5 Ways to Check S Corp Filing

Understanding S Corp Filing

When a business elects to be an S corporation, it is essentially choosing a special tax status with the IRS. This election allows the corporation to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes, thereby avoiding double taxation. However, this status comes with specific requirements and restrictions, including how the corporation files its taxes and reports its financial activities. Checking S Corp filing is crucial for ensuring compliance with IRS regulations and maintaining the S Corp status. Here are five ways to check S Corp filing:

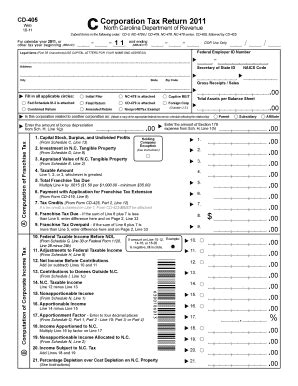

1. Review IRS Form 1120S

The IRS Form 1120S is the income tax return for S corporations. It’s used to report the corporation’s income, deductions, and credits. To check the S Corp filing, start by reviewing this form. Ensure all required information is accurately filled out, including: - Corporate name and address - Employer Identification Number (EIN) - Total assets - Income from various sources - Deductions and credits

2. Verify Shareholder Information

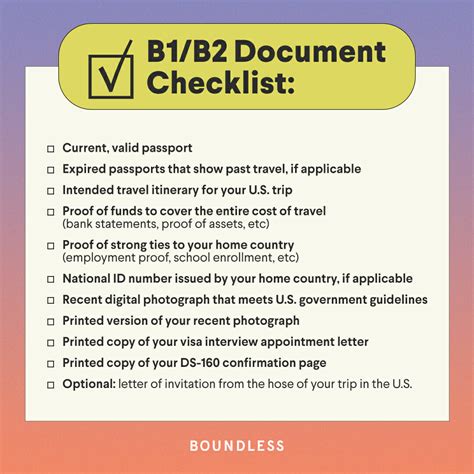

For an S corporation, the number and type of shareholders are critical. The IRS limits S corporations to having no more than 100 shareholders, and these shareholders must be U.S. citizens, resident aliens, or certain trusts and estates. Verify each shareholder’s information, including their name, address, percentage of ownership, and the number of shares owned. This information is reported on Schedule K-1 of Form 1120S.

3. Ensure Compliance with Ownership and Structural Requirements

S corporations have specific ownership and structural requirements. These include: - Having only one class of stock (with certain exceptions for voting and non-voting shares) - Not having any corporate or partnership shareholders (with exceptions for certain trusts and estate beneficiaries) - Not being an ineligible corporation (such as an insurance company) Checking these requirements involves reviewing the corporation’s bylaws, shareholder agreements, and stock issuances to ensure they comply with S Corp regulations.

4. Review Financial Statements and Records

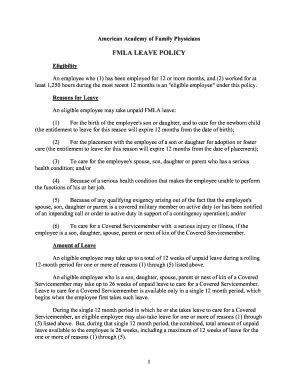

An S corporation must maintain accurate and detailed financial records, including balance sheets, income statements, and cash flow statements. Regularly reviewing these financial statements can help identify any discrepancies or issues that might affect S Corp filing. It’s also essential to ensure that all financial activities, such as income, expenses, loans, and distributions, are properly documented and reported.

5. Consult with a Tax Professional

Given the complexity of S Corp filing and the potential for penalties or loss of S Corp status due to non-compliance, consulting with a tax professional is highly recommended. A tax professional can: - Review the corporation’s current filing status and compliance - Identify any potential issues or areas for improvement - Provide guidance on maintaining accurate records and ensuring ongoing compliance - Assist in preparing and filing the necessary tax forms, including Form 1120S and related schedules

📝 Note: It's crucial to stay informed about any changes in IRS regulations or S Corp requirements to maintain compliance and avoid any potential penalties.

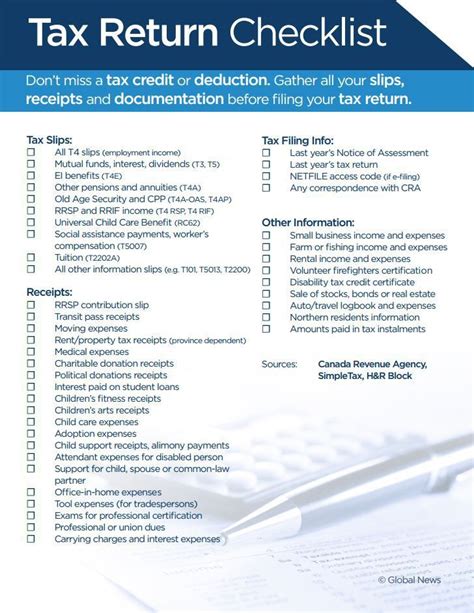

To further illustrate the importance of proper S Corp filing, consider the following table outlining key compliance areas:

| Compliance Area | Description |

|---|---|

| IRS Form 1120S | Annual income tax return for S corporations |

| Shareholder Information | Verification of shareholder details, including ownership percentages |

| Ownership and Structure | Compliance with S Corp ownership and structural requirements |

| Financial Records | Maintenance of accurate financial statements and records |

| Tax Professional Consultation | Seeking professional advice for compliance and filing assistance |

In summary, checking S Corp filing involves a thorough review of the corporation’s tax returns, shareholder information, compliance with ownership and structural requirements, financial records, and consultation with a tax professional. By following these steps, S corporations can ensure they are meeting all the necessary requirements to maintain their status and avoid any potential issues with the IRS.

What is the main difference between an S corporation and a C corporation in terms of taxation?

+

The main difference is that S corporations are pass-through entities, meaning the corporation’s income is passed through to the shareholders, who report it on their personal tax returns. In contrast, C corporations are subject to double taxation, where the corporation is taxed on its profits, and then the shareholders are taxed again on the dividends they receive.

How many shareholders can an S corporation have?

+

An S corporation can have no more than 100 shareholders.

What happens if an S corporation fails to meet the eligibility requirements?

+

If an S corporation fails to meet the eligibility requirements, it may lose its S Corp status and be treated as a C corporation for tax purposes, leading to double taxation.