Organize Small Business Paperwork

Introduction to Small Business Paperwork Organization

As a small business owner, managing paperwork can be a daunting task. With numerous documents to keep track of, from invoices and receipts to contracts and tax returns, it’s easy to feel overwhelmed. However, having a well-organized system in place can help you stay on top of your paperwork, reduce stress, and save time. In this article, we’ll explore the importance of organizing small business paperwork and provide tips and strategies for creating a system that works for you.

Why Organize Small Business Paperwork?

Organizing your small business paperwork is crucial for several reasons: * Compliance: Keeping accurate and up-to-date records is essential for complying with tax laws, regulations, and industry standards. * Financial Management: Well-organized paperwork helps you track expenses, income, and cash flow, making it easier to manage your finances and make informed business decisions. * Productivity: A organized system saves time and reduces the risk of lost or misplaced documents, allowing you to focus on core business activities. * Security: Properly storing sensitive documents, such as employee records and customer information, helps protect against data breaches and unauthorized access.

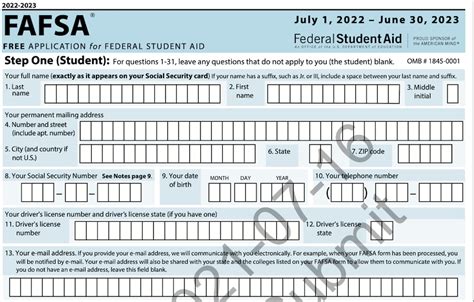

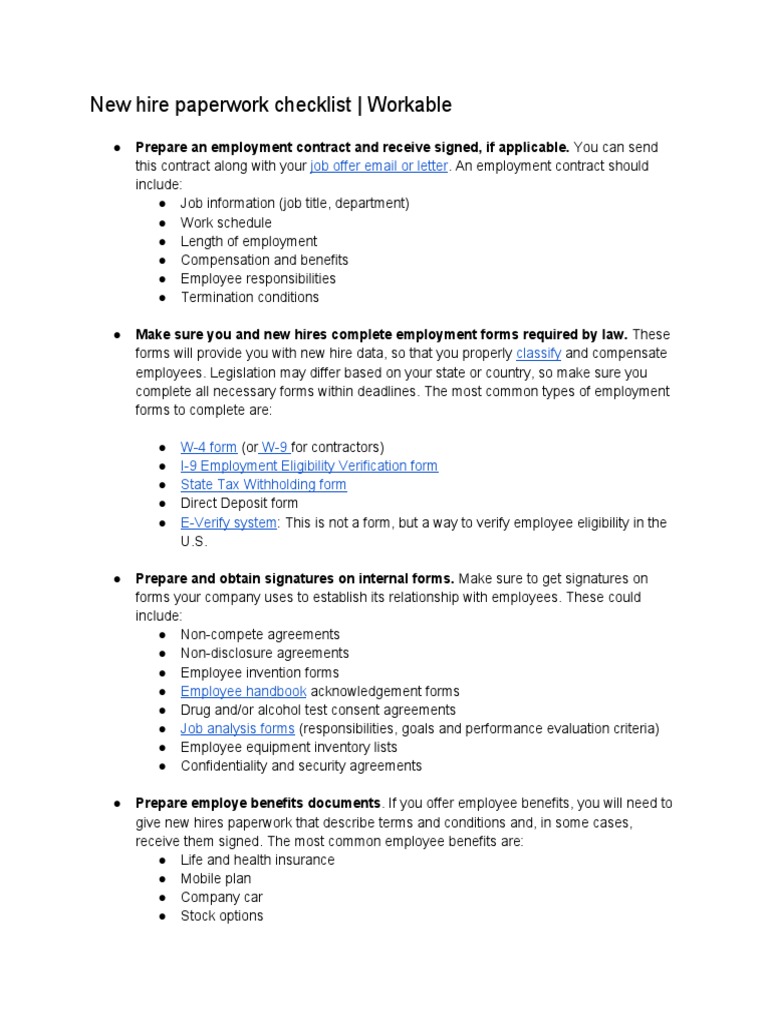

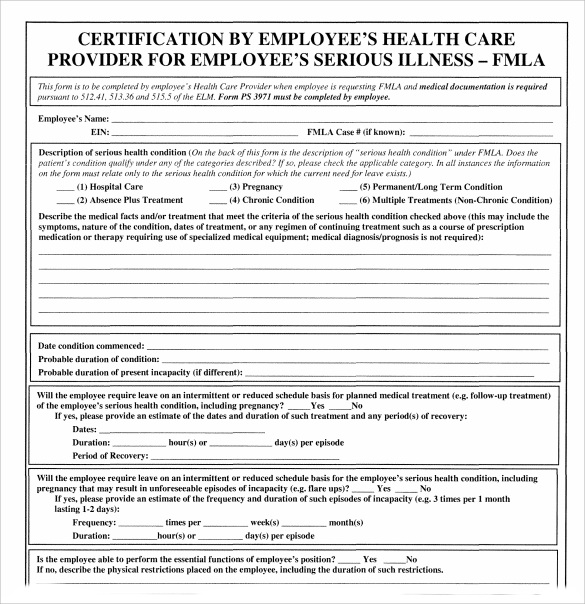

Types of Small Business Paperwork

Before we dive into the organization strategies, it’s essential to understand the different types of paperwork you’ll encounter as a small business owner. These include: * Financial Documents: Invoices, receipts, bank statements, tax returns, and accounting records. * Employee Records: Employee contracts, benefits information, payroll records, and performance evaluations. * Customer Records: Customer contracts, invoices, payment records, and communication logs. * Business Registration Documents: Business licenses, permits, articles of incorporation, and registration certificates. * Insurance and Benefits Documents: Insurance policies, benefits information, and claims records.

Organizing Small Business Paperwork: Steps and Strategies

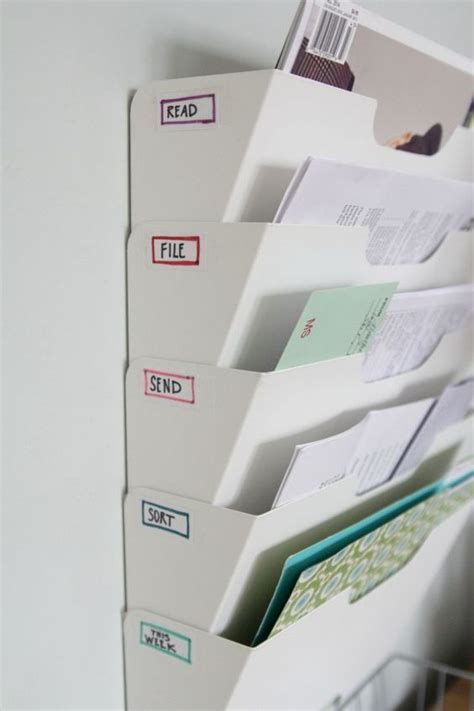

Now that we’ve covered the importance and types of small business paperwork, let’s move on to the steps and strategies for organizing your documents: * Create a Filing System: Set up a centralized filing system, either physical or digital, to store all your business documents. Use clear labels and categories to make it easy to find what you need. * Digitize Documents: Consider scanning and digitizing your paperwork to reduce physical storage space and improve accessibility. * Use Cloud Storage: Utilize cloud storage services, such as Google Drive or Dropbox, to store and share documents with employees, contractors, or clients. * Implement a Record-Keeping Schedule: Establish a regular schedule for reviewing, updating, and purging documents to ensure your records remain accurate and up-to-date. * Designate a Paperwork Manager: Assign a specific person or team to manage your paperwork, ensuring that all documents are properly filed, updated, and maintained.

Tools and Resources for Organizing Small Business Paperwork

To help you get started with organizing your small business paperwork, consider the following tools and resources: * File Management Software: Programs like Evernote, OneNote, or Shoeboxed can help you digitize and organize your documents. * Cloud Storage Services: Google Drive, Dropbox, or Microsoft OneDrive provide secure and accessible storage for your digital documents. * Accounting Software: QuickBooks, Xero, or Wave can help you manage your financial records, invoices, and expenses. * Document Scanners: Invest in a good document scanner to quickly and efficiently digitize your paperwork.

Best Practices for Maintaining Organized Small Business Paperwork

To ensure your paperwork remains organized and up-to-date, follow these best practices: * Regularly Review and Update Records: Schedule regular reviews of your documents to ensure accuracy and completeness. * Use Clear and Consistent Labeling: Use clear and consistent labeling and categorization to make it easy to find and access documents. * Limit Access to Sensitive Documents: Restrict access to sensitive documents, such as employee records or financial information, to authorized personnel only. * Backup Your Documents: Regularly backup your digital documents to prevent data loss in case of a technical issue or disaster.

💡 Note: It's essential to stay vigilant and adapt your paperwork organization system as your business grows and evolves.

Common Challenges and Solutions

When organizing small business paperwork, you may encounter common challenges, such as: * Information Overload: Too much paperwork can be overwhelming. Solution: Implement a categorization system and prioritize documents based on importance and urgency. * Lost or Misplaced Documents: Documents can go missing or be misplaced. Solution: Use a centralized filing system and regularly backup your digital documents. * Compliance Issues: Failure to comply with regulations can result in fines or penalties. Solution: Stay up-to-date with regulatory requirements and consult with a professional if needed.

| Document Type | Retention Period | Storage Location |

|---|---|---|

| Financial Records | 7 years | Cloud Storage or Physical Filing Cabinet |

| Employee Records | 5 years | Secure Physical Filing Cabinet or Encrypted Digital Storage |

| Customer Records | 3 years | Cloud Storage or Physical Filing Cabinet |

In summary, organizing small business paperwork is crucial for compliance, financial management, productivity, and security. By understanding the types of paperwork, creating a filing system, digitizing documents, and implementing a record-keeping schedule, you can stay on top of your paperwork and focus on growing your business. Remember to regularly review and update your records, use clear and consistent labeling, and limit access to sensitive documents. By following these tips and strategies, you’ll be well on your way to maintaining a well-organized and efficient paperwork system.

What is the best way to organize small business paperwork?

+

The best way to organize small business paperwork is to create a centralized filing system, digitize documents, and implement a record-keeping schedule. This will help you stay on top of your paperwork, reduce stress, and save time.

How long should I keep financial records?

+

It’s recommended to keep financial records for at least 7 years. This will help you comply with tax laws and regulations, and provide a clear picture of your business’s financial history.

What are the benefits of digitizing small business paperwork?

+

Digitizing small business paperwork can help reduce physical storage space, improve accessibility, and increase security. It can also help you quickly and easily find specific documents, and reduce the risk of lost or misplaced paperwork.