Paperwork

5 Tips Customs Paperwork

Understanding Customs Paperwork: A Key to Seamless International Trade

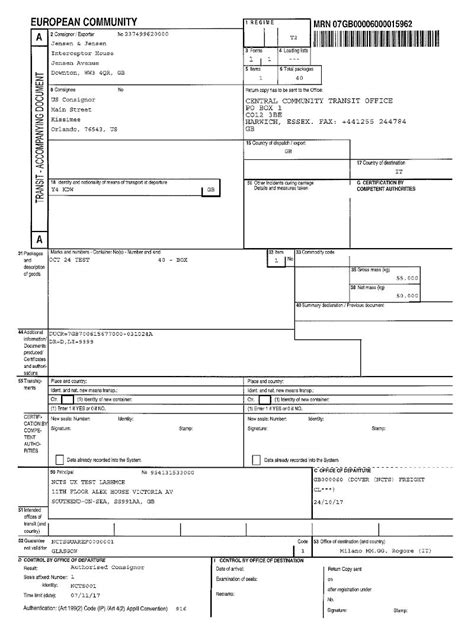

When it comes to international trade, customs paperwork is a crucial aspect that businesses must navigate. The process can be complex and time-consuming, but with the right knowledge and preparation, companies can ensure compliance with regulations and avoid costly delays. In this article, we will explore five essential tips for managing customs paperwork effectively.

Tips for Managing Customs Paperwork

Effective management of customs paperwork is vital for any business involved in international trade. Here are five tips to help you navigate the process:

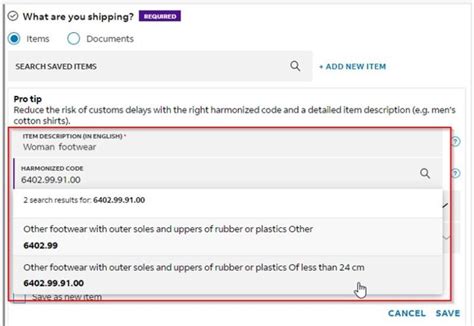

- Accurate Classification: Ensure that your goods are correctly classified under the Harmonized System (HS) code. This is critical for determining the applicable duties and taxes. Misclassification can lead to fines, penalties, and delays.

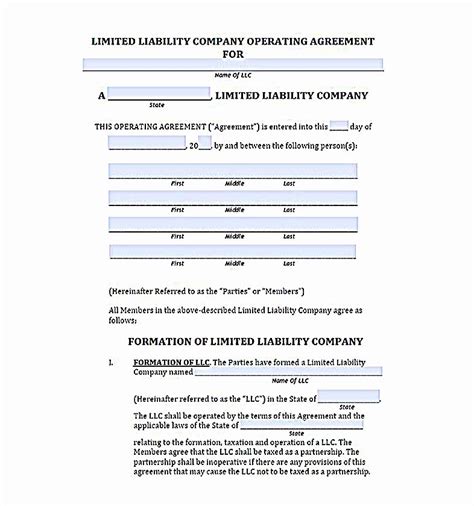

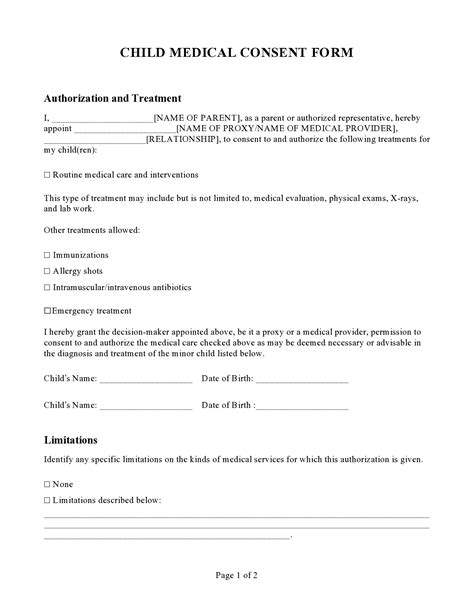

- Complete and Accurate Documentation: Ensure that all required documents, such as commercial invoices, bills of lading, and certificates of origin, are complete and accurate. Any errors or omissions can cause delays or even rejection of shipments.

- Compliance with Regulations: Familiarize yourself with relevant customs regulations, including those related to restricted or prohibited goods, licensing requirements, and valuation methods. Non-compliance can result in severe penalties and reputational damage.

- Use of Technology: Leverage technology, such as automation software and online platforms, to streamline the customs clearance process. This can help reduce errors, increase efficiency, and improve visibility.

- Partner with a Reliable Customs Broker: Consider partnering with a reliable customs broker who has expertise in managing customs paperwork and can provide guidance on compliance and regulatory requirements.

The Importance of Compliance

Compliance with customs regulations is essential for avoiding penalties, fines, and reputational damage. Non-compliance can result in severe consequences, including shipment delays, seizures, or even legal action. To ensure compliance, businesses must stay up-to-date with changing regulations, maintain accurate records, and conduct regular audits.

| Country | Regulations | Penalties for Non-Compliance |

|---|---|---|

| United States | 19 CFR, HTSUS | Fines, penalties, and shipment delays |

| European Union | Union Customs Code, HS code | Fines, penalties, and shipment delays |

| China | Customs Law, HS code | Fines, penalties, and shipment delays |

📝 Note: Businesses must consult with relevant authorities and experts to ensure compliance with specific regulations and requirements.

In summary, managing customs paperwork requires attention to detail, knowledge of regulations, and effective use of technology. By following these five tips, businesses can ensure compliance, avoid costly delays, and maintain a competitive edge in the global market. As the international trade landscape continues to evolve, it is essential for companies to stay informed and adapt to changing regulations and requirements. By doing so, they can navigate the complexities of customs paperwork and achieve success in the global marketplace.

Related Terms:

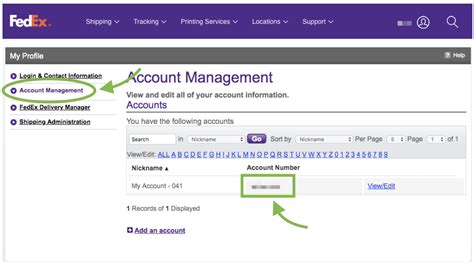

- FedEx account

- Fedex hs code