Paperwork

Snagajob Paperwork Filling Guide

Introduction to Snagajob Paperwork

Snagajob is a platform that connects hourly workers with employers across various industries. To ensure a smooth hiring process, it’s essential to understand the paperwork involved. This guide will walk you through the process of filling out Snagajob paperwork, highlighting key sections and providing tips for completion. Whether you’re a new employer or an hourly worker, this guide will help you navigate the paperwork with ease.

Pre-Hire Paperwork

Before hiring, employers must complete pre-hire paperwork, which includes: * Job posting: Create a job posting that outlines the job description, requirements, and responsibilities. * Application template: Create an application template that collects relevant information from applicants, such as contact information, work experience, and availability. * Interview questions: Prepare a list of interview questions to assess the applicant’s skills and fit for the job.

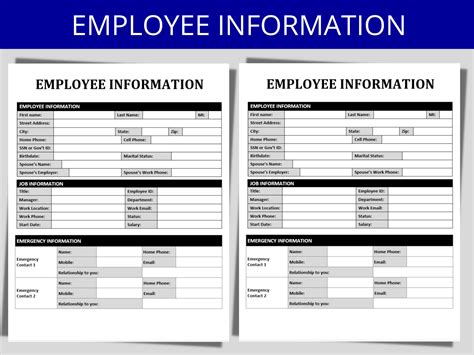

New Hire Paperwork

Once a new hire is made, the following paperwork must be completed: * Employment contract: Create an employment contract that outlines the terms of employment, including job title, pay rate, and work schedule. * W-4 form: Have the new hire complete a W-4 form to determine tax withholding. * I-9 form: Complete an I-9 form to verify the new hire’s identity and work authorization.

Payroll Paperwork

To process payroll, employers must complete the following paperwork: * Payroll schedule: Create a payroll schedule that outlines the pay periods and pay dates. * Time sheets: Have employees complete time sheets to track hours worked. * Pay stubs: Generate pay stubs that show the employee’s pay, deductions, and net pay.

Tax Paperwork

Employers must also complete tax paperwork, including: * 941 form: File a 941 form to report employment taxes. * W-2 form: Generate W-2 forms to report employee income and taxes withheld. * 1099 form: Generate 1099 forms to report income paid to independent contractors.

📝 Note: It's essential to keep accurate records of all paperwork, including employee files, payroll records, and tax documents.

Benefits and Workers’ Compensation

Employers may also need to complete paperwork related to benefits and workers’ compensation, including: * Benefits enrollment: Have employees enroll in benefits, such as health insurance or retirement plans. * Workers’ compensation: Complete workers’ compensation paperwork to report work-related injuries or illnesses.

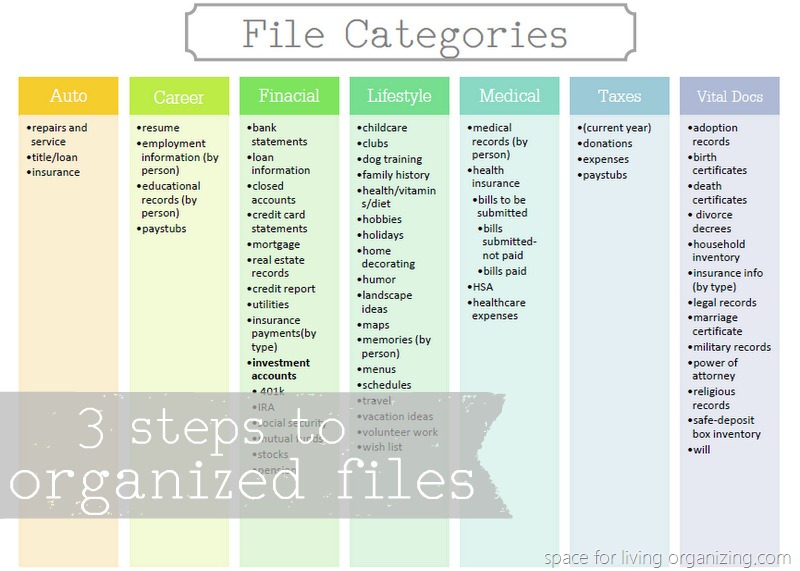

Record Keeping

It’s crucial to maintain accurate and up-to-date records of all paperwork, including: * Employee files: Keep confidential files for each employee, including employment contracts, W-4 forms, and performance evaluations. * Payroll records: Keep records of payroll, including time sheets, pay stubs, and tax documents. * Tax records: Keep records of tax filings, including 941 forms, W-2 forms, and 1099 forms.

| Document | Description |

|---|---|

| Employment contract | Outlines terms of employment |

| W-4 form | Determines tax withholding |

| I-9 form | Verifies identity and work authorization |

In summary, Snagajob paperwork involves various documents and forms that employers must complete to ensure a smooth hiring process, payroll, and tax compliance. By understanding the different types of paperwork and maintaining accurate records, employers can avoid errors and ensure compliance with labor laws and regulations.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and work authorization of new hires.

How often do I need to file a 941 form?

+

The 941 form is filed quarterly to report employment taxes.

What is the purpose of the W-2 form?

+

The W-2 form is used to report employee income and taxes withheld.