SAR Application Forms Guide

Introduction to SAR Application Forms

The SAR (Suspicious Activity Report) application form is a crucial document used by financial institutions and other organizations to report suspicious activities to the relevant authorities. The purpose of this report is to help prevent and detect money laundering, terrorist financing, and other financial crimes. In this guide, we will walk you through the process of filling out a SAR application form, highlighting the key sections and providing tips to ensure accurate and effective reporting.

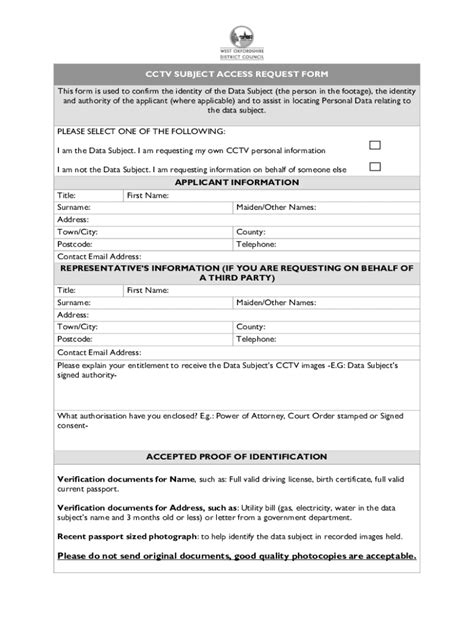

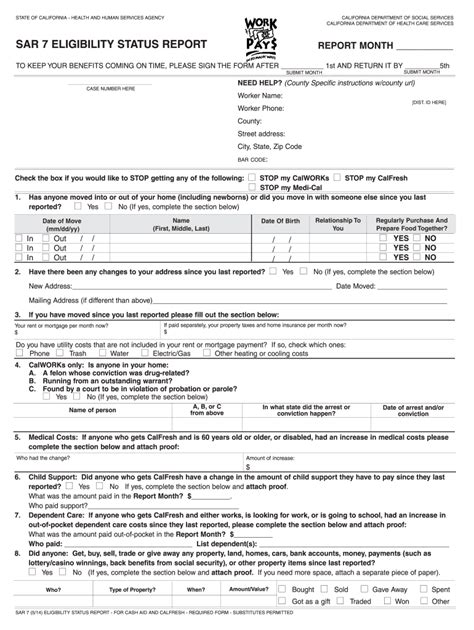

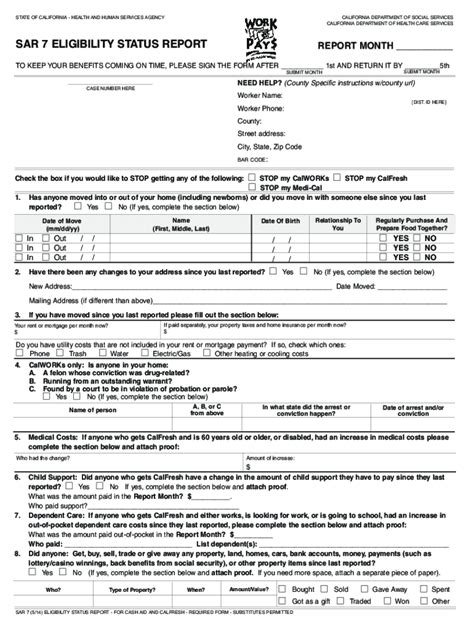

Understanding the SAR Application Form

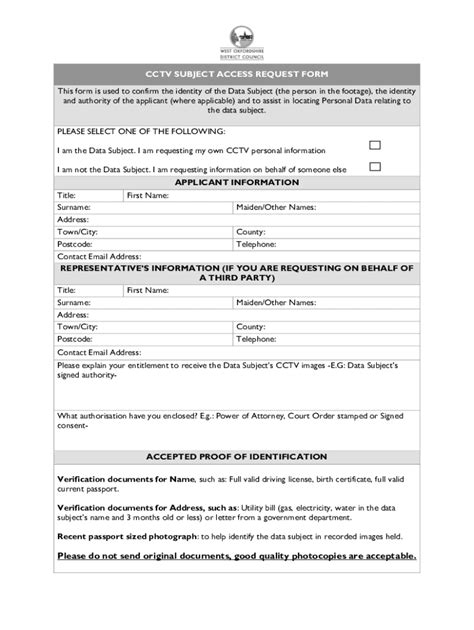

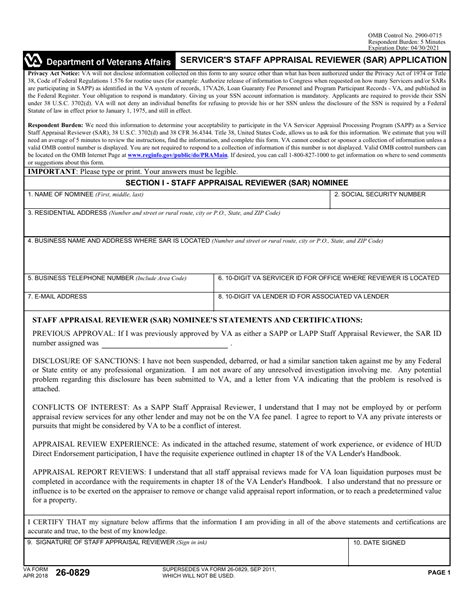

The SAR application form typically consists of several sections that require detailed information about the suspicious activity. The following are the main sections you will find in a standard SAR application form: * Section 1: Institution Information: This section requires details about the reporting institution, including the name, address, and contact information. * Section 2: Suspicious Activity Information: This section requires a detailed description of the suspicious activity, including the date, time, and location of the incident. * Section 3: Subject Information: This section requires information about the individual or organization involved in the suspicious activity, including their name, address, and identification details. * Section 4: Transaction Information: This section requires details about the transactions involved in the suspicious activity, including the amount, currency, and payment method.

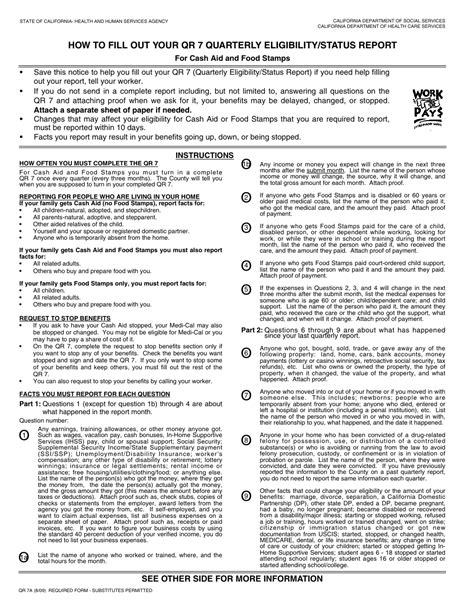

Step-by-Step Guide to Filling Out the SAR Application Form

Filling out a SAR application form requires careful attention to detail to ensure that all relevant information is included. Here are the steps to follow: * Step 1: Review the Form: Before starting to fill out the form, review it carefully to ensure you understand what information is required. * Step 2: Complete Section 1: Fill out the institution information section, providing accurate and up-to-date details about your organization. * Step 3: Complete Section 2: Provide a detailed description of the suspicious activity, including the date, time, and location of the incident. * Step 4: Complete Section 3: Fill out the subject information section, providing accurate and up-to-date details about the individual or organization involved in the suspicious activity. * Step 5: Complete Section 4: Provide details about the transactions involved in the suspicious activity, including the amount, currency, and payment method.

Importance of Accuracy and Timeliness

Accuracy and timeliness are crucial when filling out a SAR application form. Inaccurate or incomplete information can lead to delays or even rejection of the report, while failure to report suspicious activity can result in severe consequences, including fines and reputational damage. It is essential to ensure that all information is accurate and up-to-date, and that the report is submitted in a timely manner.

Common Mistakes to Avoid

When filling out a SAR application form, there are several common mistakes to avoid: * Inaccurate or incomplete information: Ensure that all information is accurate and up-to-date, and that all relevant sections are completed. * Failure to provide sufficient detail: Provide a detailed description of the suspicious activity, including the date, time, and location of the incident. * Delaying submission: Submit the report in a timely manner to ensure that the relevant authorities can take prompt action.

📝 Note: It is essential to review and understand the SAR application form before starting to fill it out, to ensure that all relevant information is included and that the report is submitted in a timely manner.

Best Practices for SAR Application Forms

To ensure effective and accurate reporting, the following best practices should be followed: * Provide detailed descriptions: Provide a detailed description of the suspicious activity, including the date, time, and location of the incident. * Use clear and concise language: Use clear and concise language when filling out the form, avoiding jargon and technical terms wherever possible. * Ensure accuracy and completeness: Ensure that all information is accurate and up-to-date, and that all relevant sections are completed.

| Section | Description |

|---|---|

| Section 1 | Institution Information |

| Section 2 | Suspicious Activity Information |

| Section 3 | Subject Information |

| Section 4 | Transaction Information |

In summary, filling out a SAR application form requires careful attention to detail and a thorough understanding of the reporting requirements. By following the steps outlined in this guide and avoiding common mistakes, organizations can ensure that their reports are accurate, complete, and submitted in a timely manner. This will help to prevent and detect financial crimes, protecting both the organization and the wider community.

What is a SAR application form?

+

A SAR (Suspicious Activity Report) application form is a document used by financial institutions and other organizations to report suspicious activities to the relevant authorities.

Why is it important to fill out a SAR application form accurately?

+

Accuracy is crucial when filling out a SAR application form, as inaccurate or incomplete information can lead to delays or even rejection of the report.

What are the consequences of failing to report suspicious activity?

+

Failure to report suspicious activity can result in severe consequences, including fines and reputational damage.