5 Tips Illinois LLC

Understanding the Basics of Illinois LLC

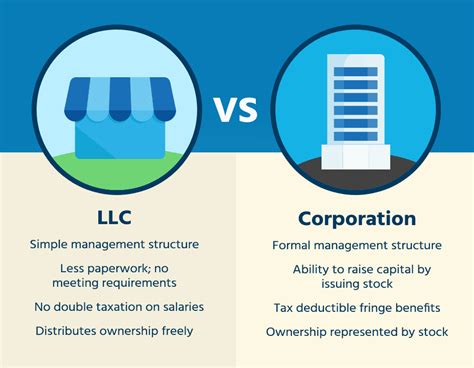

When it comes to forming a business in Illinois, one of the most popular options is the Limited Liability Company (LLC). An Illinois LLC offers personal liability protection, tax benefits, and flexibility in management structure. However, navigating the formation and operation of an LLC can be complex without the right guidance. Here are five key tips to consider when forming and running an Illinois LLC.

Tip 1: Choose a Unique Business Name

Choosing a business name is one of the first steps in forming an Illinois LLC. The name must be unique and not already in use by another business in the state. It’s also required to include a designator that indicates the business is an LLC, such as “LLC,” “L.L.C.,” “Limited Liability Company,” “Limited Liability Co.,” “L.L.C.,” or “Ltd. Liability Co.” Conducting a thorough search of the Illinois Secretary of State’s database can help ensure the desired name is available. Additionally, considering a name that reflects the brand identity and is easy for customers to remember can be beneficial for marketing purposes.

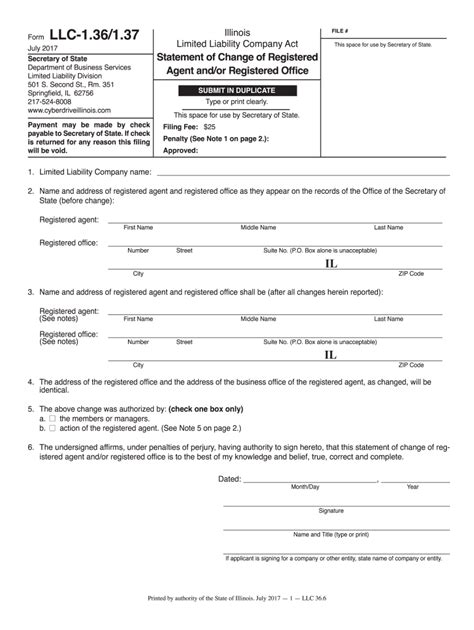

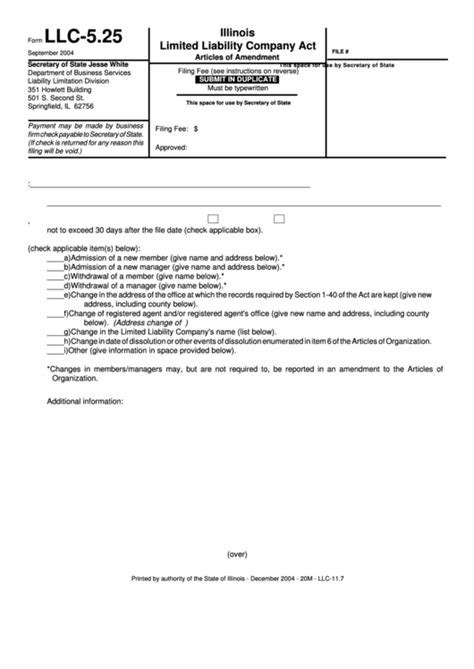

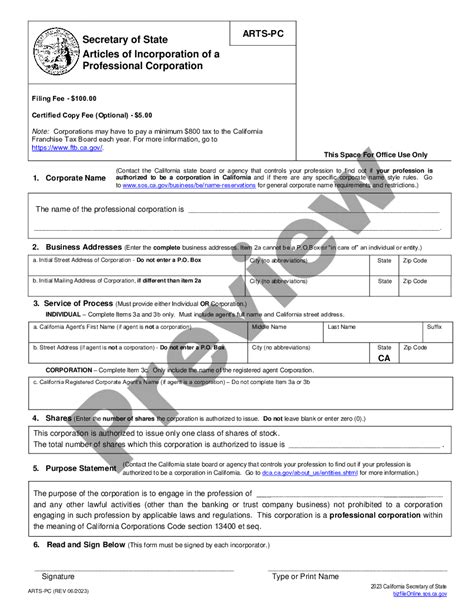

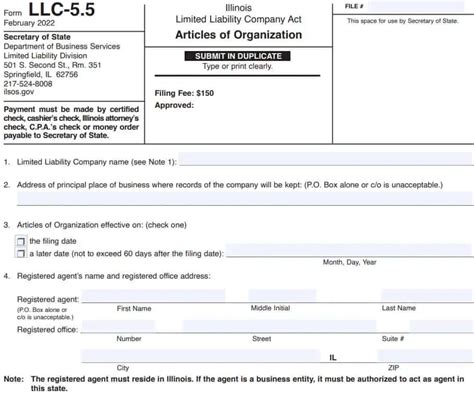

Tip 2: Prepare and File Articles of Organization

The Articles of Organization are the legal documents that officially establish the LLC with the state. These documents typically include the LLC’s name, purpose, principal place of business, registered agent’s name and address, and the names and addresses of the organizers. Filing the Articles of Organization with the Illinois Secretary of State can be done online or by mail, and there is a filing fee associated with the process. Ensuring all information is accurate and complete is crucial, as errors can lead to delays or rejection of the filing.

Tip 3: Obtain Necessary Licenses and Permits

Depending on the type of business and location, an Illinois LLC may need to obtain additional licenses and permits to operate legally. This could include professional licenses, sales tax permits, or local business licenses. Researching the specific requirements for the business and ensuring compliance can help avoid fines and penalties. Some businesses may also need to register with other state agencies or obtain federal licenses.

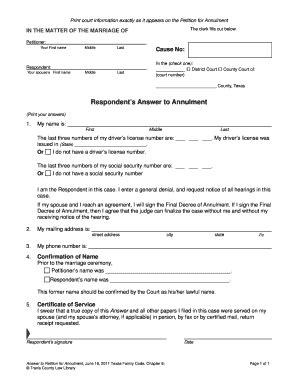

Tip 4: Create an Operating Agreement

An Operating Agreement is a document that outlines the ownership, management, and operation of the LLC. While not required by Illinois law, having an Operating Agreement in place is highly recommended. It can help establish clear roles and responsibilities among members, outline the process for making decisions, and provide a framework for resolving disputes. The agreement should be tailored to the specific needs of the business and may include provisions related to capital contributions, distributions, and membership changes.

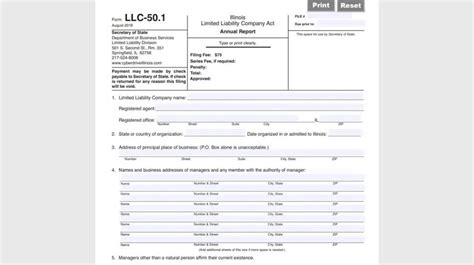

Tip 5: Maintain Compliance with Ongoing Requirements

After formation, an Illinois LLC must comply with ongoing requirements to maintain its good standing with the state. This includes annual report filings with the Illinois Secretary of State, which involve providing updated information about the business, such as changes in the registered agent or principal place of business. Additionally, LLCs must comply with federal, state, and local tax laws, which may include filing tax returns and paying applicable taxes. Staying informed about these requirements and seeking professional advice when necessary can help ensure the LLC remains in compliance and avoids potential penalties.

💡 Note: Keeping detailed records of all filings, licenses, and agreements is essential for maintaining compliance and making future changes to the LLC.

To further illustrate the importance of compliance, consider the following table outlining some key requirements for Illinois LLCs:

| Requirement | Description |

|---|---|

| Annual Report | File annual report with Illinois Secretary of State to update business information. |

| Tax Filings | Comply with federal, state, and local tax laws, including filing tax returns and paying applicable taxes. |

| Licenses and Permits | Obtain and maintain necessary licenses and permits to operate the business legally. |

In summary, forming and running an Illinois LLC requires careful consideration of several factors, from choosing a unique business name to maintaining ongoing compliance with state requirements. By understanding these key aspects and seeking professional advice when needed, business owners can set their LLC up for success and ensure it remains a viable and profitable entity over time. The importance of staying informed and adaptable cannot be overstated, as the landscape of business regulations and best practices is continually evolving.

What is the purpose of an Operating Agreement in an Illinois LLC?

+

An Operating Agreement outlines the ownership, management, and operation of the LLC, establishing clear roles and responsibilities among members and providing a framework for decision-making and dispute resolution.

How do I file the Articles of Organization for my Illinois LLC?

+

The Articles of Organization can be filed online or by mail with the Illinois Secretary of State, along with the required filing fee. Ensuring all information is accurate and complete is crucial for a successful filing.

What are the ongoing requirements for an Illinois LLC to maintain its good standing?

+

Ongoing requirements include filing annual reports with the Illinois Secretary of State, complying with federal, state, and local tax laws, and maintaining necessary licenses and permits. Staying informed about these requirements is essential for avoiding penalties and ensuring the LLC remains in good standing.