5 Tax Paperwork Tips

Introduction to Tax Paperwork

When it comes to tax season, one of the most daunting tasks for individuals and businesses alike is navigating the complex world of tax paperwork. With numerous forms, deadlines, and regulations to keep track of, it’s easy to feel overwhelmed. However, by following a few simple tips and staying organized, you can make the process much smoother and reduce the risk of errors or audits. In this article, we’ll explore five essential tax paperwork tips to help you stay on top of your tax obligations.

Tip 1: Keep Accurate and Detailed Records

Keeping accurate and detailed records is the foundation of efficient tax paperwork management. This includes income statements, expense receipts, and any other documents related to your financial activities. It’s crucial to have a system in place for organizing these documents, whether it’s a physical filing system or a digital tool. Consider using cloud storage services like Google Drive, Dropbox, or Microsoft OneDrive to store your documents securely and access them from anywhere. Remember, the more detailed your records, the easier it will be to fill out your tax forms and claim the deductions you’re eligible for.

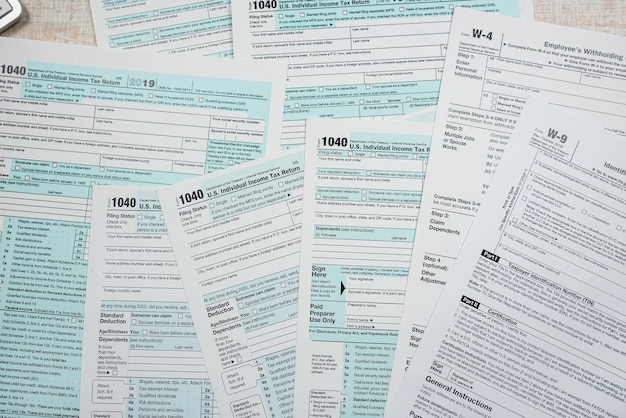

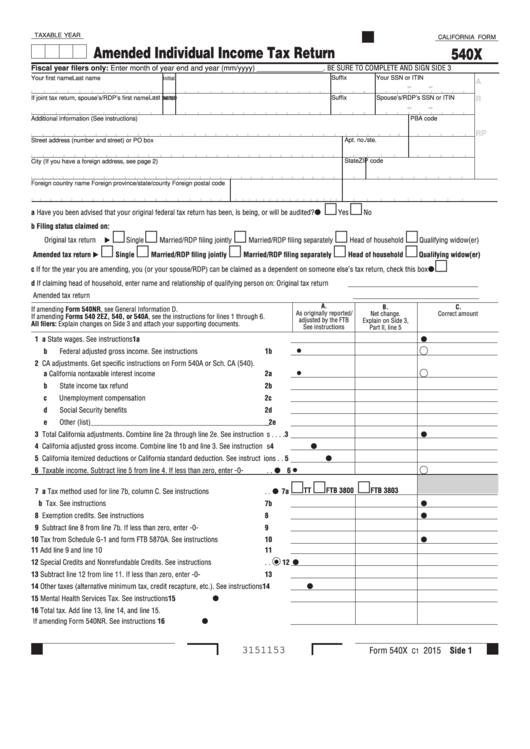

Tip 2: Understand Your Tax Forms

Tax forms can be confusing, especially for those who are new to filing taxes. It’s essential to understand which forms you need to fill out and what information is required. The most common form for individuals is the Form 1040, which is used to report income and claim deductions and credits. Businesses, on the other hand, may need to file Form 1120 for corporations or Form 1065 for partnerships. Take some time to familiarize yourself with the forms you’ll need to file, and don’t hesitate to seek professional help if you’re unsure.

Tip 3: Take Advantage of Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax liability, but many people miss out on these opportunities due to lack of knowledge or poor record-keeping. Tax deductions reduce your taxable income, while tax credits directly reduce the amount of tax you owe. Common deductions include charitable donations, mortgage interest, and business expenses. Credits might include the Earned Income Tax Credit (EITC) or the Child Tax Credit. Make sure you’re taking full advantage of the deductions and credits you’re eligible for by keeping detailed records and consulting with a tax professional if necessary.

Tip 4: File Electronically and On Time

Filing your taxes electronically and on time is crucial for avoiding penalties and ensuring you receive your refund promptly. The IRS encourages electronic filing because it’s faster, more accurate, and more secure than paper filing. You can file electronically through the IRS website or use tax software like TurboTax or H&R Block. Remember, the tax filing deadline is typically April 15th, but this can vary in certain circumstances, such as if you’re filing for an extension. Staying on top of deadlines and filing electronically can save you a lot of hassle and potential penalties.

Tip 5: Seek Professional Help When Needed

Lastly, don’t be afraid to seek professional help if you’re unsure about any aspect of your tax paperwork. Tax professionals can provide invaluable guidance and ensure you’re taking advantage of all the deductions and credits available to you. They can also help with more complex tax situations, such as audits or back taxes. Consider hiring a Certified Public Accountant (CPA) or an Enrolled Agent (EA), who are authorized by the IRS to represent taxpayers. While there’s a cost associated with hiring a professional, it can save you money in the long run by minimizing errors and maximizing your refund.

📝 Note: Always ensure that any tax professional you hire is reputable and has experience with cases similar to yours.

In summary, managing tax paperwork efficiently requires a combination of organization, knowledge, and sometimes, professional assistance. By keeping detailed records, understanding your tax forms, taking advantage of deductions and credits, filing electronically and on time, and seeking help when needed, you can navigate the complex world of tax paperwork with confidence. Whether you’re an individual or a business, following these tips can make a significant difference in your tax experience, reducing stress and potentially saving you money.

What is the most common tax form for individuals?

+

The most common tax form for individuals is the Form 1040, which is used to report income and claim deductions and credits.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe.

Why is it recommended to file taxes electronically?

+

Filing electronically is faster, more accurate, and more secure than paper filing, and it can help you receive your refund more quickly.