Prepare Tax Paperwork Easily

Introduction to Tax Preparation

Tax season can be a stressful time for many individuals and businesses, as it involves gathering numerous documents, filling out complex forms, and ensuring that all tax obligations are met. However, with the right approach and tools, preparing tax paperwork can be made easier and less daunting. In this article, we will explore the steps and strategies for simplifying the tax preparation process, making it more efficient and reducing the likelihood of errors.

Understanding Tax Requirements

Before diving into the preparation process, it is essential to understand the tax requirements that apply to your situation. This includes knowing which tax forms to fill out, what documents to gather, and any deadlines that must be met. Individuals typically need to file a tax return if their income exceeds a certain threshold, while businesses must file tax returns annually, regardless of their income level. Familiarizing yourself with the specific tax laws and regulations in your jurisdiction is crucial for accurate and compliant tax preparation.

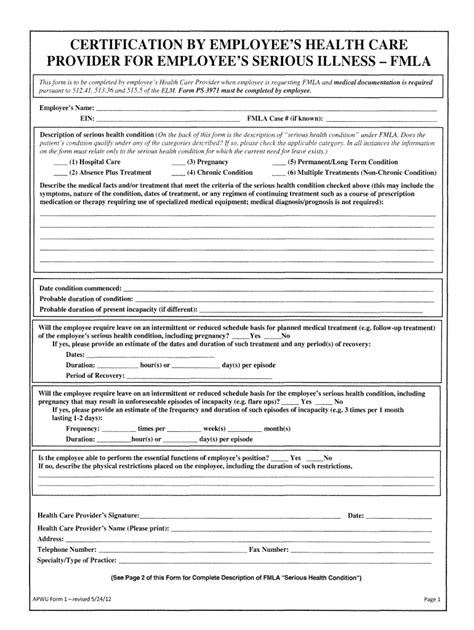

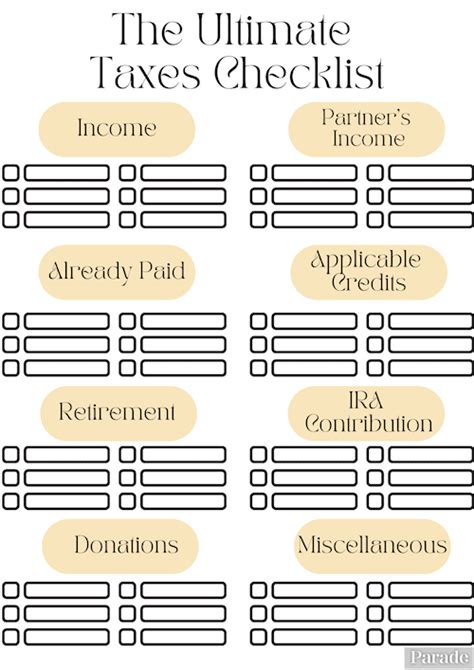

Gathering Necessary Documents

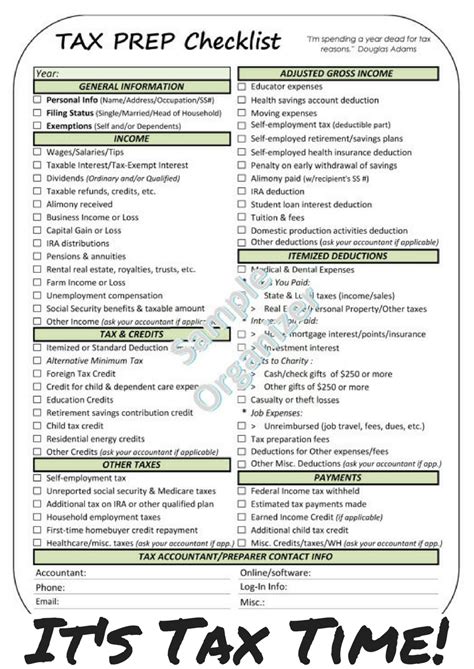

To prepare tax paperwork efficiently, it is vital to gather all necessary documents beforehand. These may include:

- Income statements (W-2 forms for employees, 1099 forms for freelancers)

- Receipts for deductions (charitable donations, medical expenses, etc.)

- Interest statements from banks and investments

- Dividend statements

- Capital gains statements

- Business expense records (for businesses)

Utilizing Tax Preparation Software

📝 Note: Utilizing tax preparation software can significantly simplify the tax preparation process.

Tax preparation software, such as TurboTax, H&R Block, or TaxAct, can guide you through the preparation process, ensuring that you complete all necessary forms and claim eligible deductions. These programs often include features such as:- Interview-style questionnaires to identify relevant tax credits and deductions

- Automatic calculations and form filling

- Import capabilities for W-2 and 1099 forms

- Free filing options for simple returns

- Support for complex tax situations, including investments and business income

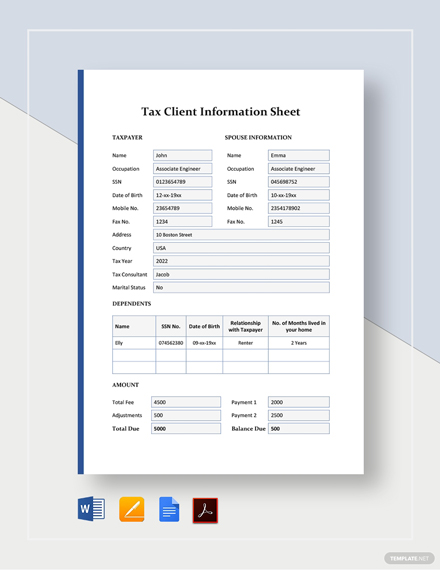

Seeking Professional Assistance

For those with complex tax situations or who are unsure about how to prepare their tax paperwork, seeking professional assistance can be highly beneficial. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), have the expertise to navigate intricate tax laws, identify potential savings, and ensure that all tax obligations are met. They can also provide guidance on tax planning strategies for the future.

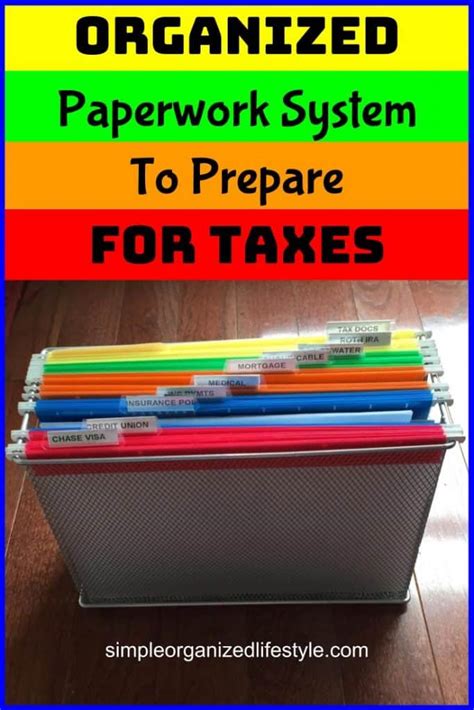

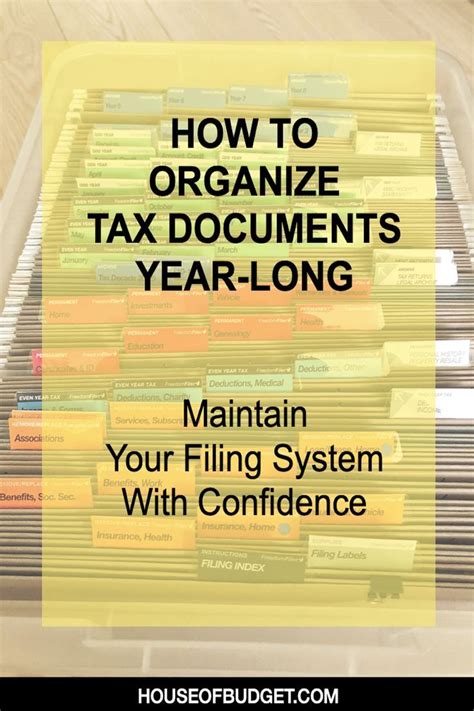

Maintaining Accurate Records

Maintaining accurate and detailed records throughout the year is crucial for efficient tax preparation. This includes:

- Keeping track of business expenses and receipts

- Recording charitable donations and medical expenses

- Monitoring investment income and capital gains

Staying Informed About Tax Changes

Tax laws and regulations are subject to change, and staying informed about these updates can help you prepare your tax paperwork more effectively. Following reputable tax news sources, consulting with a tax professional, or visiting the official website of your tax authority can provide valuable insights into new tax credits, deductions, and filing requirements.

| Document Type | Description | Importance for Tax Preparation |

|---|---|---|

| W-2 Form | Reports income and taxes withheld from employment | Essential for personal tax returns |

| 1099 Form | Reports income from freelance work, investments, etc. | Critical for self-employed individuals and businesses |

| Receipts for Deductions | Supports claims for deductions on charitable donations, medical expenses, etc. | Important for maximizing eligible deductions |

In summary, preparing tax paperwork can be made easier by understanding tax requirements, gathering necessary documents, utilizing tax preparation software, seeking professional assistance when needed, maintaining accurate records, and staying informed about tax changes. By following these steps and strategies, individuals and businesses can navigate the tax preparation process more efficiently, reducing stress and the risk of errors.

To wrap things up, effective tax preparation is about being organized, informed, and proactive. Whether you choose to prepare your tax paperwork yourself or seek the help of a professional, the key is to approach the process with a clear understanding of your tax obligations and the tools available to you. By doing so, you can ensure compliance with tax laws, maximize your eligible deductions, and make the most of your tax refund.

What documents do I need to prepare my tax paperwork?

+

You will need income statements (W-2 forms, 1099 forms), receipts for deductions, interest statements from banks and investments, dividend statements, and capital gains statements. The specific documents required may vary depending on your income sources and personal circumstances.

Can I prepare my tax paperwork myself, or do I need to hire a professional?

+

You can prepare your tax paperwork yourself using tax preparation software or by consulting IRS publications. However, if you have a complex tax situation or are unsure about how to proceed, it may be beneficial to seek the assistance of a tax professional.

What are the benefits of using tax preparation software?

+

Tax preparation software can guide you through the tax preparation process, ensure that you complete all necessary forms, and help you identify eligible deductions and credits. It can also reduce the risk of errors and facilitate the filing process with the IRS.