Get SR22 Paperwork in VA

Understanding SR22 Insurance in Virginia

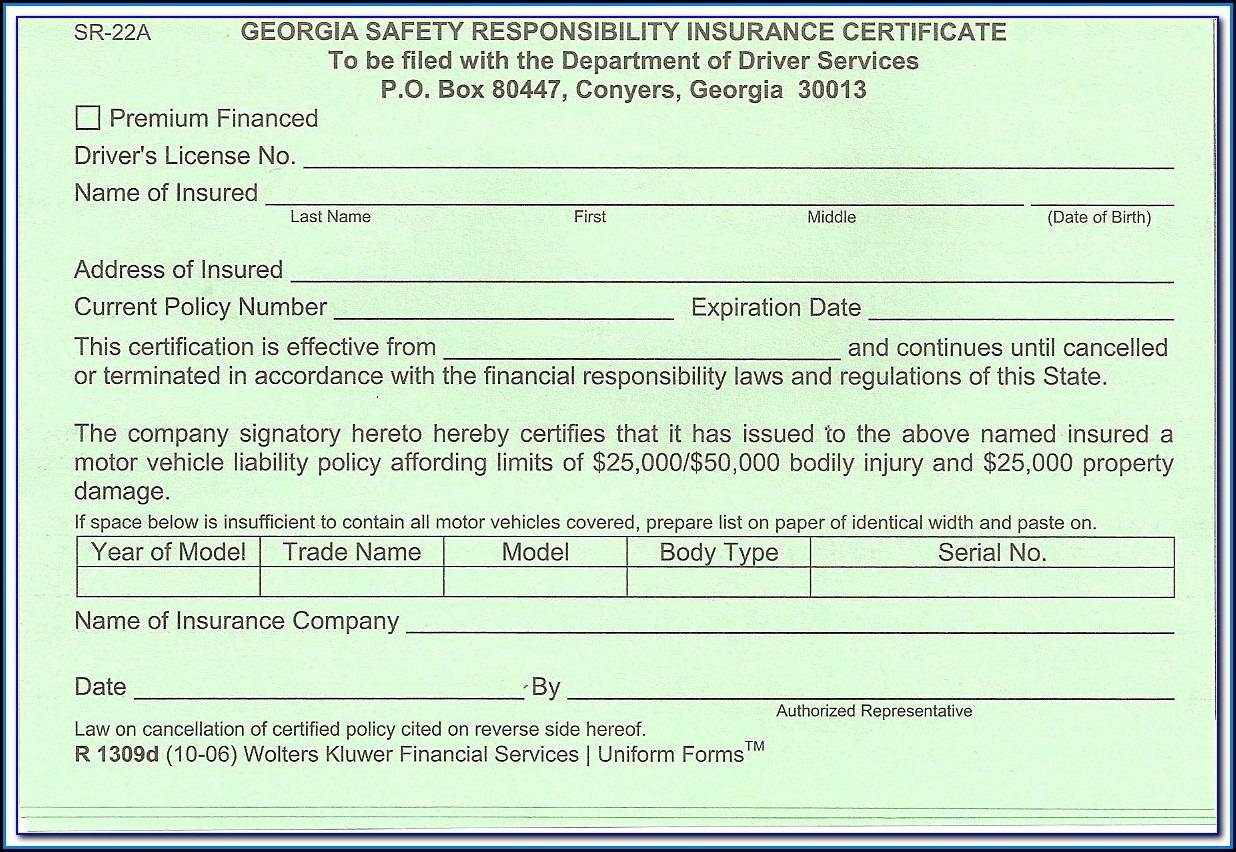

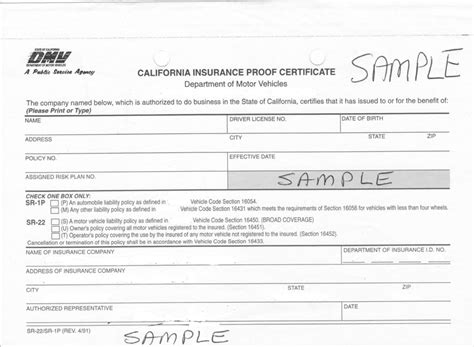

In the state of Virginia, SR22 insurance is a type of car insurance that provides proof of financial responsibility to the Department of Motor Vehicles (DMV). It is typically required for drivers who have been convicted of certain traffic offenses, such as driving under the influence (DUI) or reckless driving. The SR22 form is a document that is filed with the state DMV by an insurance company, confirming that a driver has the required insurance coverage.

Who Needs SR22 Insurance in Virginia?

There are several situations in which a driver may be required to obtain SR22 insurance in Virginia. These include: * Being convicted of a DUI or DWI offense * Receiving a suspension or revocation of driving privileges * Accumulating too many demerit points on their driving record * Failing to provide proof of insurance after an accident * Having an unsatisfied judgment against them for a car accident

How to Get SR22 Paperwork in VA

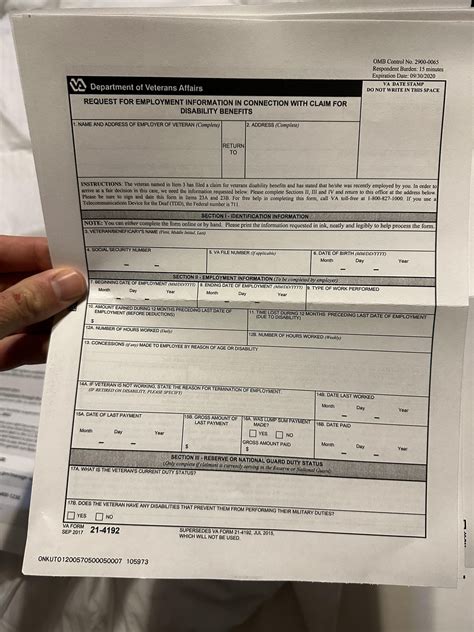

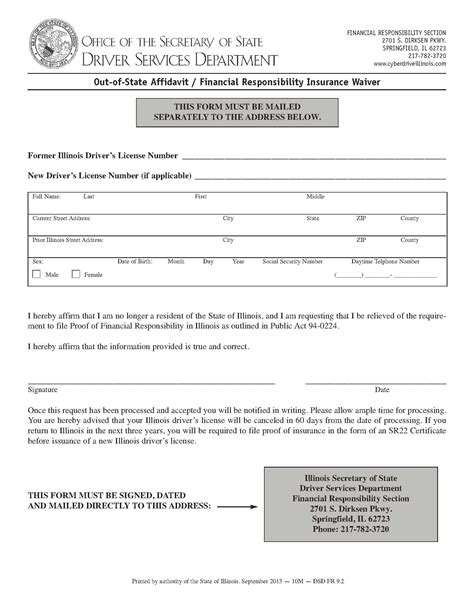

To obtain SR22 paperwork in Virginia, drivers will need to follow these steps: * Find an insurance company that offers SR22 insurance in Virginia. Not all insurance companies provide this type of coverage, so it may be necessary to shop around. * Purchase the required insurance coverage. The minimum coverage limits for SR22 insurance in Virginia are 25,000 for bodily injury or death of one person, 50,000 for bodily injury or death of two or more people, and $20,000 for property damage. * File the SR22 form with the Virginia DMV. The insurance company will typically handle this step, but drivers should confirm that the form has been filed and that their insurance coverage is in effect. * Pay the required fees. There may be fees associated with filing the SR22 form, as well as fees for reinstating driving privileges or obtaining a new driver’s license.

SR22 Insurance Requirements in Virginia

The SR22 insurance requirements in Virginia are as follows: * The insurance policy must be issued by a company that is licensed to do business in Virginia. * The policy must provide the minimum required coverage limits, which are 25,000 for bodily injury or death of one person, 50,000 for bodily injury or death of two or more people, and $20,000 for property damage. * The policy must be in effect for a minimum of three years from the date of the SR22 filing. * The insurance company must file the SR22 form with the Virginia DMV, confirming that the driver has the required insurance coverage.

| Offense | SR22 Requirement |

|---|---|

| DUI or DWI conviction | 3 years |

| Reckless driving conviction | 3 years |

| Accumulating too many demerit points | 3 years |

💡 Note: The SR22 requirement period may vary depending on the specific circumstances of the case.

Maintaining SR22 Insurance Coverage

It is important to maintain SR22 insurance coverage for the required period, as failure to do so can result in the suspension or revocation of driving privileges. Drivers should: * Make sure to pay their insurance premiums on time to avoid lapses in coverage. * Notify their insurance company of any changes to their driving record or other factors that may affect their SR22 status. * Confirm that their insurance company is still filing the SR22 form with the Virginia DMV.

Conclusion and Final Thoughts

In conclusion, obtaining SR22 paperwork in Virginia requires drivers to purchase the required insurance coverage and file the SR22 form with the state DMV. It is essential to maintain this coverage for the required period to avoid any further penalties or suspension of driving privileges. By understanding the SR22 insurance requirements and following the necessary steps, drivers can ensure that they are in compliance with Virginia state law and can get back on the road.

What is SR22 insurance in Virginia?

+

SR22 insurance in Virginia is a type of car insurance that provides proof of financial responsibility to the Department of Motor Vehicles (DMV). It is typically required for drivers who have been convicted of certain traffic offenses, such as driving under the influence (DUI) or reckless driving.

How long do I need to maintain SR22 insurance coverage in Virginia?

+

The length of time that SR22 insurance coverage is required in Virginia varies depending on the specific circumstances of the case. Typically, drivers are required to maintain SR22 insurance coverage for a minimum of three years from the date of the SR22 filing.

Can I cancel my SR22 insurance policy in Virginia?

+

No, drivers should not cancel their SR22 insurance policy in Virginia until the required period has ended. Canceling the policy can result in the suspension or revocation of driving privileges.