Get Bankruptcy Paperwork from Pacer

Introduction to Pacer and Bankruptcy Paperwork

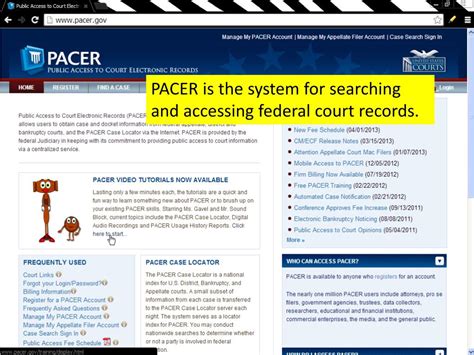

The Public Access to Court Electronic Records (Pacer) system provides access to federal court records, including bankruptcy filings. For individuals or businesses dealing with financial difficulties, understanding the process of obtaining bankruptcy paperwork from Pacer is crucial. This guide will walk you through the steps to access these documents, highlighting the importance of public access to court records and the transparency it brings to legal proceedings.

Understanding Pacer

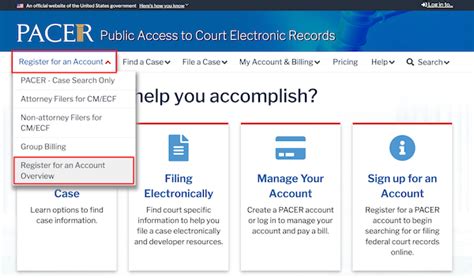

Pacer is an electronic public access service that allows users to obtain case and docket information from federal appellate, district, and bankruptcy courts. The system provides 24⁄7 access to court records, making it a valuable resource for legal professionals, researchers, and individuals involved in court cases. To use Pacer, one must first register for an account, which involves providing basic contact information and agreeing to the terms of service.

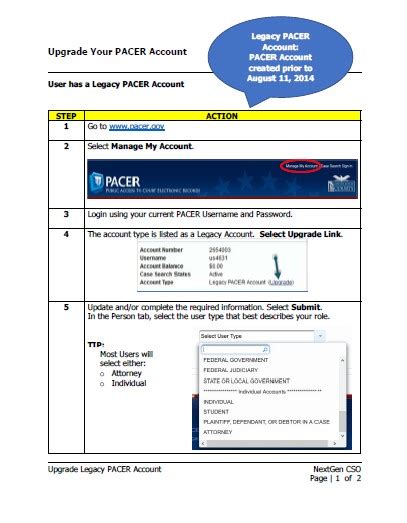

Steps to Get Bankruptcy Paperwork from Pacer

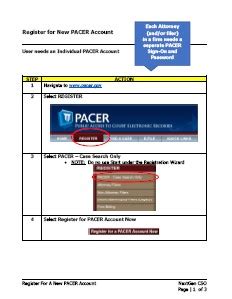

Obtaining bankruptcy paperwork from Pacer involves several straightforward steps: - Registration: If you haven’t already, create a Pacer account. This step is necessary to access the court’s electronic records. - Search for Case: Use the Pacer case locator tool to find the specific bankruptcy case you’re interested in. You can search by case number, party name, or other identifiers. - View Docket: Once you’ve located the case, view the docket to see a list of all filings made in the case. The docket will include documents such as the voluntary petition, schedules, and statements. - Retrieve Documents: Select the documents you wish to view or download. Pacer charges a fee per page for documents, with the exception of judicial opinions, which are free. - Payment: After selecting your documents, you’ll be prompted to pay for them using your Pacer account. The cost is typically 10 cents per page, with a maximum charge per document.

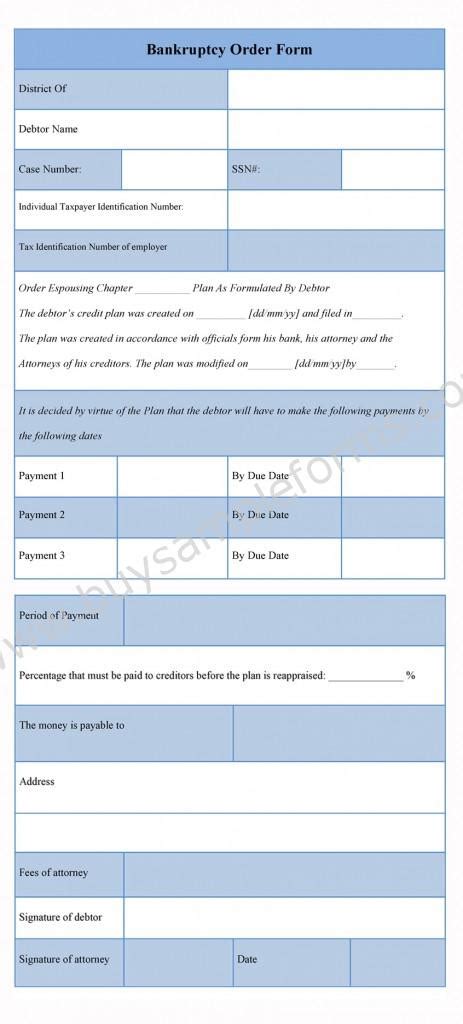

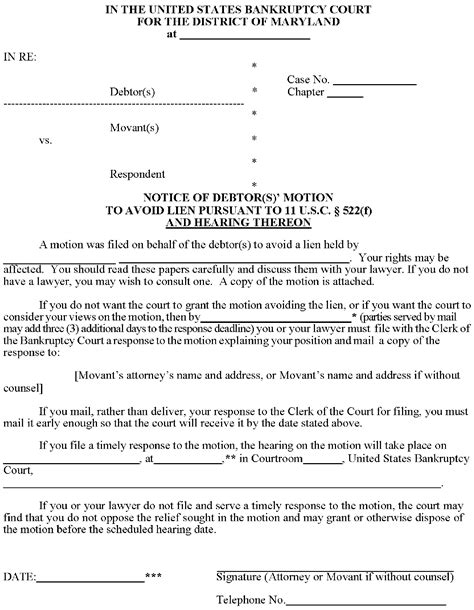

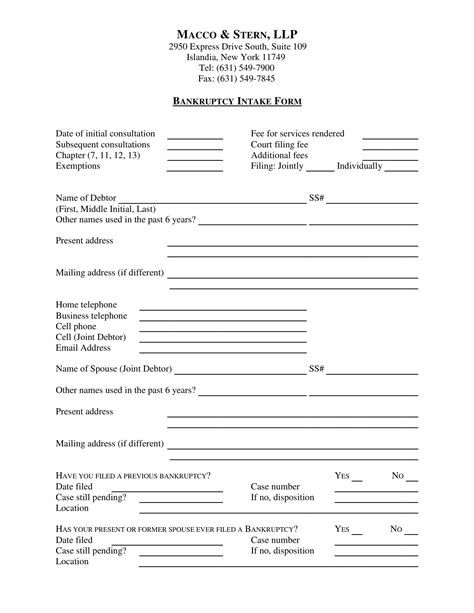

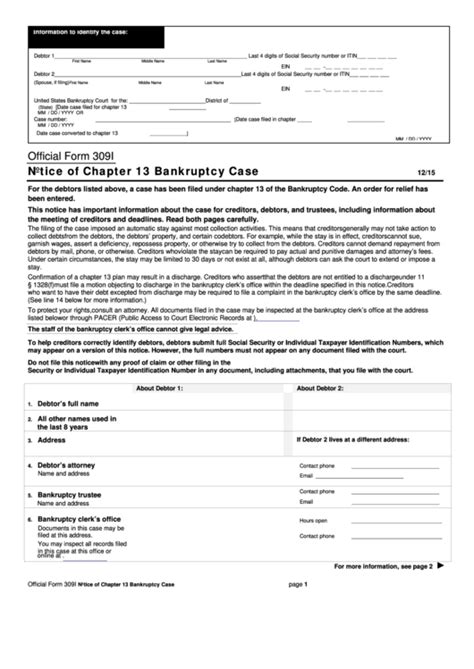

Types of Bankruptcy Filings

There are several types of bankruptcy filings that can be accessed through Pacer, each with its own set of associated documents: - Chapter 7 Bankruptcy: Involves the liquidation of assets to pay off debts. Key documents include the petition, schedules of assets and liabilities, and statement of financial affairs. - Chapter 11 Bankruptcy: A reorganization plan for businesses. Important documents may include the disclosure statement and plan of reorganization. - Chapter 13 Bankruptcy: A repayment plan for individuals. Relevant documents include the plan and schedules.

Benefits of Accessing Bankruptcy Paperwork through Pacer

Accessing bankruptcy paperwork through Pacer offers several benefits, including: - Convenience: Documents are available 24⁄7 from any location with an internet connection. - Speed: Immediate access to documents without the need to physically visit a courthouse. - Transparency: Provides a clear and public record of all bankruptcy filings and proceedings.

Challenges and Considerations

While Pacer offers a convenient way to access bankruptcy paperwork, there are challenges and considerations to keep in mind: - Cost: Accessing documents through Pacer can be costly, especially for lengthy filings. - Complexity: Bankruptcy law and the documents associated with it can be complex and difficult to understand without legal training.

💡 Note: It's essential to understand the fees associated with using Pacer and to plan accordingly to avoid unexpected costs.

Alternatives to Pacer for Bankruptcy Information

While Pacer is a primary source for federal court records, there are alternative resources for obtaining bankruptcy information, including: - National Archives: For historical bankruptcy records. - Court Clerks’ Offices: Physical court locations where records can be accessed in person. - Third-Party Services: Some companies offer access to court records, including bankruptcy filings, often with additional features like search functionality and document summaries.

| Resource | Description |

|---|---|

| Pacer | Electronic access to federal court records, including bankruptcy filings. |

| National Archives | Historical court records, including bankruptcy cases. |

| Court Clerks' Offices | Physical locations for accessing court records in person. |

| Third-Party Services | Companies offering access to court records with additional features. |

In summary, obtaining bankruptcy paperwork from Pacer is a straightforward process that involves registration, searching for the case, viewing the docket, retrieving documents, and payment. Understanding the types of bankruptcy filings and the benefits of accessing these documents through Pacer can be invaluable for legal professionals, researchers, and individuals involved in bankruptcy cases. While there are challenges and considerations, Pacer remains a critical resource for accessing federal court records.

As we finalize our discussion on accessing bankruptcy paperwork through Pacer, it’s clear that this system provides a vital service by making court records accessible to the public. This accessibility is not only a benefit for those directly involved in bankruptcy cases but also contributes to the transparency and accountability of the legal system.

What is Pacer, and how does it relate to bankruptcy paperwork?

+

Pacer, or Public Access to Court Electronic Records, is a system that provides electronic access to federal court records, including bankruptcy filings. It allows users to view and download documents related to bankruptcy cases.

How do I register for a Pacer account to access bankruptcy paperwork?

+

To register for a Pacer account, go to the Pacer website and follow the registration prompts. You will need to provide basic contact information and agree to the terms of service.

What types of bankruptcy filings can I access through Pacer?

+

Through Pacer, you can access various types of bankruptcy filings, including Chapter 7, Chapter 11, and Chapter 13 bankruptcies. Each type of filing will have its own set of associated documents.