5 Ways File Taxes

Introduction to Filing Taxes

Filing taxes is an essential task that individuals and businesses must undertake annually. The process can be daunting, especially for those who are new to it. However, with the advancement of technology and the availability of various resources, there are now multiple ways to file taxes. In this article, we will explore five ways to file taxes, highlighting the benefits and drawbacks of each method.

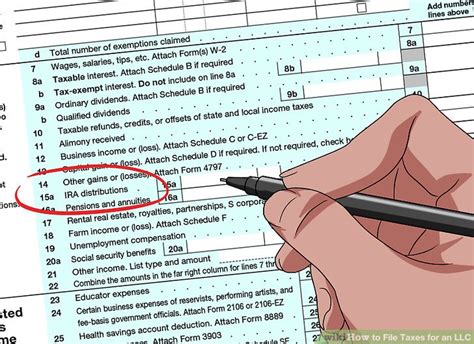

Method 1: Filing Taxes Manually

Filing taxes manually involves filling out tax forms by hand and submitting them to the relevant tax authority. This method is often time-consuming and prone to errors. However, it can be a cost-effective option for those with simple tax returns. To file taxes manually, individuals will need to: * Obtain the necessary tax forms from the tax authority’s website or a local library * Fill out the forms accurately and completely * Attach any required supporting documents, such as receipts and invoices * Submit the forms to the tax authority by the designated deadline

Method 2: Using Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can guide individuals through the tax filing process. These programs ask a series of questions and use the answers to fill out the necessary tax forms. This method is often faster and more accurate than manual filing. Some benefits of using tax preparation software include: * Convenience: Tax preparation software can be accessed from anywhere with an internet connection * Accuracy: The software can reduce errors and ensure that all necessary forms are completed * Time-saving: The software can automate many tasks, such as calculations and form filling

Method 3: Hiring a Tax Professional

Hiring a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), can provide individuals with expert guidance and support. Tax professionals can: * Prepare and file tax returns on behalf of their clients * Provide advice on tax planning and optimization * Represent clients in case of an audit or other tax-related issues Some benefits of hiring a tax professional include: * Expertise: Tax professionals have extensive knowledge of tax laws and regulations * Time-saving: Tax professionals can handle all aspects of tax filing, freeing up time for their clients * Peace of mind: Tax professionals can provide reassurance and support throughout the tax filing process

Method 4: Using Online Tax Filing Services

Online tax filing services, such as TaxAct or Credit Karma, offer a convenient and often free way to file taxes. These services typically provide: * Guided interviews: Users are asked a series of questions to determine their tax obligations * Automated form filling: The service fills out the necessary tax forms based on the user’s answers * E-filing: The service submits the tax return electronically to the tax authority Some benefits of using online tax filing services include: * Convenience: Online tax filing services can be accessed from anywhere with an internet connection * Cost-effectiveness: Many online tax filing services are free or low-cost * Speed: Online tax filing services can provide rapid refunds and status updates

Method 5: Using Mobile Tax Filing Apps

Mobile tax filing apps, such as TurboTax or H&R Block, allow users to file their taxes from their smartphone or tablet. These apps often provide: * Guided interviews: Users are asked a series of questions to determine their tax obligations * Automated form filling: The app fills out the necessary tax forms based on the user’s answers * E-filing: The app submits the tax return electronically to the tax authority Some benefits of using mobile tax filing apps include: * Convenience: Mobile tax filing apps can be accessed from anywhere with a mobile device * Portability: Mobile tax filing apps can be used on-the-go, making it easy to file taxes at any time * Speed: Mobile tax filing apps can provide rapid refunds and status updates

📝 Note: When choosing a method for filing taxes, it's essential to consider factors such as cost, convenience, and accuracy. Individuals should also ensure that they meet the necessary deadlines and follow all applicable tax laws and regulations.

Comparison of Tax Filing Methods

The following table provides a comparison of the five tax filing methods discussed in this article:

| Method | Cost | Convenience | Accuracy |

|---|---|---|---|

| Manual Filing | Low | Low | Low |

| Tax Preparation Software | Medium | High | High |

| Hiring a Tax Professional | High | High | High |

| Online Tax Filing Services | Low | High | High |

| Mobile Tax Filing Apps | Low | High | High |

In summary, there are various ways to file taxes, each with its benefits and drawbacks. By considering factors such as cost, convenience, and accuracy, individuals can choose the method that best suits their needs. Whether filing manually, using tax preparation software, hiring a tax professional, or utilizing online or mobile tax filing services, it’s essential to ensure that taxes are filed accurately and on time to avoid any potential penalties or issues.

What is the deadline for filing taxes?

+

The deadline for filing taxes varies depending on the country and tax authority. In the United States, the deadline is typically April 15th for individual tax returns.

Can I file my taxes online?

+

Yes, many tax authorities and online tax filing services offer the option to file taxes online. This can be a convenient and efficient way to submit your tax return.

What are the benefits of hiring a tax professional?

+

Hiring a tax professional can provide expert guidance and support, ensuring that your taxes are filed accurately and on time. Tax professionals can also provide advice on tax planning and optimization.