5 Ways Unemployment Tax Paperwork

Understanding Unemployment Tax Paperwork: A Comprehensive Guide

Unemployment tax paperwork can be a daunting task for many individuals and businesses. The process involves complex forms, calculations, and deadlines, making it essential to have a thorough understanding of the requirements. In this article, we will delve into the world of unemployment tax paperwork, exploring the key aspects, benefits, and best practices for managing this critical task.

What is Unemployment Tax Paperwork?

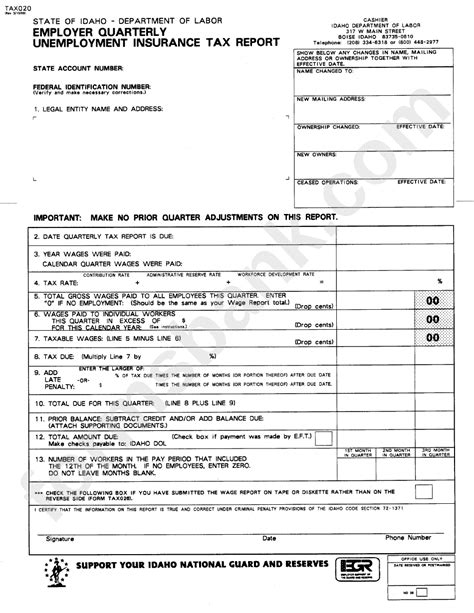

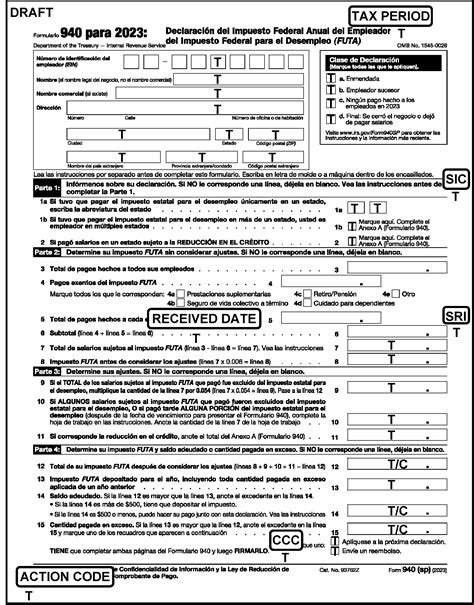

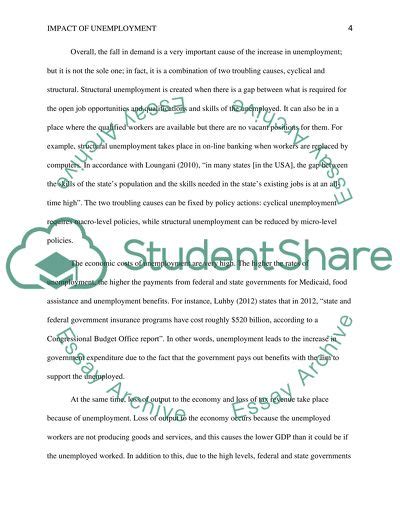

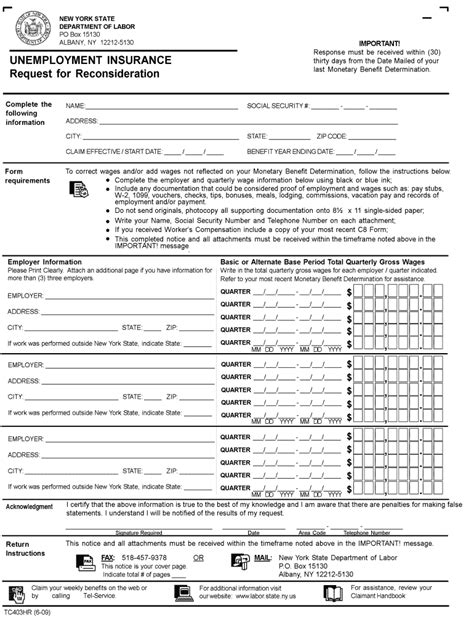

Unemployment tax paperwork refers to the documentation and reporting required by employers to comply with federal and state unemployment tax laws. The primary purpose of this paperwork is to report employment data, calculate tax liabilities, and make timely payments to the relevant authorities. Employers must file various forms, including the Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) returns, to ensure compliance with the regulations.

5 Ways to Streamline Unemployment Tax Paperwork

To simplify the process and minimize errors, consider the following five ways to streamline unemployment tax paperwork: * Automate Data Entry: Utilize payroll software or accounting systems to automate data entry, reducing manual errors and increasing efficiency. * Outsource Tax Preparation: Engage a professional tax preparer or accountant to handle unemployment tax paperwork, ensuring accuracy and compliance with regulations. * Implement a Tax Calendar: Create a tax calendar to track important deadlines, including filing dates and payment due dates, to avoid late fees and penalties. * Utilize Online Filing Options: Take advantage of online filing options, such as the Electronic Federal Tax Payment System (EFTPS), to simplify the payment process and reduce paperwork. * Conduct Regular Audits: Perform regular audits to ensure accuracy and compliance with unemployment tax regulations, identifying and addressing any errors or discrepancies.

Benefits of Efficient Unemployment Tax Paperwork Management

Effective management of unemployment tax paperwork offers numerous benefits, including: * Reduced Errors: Minimizing errors and discrepancies in unemployment tax paperwork helps avoid costly penalties and fines. * Increased Efficiency: Streamlining the process saves time and resources, allowing employers to focus on core business activities. * Improved Compliance: Ensuring compliance with federal and state regulations reduces the risk of audits and penalties. * Enhanced Accuracy: Accurate unemployment tax paperwork helps prevent overpayment or underpayment of taxes, ensuring a smooth and efficient process.

Common Challenges in Unemployment Tax Paperwork

Despite the importance of efficient unemployment tax paperwork management, many employers face challenges, including: * Lack of Knowledge: Insufficient understanding of federal and state regulations can lead to errors and non-compliance. * Complexity of Forms: The complexity of unemployment tax forms, such as the FUTA and SUTA returns, can be overwhelming for employers. * Tight Deadlines: Meeting strict filing deadlines and payment due dates can be stressful, especially for small businesses or those with limited resources. * Penalties for Non-Compliance: Failure to comply with regulations can result in costly penalties, fines, and interest on unpaid taxes.

📝 Note: Employers must ensure accurate and timely filing of unemployment tax paperwork to avoid penalties and fines. It is essential to stay up-to-date with changing regulations and seek professional help when needed.

Best Practices for Unemployment Tax Paperwork Management

To ensure efficient and accurate unemployment tax paperwork management, consider the following best practices: * Stay Organized: Maintain accurate and detailed records, including employee data, tax payments, and filing deadlines. * Utilize Technology: Leverage payroll software, accounting systems, and online filing options to streamline the process and reduce errors. * Seek Professional Help: Engage a tax professional or accountant to ensure compliance with regulations and accurate preparation of unemployment tax paperwork. * Conduct Regular Reviews: Perform regular reviews of unemployment tax paperwork to identify and address any errors or discrepancies.

| Form | Purpose | Filing Deadline |

|---|---|---|

| FUTA Return (Form 940) | Report federal unemployment tax liability | January 31st |

| SUTA Return (Form varies by state) | Report state unemployment tax liability | Varies by state |

In summary, efficient management of unemployment tax paperwork is crucial for employers to ensure compliance with federal and state regulations, avoid penalties and fines, and minimize errors. By understanding the key aspects of unemployment tax paperwork, implementing best practices, and seeking professional help when needed, employers can streamline the process and focus on core business activities.

What is the purpose of the Federal Unemployment Tax Act (FUTA)?

+

The Federal Unemployment Tax Act (FUTA) is a federal law that requires employers to pay taxes to fund state unemployment insurance programs.

How often must employers file unemployment tax returns?

+

Employers must file unemployment tax returns annually, with the FUTA return due on January 31st and SUTA returns due on varying dates depending on the state.

What are the consequences of failing to file unemployment tax returns on time?

+

Failing to file unemployment tax returns on time can result in penalties, fines, and interest on unpaid taxes, which can be costly for employers.