Send Paperwork to Credit Bureau

Understanding the Importance of Sending Paperwork to Credit Bureaus

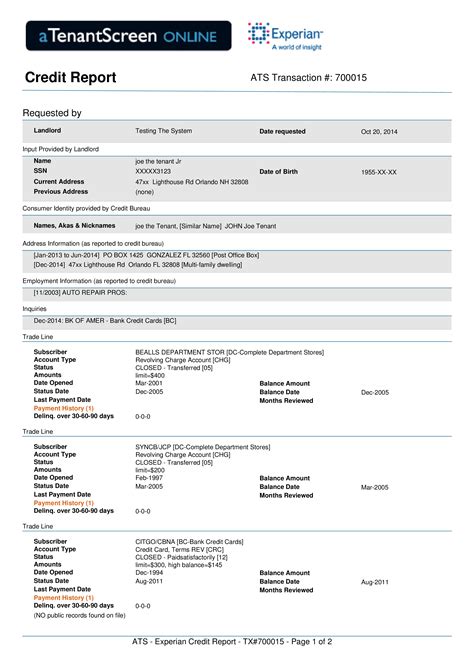

When it comes to maintaining a healthy credit score, one of the most crucial steps is ensuring that all credit information is accurately reported to the credit bureaus. This involves sending paperwork to these bureaus to verify, update, or correct information in your credit report. Accurate credit reporting is essential for obtaining loans, credit cards, and even for background checks during job applications. In this article, we will delve into the process of sending paperwork to credit bureaus, its significance, and the steps involved in doing so effectively.

Why Send Paperwork to Credit Bureaus?

Sending paperwork to credit bureaus is a proactive approach to managing your credit. This process can help in correcting errors in your credit report, adding positive information that may not be included, and removing outdated or negative information that is no longer relevant. By ensuring your credit report is accurate and up-to-date, you can improve your credit score, which in turn can lead to better loan and credit card offers, lower interest rates, and even improved job prospects.

Steps to Send Paperwork to Credit Bureaus

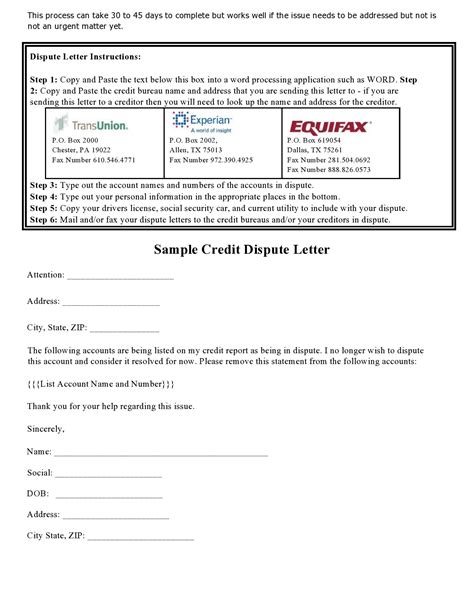

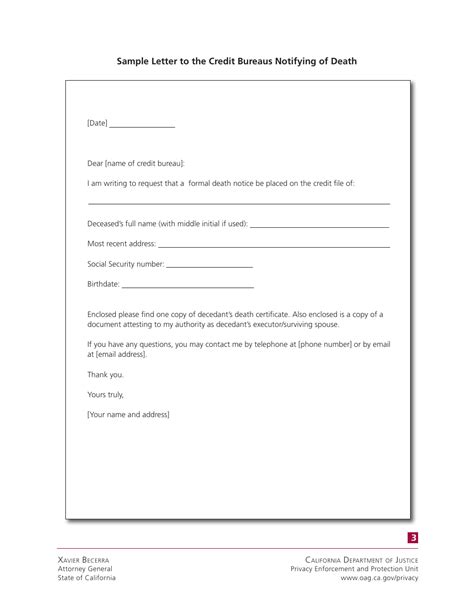

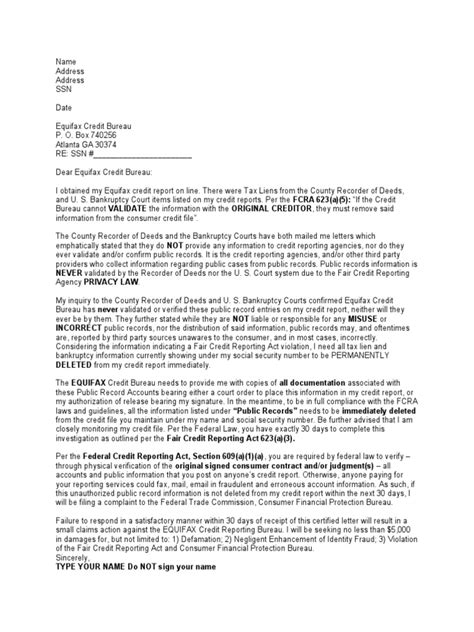

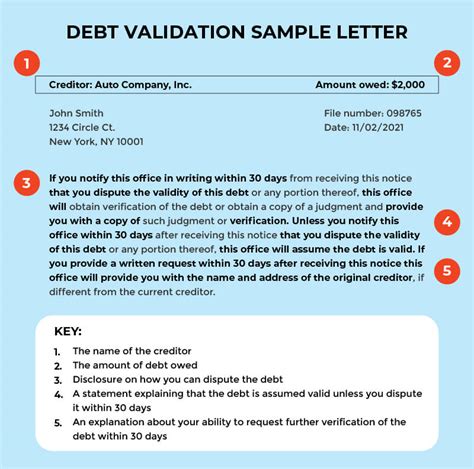

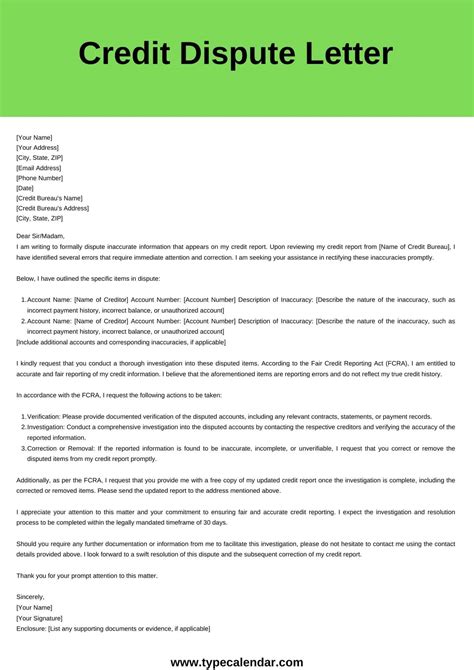

The process of sending paperwork to credit bureaus involves several steps: - Gather necessary documents: This includes identification, proof of address, and any documents related to the credit issue you are trying to resolve (e.g., payment receipts, letters from creditors). - Identify the credit bureaus: The three major credit bureaus are Equifax, Experian, and TransUnion. You may need to send paperwork to one, two, or all three, depending on your situation. - Write a dispute letter or request form: Clearly state the issue, the correction you are requesting, and include your contact information. - Mail the documents: Use certified mail to send your documents and keep a record of what you sent and when.

Tips for Effective Communication

To ensure your paperwork is processed efficiently: - Be thorough and clear in your communication. - Keep copies of all documents you send. - Follow up if you do not receive a response within the expected timeframe (usually 30-45 days).

| Credit Bureau | Mailing Address | Phone Number |

|---|---|---|

| Equifax | Equifax Information Services LLC, P.O. Box 740241, Atlanta, GA 30374 | 1-800-685-5000 |

| Experian | Experian Information Solutions, Inc., P.O. Box 2002, Allen, TX 75013 | 1-866-200-6020 |

| TransUnion | TransUnion LLC, P.O. Box 2000, Chester, PA 19016 | 1-800-916-8800 |

📝 Note: Always check the credit bureau's website for the most current mailing address and contact information before sending your documents.

Maintaining Good Credit Habits

Beyond sending paperwork to credit bureaus, maintaining good credit habits is key to a healthy credit score. This includes: - Paying bills on time - Keeping credit utilization low - Monitoring your credit report regularly - Avoiding unnecessary credit inquiries

By following these habits and knowing how to effectively communicate with credit bureaus, you can ensure your credit report is accurate and your credit score is the best it can be.

In wrapping up the discussion on the importance and process of sending paperwork to credit bureaus, it’s clear that proactive management of your credit information is crucial for financial health. By understanding the steps involved and maintaining good credit habits, individuals can better navigate the complex world of credit reporting and scoring, ultimately leading to more financial opportunities and stability. The journey to excellent credit begins with awareness and action, empowering you to take control of your financial future.

What documents do I need to send to credit bureaus?

+

You will need identification, proof of address, and any documents related to the credit issue you are trying to resolve.

How long does it take for credit bureaus to process my paperwork?

+

Typically, it takes 30-45 days for credit bureaus to process your paperwork and update your credit report.

Can I send my paperwork electronically?

+

While some credit bureaus may offer online dispute forms, it’s often recommended to send paperwork via certified mail to ensure you have proof of delivery and receipt.