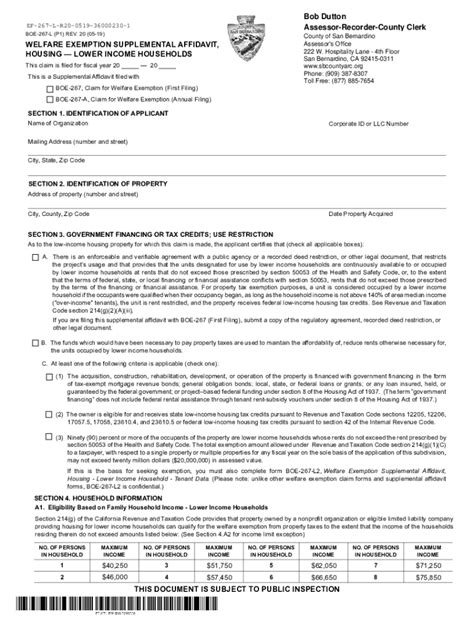

San Bernardino Homestead Exemption Form

Introduction to San Bernardino Homestead Exemption

The San Bernardino homestead exemption is a legal provision designed to protect homeowners in San Bernardino, California, from losing their homes to creditors in the event of bankruptcy or other financial difficulties. This exemption allows homeowners to declare a certain portion of their home’s value as exempt from creditors, ensuring they have a place to live. Understanding and properly filing for the homestead exemption can be crucial for individuals facing financial hardships.

Benefits of the Homestead Exemption

The primary benefit of the homestead exemption is that it safeguards a portion of the home’s value from creditors, thus providing homeowners with a level of financial security. This can be particularly beneficial in situations where individuals are facing debt collectors or are considering filing for bankruptcy. By exempting a portion of the home’s equity, homeowners can retain their residence and have a foundation for rebuilding their financial stability.

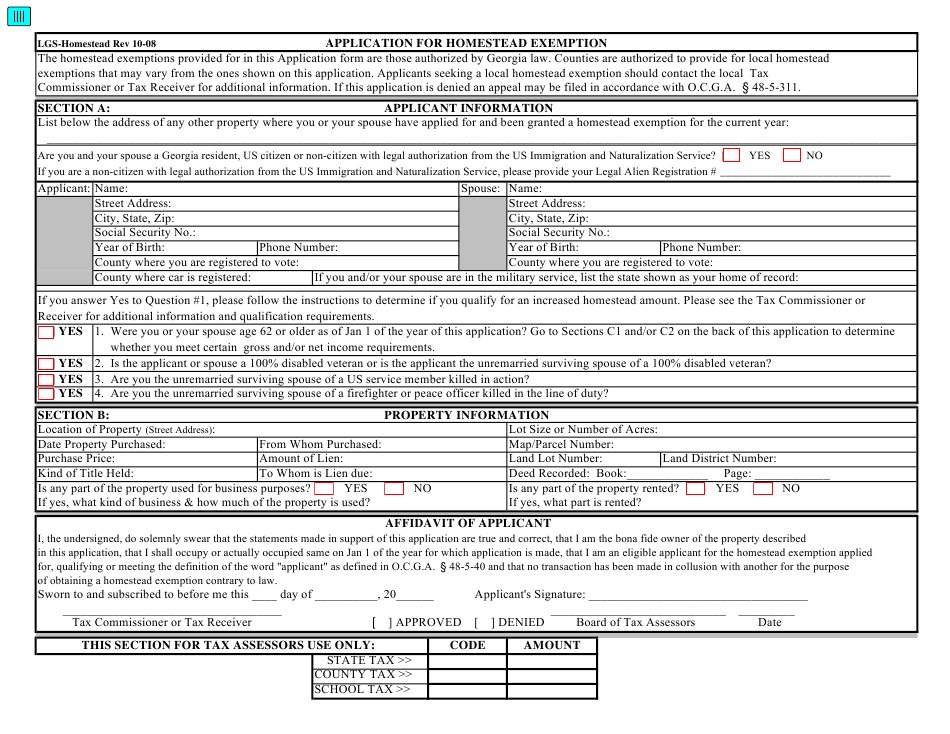

Eligibility and Requirements

To be eligible for the San Bernardino homestead exemption, individuals must meet specific requirements. These typically include: - Ownership: The individual must own the home. - Residency: The home must be the individual’s primary residence. - Filing: The homeowner must file the homestead exemption form with the appropriate county office. - Timing: The exemption must be filed before any creditor action against the property.

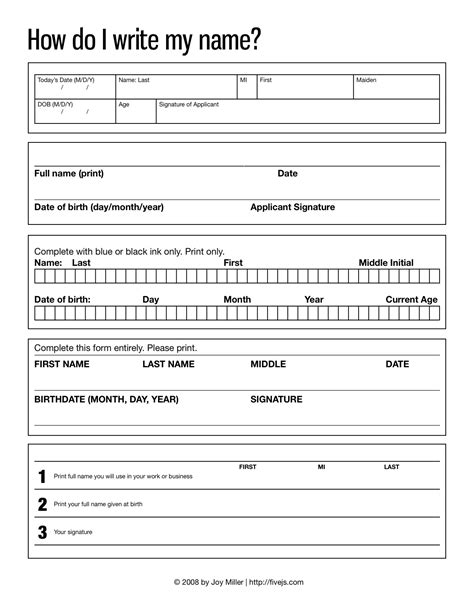

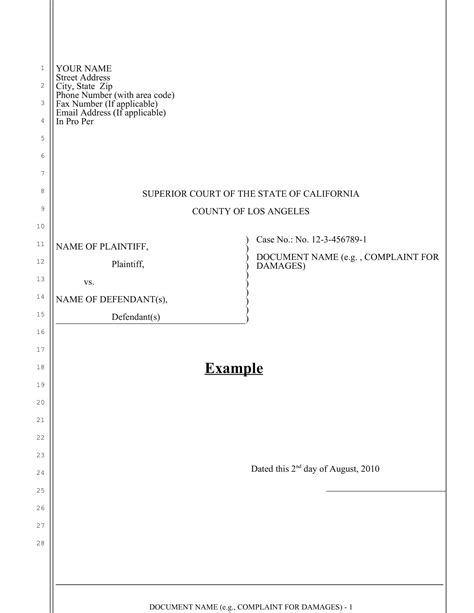

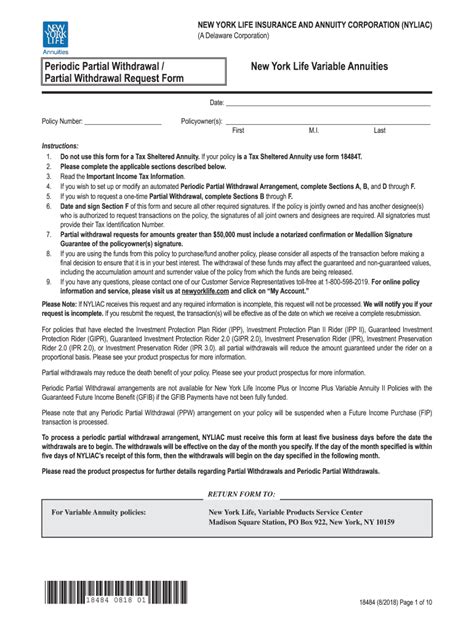

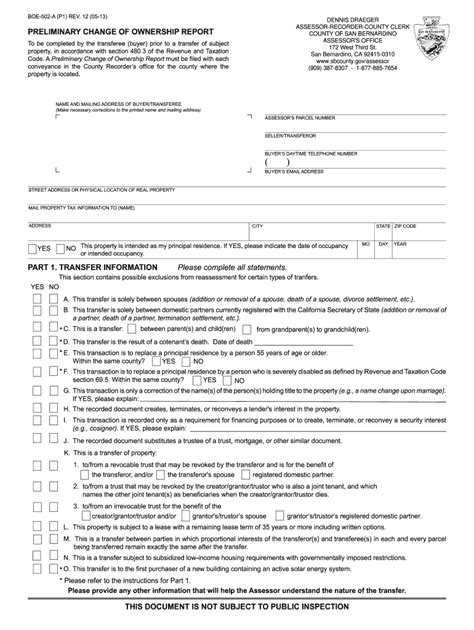

Steps to File for Homestead Exemption in San Bernardino

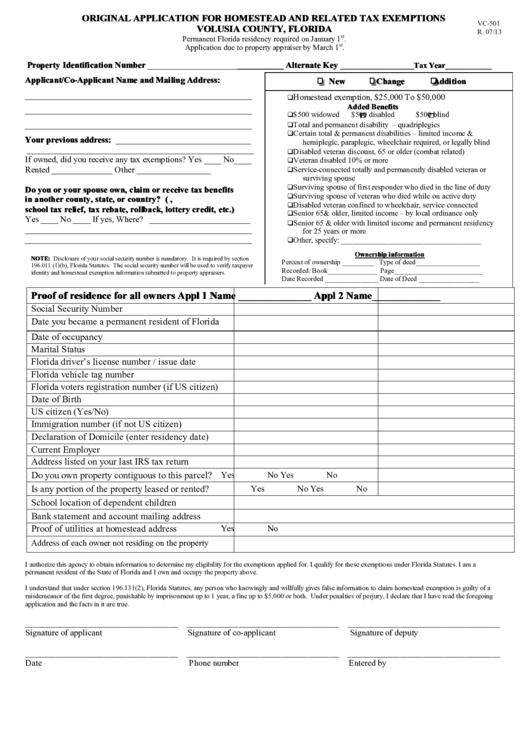

Filing for the homestead exemption in San Bernardino involves several steps: - Obtain the Form: Secure a homestead exemption form from the San Bernardino County Recorder’s office or download it from their official website. - Fill Out the Form: Complete the form accurately, ensuring all required information is provided. This includes the property’s address, the homeowner’s name, and a declaration that the property is the homeowner’s primary residence. - Sign the Form: The form must be signed by the homeowner(s) in the presence of a notary public. - File the Form: Submit the completed and signed form to the San Bernardino County Recorder’s office. There may be a filing fee associated with this step. - Record the Form: After filing, the form becomes a public record, and the homestead exemption is officially declared.

📝 Note: It is crucial to follow the instructions carefully and ensure the form is filed correctly to avoid any issues with the exemption.

Amount of Exemption

The amount of the homestead exemption in California can vary, but as of the last update, it allows for an exemption of up to 300,000 of the home's equity for single individuals and up to 600,000 for families. However, these figures are subject to change, and individuals should consult the latest legal provisions or consult with a legal professional for the most current information.

Importance of Consulting a Professional

While the process of filing for a homestead exemption can seem straightforward, consulting with a legal professional can be highly beneficial. An attorney can provide guidance on the eligibility criteria, ensure the form is filled out correctly, and offer advice on how the exemption interacts with other financial and legal situations, such as bankruptcy.

Conclusion and Final Thoughts

In summary, the San Bernardino homestead exemption is a valuable legal tool that can provide homeowners with significant protection against financial hardships. By understanding the benefits, eligibility criteria, and the process of filing for the exemption, homeowners can take proactive steps to safeguard their homes. Remember, the specifics of the law can change, and individual circumstances can affect the application of the exemption, making it important to stay informed and seek professional advice when needed.

What is the primary purpose of the homestead exemption in San Bernardino?

+

The primary purpose of the homestead exemption is to protect a portion of the home’s value from creditors, ensuring homeowners have a place to live even in financial difficulties.

How much of the home’s equity can be exempted under the California homestead exemption?

+

As of the last update, single individuals can exempt up to 300,000 of their home's equity, and families can exempt up to 600,000. However, these figures are subject to change.

Is it necessary to hire a lawyer to file for the homestead exemption?

+

While it is possible to file for the homestead exemption without a lawyer, consulting with a legal professional can be highly beneficial, especially for ensuring the form is filled out correctly and understanding how the exemption applies to individual circumstances.