Fill Out Estate Paperwork Easily

Understanding the Process of Estate Paperwork

Estate planning is a crucial aspect of managing one’s assets and ensuring that wishes are respected after passing away. It involves creating a set of documents that outline how properties, possessions, and other assets should be distributed among beneficiaries. The process can seem daunting, especially when dealing with legal terminology and complex procedures. However, with the right guidance, filling out estate paperwork can be easier and less overwhelming.

Key Documents in Estate Planning

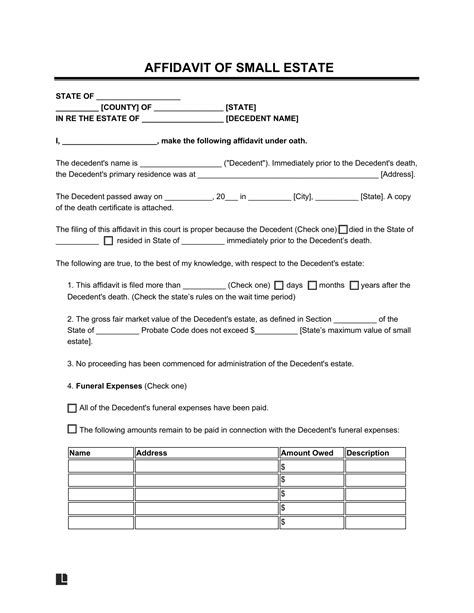

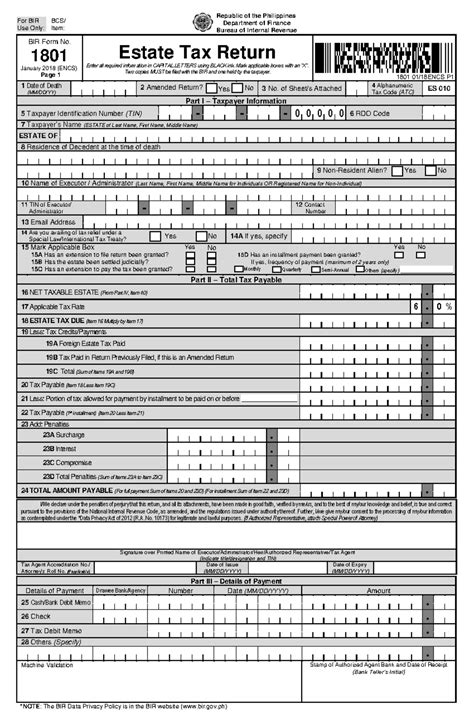

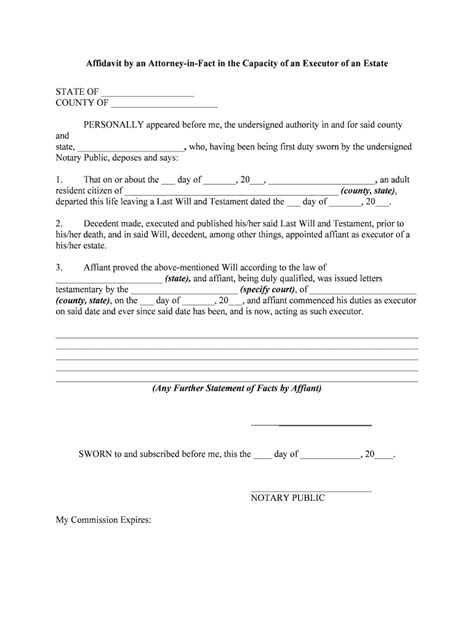

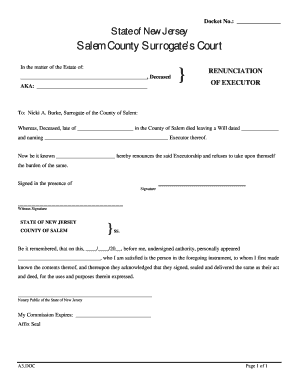

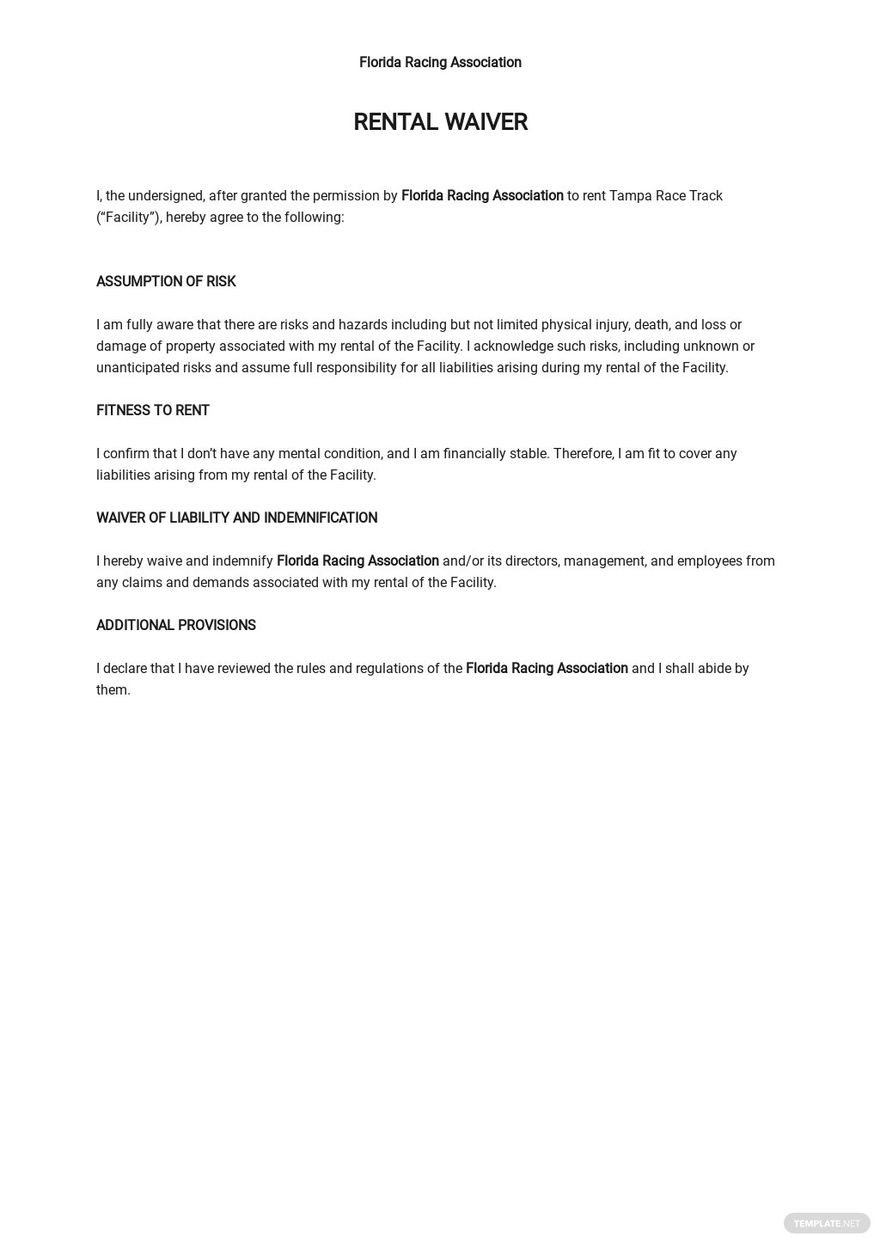

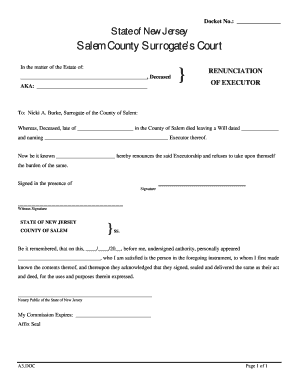

Several documents are essential in estate planning, each serving a specific purpose: * Last Will and Testament: This document specifies how assets should be distributed after death. It also names an executor who will manage the estate and ensure that the deceased’s wishes are carried out. * Power of Attorney: This grants someone the authority to make financial and legal decisions on behalf of the grantor if they become incapacitated. * Living Trust: A living trust allows assets to be transferred into a trust during the grantor’s lifetime, avoiding probate and ensuring that assets are distributed according to the grantor’s wishes. * Advance Directives: These documents, including living wills and healthcare proxies, outline medical treatment preferences and name someone to make medical decisions if the individual becomes unable to do so.

Steps to Fill Out Estate Paperwork

Filling out estate paperwork involves several steps: 1. Gather Information: Before starting, gather all necessary information, including asset details, beneficiary information, and the names of executors or trustees. 2. Choose the Right Forms: Select the appropriate forms for your estate planning needs. This may include wills, trusts, powers of attorney, and advance directives. 3. Fill Out Forms Carefully: Complete each form accurately and thoroughly. Ensure that all sections are filled out, and signatures are witnessed as required. 4. Review and Update: Regularly review estate documents to ensure they remain current and reflective of any changes in assets, beneficiaries, or wishes.

📝 Note: It's essential to have estate documents reviewed by an attorney to ensure they are legally binding and meet state requirements.

Benefits of Proper Estate Planning

Proper estate planning offers numerous benefits, including: * Avoiding Probate: By transferring assets into a trust, individuals can avoid the lengthy and costly probate process. * Reducing Taxes: Estate planning strategies can help minimize tax liabilities, ensuring more assets are preserved for beneficiaries. * Ensuring Wishes are Respected: Clear documentation of wishes ensures that assets are distributed as intended, reducing the potential for disputes among beneficiaries. * Providing Peace of Mind: Knowing that estate planning is in order can provide peace of mind, both for the individual and their loved ones.

Common Mistakes in Estate Planning

Several common mistakes can complicate the estate planning process: * Not Updating Documents: Failure to update estate documents after significant life changes, such as divorce or the birth of a child, can lead to outdated and potentially invalid documents. * Not Funding Trusts: Forgetting to transfer assets into a trust can render the trust ineffective, leading to probate and other complications. * Not Naming Beneficiaries: Failing to name beneficiaries or not keeping beneficiary designations up to date can result in assets being distributed according to state law rather than the individual’s wishes.

| Document | Purpose |

|---|---|

| Last Will and Testament | Specifies asset distribution and names an executor |

| Power of Attorney | Grants authority for financial and legal decisions |

| Living Trust | Transfers assets to avoid probate and ensure distribution according to wishes |

| Advance Directives | Outlines medical treatment preferences and names a healthcare proxy |

As the process of estate planning and filling out the necessary paperwork comes to a close, it’s clear that while it may seem complex, it is a crucial step in ensuring that one’s wishes are respected and that loved ones are protected. By understanding the key documents involved, following the steps to fill out estate paperwork carefully, and avoiding common mistakes, individuals can navigate this process with confidence. Ultimately, the peace of mind that comes from knowing one’s estate is in order is invaluable, making the effort well worth it.

What is the purpose of a Last Will and Testament?

+

The Last Will and Testament specifies how assets should be distributed after death and names an executor to manage the estate.

Why is it important to update estate documents regularly?

+

Updating estate documents ensures they remain current and reflective of any changes in assets, beneficiaries, or wishes, preventing potential disputes and complications.

What are the benefits of avoiding probate through estate planning?

+

Avoiding probate saves time and money, as it eliminates the need for court oversight and associated fees, ensuring more assets are preserved for beneficiaries.