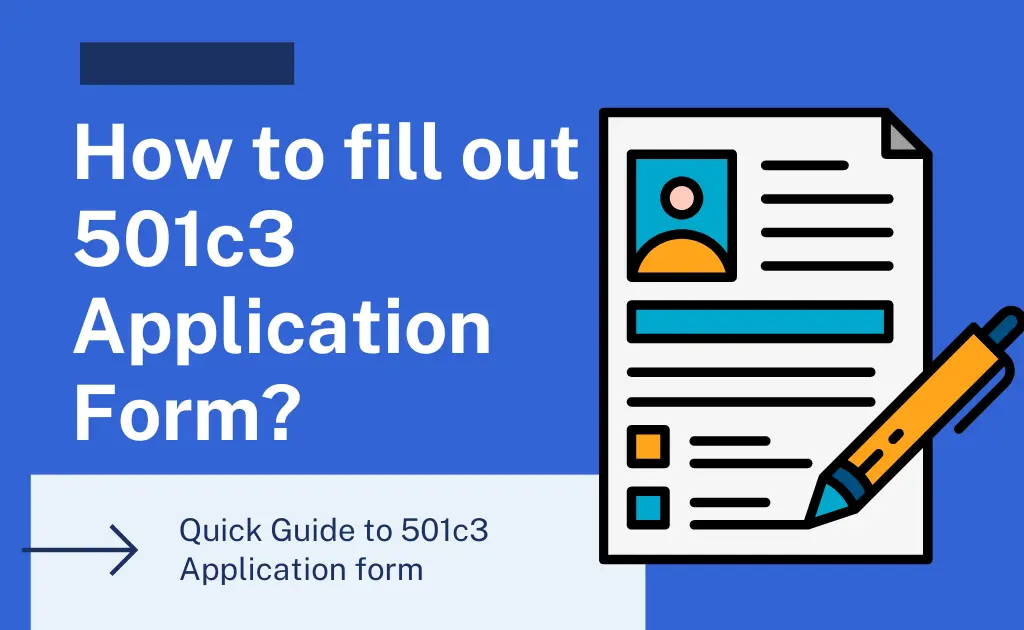

5 Tips 501c3

Understanding the Basics of 501c3

When it comes to non-profit organizations, one of the most important designations is the 501c3 status. This status, granted by the Internal Revenue Service (IRS), signifies that an organization is exempt from federal income tax and is eligible to receive tax-deductible donations. The purpose of a 501c3 organization can vary widely, from charitable and educational to scientific and literary. To achieve and maintain this status, organizations must adhere to specific guidelines and regulations.

Tip 1: Establish a Clear Mission Statement

A clear and concise mission statement is essential for any non-profit organization seeking 501c3 status. This statement should outline the organization’s purpose, goals, and objectives, ensuring that they align with the IRS’s requirements for tax-exempt status. A well-defined mission statement also helps in guiding the organization’s activities and decision-making processes, ensuring that they remain focused on their intended purpose.

- Define the purpose: Clearly state what the organization aims to achieve.

- Outline the goals: Specify how the organization plans to achieve its purpose.

- Identify the target audience: Determine who the organization intends to serve or benefit.

Tip 2: Understand the Application Process

The application process for 501c3 status involves several steps, including: * Preparing and filing Form 1023 with the IRS, which requires detailed information about the organization, its structure, its financial plans, and its governance. * Obtaining an Employer Identification Number (EIN) from the IRS, necessary for tax purposes. * Creating a board of directors or trustees, which is responsible for overseeing the organization’s activities and ensuring compliance with IRS regulations.

📝 Note: The application process can be complex, so it's often beneficial to consult with a legal or financial professional experienced in non-profit law.

Tip 3: Maintain Compliance and Record-Keeping

After receiving 501c3 status, organizations must maintain compliance with IRS regulations to avoid revocation of their tax-exempt status. This includes: - Filing annual information returns (Form 990) with the IRS, which provides details about the organization’s finances, activities, and governance. - Keeping accurate and detailed financial records, demonstrating transparency and accountability. - Ensuring ongoing compliance with state and local regulations, as these can vary.

Tip 4: Build a Strong Governance Structure

A strong governance structure is crucial for the success and integrity of a 501c3 organization. This includes: * Establishing a board of directors that is independent and diverse, bringing a range of skills and perspectives. * Defining roles and responsibilities clearly, to avoid conflicts of interest and ensure effective decision-making. * Implementing policies for governance, financial management, and conflict of interest, to maintain transparency and accountability.

Tip 5: Foster Community Engagement and Support

Engaging with the community and fostering support from donors, volunteers, and stakeholders is vital for the long-term success of a 501c3 organization. This can be achieved through: - Building relationships with local businesses, schools, and community groups. - Organizing events and campaigns to raise awareness and funds for the organization’s mission. - Utilizing social media and online platforms to communicate the organization’s work and impact, and to engage with supporters.

| Tip | Description |

|---|---|

| 1. Clear Mission Statement | Defines the organization's purpose, goals, and objectives. |

| 2. Understand Application Process | Involves preparing and filing Form 1023, obtaining an EIN, and creating a board of directors. |

| 3. Maintain Compliance | Requires filing annual information returns, keeping accurate records, and ensuring state and local compliance. |

| 4. Strong Governance Structure | Includes establishing a diverse board, defining roles, and implementing governance policies. |

| 5. Community Engagement | Involves building relationships, organizing events, and utilizing social media to engage with supporters. |

In summary, achieving and maintaining 501c3 status requires careful planning, ongoing compliance, and a commitment to transparency and community engagement. By following these tips and understanding the intricacies of non-profit law, organizations can ensure they are operating effectively and making a meaningful impact in their communities.

What is the purpose of a 501c3 organization?

+

The purpose of a 501c3 organization can vary, including charitable, educational, scientific, and literary purposes, with the goal of benefiting the public or a specific group.

How do I apply for 501c3 status?

+

To apply, you must prepare and file Form 1023 with the IRS, obtain an Employer Identification Number (EIN), and create a board of directors or trustees.

What are the benefits of having 501c3 status?

+

The benefits include exemption from federal income tax and the ability to receive tax-deductible donations, which can significantly support the organization’s mission and activities.