5 Ways Organize Bills

Introduction to Bill Organization

Managing bills can be a daunting task, especially when you have multiple due dates to keep track of and limited time to handle them. Effective bill management is crucial to avoid late fees, penalties, and a negative impact on your credit score. In this article, we will discuss five ways to organize your bills, ensuring you never miss a payment and keep your financial records in order.

Understanding the Importance of Bill Organization

Before diving into the methods of organizing bills, it’s essential to understand why it’s critical. Late payments can lead to additional charges, damage your credit history, and even result in the discontinuation of services. Moreover, staying on top of your bills helps in budgeting and planning for the future. By prioritizing and systematically managing your bills, you can reduce financial stress and make informed decisions about your money.

5 Ways to Organize Your Bills

Here are five practical strategies to help you manage your bills efficiently:

- Automate Your Payments: Setting up automatic payments is one of the most effective ways to ensure you never miss a bill. Most service providers offer this option, allowing you to link your bank account or credit card to your account. This way, the payment is deducted automatically on the due date, saving you time and worry.

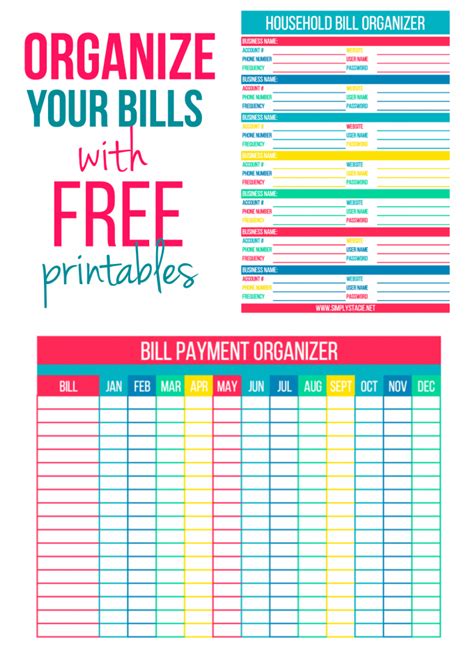

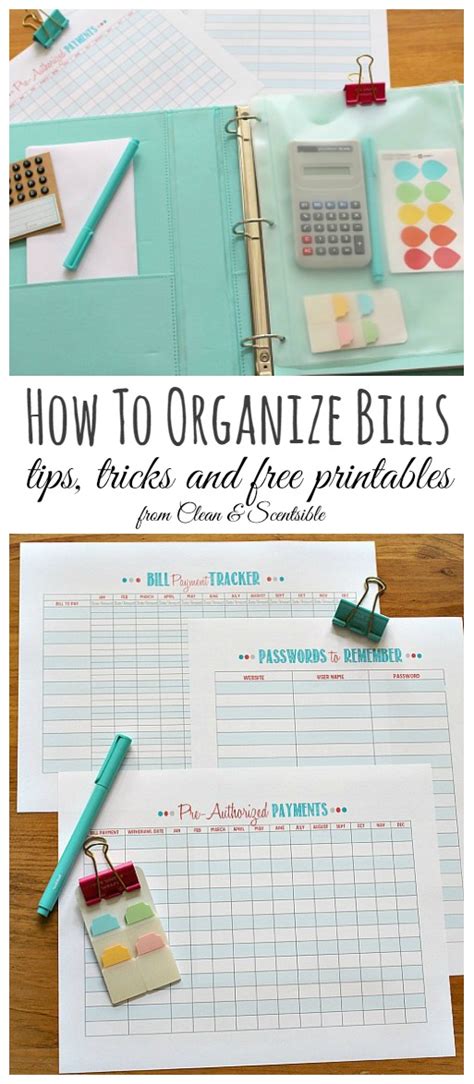

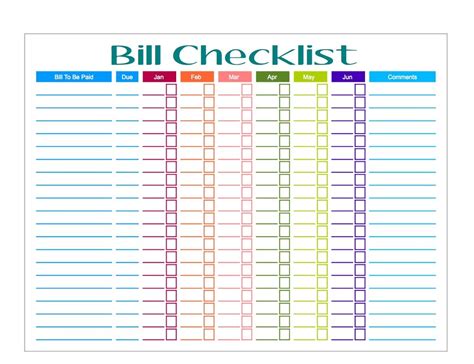

- Use a Bill Tracker: A bill tracker, whether it’s a physical notebook, a spreadsheet, or a mobile app, helps you keep all your bills in one place. You can list down each bill, its due date, the amount, and the payment method. This visual overview makes it easier to plan and manage your payments.

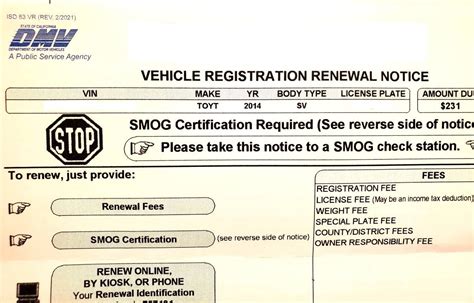

- Prioritize Your Bills: Not all bills are created equal. Some, like rent/mortgage and utilities, are essential and should be prioritized. Late payments on these critical bills can have severe consequences, such as eviction or service cutoffs. Make sure to pay these bills first, followed by less critical ones like credit cards or subscription services.

- Consider a Bill Management Service: For those who prefer a hands-off approach or struggle with keeping track of multiple bills, a bill management service can be a solution. These services consolidate your bills into one monthly payment, making it simpler to manage your finances. However, be aware that these services may charge fees.

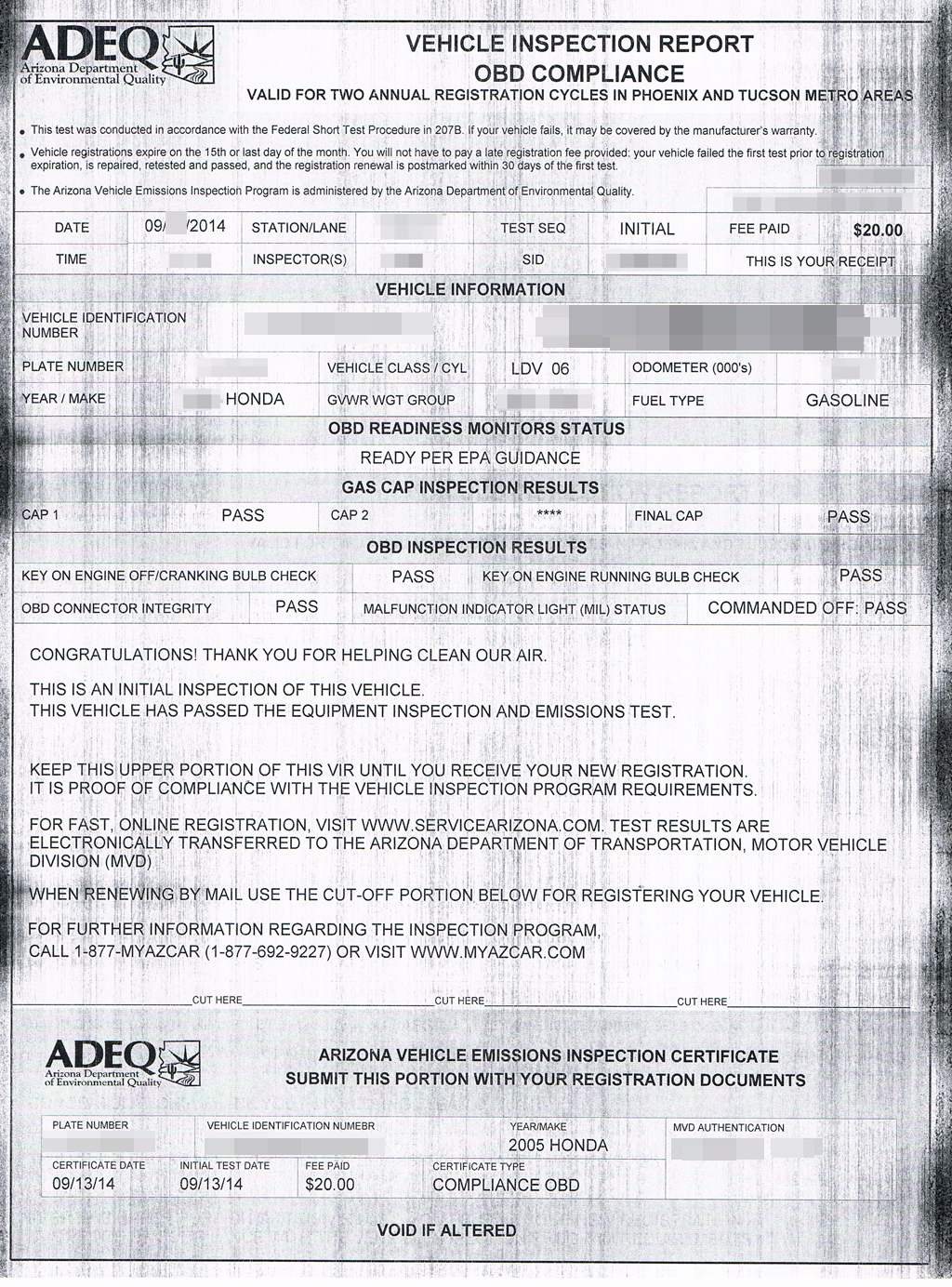

- Regularly Review and Adjust: Your financial situation and bills can change over time. It’s essential to regularly review your bill management strategy to ensure it still works for you. Adjust your budget and payment schedule as needed to accommodate changes in income, expenses, or new bills.

Tools and Resources for Bill Organization

Several tools and resources can aid in bill organization, including: - Mobile Apps: Apps like Mint, Personal Capital, and Prism can help track bills, send reminders, and even facilitate payments. - Spreadsheets: Creating a spreadsheet can provide a customizable and detailed overview of your bills and payments. - Calendar Reminders: Setting reminders on your digital calendar ensures you’re notified of upcoming due dates.

| Tool/Resource | Description |

|---|---|

| Mint | A personal finance app that tracks spending, creates budgets, and sends bill reminders. |

| Personal Capital | An app that helps track income and expenses, investments, and debts, offering a comprehensive financial overview. |

| Prism | An app designed specifically for bill tracking and payment, allowing users to see all their bills in one place. |

📝 Note: When choosing a tool or service for bill management, consider factors like ease of use, security, and any associated fees to ensure it meets your needs and budget.

In essence, organizing your bills is about finding a system that works for you and sticking to it. Whether you prefer automation, manual tracking, or a combination of methods, the key is to be consistent and regularly review your approach to ensure it remains effective.

To summarize the key points, effective bill management involves understanding the importance of timely payments, choosing the right tools and strategies for organization, and regularly reviewing and adjusting your approach as needed. By following these steps and maintaining a proactive stance on your financial obligations, you can avoid the pitfalls of late payments and build a stronger financial foundation.

What are the consequences of missing a bill payment?

+

Missing a bill payment can lead to late fees, damage to your credit score, and in severe cases, discontinuation of the service. It’s essential to prioritize payments and use reminders or automation to avoid these consequences.

How do I choose the best bill management tool for my needs?

+

When selecting a bill management tool, consider factors such as ease of use, the ability to track and pay bills, security, and any associated fees. Reading reviews and comparing features can help you find the tool that best fits your financial management style and needs.

Can I automate all my bill payments?

+

Yes, most bills can be automated through automatic bank drafts or credit card payments. However, it’s crucial to ensure you have sufficient funds in your account to avoid overdrafts. Regularly review your automated payments to adjust for any changes in bill amounts or due dates.