5 Ways Assume Mortgage

Assuming a Mortgage: A Comprehensive Guide

Assuming a mortgage can be a viable option for both buyers and sellers in the real estate market. It allows the buyer to take over the seller’s existing mortgage, which can be beneficial in certain situations. In this article, we will explore the concept of assuming a mortgage, its benefits, and the process involved.

What is a Mortgage Assumption?

A mortgage assumption occurs when a buyer takes over the seller’s existing mortgage, including the outstanding balance, interest rate, and repayment terms. This means that the buyer becomes responsible for making the monthly payments, and the seller is released from their obligations. Mortgage assumptions can be a win-win situation for both parties, as the buyer can benefit from a lower interest rate, and the seller can avoid paying penalties for early repayment.

Benefits of Assuming a Mortgage

There are several benefits to assuming a mortgage, including: * Lower interest rates: If the seller’s mortgage has a lower interest rate than current market rates, the buyer can benefit from lower monthly payments. * Reduced closing costs: Assuming a mortgage can reduce the closing costs associated with obtaining a new mortgage. * Faster closing: The process of assuming a mortgage can be faster than applying for a new mortgage, as the buyer does not need to go through the entire underwriting process. * Increased purchasing power: By assuming a mortgage, the buyer may be able to afford a more expensive property than they would have been able to with a new mortgage. * Tax benefits: The buyer may be able to deduct the interest payments on the assumed mortgage from their taxable income.

Types of Mortgages that Can be Assumed

Not all mortgages can be assumed. The most common types of mortgages that can be assumed are: * VA loans: VA loans are guaranteed by the Department of Veterans Affairs and can be assumed by eligible buyers. * FHA loans: FHA loans are insured by the Federal Housing Administration and can be assumed by buyers who meet the FHA’s requirements. * USDA loans: USDA loans are guaranteed by the United States Department of Agriculture and can be assumed by eligible buyers. * Conventional loans: Some conventional loans can be assumed, but this is less common and typically requires the lender’s approval.

How to Assume a Mortgage

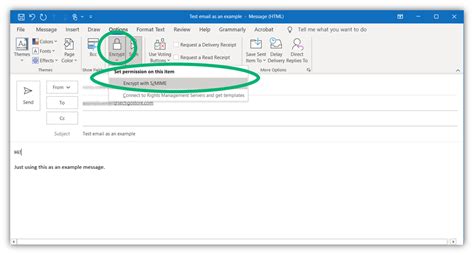

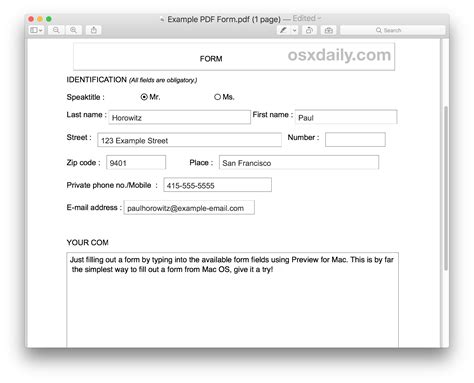

The process of assuming a mortgage involves several steps: * Check the mortgage contract: Review the mortgage contract to see if it allows for assumptions. * Get lender approval: The buyer must get approval from the lender to assume the mortgage. * Apply for a mortgage assumption: The buyer must apply for a mortgage assumption, which involves providing financial information and credit history. * Pay an assumption fee: The buyer may need to pay an assumption fee, which can range from 0.5% to 1% of the outstanding balance. * Close the deal: Once the assumption is approved, the buyer and seller can close the deal, and the buyer becomes responsible for making the monthly payments.

📝 Note: It's essential to work with a real estate agent and a lender who are experienced in mortgage assumptions to ensure a smooth process.

Example of a Mortgage Assumption

Let’s say a seller has a 200,000 mortgage with an interest rate of 4% and a monthly payment of 955. The buyer wants to assume the mortgage and take over the monthly payments. The buyer would need to apply for a mortgage assumption, pay an assumption fee, and get lender approval. Once the assumption is approved, the buyer becomes responsible for making the monthly payments, and the seller is released from their obligations.

| Outstanding Balance | Interest Rate | Monthly Payment |

|---|---|---|

| $200,000 | 4% | $955 |

Mortgage Assumption vs. Refinancing

Assuming a mortgage is different from refinancing a mortgage. When you refinance a mortgage, you pay off the existing mortgage and replace it with a new one. When you assume a mortgage, you take over the existing mortgage and its terms. Refinancing can be a good option if you want to take advantage of lower interest rates or change the terms of your mortgage. However, assuming a mortgage can be a better option if you want to avoid paying penalties for early repayment or reduce closing costs.

In the end, assuming a mortgage can be a great option for buyers and sellers who want to save money on closing costs and interest rates. By understanding the process and benefits of assuming a mortgage, you can make an informed decision about whether this option is right for you.

What is a mortgage assumption?

+

A mortgage assumption occurs when a buyer takes over the seller’s existing mortgage, including the outstanding balance, interest rate, and repayment terms.

What are the benefits of assuming a mortgage?

+

The benefits of assuming a mortgage include lower interest rates, reduced closing costs, faster closing, increased purchasing power, and tax benefits.

Can all mortgages be assumed?

+

No, not all mortgages can be assumed. The most common types of mortgages that can be assumed are VA loans, FHA loans, USDA loans, and some conventional loans.

How do I assume a mortgage?

+

To assume a mortgage, you need to check the mortgage contract, get lender approval, apply for a mortgage assumption, pay an assumption fee, and close the deal.

What is the difference between assuming a mortgage and refinancing a mortgage?

+

Assuming a mortgage means taking over the existing mortgage and its terms, while refinancing a mortgage means paying off the existing mortgage and replacing it with a new one.