Paperwork

Michigan Unemployment Tax Paperwork

Understanding Michigan Unemployment Tax Paperwork

When dealing with unemployment in Michigan, it’s essential to understand the necessary paperwork and taxes involved. The state’s unemployment insurance program is designed to provide financial assistance to workers who have lost their jobs through no fault of their own. However, navigating the system can be complex, and completing the required paperwork accurately is crucial to receiving benefits.

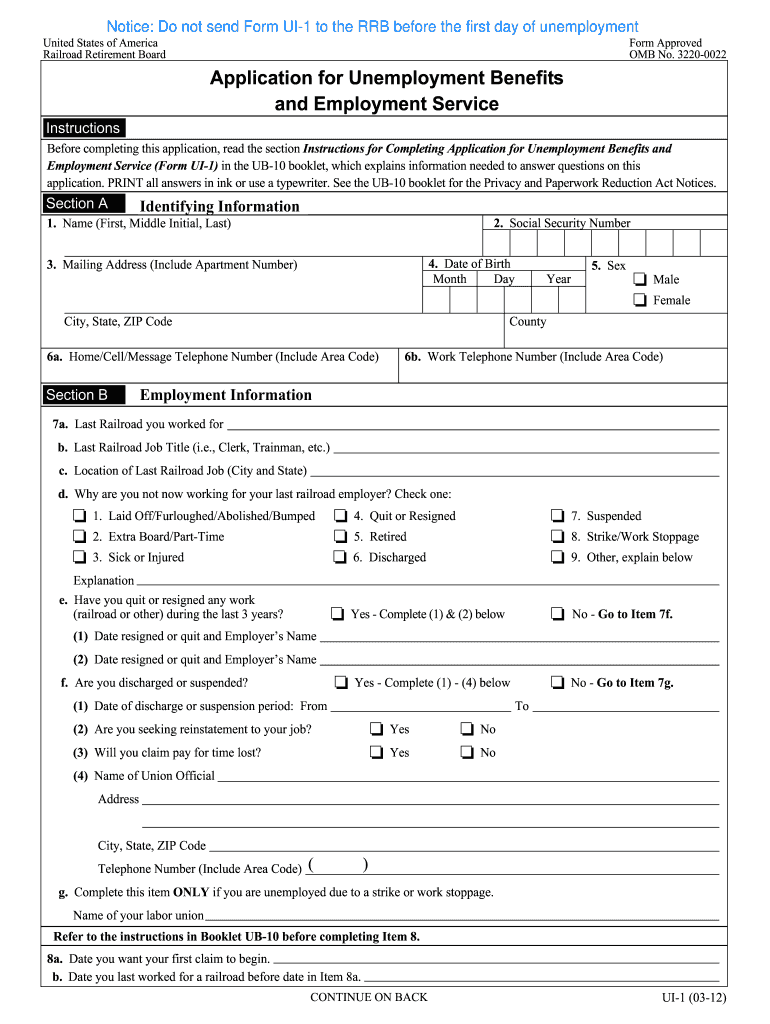

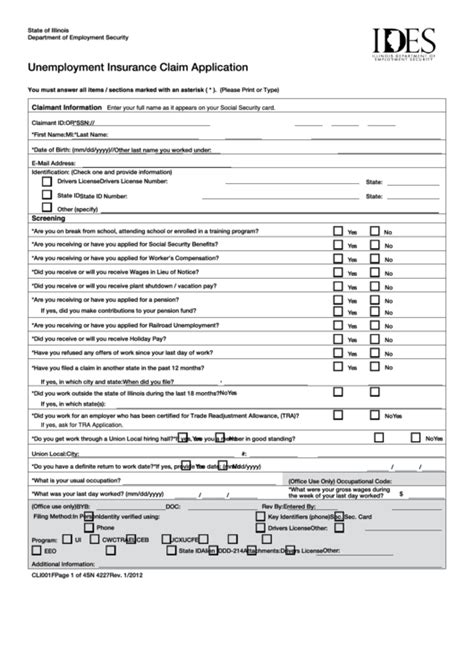

Initial Claim Process

To begin the unemployment claim process in Michigan, individuals must file an initial claim. This involves submitting Form UIA 1718, which requires personal and employment information. The form can be completed online or by phone, and it’s essential to have the following documents ready: * Social Security number * Driver’s license or state ID * Proof of employment, such as pay stubs or W-2 forms * Proof of income, such as tax returns or 1099 forms

Tax Implications

Unemployment benefits in Michigan are subject to federal income tax, but not state income tax. Recipients will receive a Form 1099-G at the end of each year, showing the total amount of benefits received. This form must be included when filing federal income tax returns. It’s also important to note that quarterly tax payments may be required, depending on the individual’s tax situation.

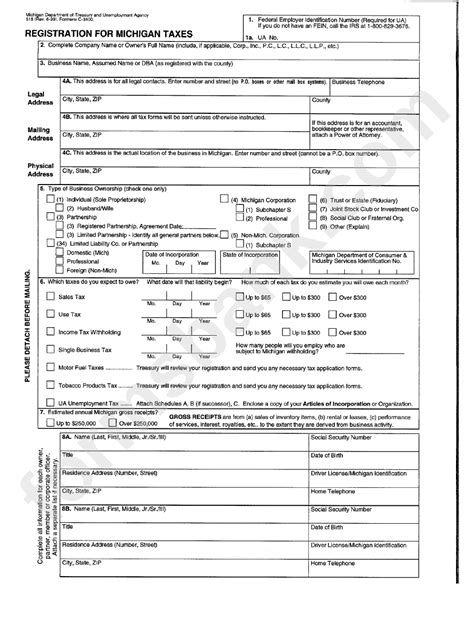

Michigan Unemployment Tax Rates

Employers in Michigan pay unemployment taxes on a percentage of their employees’ wages. The tax rate varies depending on the employer’s experience rating, which is based on their history of layoffs and unemployment claims. The Michigan Unemployment Insurance Agency (UIA) determines the tax rate for each employer, and it’s essential to understand how this rate is calculated: * New employers: 2.7% to 6.4% of taxable wages * Experienced employers: 0.06% to 6.4% of taxable wages * Voluntary contributors: 2.7% to 6.4% of taxable wages

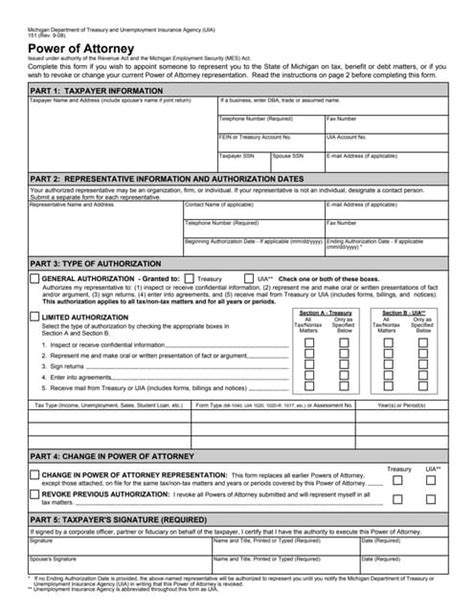

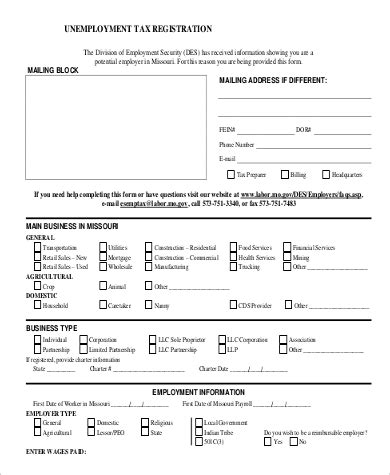

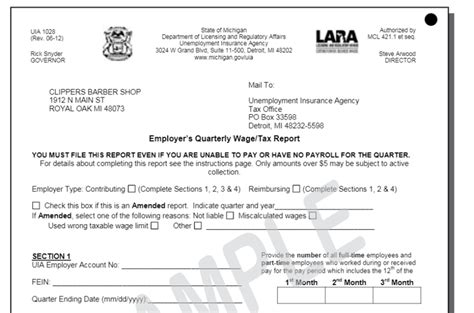

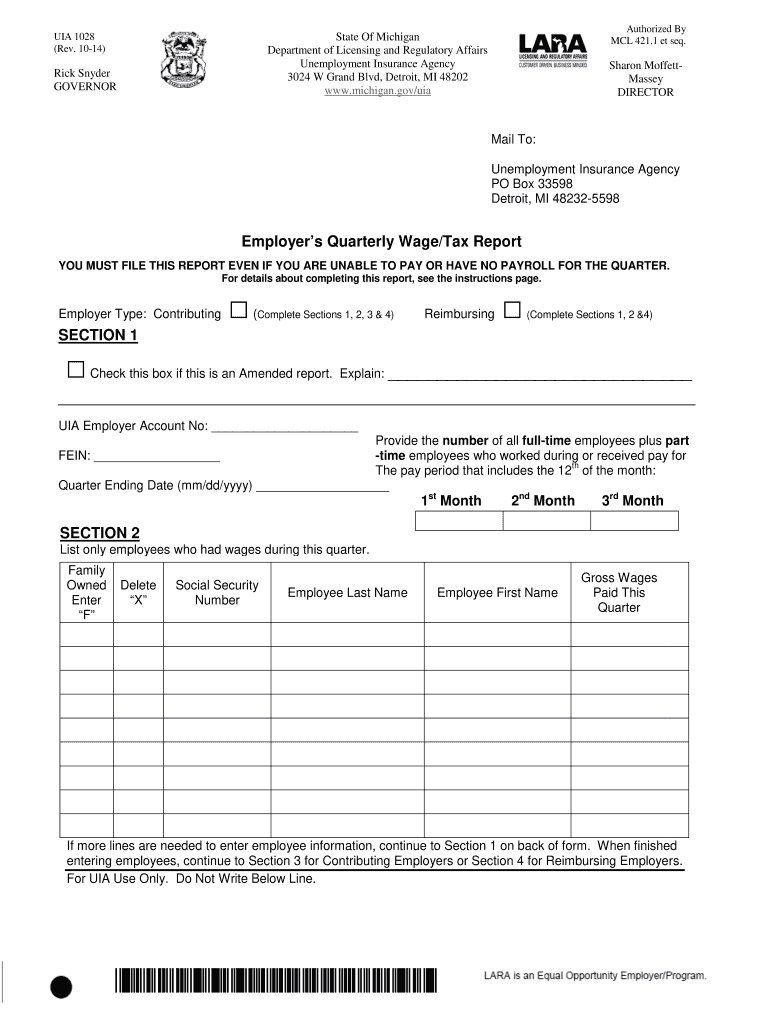

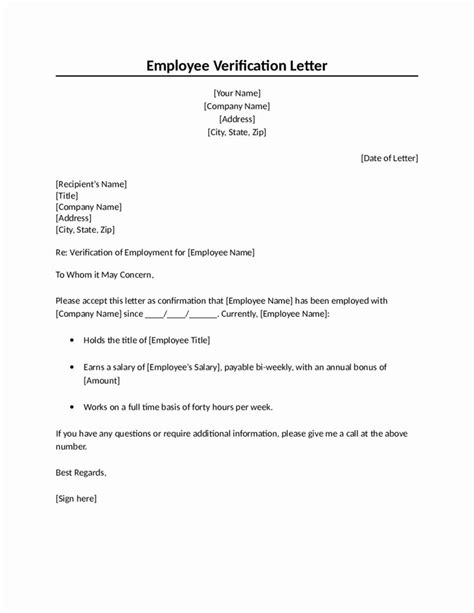

Required Paperwork for Employers

Employers in Michigan must complete various forms and reports to comply with unemployment tax regulations. These include: * Form UIA 1020: Quarterly tax report * Form UIA 1021: Annual tax report * Form UIA 1711: New hire reporting

📝 Note: Employers must also maintain accurate records of employee wages, hours worked, and other relevant information to support their tax filings.

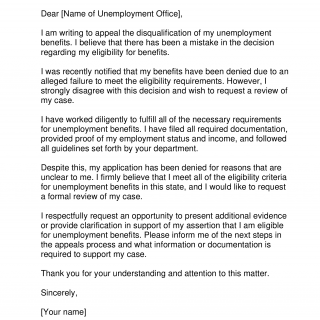

Appeals and Disputes

In cases where an individual’s unemployment claim is denied or an employer disputes a tax assessment, an appeal can be filed. This involves submitting Form UIA 1040 and providing supporting documentation. The appeals process can be complex, and seeking professional assistance may be beneficial.

Penalties and Interest

Failure to file or pay unemployment taxes on time can result in penalties and interest. The Michigan UIA may impose penalties of up to 25% of the unpaid tax amount, plus interest on the outstanding balance. It’s essential to stay on top of tax filings and payments to avoid these additional costs.

Conclusion Summary

In summary, understanding Michigan unemployment tax paperwork is crucial for both individuals and employers. By completing the required forms accurately and on time, individuals can receive the benefits they need, and employers can avoid penalties and interest. It’s also essential to stay informed about tax regulations and rates to ensure compliance with state and federal laws.

What is the deadline for filing an initial unemployment claim in Michigan?

+

The deadline for filing an initial unemployment claim in Michigan is within 14 days of the last day worked.

How do I appeal a denied unemployment claim in Michigan?

+

To appeal a denied unemployment claim in Michigan, you must submit Form UIA 1040 and provide supporting documentation within 30 days of the denial.

What is the tax rate for new employers in Michigan?

+

The tax rate for new employers in Michigan ranges from 2.7% to 6.4% of taxable wages.