Paperwork

5 Ways Fix LLC Paperwork

Introduction to LLC Paperwork

Forming a Limited Liability Company (LLC) is a significant step for any business, offering liability protection and tax benefits. However, the process of setting up an LLC involves several legal and administrative tasks, one of which is completing the necessary paperwork. The paperwork for an LLC can be complex and varies by state, but there are common steps and documents that are required across the board. In this post, we will explore five ways to fix common issues with LLC paperwork and provide a comprehensive guide on how to navigate the process smoothly.

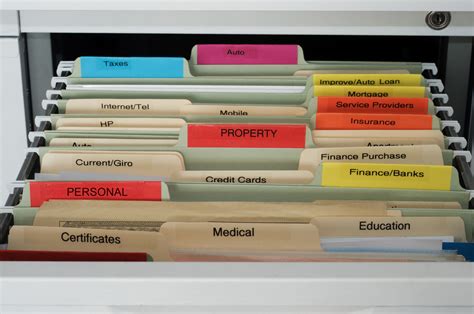

Understanding LLC Paperwork Requirements

Before diving into the solutions, it’s essential to understand what LLC paperwork entails. The primary documents include Articles of Organization, Operating Agreement, EIN (Employer Identification Number) application, and other state-specific filings. Each of these documents plays a crucial role in the formation and operation of an LLC. Accuracy and completeness are key when preparing these documents to avoid delays or legal issues.

1. Correcting Errors in Articles of Organization

The Articles of Organization is the foundational document that establishes your LLC with the state. Errors in this document can lead to rejection by the state, delaying your business’s formation. Common mistakes include incorrect business name, improperly listed members or managers, and inaccurate business address. To fix these errors, you should: - Review the state’s requirements carefully to ensure all information is accurate and complete. - Amend the Articles of Organization if the LLC has already been formed, which may require filing additional paperwork with the state.

2. Drafting a Comprehensive Operating Agreement

An Operating Agreement outlines the ownership, management, and operation of the LLC. It’s a critical document that can prevent disputes among members. A common issue with Operating Agreements is that they are either too vague or not tailored to the specific needs of the business. To fix this: - Customize the Operating Agreement to fit your LLC’s unique structure and needs. - Include detailed provisions for member roles, profit and loss distribution, and dispute resolution.

3. Obtaining an EIN and Complying with Tax Requirements

An EIN (Employer Identification Number) is necessary for tax purposes and to open a business bank account. Issues can arise if the EIN application is incorrectly filled out or if the LLC fails to comply with tax requirements. To address these issues: - Ensure the EIN application is accurately completed, paying close attention to the business name and address. - Understand the tax obligations of the LLC, including whether it will be taxed as a pass-through entity or a corporation.

4. Meeting State-Specific Filing Requirements

Each state has its own set of requirements for LLC formation, which can include annual reports, business licenses, and public notices. Failure to meet these requirements can result in penalties or even dissolution of the LLC. To fix issues related to state filings: - Research the specific requirements for your state and ensure you understand all necessary filings and deadlines. - Comply with ongoing requirements, such as annual reports, to maintain good standing with the state.

5. Seeking Professional Assistance

Given the complexity of LLC paperwork, seeking professional help can be invaluable. Attorneys and business formation services can guide you through the process, ensuring that all documents are correctly prepared and filed. This can help avoid costly mistakes and provide peace of mind.

💡 Note: Always keep detailed records of your LLC's formation documents and any subsequent amendments or filings, as these will be essential for legal and tax purposes.

Conclusion and Next Steps

Navigating the process of forming an LLC and fixing issues with its paperwork requires careful attention to detail and a thorough understanding of the legal and administrative requirements. By following the steps outlined above and seeking professional assistance when needed, you can ensure your LLC is properly established and set up for success. Remember, accuracy and compliance are key to avoiding legal and financial complications down the line.

What is the primary document for forming an LLC?

+

The primary document for forming an LLC is the Articles of Organization, which is filed with the state to establish the LLC.

Why is an Operating Agreement important for an LLC?

+

An Operating Agreement is crucial because it outlines the ownership, management, and operation of the LLC, helping to prevent disputes among members and ensuring the business runs smoothly.

What happens if an LLC fails to comply with state filing requirements?

+

Failure to comply with state filing requirements, such as annual reports, can result in penalties, fines, and potentially the dissolution of the LLC by the state.