Bankruptcy Proof of Claim Paperwork

Understanding Bankruptcy Proof of Claim Paperwork

When an individual or business files for bankruptcy, creditors are required to submit a proof of claim to the bankruptcy court in order to receive a distribution from the bankruptcy estate. The proof of claim is a document that outlines the creditor’s claim against the debtor, including the amount owed and the basis for the claim. In this blog post, we will explore the process of filing a proof of claim in a bankruptcy case and provide guidance on completing the necessary paperwork.

Who Needs to File a Proof of Claim?

Any creditor who has a claim against the debtor must file a proof of claim in order to participate in the bankruptcy case. This includes secured creditors, unsecured creditors, and priority creditors. Secured creditors are those who have a lien on the debtor’s property, such as a mortgage or car loan. Unsecured creditors are those who do not have a lien on the debtor’s property, such as credit card companies or medical providers. Priority creditors are those who have a claim that is entitled to priority treatment under the bankruptcy code, such as tax authorities or employees who are owed wages.

What is Required to File a Proof of Claim?

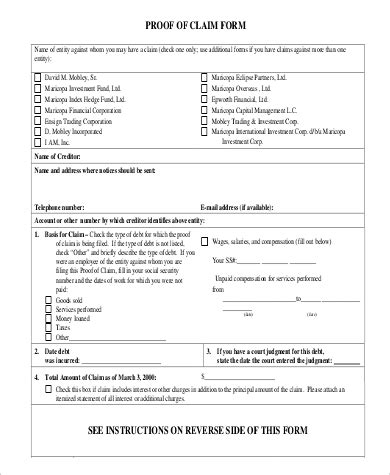

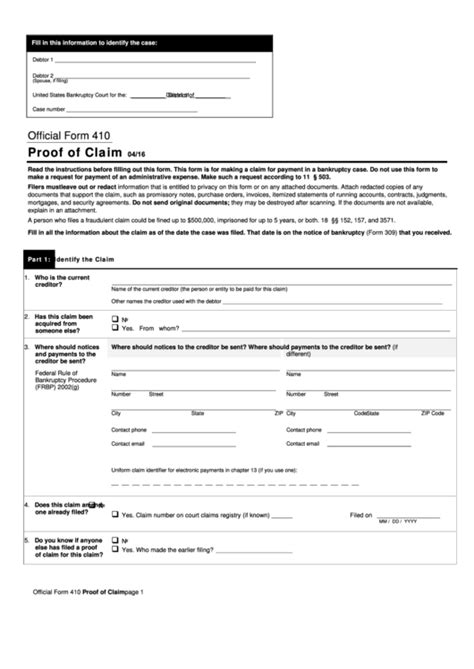

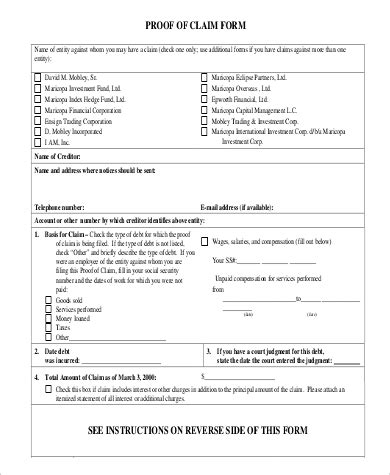

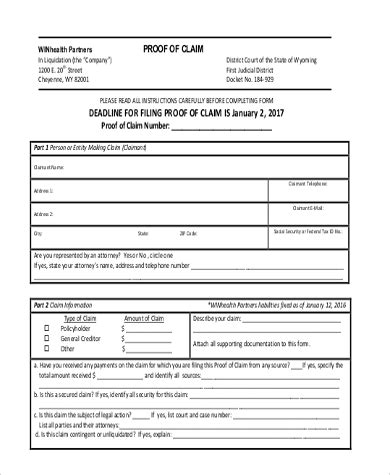

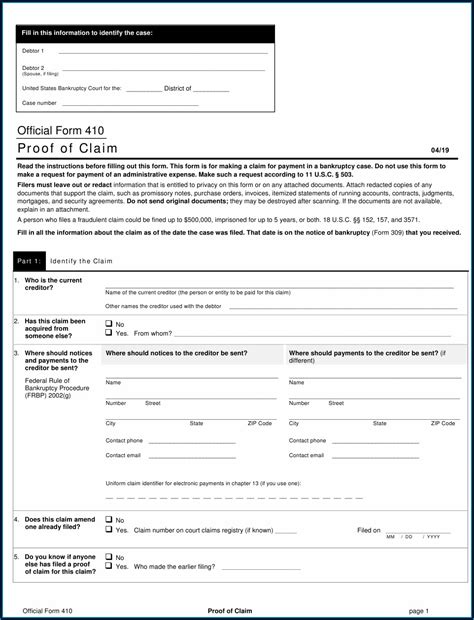

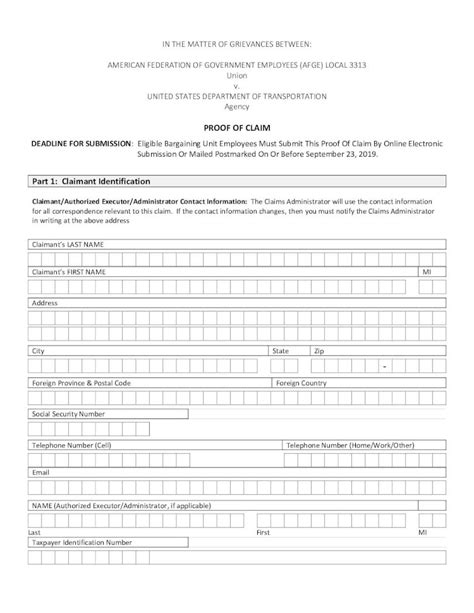

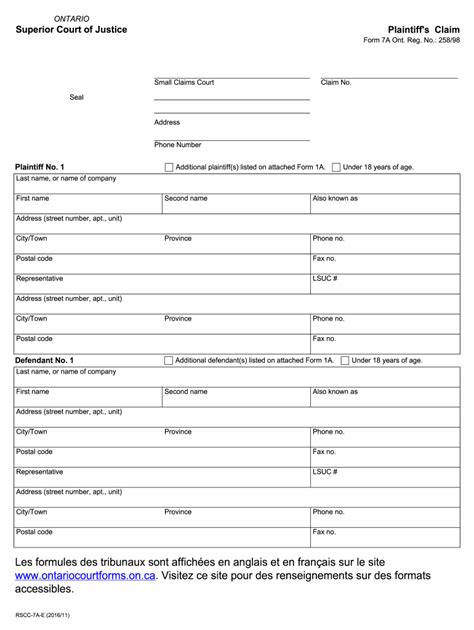

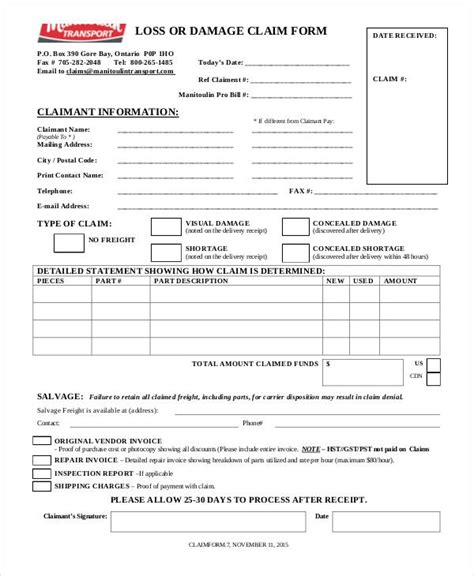

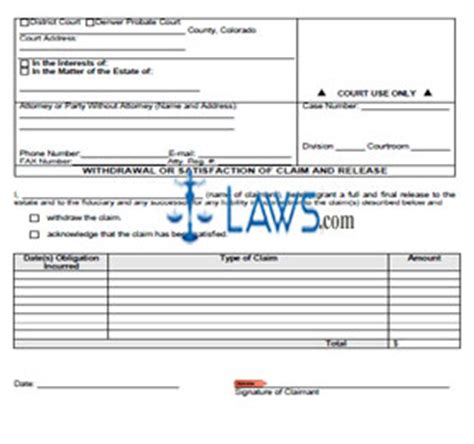

To file a proof of claim, creditors must submit a completed proof of claim form to the bankruptcy court. The form must include the following information: * The creditor’s name and address * The debtor’s name and address * A description of the claim, including the amount owed and the basis for the claim * The nature of the claim, such as secured, unsecured, or priority * The date the claim arose * Any supporting documentation, such as contracts, invoices, or promissory notes

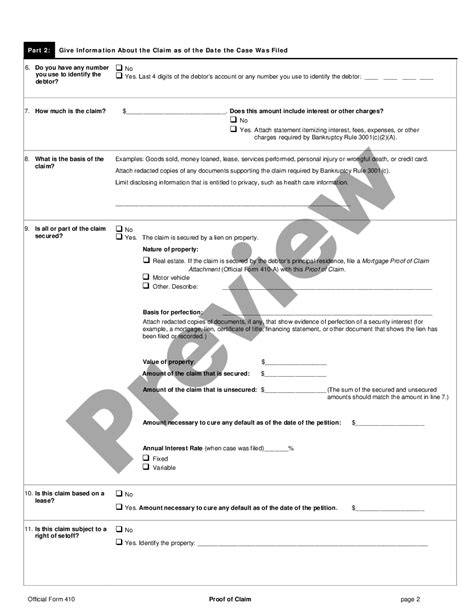

Completing the Proof of Claim Form

The proof of claim form is typically a standard form that is used in all bankruptcy cases. The form will require the creditor to provide detailed information about the claim, including the amount owed and the basis for the claim. Creditors must ensure that the form is completed accurately and thoroughly, as any errors or omissions may result in the claim being disallowed.

Supporting Documentation

In addition to the proof of claim form, creditors may be required to submit supporting documentation to substantiate their claim. This may include: * Contracts or agreements between the creditor and debtor * Invoices or statements showing the amount owed * Promissory notes or other evidence of debt * Security agreements or other documents evidencing a lien on the debtor’s property

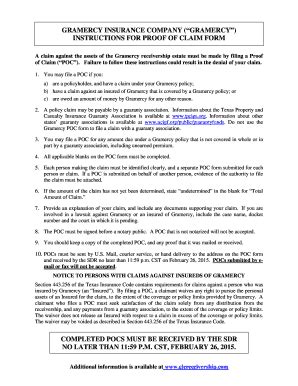

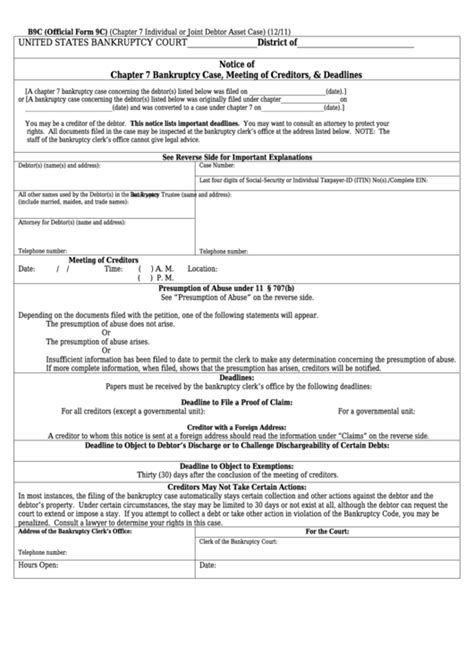

Deadlines for Filing a Proof of Claim

Creditors must file their proof of claim by the deadline established by the bankruptcy court. This deadline is typically set by the court and will be announced in the bankruptcy notice. If a creditor fails to file their proof of claim by the deadline, they may be barred from participating in the bankruptcy case and may not receive a distribution from the bankruptcy estate.

What Happens After a Proof of Claim is Filed?

After a proof of claim is filed, the debtor or trustee may object to the claim. If an objection is filed, the creditor will have the opportunity to respond and provide additional evidence to support their claim. The bankruptcy court will then hold a hearing to determine the validity and amount of the claim. If the claim is allowed, the creditor will receive a distribution from the bankruptcy estate.

📝 Note: Creditors should carefully review the proof of claim form and supporting documentation to ensure accuracy and completeness, as any errors or omissions may result in the claim being disallowed.

Tips for Creditors

* File the proof of claim form early to avoid missing the deadline * Ensure the form is completed accurately and thoroughly * Submit supporting documentation to substantiate the claim * Respond promptly to any objections or requests for additional information * Attend the hearing to present evidence and argue in support of the claim

Common Mistakes to Avoid

* Failing to file the proof of claim form by the deadline * Submitting an incomplete or inaccurate proof of claim form * Failing to provide supporting documentation * Ignoring objections or requests for additional information * Failing to attend the hearing to present evidence and argue in support of the claim

| Type of Creditor | Description |

|---|---|

| Secured Creditor | A creditor with a lien on the debtor's property |

| Unsecured Creditor | A creditor without a lien on the debtor's property |

| Priority Creditor | A creditor with a claim that is entitled to priority treatment under the bankruptcy code |

In summary, filing a proof of claim is a critical step in the bankruptcy process for creditors. By understanding the requirements and deadlines for filing a proof of claim, creditors can ensure that their claim is allowed and they receive a distribution from the bankruptcy estate. It is essential for creditors to carefully review the proof of claim form and supporting documentation to ensure accuracy and completeness, and to respond promptly to any objections or requests for additional information.

What is a proof of claim in bankruptcy?

+

A proof of claim is a document filed by a creditor in a bankruptcy case to outline their claim against the debtor and receive a distribution from the bankruptcy estate.

Who needs to file a proof of claim in bankruptcy?

+

All creditors who have a claim against the debtor, including secured creditors, unsecured creditors, and priority creditors, must file a proof of claim to participate in the bankruptcy case.

What happens if a creditor fails to file a proof of claim by the deadline?

+

If a creditor fails to file their proof of claim by the deadline, they may be barred from participating in the bankruptcy case and may not receive a distribution from the bankruptcy estate.

Related Terms:

- Proof of claim form

- Proof of Claim Form 410

- Proof of claim form PDF

- Proof of claim form example

- Proof of Claim instructions

- Proof of claim Chapter 11