Paperwork

5 Tips Organize Tax Paperwork

Introduction to Tax Paperwork Organization

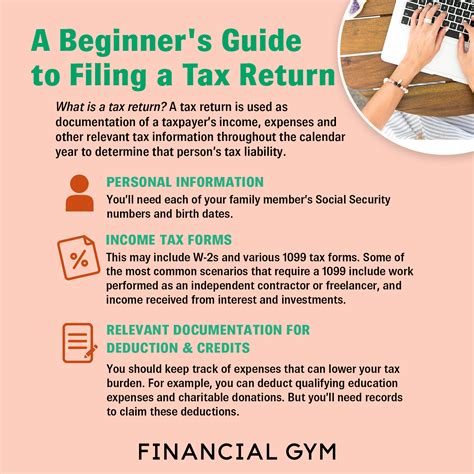

Tax season can be a daunting time for many individuals and businesses, especially when it comes to organizing the necessary paperwork. With the numerous forms, receipts, and documents required for tax filing, it’s easy to get overwhelmed. However, having a system in place to manage and organize tax paperwork can make the process much smoother and reduce the stress associated with tax season. In this article, we will explore five tips to help individuals and businesses organize their tax paperwork effectively.

Understanding the Importance of Tax Paperwork Organization

Before diving into the tips, it’s essential to understand why organizing tax paperwork is crucial. Proper organization can help prevent errors, reduce the risk of audits, and ensure that all necessary documents are readily available when needed. Additionally, a well-organized system can save time and effort in the long run, making the tax filing process more efficient.

Tips for Organizing Tax Paperwork

Here are five tips to help individuals and businesses organize their tax paperwork:

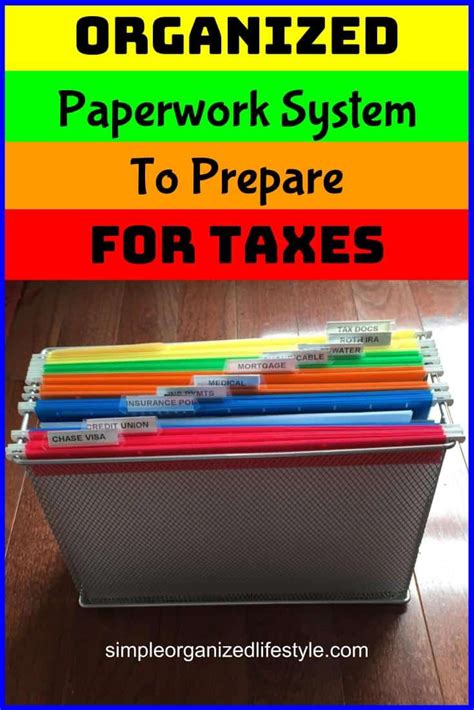

- Create a centralized filing system: Designate a specific area or folder to store all tax-related documents, including receipts, invoices, and bank statements. This can be a physical file cabinet or a digital folder on your computer.

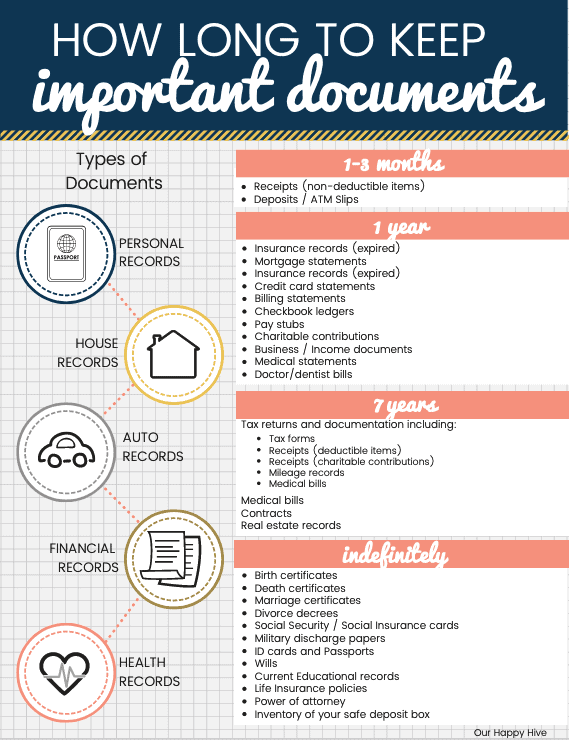

- Categorize documents: Organize documents into categories, such as income, expenses, deductions, and credits. This will make it easier to locate specific documents when needed.

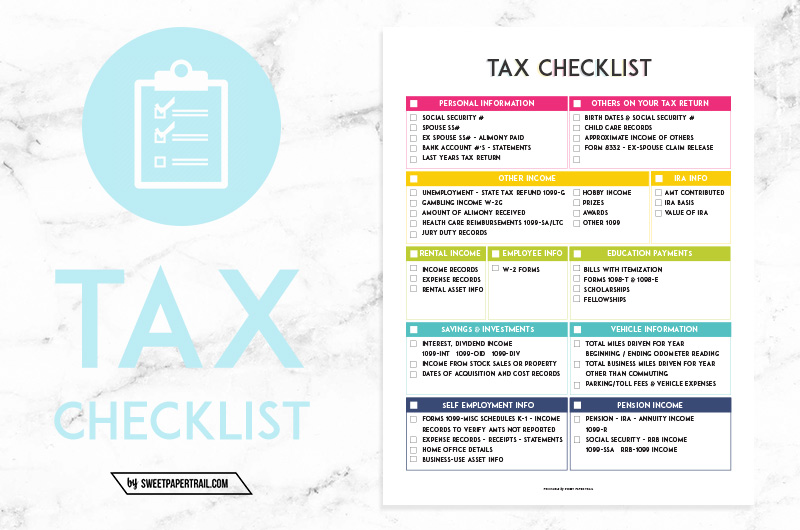

- Use a tax checklist: Create a checklist of all the necessary documents required for tax filing, including forms, receipts, and identification documents. This will help ensure that all required documents are accounted for.

- Digitize documents: Consider scanning and digitizing physical documents to reduce clutter and make them easier to access. This can also help prevent loss or damage to important documents.

- Stay up-to-date: Regularly review and update your tax paperwork organization system to ensure that it remains effective and efficient.

Additional Tools and Resources

In addition to the tips mentioned above, there are several tools and resources available to help individuals and businesses organize their tax paperwork. These include:

| Tool/Resource | Description |

|---|---|

| Tax software | Programs like TurboTax or H&R Block can help guide individuals through the tax filing process and provide tools for organizing documents. |

| Spreadsheet templates | Pre-designed spreadsheet templates can help individuals and businesses track income, expenses, and deductions throughout the year. |

| Cloud storage services | Services like Dropbox or Google Drive can provide a secure and accessible location for storing digital tax documents. |

📝 Note: It's essential to research and chooses tools and resources that fit your specific needs and budget.

Common Mistakes to Avoid

When organizing tax paperwork, there are several common mistakes to avoid. These include: * Lack of consistency: Failing to establish a consistent system for organizing tax documents can lead to confusion and errors. * Insufficient documentation: Failing to keep accurate and complete records can result in missed deductions or credits. * Inadequate security: Failing to protect tax documents from loss, damage, or unauthorized access can compromise sensitive information.

Best Practices for Maintenance

To ensure that your tax paperwork organization system remains effective, it’s essential to establish best practices for maintenance. These include: * Regularly reviewing and updating documents: Ensure that all documents are accurate and up-to-date. * Backing up digital documents: Regularly backup digital documents to prevent loss or damage. * Seeking professional help when needed: If you’re unsure about any aspect of tax paperwork organization, consider seeking help from a tax professional.

In the end, organizing tax paperwork is a crucial step in ensuring a smooth and stress-free tax filing process. By following the tips and best practices outlined in this article, individuals and businesses can establish an effective system for managing tax documents and reduce the risk of errors or audits. The key to successful tax paperwork organization is to create a system that is tailored to your specific needs and to regularly review and update it to ensure that it remains effective.