Fill Out LLC Paperwork Correctly

Understanding the Importance of LLC Paperwork

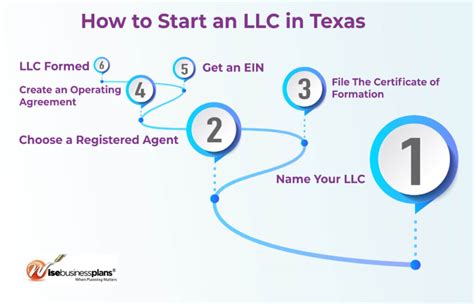

When forming a Limited Liability Company (LLC), it is crucial to fill out the necessary paperwork correctly to ensure the legitimacy and legality of the business. The process involves several steps, including choosing a business name, selecting a registered agent, and filing the articles of organization. Accuracy and attention to detail are key to avoiding potential issues and ensuring the smooth operation of the LLC.

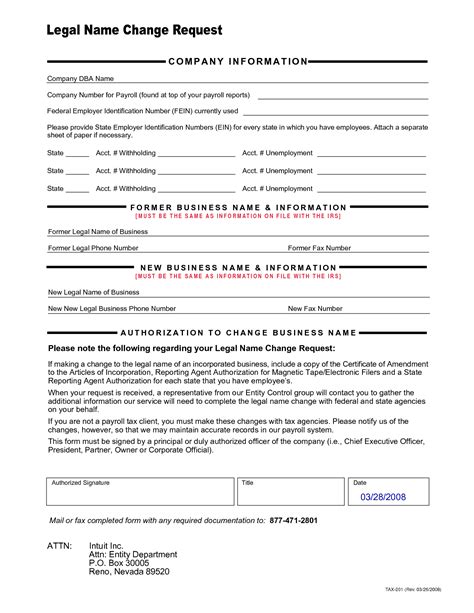

Step 1: Choose a Business Name

The first step in filling out LLC paperwork is to choose a unique and compliant business name. The name must include the phrase “Limited Liability Company” or an abbreviation such as “LLC” or “L.L.C.” It is essential to check the availability of the desired name with the state’s business database to ensure it is not already in use. Additionally, the name must comply with the state’s naming requirements, which may include restrictions on certain words or phrases.

Step 2: Select a Registered Agent

A registered agent, also known as a resident agent, is an individual or business entity that receives important documents and notices on behalf of the LLC. The registered agent must have a physical address in the state where the LLC is formed and be available to receive documents during business hours. Choosing a reliable registered agent is vital to ensure that the LLC receives important notices and documents in a timely manner.

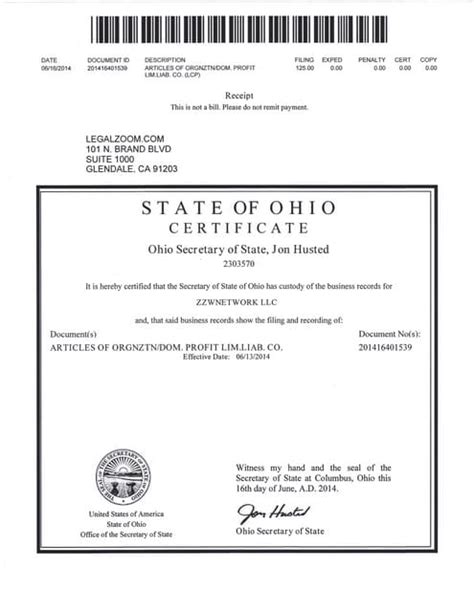

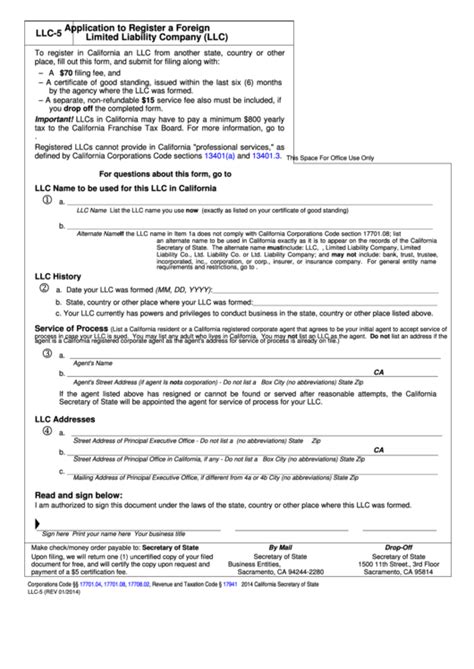

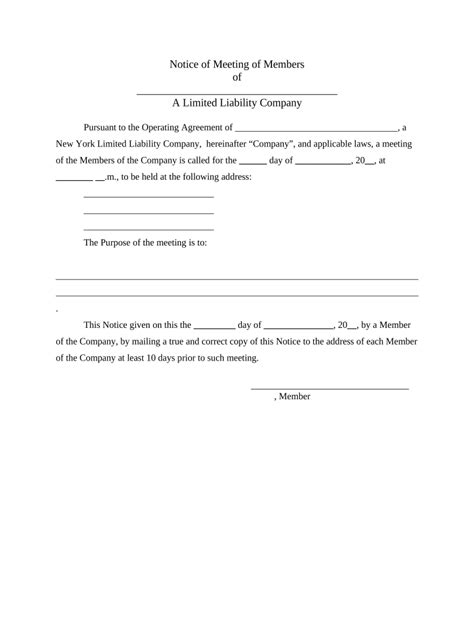

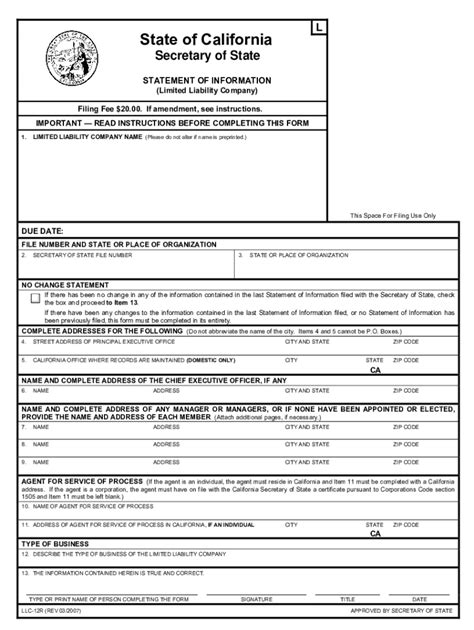

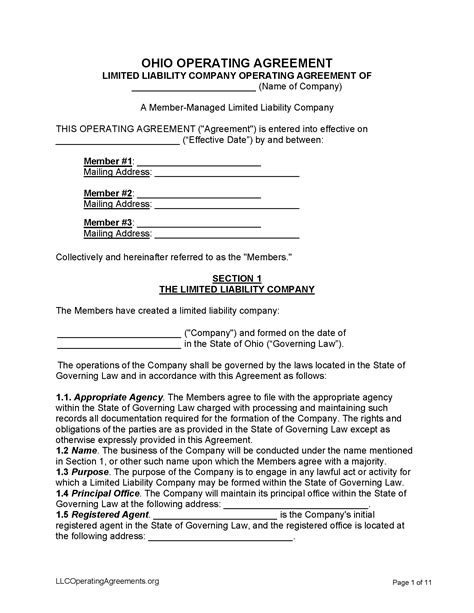

Step 3: File the Articles of Organization

The articles of organization, also known as the certificate of formation, are the primary documents filed with the state to form an LLC. The articles must include the following information: * The name and address of the LLC * The name and address of the registered agent * The purpose of the LLC * The management structure of the LLC (member-managed or manager-managed) * The names and addresses of the LLC’s members or managers It is essential to fill out the articles of organization accurately and ensure that all required information is included.

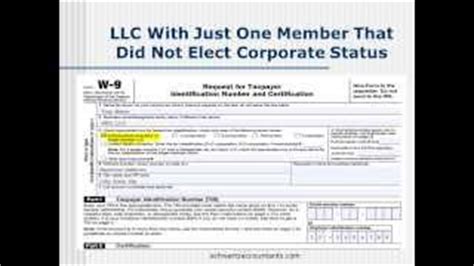

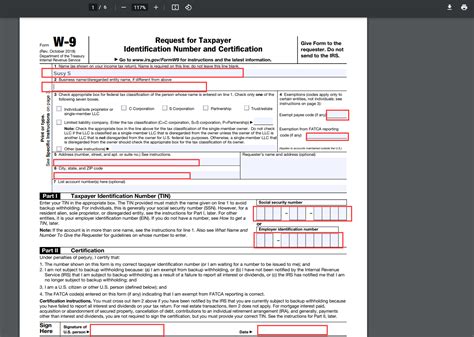

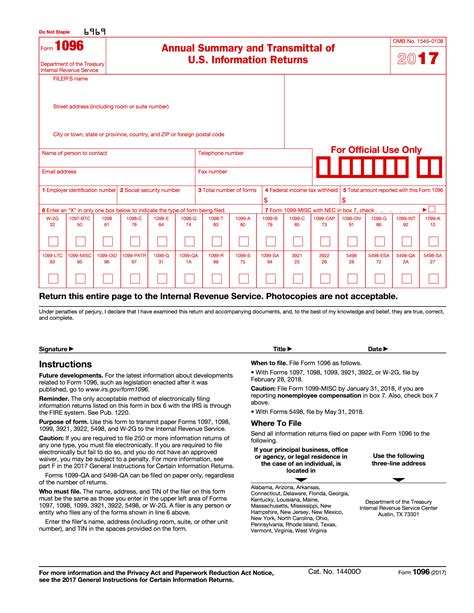

Step 4: Obtain an EIN and Open a Business Bank Account

After filing the articles of organization, the next step is to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The EIN is used to identify the LLC for tax purposes and is required to open a business bank account. Obtaining an EIN and opening a business bank account are crucial steps in establishing the LLC’s financial identity and separating personal and business finances.

Step 5: Obtain Necessary Licenses and Permits

Depending on the type of business and location, the LLC may need to obtain additional licenses and permits to operate. Researching and obtaining the necessary licenses and permits is essential to ensure compliance with state and local regulations.

📝 Note: It is essential to consult with an attorney or accountant to ensure that all necessary paperwork is completed accurately and that the LLC is in compliance with all state and federal regulations.

Common Mistakes to Avoid

When filling out LLC paperwork, there are several common mistakes to avoid, including: * Inaccurate or incomplete information: Ensure that all information is accurate and complete to avoid delays or rejection of the filing. * Failure to choose a unique business name: Ensure that the business name is unique and compliant with state regulations to avoid conflicts with other businesses. * Failure to select a reliable registered agent: Ensure that the registered agent is reliable and able to receive important documents and notices on behalf of the LLC. * Failure to obtain necessary licenses and permits: Ensure that all necessary licenses and permits are obtained to avoid fines or penalties.

| State | Filing Fee | Processing Time |

|---|---|---|

| California | $70 | 2-3 business days |

| Florida | $125 | 1-2 business days |

| New York | $200 | 2-3 business days |

Conclusion and Final Thoughts

In conclusion, filling out LLC paperwork correctly is a critical step in forming a legitimate and compliant business. By following the steps outlined above and avoiding common mistakes, business owners can ensure that their LLC is properly established and positioned for success. It is essential to seek professional advice and ensure that all necessary paperwork is completed accurately to avoid potential issues and ensure the smooth operation of the LLC.

What is the purpose of the articles of organization?

+

The articles of organization are the primary documents filed with the state to form an LLC. They provide basic information about the LLC, such as its name, address, and management structure.

What is the difference between a member-managed and manager-managed LLC?

+

A member-managed LLC is managed by its members, who are responsible for making decisions and overseeing the day-to-day operations of the business. A manager-managed LLC, on the other hand, is managed by one or more managers who are appointed by the members.

How long does it take to process the articles of organization?

+

The processing time for the articles of organization varies by state, but it typically takes 2-3 business days. Some states offer expedited processing options for an additional fee.