is accurate and complete to avoid delays or disputes. * Missing documents: Ensure that all necessary documents are included to avoid delays or penalties. * Insufficient funds: Ensure that sufficient funds are deposited into the escrow account to avoid delays or penalties. To avoid these mistakes, it’s essential to: * Double-check all information for accuracy and completeness. * Use a checklist to ensure all necessary documents are included. * Verify that sufficient funds are deposited into the escrow account.

Benefits of Using an Escrow Service

Using an escrow service can provide several benefits, including: * Protection for both the buyer and seller. * Convenience and efficiency in the transaction process. * Reduced risk of disputes or delays. To get the most out of an escrow service, it’s essential to: * Research the escrow company and their fees. * Understand the terms and conditions of the escrow agreement. * Communicate clearly with the escrow officer to ensure a smooth process.

📝 Note: It's essential to understand the terms and conditions of the escrow agreement to avoid any disputes or delays.

Conclusion and Next Steps

In conclusion, filling out escrow paperwork can be a complex process, but with the right preparation and understanding, it can be done easily and efficiently. By following the tips and guidelines outlined in this blog post, you can ensure a smooth and successful transaction. Remember to stay organized, communicate clearly with the escrow officer, and don’t hesitate to ask questions if you’re unsure about anything. With the right approach, you can navigate the escrow process with confidence and achieve your goals.

What is the purpose of an escrow service?

+

The purpose of an escrow service is to hold funds or assets on behalf of two parties involved in a transaction, ensuring that both parties fulfill their obligations before the transfer of ownership takes place.

What documents are typically included in escrow paperwork?

+

The documents typically included in escrow paperwork are escrow instructions, deposit receipt, title report, and insurance documents.

How can I avoid common mistakes when filling out escrow paperwork?

+

To avoid common mistakes, ensure that all information is accurate and complete, use a checklist to ensure all necessary documents are included, and verify that sufficient funds are deposited into the escrow account.