Get EIN Paperwork Easily

Introduction to EIN Paperwork

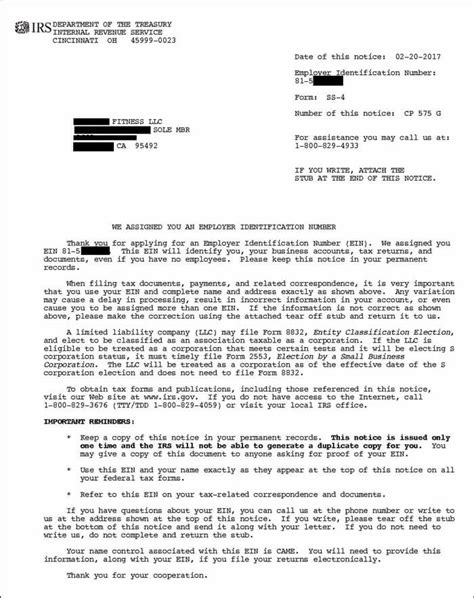

Obtaining an Employer Identification Number (EIN) is a crucial step for any business, as it serves as a unique identifier for tax purposes. The EIN paperwork process can seem daunting, but with the right guidance, it can be completed efficiently. In this article, we will delve into the world of EIN paperwork, exploring the importance of EIN, the application process, and providing valuable tips to ensure a smooth experience.

Understanding the Importance of EIN

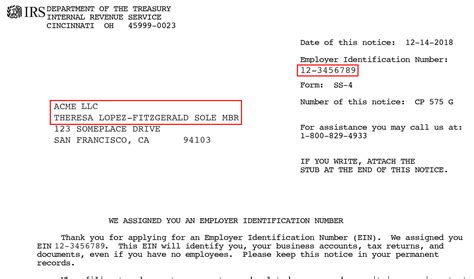

An EIN is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity. It is used to open a business bank account, file tax returns, and hire employees. Having an EIN is essential for any business, as it helps to establish credibility and legitimacy. Without an EIN, a business may struggle to secure funding, enter into contracts, or even operate legally.

The EIN Application Process

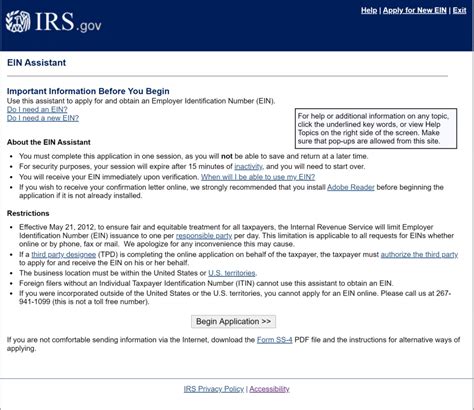

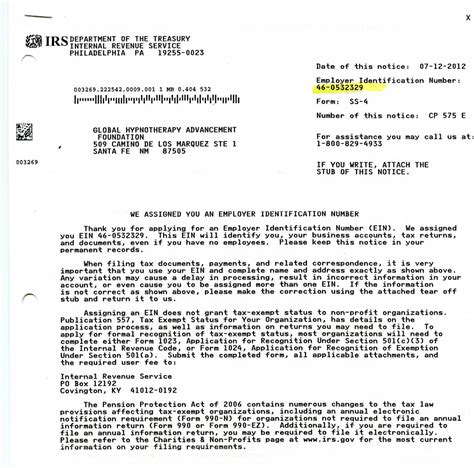

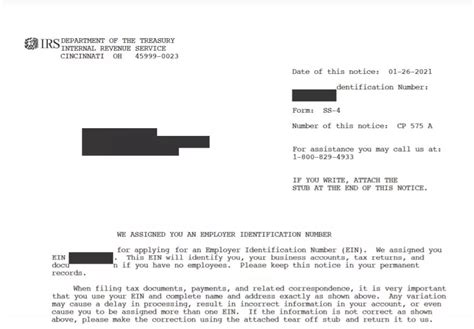

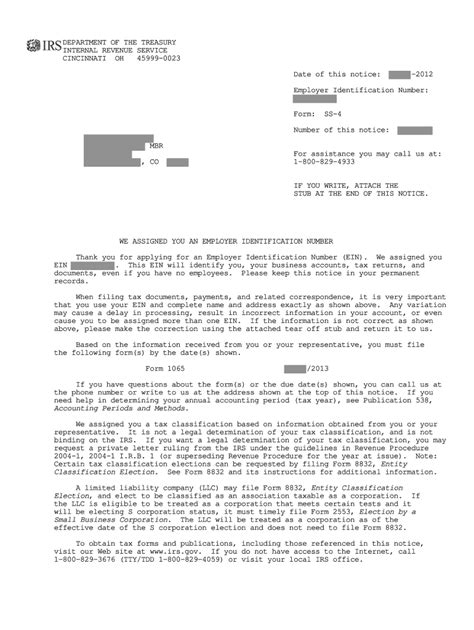

The EIN application process is relatively straightforward. To apply, business owners can: * Visit the IRS website and complete Form SS-4, Application for Employer Identification Number * Call the IRS Business and Specialty Tax Line at (800) 829-4933 * Fax the completed Form SS-4 to (855) 214-2228 * Mail the completed Form SS-4 to the IRS address listed on the form It is essential to gather all necessary information before starting the application process, including the business name, address, and type of entity.

Tips for a Smooth EIN Application Process

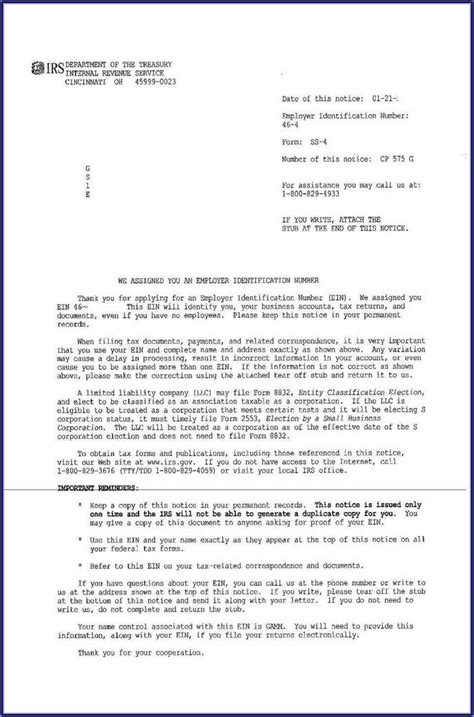

To ensure a smooth EIN application process, consider the following tips: * Apply online: The online application process is the fastest way to obtain an EIN. * Have all necessary information ready: Make sure to have all required information, including the business name, address, and type of entity. * Double-check the application: Carefully review the application for errors or omissions before submitting. * Keep records: Keep a copy of the EIN confirmation letter for future reference.

📝 Note: The EIN application process is free, and there is no fee associated with obtaining an EIN.

EIN Paperwork Requirements

To complete the EIN paperwork, business owners will need to provide the following information: * Business name and address * Type of entity (sole proprietorship, partnership, corporation, etc.) * Reason for applying for an EIN * Business owner’s name and title * Business owner’s Social Security number or Individual Taxpayer Identification Number (ITIN)

| Business Type | Description |

|---|---|

| Sole Proprietorship | A business owned and operated by one individual |

| Partnership | A business owned and operated by two or more individuals |

| Corporation | A business entity that is separate from its owners |

Maintaining EIN Records

Once an EIN is obtained, it is essential to maintain accurate records. This includes keeping a copy of the EIN confirmation letter, as well as any other relevant documentation. Business owners should also be aware of the importance of updating EIN information, such as changes to the business name or address.

Common EIN-Related Issues

Some common issues that business owners may encounter when dealing with EIN paperwork include: * Lost or misplaced EIN confirmation letter: If the EIN confirmation letter is lost or misplaced, business owners can contact the IRS to request a replacement. * Error on the EIN application: If an error is made on the EIN application, business owners can contact the IRS to correct the mistake. * Changes to EIN information: If changes are made to the business name, address, or other information, business owners must update their EIN records with the IRS.

As we near the end of our discussion on EIN paperwork, it is clear that obtaining and maintaining an EIN is a vital part of running a successful business. By understanding the importance of EIN, following the application process, and maintaining accurate records, business owners can ensure a smooth and efficient experience.

In summary, the key points to take away from this article are the importance of EIN, the application process, and the need to maintain accurate records. By following these guidelines and being aware of common EIN-related issues, business owners can navigate the world of EIN paperwork with confidence.

What is an EIN, and why is it necessary for my business?

+

An EIN is a unique identifier assigned by the IRS to identify a business entity. It is necessary for tax purposes, opening a business bank account, and hiring employees.

How do I apply for an EIN?

+

You can apply for an EIN online, by phone, fax, or mail. The fastest way to obtain an EIN is through the online application process.

What information do I need to provide to complete the EIN application process?

+

You will need to provide the business name and address, type of entity, reason for applying for an EIN, business owner’s name and title, and business owner’s Social Security number or ITIN.