Fix Taxes Without Paperwork

Introduction to Tax Solutions

Fixing taxes without paperwork is a goal for many individuals and businesses, given the complexity and time-consuming nature of traditional tax filing methods. With the advancement of technology, it’s now possible to streamline the tax preparation and filing process, reducing the need for physical paperwork. This approach not only saves time but also minimizes the risk of errors that can lead to audits or delays in refunds. In this article, we’ll explore the ways to fix taxes without the hassle of paperwork, focusing on digital solutions that simplify tax management.

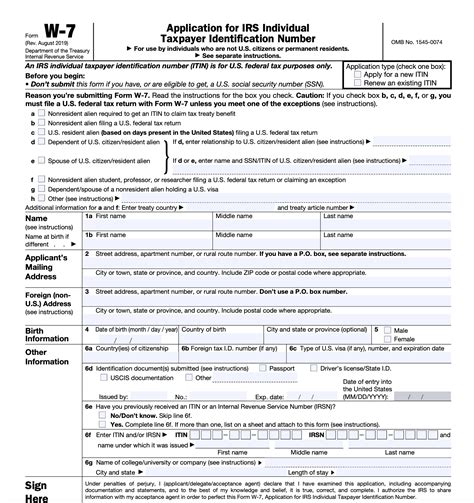

Understanding Digital Tax Filing

Digital tax filing, or e-filing, has become increasingly popular due to its efficiency and accuracy. E-filing allows taxpayers to submit their tax returns electronically, directly to the tax authority’s database. This method is supported by various tax preparation software and online platforms, which guide users through the filing process, ensuring compliance with tax laws and regulations. By choosing e-filing, individuals can avoid the tedious task of filling out paper forms and reduce the likelihood of mathematical errors.

Benefits of Digital Tax Solutions

The benefits of digital tax solutions are numerous: - Convenience: Digital platforms are accessible from anywhere with an internet connection, allowing users to work on their taxes at their own pace. - Accuracy: Tax software automatically checks for errors and ensures that all necessary information is included, reducing the risk of audits. - Speed: E-filing results in faster processing times for refunds, with many taxpayers receiving their refunds within a few weeks of filing. - Environmentally Friendly: By reducing the need for paper, digital tax solutions contribute to a more sustainable environment.

Popular Digital Tax Preparation Tools

Several digital tax preparation tools are available, catering to different needs and budgets: - TurboTax: Offers a comprehensive tax preparation experience, including guided interviews and audit support. - H&R Block: Provides a user-friendly interface and unlimited live support for tax-related questions. - TaxAct: A budget-friendly option with robust features, including free filing for simple returns. - Credit Karma Tax: Free tax filing with no income or tax status restrictions, offering a straightforward and cost-effective solution.

Security Considerations

When using digital tax solutions, security is a top concern. Reputable tax preparation software and platforms employ robust security measures, including: - Encryption: Protects user data both in transit and at rest. - Two-Factor Authentication: Adds an extra layer of protection against unauthorized access. - Regular Updates: Ensures that the software stays ahead of potential vulnerabilities.

Table of Comparison for Tax Software

| Software | Free Filing | Audit Support | Live Support |

|---|---|---|---|

| TurboTax | Limited | Yes | Yes |

| H&R Block | Limited | Yes | Unlimited |

| TaxAct | Yes, for simple returns | Yes | Limited |

| Credit Karma Tax | Yes, for all | Yes | Limited |

📝 Note: The comparison table highlights key features of popular tax software, but it's essential to visit their official websites for the most current and detailed information.

Maximizing Tax Deductions and Credits

Digital tax solutions often include features to help maximize tax deductions and credits. These can significantly reduce the amount of tax owed or increase the refund amount. Common deductions and credits include: - Charitable Donations: Donations to qualified charitable organizations can be deducted. - Education Credits: Credits like the American Opportunity Tax Credit can help with education expenses. - Home Office Deduction: For self-employed individuals, a portion of home expenses can be deducted as business expenses.

Future of Tax Filing

The future of tax filing is expected to be even more streamlined, with advancements in artificial intelligence (AI) and machine learning (ML). These technologies will further automate the tax preparation process, potentially allowing for real-time tax assessments and payments. Additionally, there’s a push towards blockchain technology for secure and transparent tax management, though its implementation is still in the early stages.

To summarize the key points, fixing taxes without paperwork is now a reality thanks to digital tax solutions. These platforms offer convenience, accuracy, and speed, making the tax filing process less daunting. By choosing the right digital tax preparation tool and being aware of security considerations, individuals can ensure a smooth and efficient tax filing experience. As technology continues to evolve, we can expect even more innovative solutions to emerge, further simplifying tax management for everyone involved.

What are the benefits of e-filing taxes?

+

The benefits of e-filing taxes include convenience, accuracy, speed, and environmental friendliness. E-filing reduces the risk of errors, allows for faster refund processing, and eliminates the need for paper forms.

How secure are digital tax preparation platforms?

+

Reputable digital tax preparation platforms employ robust security measures, including encryption, two-factor authentication, and regular updates to protect against vulnerabilities. However, it’s crucial to choose a well-established and trusted platform.

What are some common tax deductions and credits I should know about?

+

Common tax deductions and credits include charitable donations, education credits like the American Opportunity Tax Credit, and the home office deduction for self-employed individuals. Digital tax solutions can help identify which deductions and credits you qualify for.