5 Ways Get Loan Papers

Introduction to Loan Papers

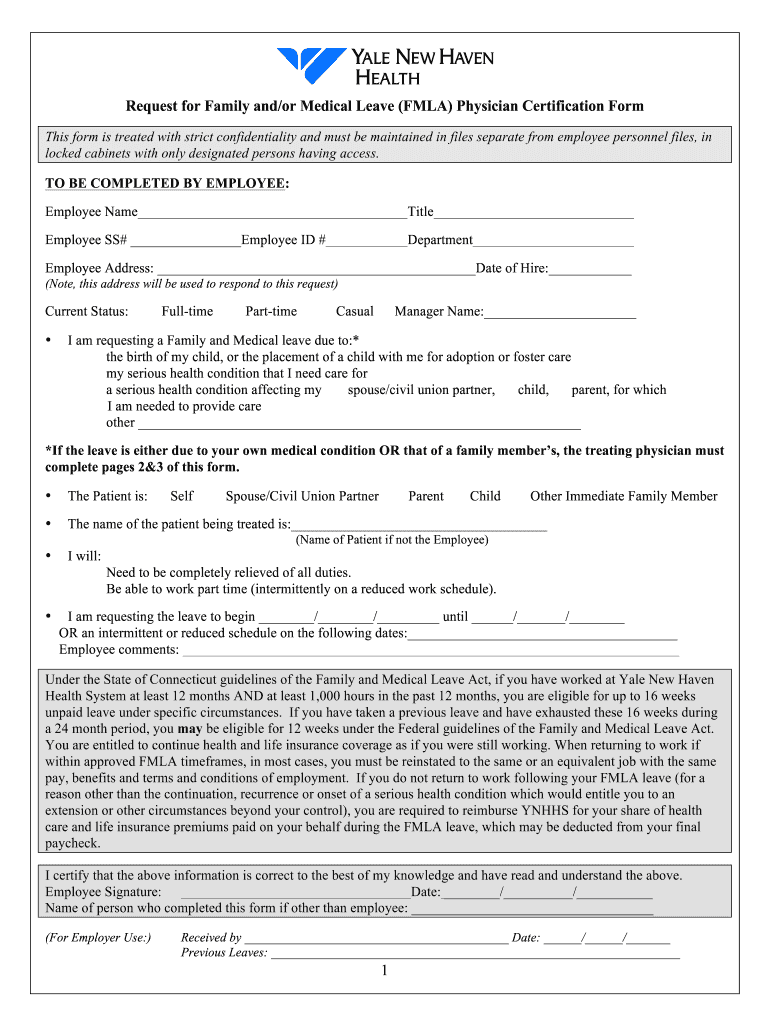

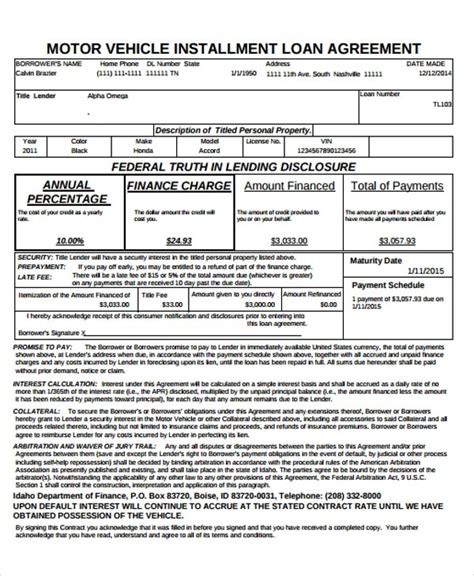

When considering taking out a loan, whether it’s for a personal, business, or mortgage purpose, understanding the loan papers is crucial. These documents outline the terms and conditions of the loan, including the interest rate, repayment terms, and any penalties for late payments. In this article, we will explore five ways to obtain loan papers, highlighting the importance of carefully reviewing these documents before signing.

Understanding Loan Papers

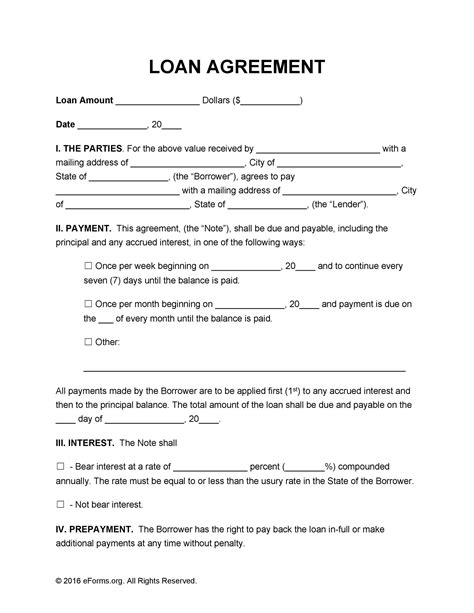

Loan papers, also known as loan agreements or promissory notes, are legal contracts between the lender and the borrower. They provide detailed information about the loan, such as the loan amount, interest rate, repayment schedule, and any collateral required. It’s essential to carefully review these documents to ensure you understand your obligations and the terms of the loan. Failure to do so can lead to financial difficulties and damage to your credit score.

5 Ways to Get Loan Papers

Here are five ways to obtain loan papers: * Directly from the Lender: The most straightforward way to get loan papers is directly from the lender. Once you’ve applied for a loan and been approved, the lender will provide you with the loan papers to review and sign. * Online Loan Platforms: Many online loan platforms, such as LendingTree or Personal Loans, offer loan papers and agreements that can be downloaded or printed from their websites. * Loan Brokers: Loan brokers can also provide loan papers and help you navigate the loan application process. They often have relationships with multiple lenders and can assist in finding the best loan option for your needs. * Financial Institutions: Banks and credit unions typically have loan papers available for their loan products. You can visit their websites or branches to obtain the necessary documents. * Law Firms or Attorneys: In some cases, you may want to consult with a law firm or attorney to review loan papers before signing. They can provide guidance on the legal implications of the loan agreement and ensure you understand your obligations.

Reviewing Loan Papers

When reviewing loan papers, it’s essential to pay attention to the following:

| Section | Description |

|---|---|

| Loan Amount | The total amount borrowed, including any fees or interest |

| Interest Rate | The rate at which interest is charged on the loan |

| Repayment Schedule | The frequency and amount of payments due |

| Collateral | Any assets required to secure the loan |

| Penalties | Any fees or charges for late payments or default |

📝 Note: Carefully review the loan papers to ensure you understand all the terms and conditions before signing.

Importance of Loan Papers

Loan papers are a critical component of the loan process. They provide a clear understanding of the loan terms and conditions, helping you make informed decisions about your financial obligations. By carefully reviewing loan papers, you can avoid potential pitfalls, such as hidden fees or unfavorable repayment terms. It’s essential to take the time to review and understand the loan papers to ensure you’re comfortable with the terms and conditions.

To finalize your loan application, it is crucial to ensure all parties involved have signed the loan papers, and you have received a copy for your records.

In the end, getting a loan can be a complex process, but understanding and carefully reviewing the loan papers can make all the difference in ensuring a smooth and successful transaction.

What is the purpose of loan papers?

+

Loan papers, also known as loan agreements or promissory notes, are legal contracts between the lender and the borrower that outline the terms and conditions of the loan.

How do I obtain loan papers?

+

You can obtain loan papers directly from the lender, online loan platforms, loan brokers, financial institutions, or law firms and attorneys.

What should I look for when reviewing loan papers?

+

When reviewing loan papers, pay attention to the loan amount, interest rate, repayment schedule, collateral, and penalties for late payments or default.