Submit Bankruptcy Paperwork

Introduction to Submitting Bankruptcy Paperwork

When individuals or businesses are overwhelmed by debt and cannot pay their creditors, they may consider filing for bankruptcy. The process of filing for bankruptcy involves submitting extensive paperwork to the court, which can be complex and time-consuming. It is essential to understand the steps involved in submitting bankruptcy paperwork to ensure a smooth and successful filing process. In this article, we will guide you through the process of submitting bankruptcy paperwork, highlighting the key documents required, the steps to follow, and the importance of seeking professional help.

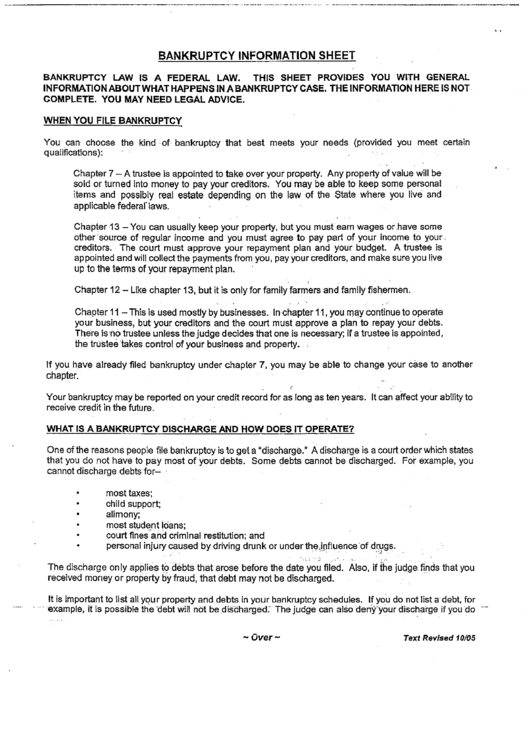

Types of Bankruptcy

There are several types of bankruptcy, each with its own set of rules and requirements. The most common types of bankruptcy are: * Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, this type of bankruptcy involves the sale of non-exempt assets to pay off creditors. * Chapter 13 Bankruptcy: This type of bankruptcy involves creating a repayment plan to pay off a portion of the debt over time. * Chapter 11 Bankruptcy: This type of bankruptcy is typically used by businesses to restructure their debt and operations.

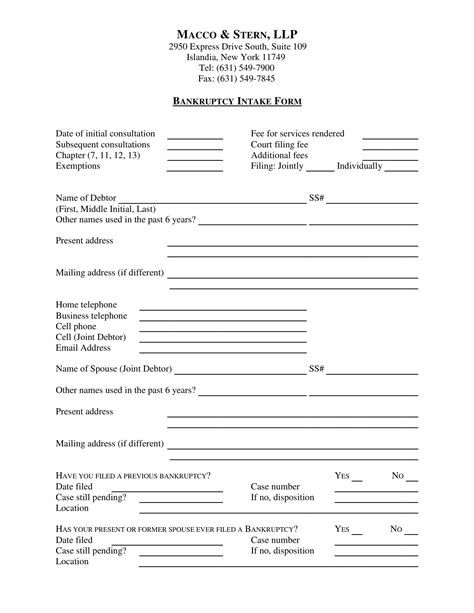

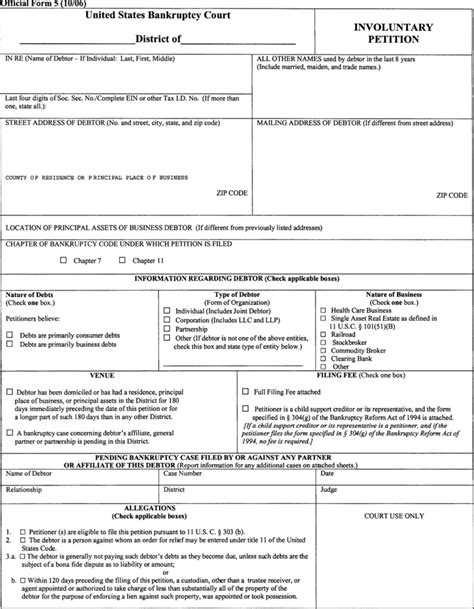

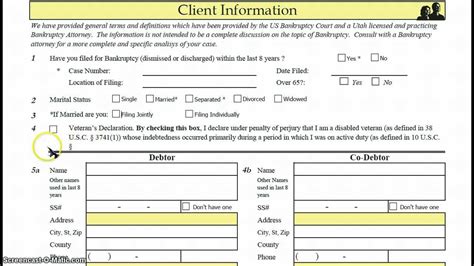

Required Documents

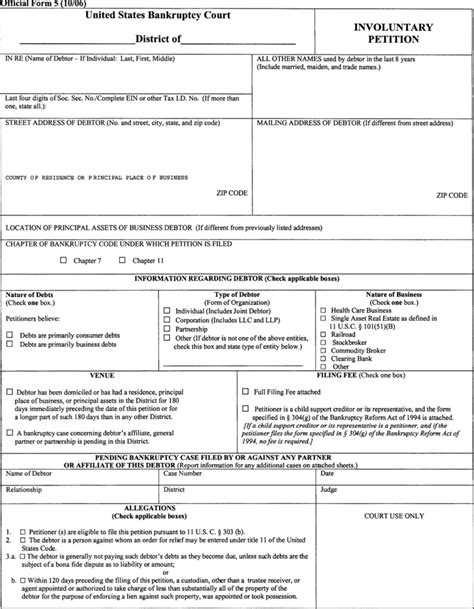

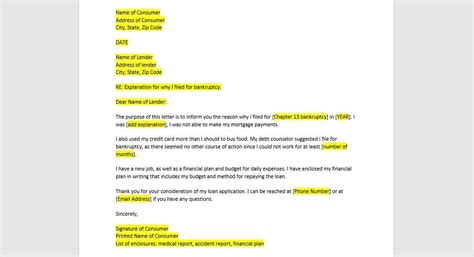

To submit bankruptcy paperwork, you will need to gather and complete various documents, including: * Petition: The petition is the initial document filed with the court to commence the bankruptcy process. * Schedules: The schedules provide detailed information about your assets, liabilities, income, and expenses. * Statement of Financial Affairs: This document provides information about your financial transactions, including income, expenses, and debt payments. * Means Test: The means test is used to determine whether you are eligible for Chapter 7 bankruptcy or if you need to file for Chapter 13 bankruptcy. * Plan: If you are filing for Chapter 13 bankruptcy, you will need to create a repayment plan that outlines how you will pay off your debt over time.

Steps to Submit Bankruptcy Paperwork

The process of submitting bankruptcy paperwork involves the following steps: * Prepare your documents: Gather and complete all the required documents, including the petition, schedules, statement of financial affairs, and means test. * File your petition: Submit your petition to the court, along with the required filing fee. * Attend the meeting of creditors: After filing your petition, you will need to attend a meeting of creditors, where you will be questioned by the trustee and your creditors about your financial situation. * Complete the plan: If you are filing for Chapter 13 bankruptcy, you will need to create and submit a repayment plan to the court. * Receive a discharge: After completing the bankruptcy process, you will receive a discharge, which releases you from liability for most of your debts.

📝 Note: It is essential to seek the help of a bankruptcy attorney to ensure that you complete and submit all the required documents accurately and on time.

Benefits of Submitting Bankruptcy Paperwork

Submitting bankruptcy paperwork can provide several benefits, including: * Debt relief: Bankruptcy can help you eliminate or reduce your debt, providing a fresh start. * Automatic stay: When you file for bankruptcy, an automatic stay is triggered, which temporarily stops creditors from collecting debts, garnishing wages, or repossessing property. * Repayment plan: If you file for Chapter 13 bankruptcy, you can create a repayment plan that allows you to pay off your debt over time.

Common Mistakes to Avoid

When submitting bankruptcy paperwork, it is essential to avoid common mistakes, including: * Incomplete or inaccurate documents: Failing to complete or accurately fill out the required documents can lead to delays or even dismissal of your case. * Missing deadlines: Failing to meet the required deadlines can result in penalties or even dismissal of your case. * Failing to disclose assets: Failing to disclose all your assets can lead to penalties or even criminal charges.

| Document | Description |

|---|---|

| Petition | Initial document filed with the court to commence the bankruptcy process |

| Schedules | Provide detailed information about your assets, liabilities, income, and expenses |

| Statement of Financial Affairs | Provide information about your financial transactions, including income, expenses, and debt payments |

In summary, submitting bankruptcy paperwork is a complex and time-consuming process that requires careful attention to detail and a thorough understanding of the bankruptcy laws and regulations. By seeking the help of a bankruptcy attorney and following the steps outlined in this article, you can ensure a smooth and successful filing process. Remember to avoid common mistakes, such as incomplete or inaccurate documents, missing deadlines, and failing to disclose assets. With the right guidance and support, you can navigate the bankruptcy process and achieve a fresh start.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the sale of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy involves creating a repayment plan to pay off a portion of the debt over time.

Do I need to hire a bankruptcy attorney to submit bankruptcy paperwork?

+

While it is possible to submit bankruptcy paperwork without an attorney, it is highly recommended that you seek the help of a bankruptcy attorney to ensure that you complete and submit all the required documents accurately and on time.

How long does the bankruptcy process take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and the complexity of the case. On average, a Chapter 7 bankruptcy can take 4-6 months to complete, while a Chapter 13 bankruptcy can take 3-5 years to complete.