Paperwork

5 SST Paperwork Tips

Introduction to SST Paperwork

When it comes to handling Sales and Services Tax (SST), one of the most critical aspects that businesses need to grasp is the paperwork involved. Accurate and timely completion of SST paperwork is essential for compliance with tax regulations and to avoid any potential penalties. In this article, we will delve into the world of SST paperwork, exploring the key tips that can help businesses navigate this complex landscape with ease.

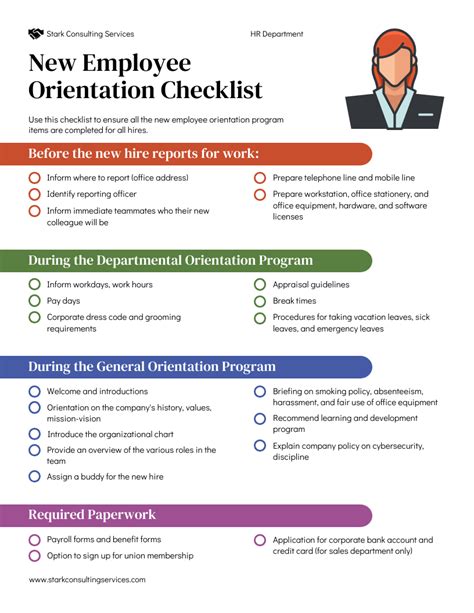

Understanding SST Paperwork Requirements

Before diving into the tips, it’s crucial to understand the basic requirements of SST paperwork. This includes registration, returns, and payment. Businesses must register for SST if their annual turnover exceeds a certain threshold. After registration, they must file returns periodically, usually on a quarterly basis, and make payments accordingly. The paperwork for SST can be extensive, including invoices, receipts, and other documents that support the tax returns.

5 Essential Tips for Managing SST Paperwork

Managing SST paperwork efficiently can save businesses a significant amount of time and resources. Here are five tips to help streamline the process:

- Keep Accurate Records: Maintaining accurate and detailed records is the foundation of managing SST paperwork effectively. This includes keeping all invoices, receipts, and any other documents that relate to sales and purchases. Digital record-keeping can be particularly helpful, as it allows for easy access and retrieval of documents when needed.

- Use SST-Compliant Invoicing: Ensuring that all invoices are SST-compliant is crucial. This means including all the necessary details such as the business’s SST registration number, the date of supply, and the taxable amount. Automated invoicing systems can help in generating compliant invoices quickly and efficiently.

- File Returns on Time: Filing SST returns on time is vital to avoid penalties. Businesses should mark their calendars for the return filing dates and ensure they have all the necessary information ready. Using online filing systems can make the process faster and more convenient.

- Stay Updated with Regulations: Tax regulations can change frequently, and it’s essential for businesses to stay updated. Regularly checking the official tax authority website or subscribing to tax newsletters can help businesses stay informed about any changes in SST regulations.

- Seek Professional Help When Needed: Managing SST paperwork can be complex, especially for small businesses or those new to tax compliance. Seeking help from a tax professional can provide valuable insights and ensure that all paperwork is completed correctly and on time.

Benefits of Efficient SST Paperwork Management

Efficient management of SST paperwork offers several benefits to businesses. It helps in avoiding penalties for late or incorrect filing, reducing administrative costs by streamlining the process, and improving compliance with tax regulations. Moreover, it allows businesses to focus on their core activities, promoting growth and development.

📝 Note: Businesses should regularly review their SST paperwork process to identify areas for improvement and implement changes as necessary.

Conclusion and Next Steps

In conclusion, managing SST paperwork is a critical task for businesses to ensure compliance with tax regulations and avoid potential penalties. By following the tips outlined above, businesses can streamline their SST paperwork process, making it more efficient and less prone to errors. As the tax landscape continues to evolve, staying informed and adaptable will be key to navigating the complexities of SST paperwork successfully.

What is the purpose of SST paperwork?

+

The purpose of SST paperwork is to ensure compliance with Sales and Services Tax regulations, including registration, filing returns, and making payments.

How often do businesses need to file SST returns?

+

Businesses typically need to file SST returns on a quarterly basis, though this may vary depending on the specific regulations in their jurisdiction.

What are the consequences of not managing SST paperwork efficiently?

+

The consequences can include penalties for late or incorrect filing, increased administrative costs, and potential legal issues due to non-compliance with tax regulations.