Paperwork

5 Ways Texas LLC

Introduction to Texas LLC Formation

When it comes to forming a business in Texas, one of the most popular options is creating a Limited Liability Company, or LLC. This is because an LLC offers personal liability protection and tax benefits, making it an attractive choice for entrepreneurs. In this article, we will explore the top 5 ways Texas LLC formation can benefit your business and provide a step-by-step guide on how to form an LLC in Texas.

Benefits of Forming a Texas LLC

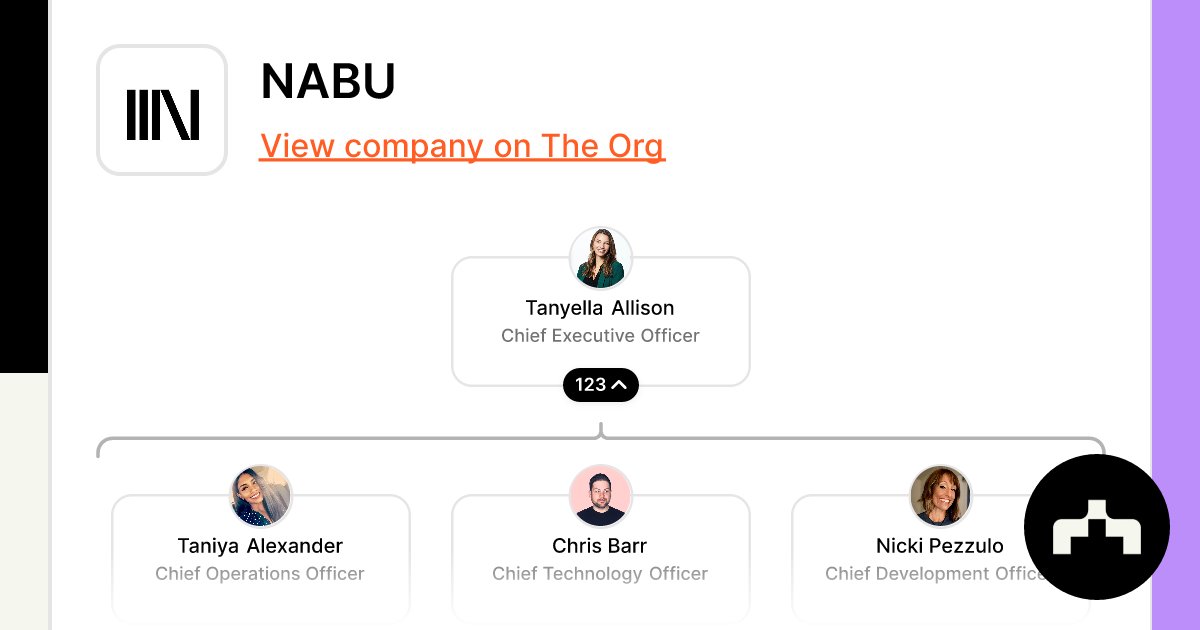

Forming a Texas LLC offers numerous benefits, including: * Personal Liability Protection: An LLC protects its owners, also known as members, from personal liability in case the business is sued or incurs debt. * Tax Benefits: LLCs are pass-through entities, meaning that the business income is only taxed at the individual level, not at the business level. * Flexible Ownership Structure: LLCs can have any number of owners, and ownership can be structured in a variety of ways, including membership interests and voting rights. * Ease of Formation: Forming an LLC in Texas is a relatively simple and straightforward process. * Credibility and Legitimacy: Forming an LLC can help establish credibility and legitimacy with customers, vendors, and partners.

Step-by-Step Guide to Forming a Texas LLC

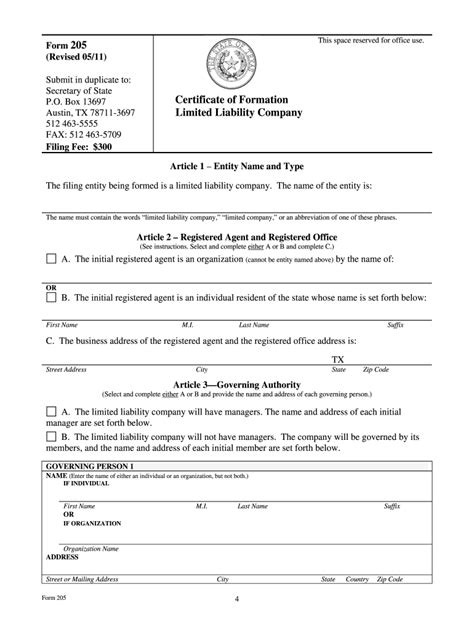

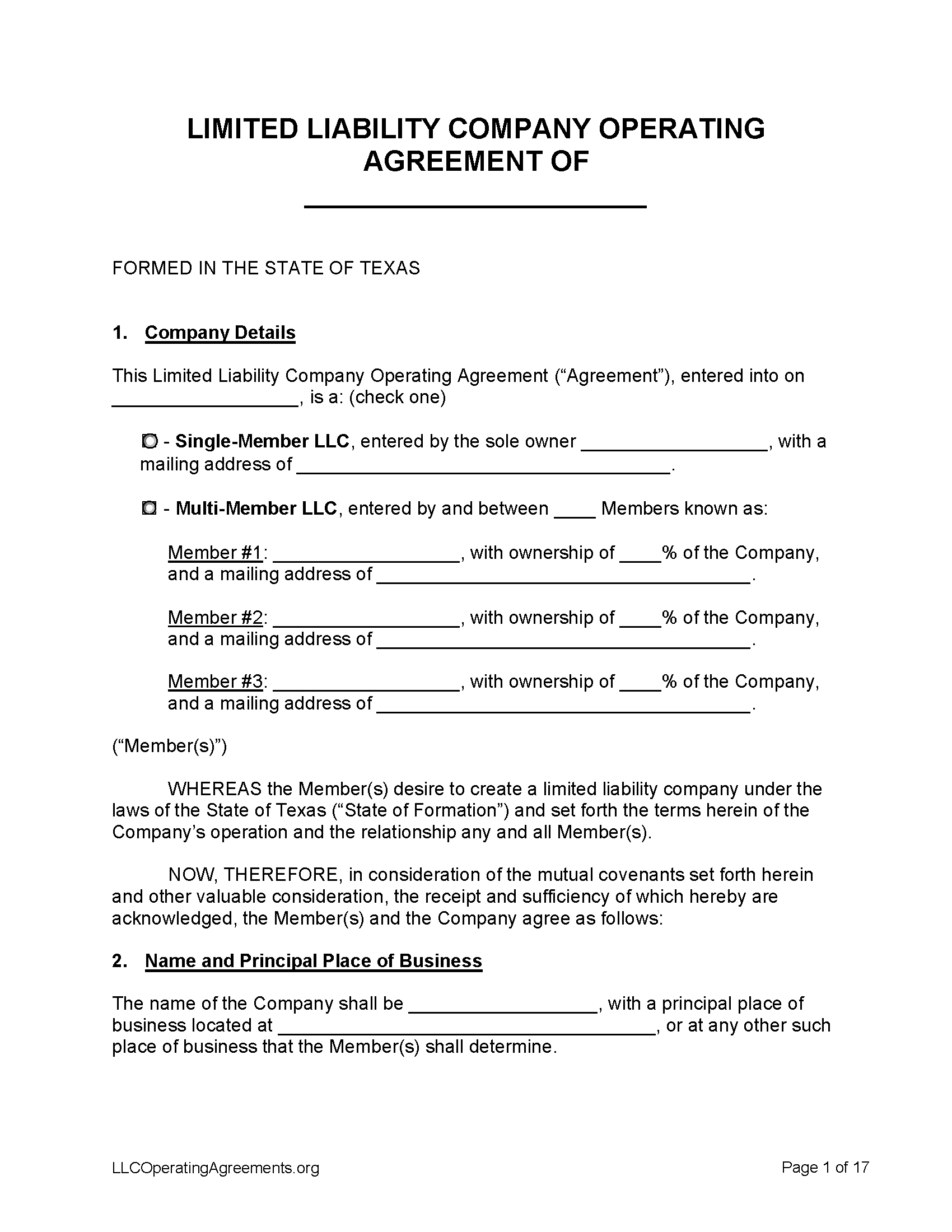

To form a Texas LLC, follow these steps: * Choose a Business Name: Select a unique and memorable name for your LLC that complies with Texas naming requirements. * File Articles of Organization: Submit the Articles of Organization to the Texas Secretary of State, either online or by mail. * Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS. * Create an Operating Agreement: Develop an operating agreement that outlines the ownership structure, management, and operational procedures of your LLC. * Obtain Licenses and Permits: Obtain any necessary licenses and permits to operate your business in Texas.

Texas LLC Formation Requirements

To form a Texas LLC, you will need to meet the following requirements: * Minimum Age: You must be at least 18 years old to form an LLC in Texas. * Residency: You do not need to be a Texas resident to form an LLC in the state. * Business Purpose: Your LLC must have a legitimate business purpose. * Registered Agent: You must appoint a registered agent with a physical address in Texas.

Texas LLC Formation Costs

The costs associated with forming a Texas LLC include: * Filing Fee: The filing fee for the Articles of Organization is currently 300. * <b>Registered Agent Fee</b>: The cost of hiring a registered agent can range from 100 to 300 per year. * <b>Operating Agreement</b>: The cost of creating an operating agreement can range from 500 to $2,000, depending on the complexity of the document.

📝 Note: It's essential to consult with an attorney or tax professional to ensure you comply with all Texas LLC formation requirements and regulations.

Conclusion and Final Thoughts

In conclusion, forming a Texas LLC can provide numerous benefits, including personal liability protection, tax benefits, and flexibility in ownership structure. By following the step-by-step guide and meeting the formation requirements, you can establish a successful and legitimate business in Texas. Remember to consult with professionals and stay up-to-date on all regulations and laws governing Texas LLCs.

What is the minimum number of owners required to form a Texas LLC?

+

There is no minimum number of owners required to form a Texas LLC. A single individual can form an LLC in Texas.

How long does it take to form a Texas LLC?

+

The processing time for forming a Texas LLC can range from a few days to several weeks, depending on the filing method and the workload of the Texas Secretary of State.

Do I need to obtain a business license to operate a Texas LLC?

+

Yes, you may need to obtain a business license or permit to operate your Texas LLC, depending on the type of business and location. Check with the Texas Secretary of State and local authorities to determine the specific requirements.