5 Ways Get Tax Return

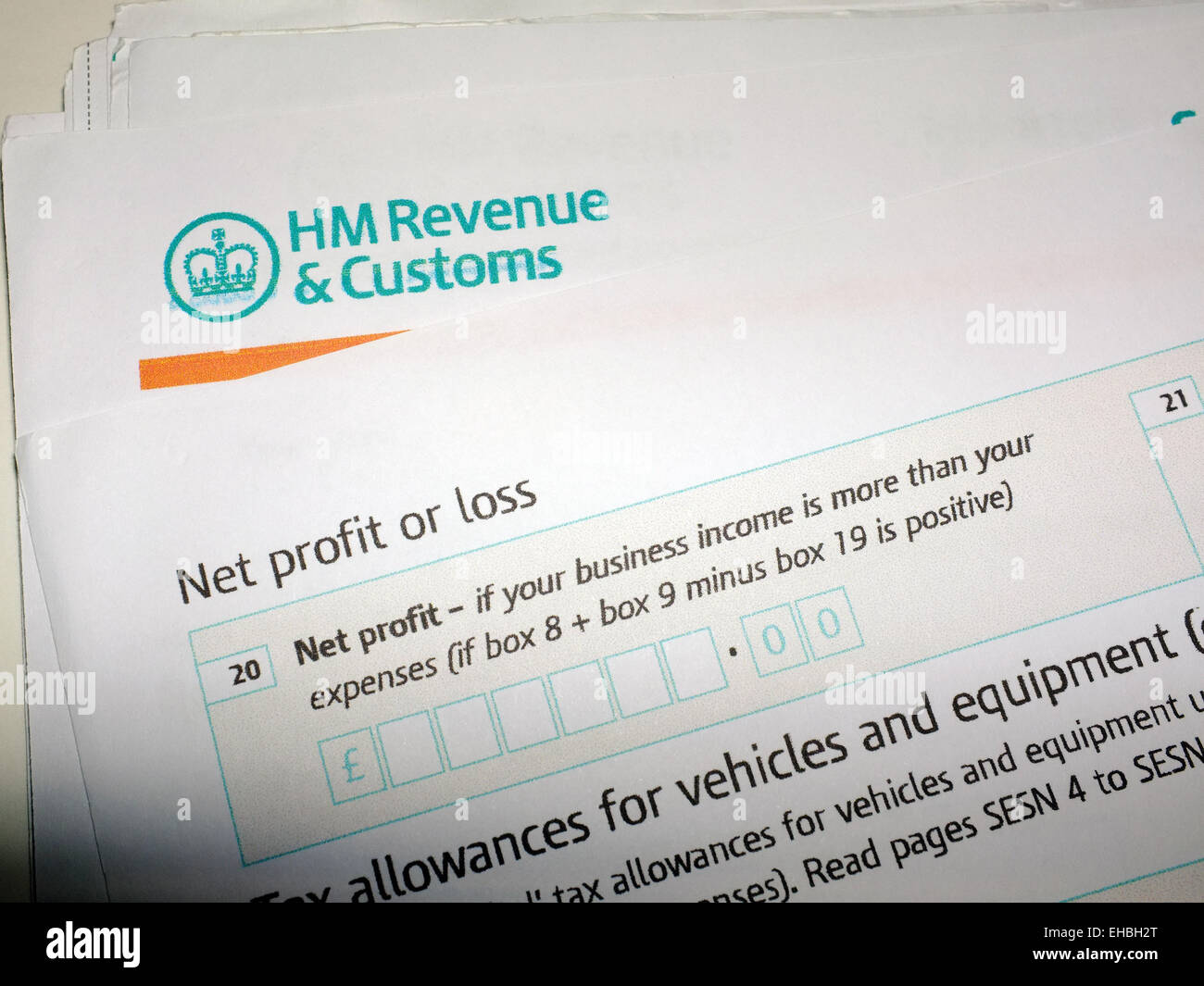

Understanding Tax Returns

Tax returns are an essential part of the financial year for individuals and businesses alike. The process involves declaring your income and expenses to the relevant tax authority, which then calculates the amount of tax you owe or the refund you are due. Efficient management of tax returns can lead to significant financial benefits, including avoiding penalties for late submissions or payments and ensuring you receive any refunds you are entitled to in a timely manner. In this article, we will explore five ways to get your tax return, focusing on methods that maximize your refund and minimize your tax liability.

Method 1: DIY Tax Preparation

One of the most straightforward ways to manage your tax return is by doing it yourself. DIY tax preparation involves using tax preparation software or filling out the tax forms manually. This method is cost-effective and allows for complete control over your tax return process. However, it requires a good understanding of tax laws and regulations, which can be complex and time-consuming to navigate. Popular DIY tax preparation software includes TurboTax and H&R Block, which guide you through the process with interview-style questions and automatically fill out the necessary forms based on your inputs.

Method 2: Hiring a Tax Professional

For those who find tax laws confusing or who have complex tax situations, hiring a tax professional can be a viable option. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise to navigate complex tax laws and ensure you take advantage of all the deductions and credits you are eligible for. This method can be more expensive than DIY preparation but often results in a larger refund or lower tax liability due to the professional’s ability to identify overlooked deductions and credits.

Method 3: Using Online Tax Preparation Services

Online tax preparation services offer a balance between the control of DIY preparation and the expertise of hiring a professional. These services, such as TaxAct or Credit Karma Tax, provide user-friendly interfaces and real-time calculations to help you prepare and file your taxes online. Many of these services offer free filing for simple returns and charge a fee for more complex returns. They also often include audit protection and refund guarantees, making them a secure option for those who want the benefits of professional preparation without the high costs.

Method 4: Tax Preparation Companies

Visiting a tax preparation company like Jackson Hewitt or H&R Block in person is another method. These companies have physical locations where you can meet with a tax professional face-to-face. They guide you through the tax preparation process, ensuring that all necessary forms are filled out correctly and that you are taking advantage of all eligible deductions and credits. This method is particularly useful for those who prefer personal interaction or have questions and concerns they would like to discuss in person.

Method 5: Free Tax Preparation Services

For individuals with lower incomes or simple tax returns, free tax preparation services may be available. The IRS offers the Free File program, which allows eligible taxpayers to prepare and file their federal income tax online for free. Additionally, many communities have Volunteer Income Tax Assistance (VITA) programs, where volunteers prepare tax returns for free for those who qualify, typically individuals with disabilities, the elderly, and limited English speakers. These services not only save money but also ensure that individuals who might otherwise struggle with the tax preparation process receive the assistance they need.

📝 Note: When choosing a method for preparing your tax return, consider your financial situation, the complexity of your taxes, and your personal preferences regarding control and cost.

In summary, the method you choose for getting your tax return should align with your financial situation, the complexity of your tax return, and your personal preferences. Whether you opt for DIY preparation, hire a professional, use online services, visit a tax preparation company, or utilize free services, the key is to ensure you are maximizing your refund and minimizing your tax liability. By understanding and leveraging these options, you can make the tax season less stressful and more financially beneficial.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns typically falls on April 15th of each year, but it can vary if this date falls on a weekend or a federal holiday. It’s also worth noting that you can file for an extension if you need more time to prepare your return.

Can I file my tax return for free?

+

Yes, you can file your tax return for free under certain conditions. The IRS Free File program and community Volunteer Income Tax Assistance (VITA) programs offer free tax preparation and filing for eligible individuals, typically those with lower incomes or simple tax returns.

How do I know if I need to file a tax return?

+

You generally need to file a tax return if your income meets certain thresholds, which vary based on your filing status and age. Even if you don’t meet these thresholds, you may still want to file a return if you have taxes withheld or are eligible for a refund or credits, such as the Earned Income Tax Credit (EITC).