Idaho Garnishment Paperwork Guide

Introduction to Idaho Garnishment Paperwork

When an individual or business owes a debt, creditors may use various methods to collect the debt, including garnishment. Garnishment is a legal process where a creditor obtains a court order to require a third party, such as an employer or bank, to withhold a portion of the debtor’s assets, like wages or bank accounts, to satisfy the debt. In Idaho, the garnishment process involves specific paperwork and procedures that must be followed. This guide will walk you through the Idaho garnishment paperwork and the steps involved in the garnishment process.

Understanding Idaho Garnishment Laws

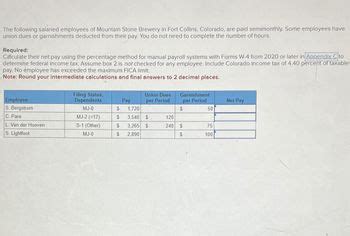

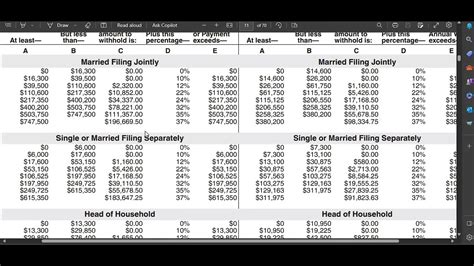

Before diving into the paperwork, it’s essential to understand the Idaho garnishment laws. Idaho follows federal garnishment laws, which set limits on the amount of wages that can be garnished. The Idaho Code (Section 8-505) outlines the state’s garnishment laws, including the types of property that can be garnished, the procedures for garnishment, and the exemptions from garnishment. Creditors must comply with these laws when seeking to garnish a debtor’s assets.

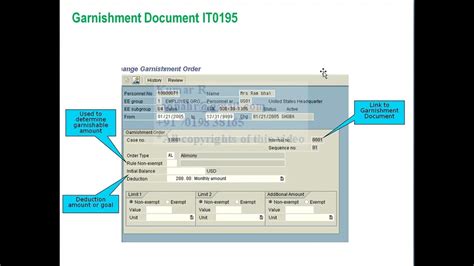

Garnishment Paperwork Requirements

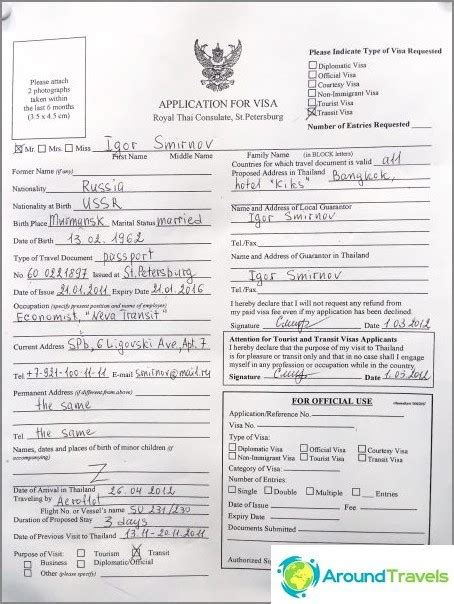

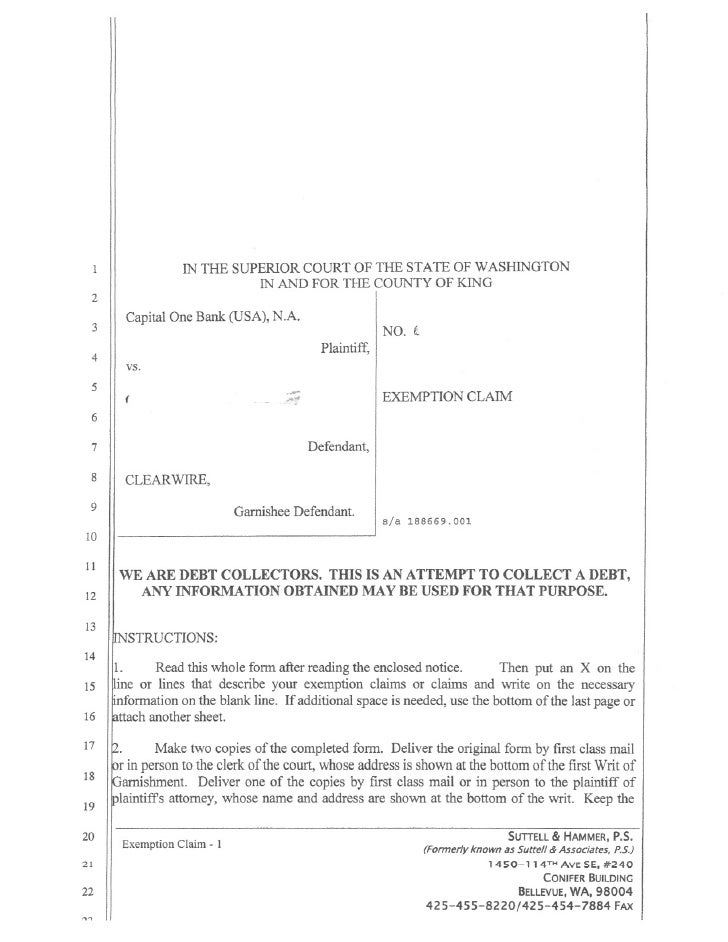

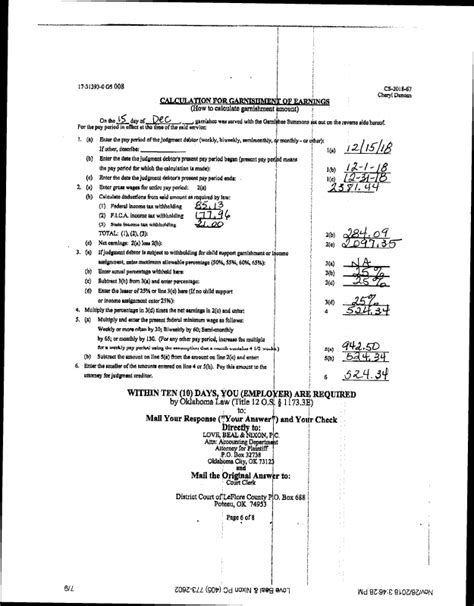

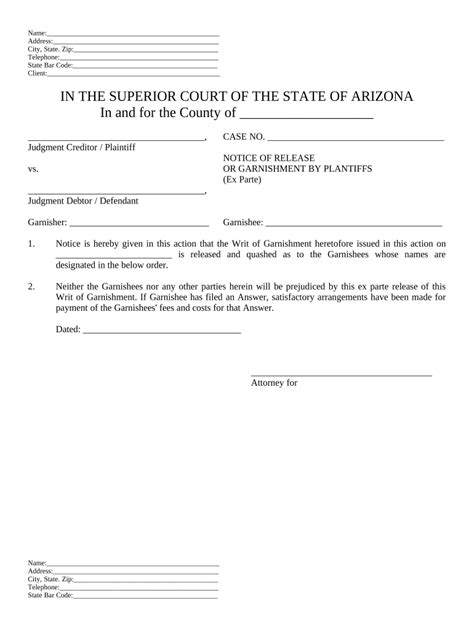

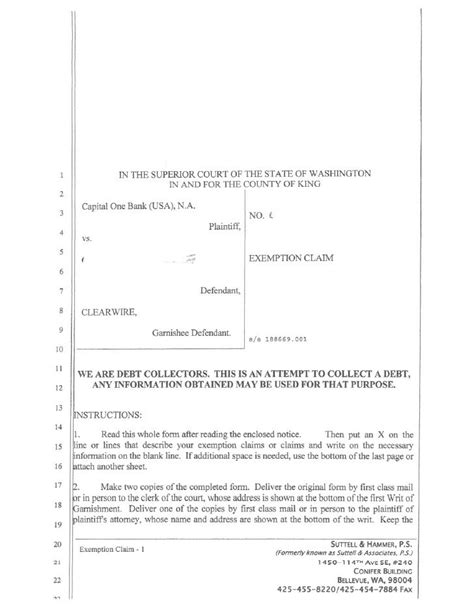

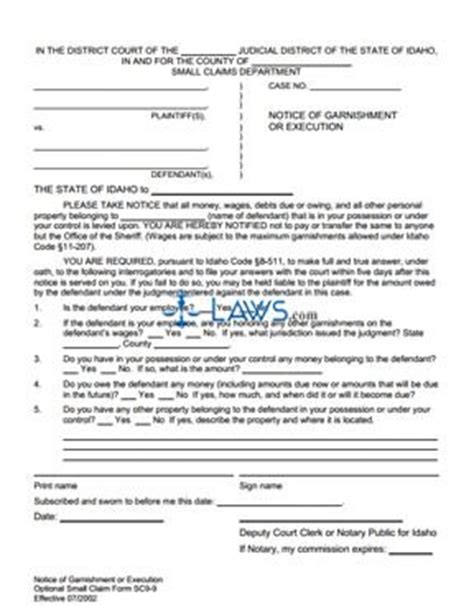

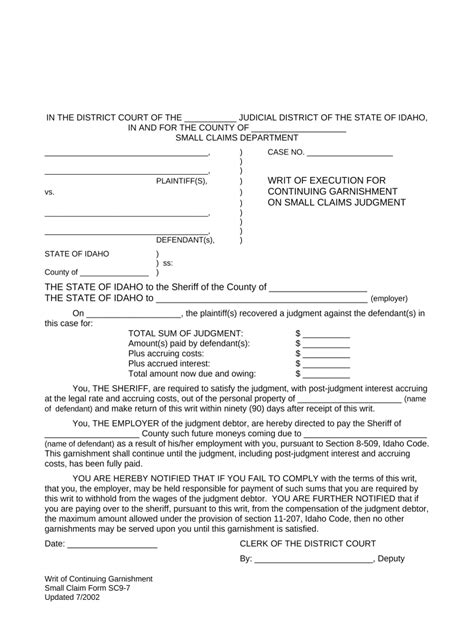

To initiate the garnishment process in Idaho, creditors must prepare and file specific paperwork with the court. The required documents include: * Writ of Garnishment: This is the court order that requires the third party (e.g., employer or bank) to withhold the debtor’s assets. * Application for Writ of Garnishment: This document is filed with the court to request the writ of garnishment. * Affidavit of Debt: The creditor must provide an affidavit stating the amount of the debt, the debtor’s name and address, and the creditor’s name and address. * Notice of Garnishment: The creditor must provide notice to the debtor and the third party of the garnishment.

Step-by-Step Guide to Idaho Garnishment Paperwork

Here’s a step-by-step guide to help creditors navigate the Idaho garnishment paperwork process: * Step 1: Determine the Type of Garnishment: Creditors must determine the type of garnishment they are seeking, such as wage garnishment or bank account garnishment. * Step 2: Prepare the Application for Writ of Garnishment: The creditor must prepare the application, which includes providing information about the debt, the debtor, and the creditor. * Step 3: Prepare the Affidavit of Debt: The creditor must prepare the affidavit, which states the amount of the debt and the parties involved. * Step 4: File the Application and Affidavit with the Court: The creditor must file the application and affidavit with the Idaho court. * Step 5: Obtain the Writ of Garnishment: The court will review the application and affidavit and issue a writ of garnishment if the creditor’s request is granted. * Step 6: Serve the Writ of Garnishment: The creditor must serve the writ of garnishment on the third party (e.g., employer or bank). * Step 7: Provide Notice of Garnishment: The creditor must provide notice to the debtor and the third party of the garnishment.

Exemptions from Garnishment

Idaho law provides exemptions from garnishment for certain types of property, including: * Primary Residence: A debtor’s primary residence is exempt from garnishment. * Retirement Accounts: Certain retirement accounts, such as 401(k) and IRA accounts, are exempt from garnishment. * Social Security Benefits: Social Security benefits are exempt from garnishment.

Challenging a Garnishment

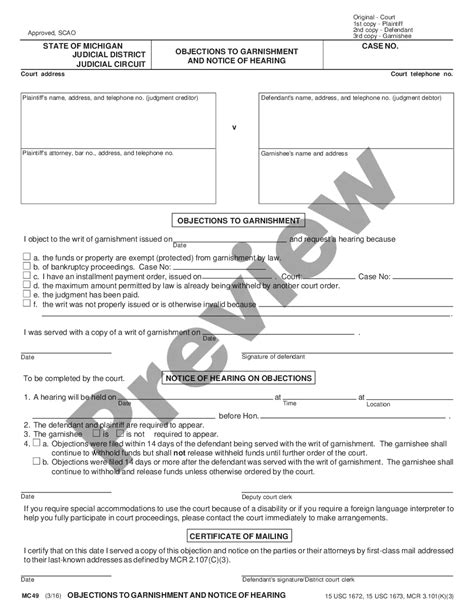

Debtors have the right to challenge a garnishment by filing a Claim of Exemption with the court. The debtor must provide evidence to support their claim, such as proof of exemption or proof that the garnishment is incorrect.

📝 Note: Debtors should seek the advice of an attorney if they receive a notice of garnishment, as there may be options available to challenge or stop the garnishment.

Garnishment Paperwork Tips and Reminders

Here are some tips and reminders for creditors and debtors: * Use the Correct Forms: Creditors must use the correct forms when preparing garnishment paperwork. * Follow the Correct Procedures: Creditors must follow the correct procedures when serving the writ of garnishment and providing notice to the debtor and third party. * Keep Accurate Records: Creditors and debtors should keep accurate records of the garnishment process, including all paperwork and correspondence.

| Document | Description |

|---|---|

| Writ of Garnishment | Court order requiring third party to withhold debtor's assets |

| Application for Writ of Garnishment | Document filed with court to request writ of garnishment |

| Affidavit of Debt | Document stating amount of debt and parties involved |

| Notice of Garnishment | Notice provided to debtor and third party of garnishment |

In summary, the Idaho garnishment paperwork process involves specific procedures and documents that must be followed. Creditors must prepare and file the correct paperwork, including the application for writ of garnishment, affidavit of debt, and notice of garnishment. Debtors have the right to challenge a garnishment by filing a claim of exemption. It’s essential for both creditors and debtors to understand the Idaho garnishment laws and procedures to ensure a smooth and compliant process.

What is the purpose of a writ of garnishment?

+

The purpose of a writ of garnishment is to require a third party, such as an employer or bank, to withhold a portion of the debtor’s assets to satisfy a debt.

How do I challenge a garnishment in Idaho?

+

To challenge a garnishment in Idaho, debtors must file a claim of exemption with the court, providing evidence to support their claim.

What types of property are exempt from garnishment in Idaho?

+

In Idaho, certain types of property are exempt from garnishment, including primary residence, retirement accounts, and Social Security benefits.