5 Ways Organize Bills

Introduction to Bill Organization

Managing bills effectively is a crucial aspect of personal finance and household management. It helps in avoiding late fees, penalties, and negative impacts on credit scores. With the plethora of bills to pay, from utilities and credit cards to mortgages and insurance, organizing them can seem daunting. However, with the right strategies and tools, anyone can develop a system that works for them. In this article, we will explore 5 ways to organize bills, making the process simpler, more efficient, and less stressful.

Understanding the Importance of Bill Organization

Before diving into the methods of organizing bills, it’s essential to understand why it’s crucial. Late payments can lead to additional charges, higher interest rates, and a decrease in credit score. Moreover, missing payments can result in service interruptions, which can be inconvenient and costly to resolve. A well-organized bill payment system helps in budgeting, ensuring that there’s enough money set aside for all necessary payments, thus avoiding financial strain.

5 Effective Ways to Organize Bills

Here are five strategies to help manage bills effectively:

- Calendar Method: This involves marking down all bill due dates on a calendar. It can be a physical calendar hung on the wall or a digital one on your smartphone. Setting reminders a few days before the due date can ensure timely payments.

- Automated Payments: Setting up automatic payments for bills can simplify the process. This way, the payment is deducted from your account on the due date, eliminating the risk of late payments. It’s essential to ensure there’s enough money in the account to avoid overdraft fees.

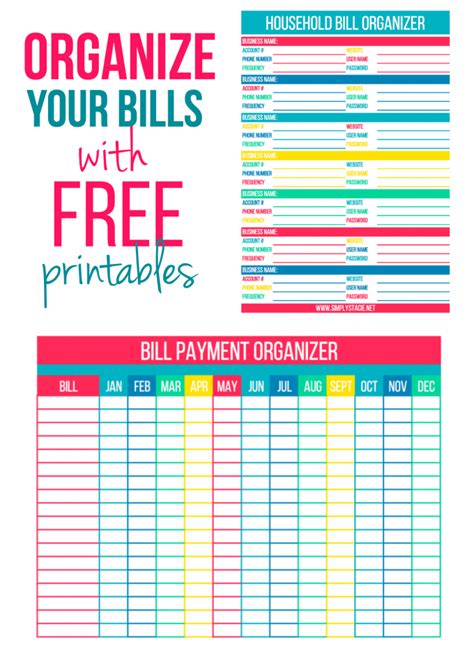

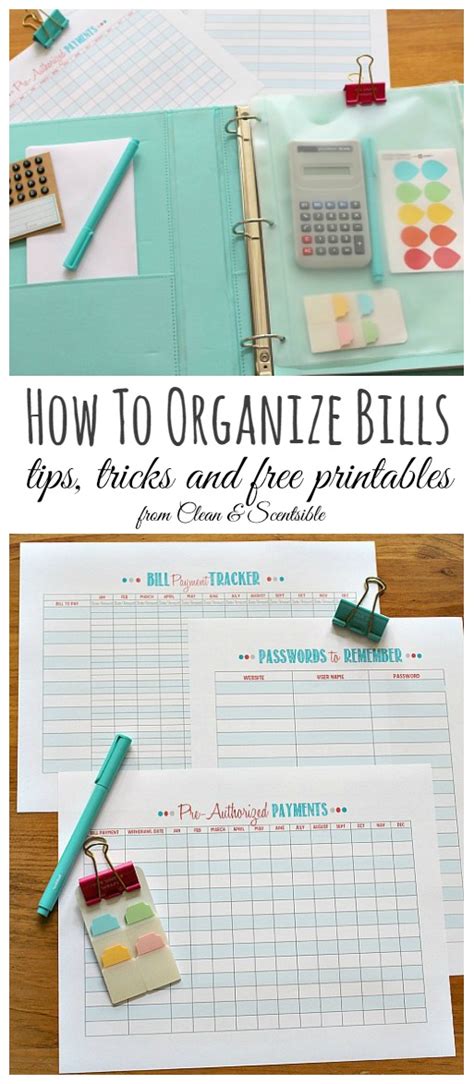

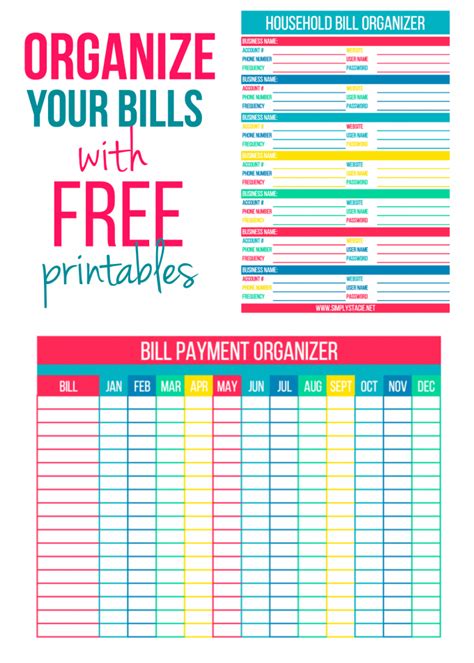

- Bill Tracker: Creating or using a bill tracker spreadsheet can be highly effective. This involves listing all bills, their due dates, and the amount to be paid. It provides a clear overview of upcoming payments and helps in planning the budget accordingly.

- Envelope System: For those who prefer a more hands-on approach, the envelope system can be useful. It involves creating an envelope for each bill, where the payment stub and any relevant information are kept. Once the payment is made, the receipt is stored in the envelope for record-keeping.

- Digital Bill Management Tools: There are numerous digital tools and apps designed to manage bills. These platforms allow users to track their bills, receive reminders, and make payments directly through the app. They often provide features like bill tracking, budgeting advice, and alerts for unusual account activity.

Implementing the Chosen Method

Once a method is chosen, it’s crucial to implement it consistently. Here are some steps to follow: - List All Bills: Start by making a list of all the bills that need to be paid, including the due date and amount. - Choose a Payment Method: Decide whether to use automatic bank drafts, online payments, or another method for each bill. - Set Reminders: Regardless of the method chosen, set reminders for each bill a few days before it’s due to ensure there are sufficient funds and to avoid late payments. - Review and Adjust: Regularly review the bill payment system to ensure it’s working effectively and make adjustments as necessary.

Benefits of Organized Bill Payments

Organizing bills has numerous benefits, including: - Reduced Stress: Knowing exactly when bills are due and having a plan to pay them reduces financial stress. - Improved Credit Score: Paying bills on time is one of the most significant factors in maintaining a good credit score. - Budgeting: It helps in creating a more accurate budget, as all financial obligations are accounted for. - Avoidance of Late Fees: Timely payments eliminate late fees and penalties, saving money in the long run.

Common Mistakes to Avoid

When organizing bills, there are common mistakes to be aware of and avoid: - Forgetting Due Dates: Failing to remember when bills are due can lead to late payments. - Insufficient Funds: Not ensuring there’s enough money in the account for automatic payments can result in overdraft fees. - Lack of Review: Not regularly reviewing the bill payment system can lead to inefficiencies and missed payments.

📝 Note: Regularly reviewing and adjusting the bill organization system is key to its success. It ensures that the method continues to meet changing financial needs and obligations.

In the end, organizing bills is about finding a system that fits your lifestyle and financial management style. Whether it’s through digital tools, physical calendars, or a combination of methods, the goal is to ensure all bills are paid on time, every time. By implementing one of the 5 ways to organize bills discussed here and avoiding common mistakes, individuals can better manage their finances, reduce stress, and improve their overall financial health. The key to successful bill organization is consistency, patience, and a willingness to adapt the system as financial situations change. By doing so, managing bills becomes a manageable task, freeing up time and energy to focus on other aspects of life.