501c3 Paperwork Filing Made Easy

Introduction to 501c3 Paperwork Filing

Filing for 501c3 status can be a daunting task, especially for those who are new to the world of nonprofit organizations. The process involves submitting a significant amount of paperwork to the Internal Revenue Service (IRS), which can be overwhelming. However, with the right guidance, filing for 501c3 status can be made easy. In this article, we will walk you through the steps involved in filing for 501c3 status and provide you with tips and tricks to make the process smoother.

Understanding 501c3 Status

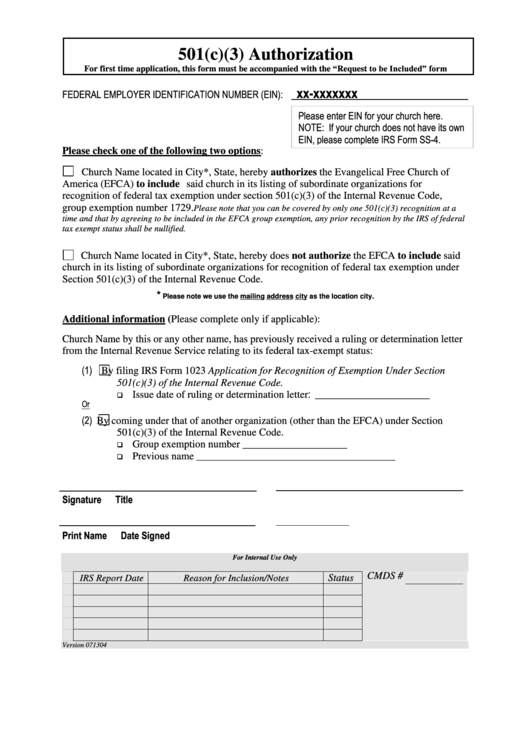

Before we dive into the paperwork filing process, it’s essential to understand what 501c3 status is and why it’s crucial for nonprofit organizations. 501c3 status refers to a tax-exempt status granted to nonprofit organizations by the IRS. This status allows organizations to exempt from paying federal income tax and enables them to receive tax-deductible donations. To qualify for 501c3 status, an organization must meet specific requirements, including being organized and operated exclusively for charitable, educational, or religious purposes.

Step-by-Step Guide to Filing 501c3 Paperwork

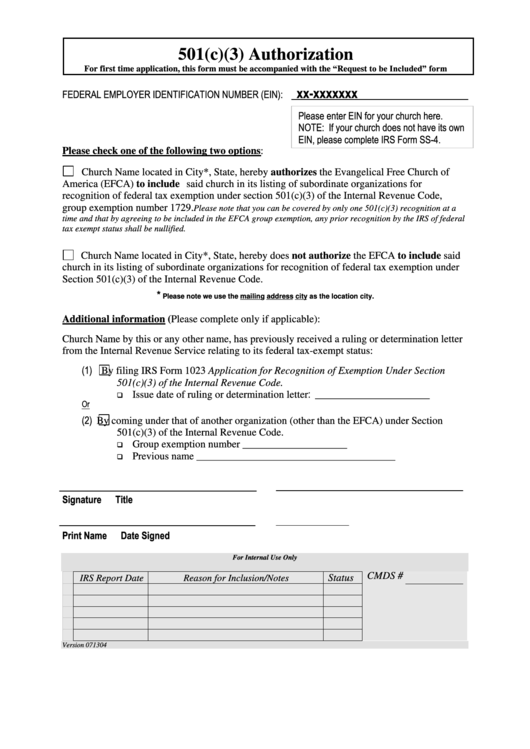

Filing for 501c3 status involves several steps, which are outlined below: * Step 1: Determine Eligibility: Ensure that your organization meets the requirements for 501c3 status, including being a nonprofit corporation, trust, or association. * Step 2: Obtain an Employer Identification Number (EIN): Apply for an EIN from the IRS, which is required for all nonprofit organizations. * Step 3: Prepare and File Form 1023: Complete and submit Form 1023, Application for Recognition of Exemption, to the IRS. This form requires detailed information about your organization, including its purpose, structure, and financial information. * Step 4: Pay the Filing Fee: Pay the required filing fee, which currently ranges from 275 to 900, depending on the type of organization and the complexity of the application. * Step 5: Wait for IRS Review and Approval: The IRS will review your application and may request additional information or clarification. Once your application is approved, you will receive a determination letter from the IRS.

Tips and Tricks for Filing 501c3 Paperwork

To make the paperwork filing process easier, consider the following tips and tricks: * Start Early: Allow plenty of time to complete and submit your application, as the process can take several months. * Seek Professional Help: Consider hiring a professional, such as an attorney or accountant, to help with the application process. * Ensure Accuracy and Completeness: Double-check your application for accuracy and completeness, as errors or omissions can delay the review process. * Be Prepared to Provide Additional Information: The IRS may request additional information or clarification, so be prepared to provide supporting documentation.

📝 Note: It's essential to keep detailed records of your organization's finances, governance, and activities, as this information will be required during the application process.

Common Mistakes to Avoid When Filing 501c3 Paperwork

To avoid delays or rejection of your application, be aware of the following common mistakes: * Inaccurate or Incomplete Information: Ensure that all information provided is accurate and complete. * Failure to Pay the Filing Fee: Make sure to pay the required filing fee, as failure to do so can result in delayed processing. * Insufficient Supporting Documentation: Provide all required supporting documentation, including financial statements, governance documents, and proof of nonprofit status.

| Form 1023 Requirements | Description |

|---|---|

| Organizational Structure | Provide a detailed description of your organization's structure, including its governance and management. |

| Financial Information | Provide detailed financial information, including income statements, balance sheets, and budget projections. |

| Nonprofit Purpose | Describe your organization's purpose and how it aligns with the requirements for 501c3 status. |

Conclusion and Final Thoughts

Filing for 501c3 status can be a complex and time-consuming process, but with the right guidance and preparation, it can be made easier. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and successful application process. Remember to start early, seek professional help, and ensure accuracy and completeness in your application. With 501c3 status, your nonprofit organization can enjoy tax-exempt status, receive tax-deductible donations, and further its mission to make a positive impact in the community.

What is the purpose of Form 1023?

+

Form 1023 is used to apply for recognition of exemption under Section 501c3 of the Internal Revenue Code. It provides the IRS with detailed information about your organization, including its purpose, structure, and financial information.

How long does it take to process a 501c3 application?

+

The processing time for a 501c3 application can vary, but it typically takes several months. The IRS reviews applications in the order they are received, and the processing time can be delayed if additional information is required or if the application is incomplete.

Can I file for 501c3 status online?

+

No, you cannot file for 501c3 status online. You must submit a paper application, Form 1023, to the IRS. However, you can pay the filing fee online and submit supporting documentation electronically.