Paperwork

Update 501c7 Paperwork Easily

Introduction to 501c7 Paperwork

Social clubs, like many other organizations, are required to file specific paperwork with the Internal Revenue Service (IRS) to maintain their tax-exempt status under section 501©(7) of the Internal Revenue Code. This status is crucial for social clubs as it allows them to operate without paying income tax on their exempt income. However, navigating the paperwork and ensuring compliance with IRS regulations can be daunting. This guide aims to simplify the process of updating 501c7 paperwork, making it easier for social clubs to focus on their core activities.

Understanding 501c7 Requirements

Before diving into the update process, it’s essential to understand the basic requirements for 501©(7) organizations. These social clubs must be organized for pleasure, recreation, and other nonprofitable purposes, substantially all of the activities of which are for such purposes. They must also provide an opportunity for social communion and mutual benefit to their members. The IRS closely examines the club’s activities, financial records, and membership policies to ensure compliance with these requirements.

Steps to Update 501c7 Paperwork

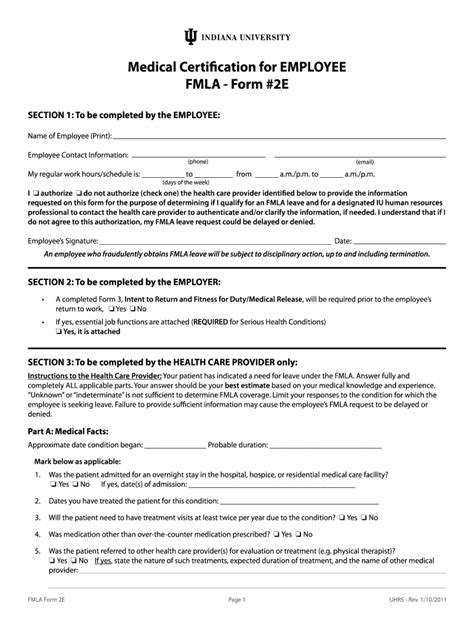

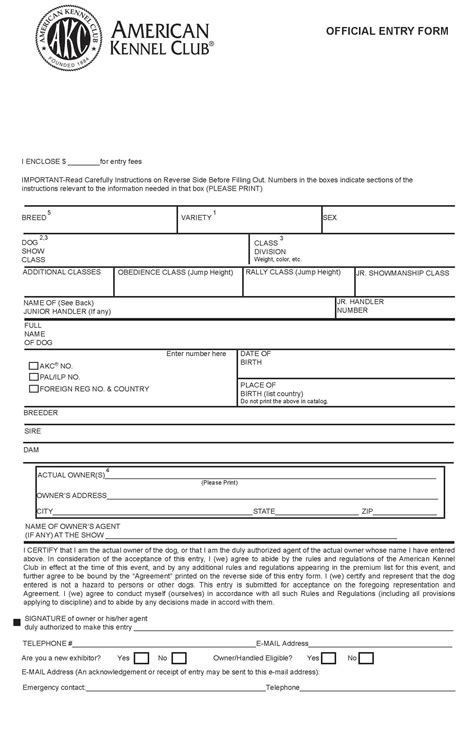

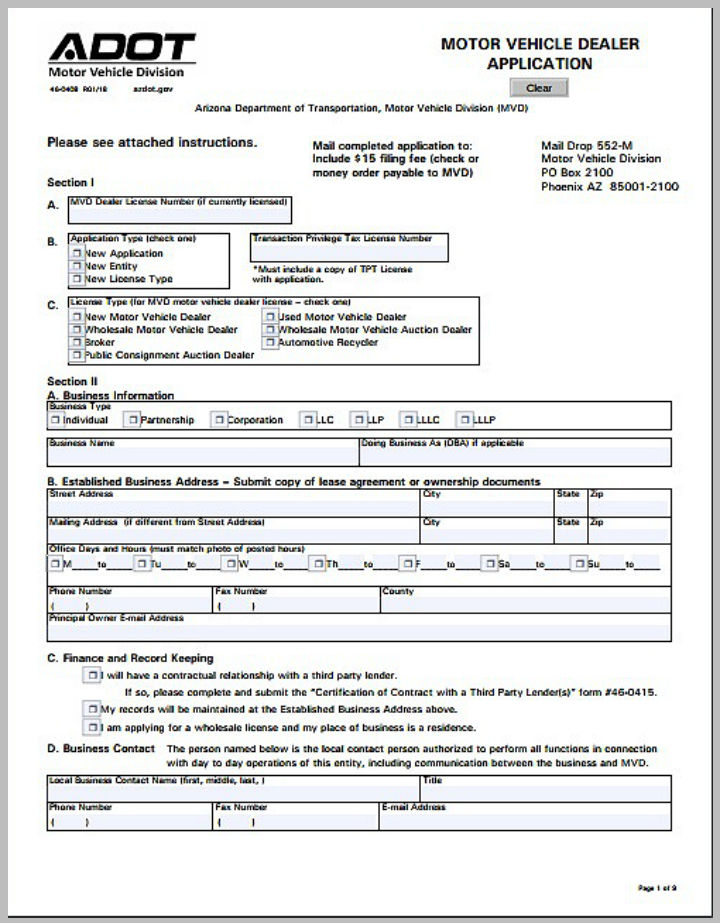

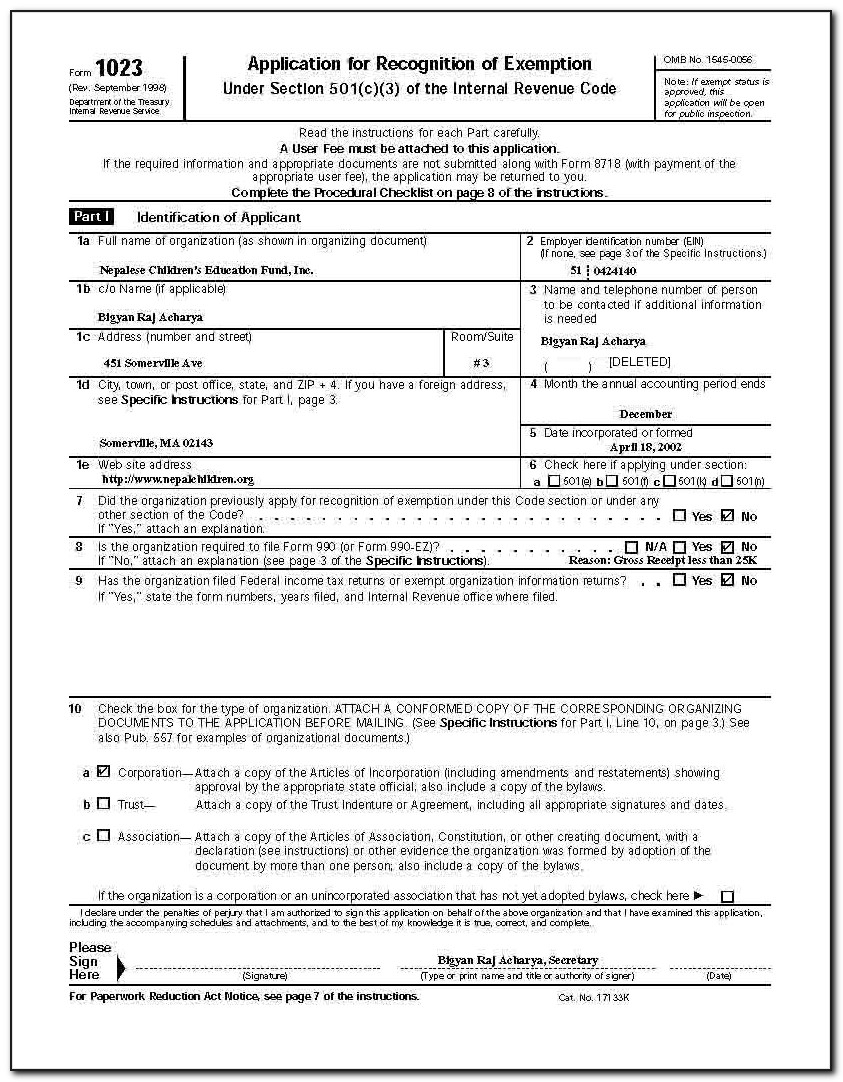

Updating 501c7 paperwork involves several steps, including: - Annual Information Return (Form 990): Most tax-exempt organizations, including 501©(7) social clubs, are required to file an annual information return with the IRS. This return provides information about the club’s activities, governance, and financial condition. - Employment Taxes: If the social club has employees, it must comply with employment tax requirements, including filing Form 941 (Employer’s Quarterly Federal Tax Return) and Form W-2 (Wage and Tax Statement) for each employee. - Changes in Governance or Operations: If there are significant changes in the club’s governance structure, operational policies, or financial practices, these must be reported to the IRS through the appropriate forms and schedules.

Key Forms and Schedules for 501c7 Organizations

Several forms and schedules are critical for 501©(7) social clubs to update their paperwork: - Form 990: The primary annual information return for most tax-exempt organizations. - Form 990-EZ: A simplified version of Form 990 for smaller organizations. - Schedule A (Form 990): Public Charity Status and Public Support. - Schedule B (Form 990, 990-EZ): Schedule of Contributions and Grants. - Form 941: Employer’s Quarterly Federal Tax Return.

Best Practices for Compliance

To ensure compliance and simplify the process of updating 501c7 paperwork, social clubs should adopt the following best practices: - Maintain Accurate Records: Keep detailed and accurate financial records and minutes of meetings. - Consult Professionals: Seek advice from tax professionals or attorneys experienced in nonprofit law. - Stay Informed: Regularly check the IRS website for updates on forms, instructions, and compliance requirements. - Plan Ahead: Prepare for the annual filing well in advance to avoid last-minute rush and potential penalties.

Challenges and Solutions

Social clubs may face several challenges when updating their 501c7 paperwork, including navigating complex IRS regulations, managing paperwork deadlines, and ensuring accurate financial reporting. Solutions to these challenges include: - Utilizing IRS Resources: The IRS offers various resources, including forms, instructions, and publications, to guide nonprofits through the filing process. - Seeking Professional Help: Consulting with a tax professional or nonprofit expert can help navigate complex regulations and ensure compliance. - Implementing Efficient Record-Keeping Systems: Adopting digital record-keeping systems can streamline financial reporting and make it easier to prepare annual returns.

| Form | Purpose | Filing Deadline |

|---|---|---|

| Form 990 | Annual Information Return | 15th day of the 5th month after the close of the tax year |

| Form 941 | Employer's Quarterly Federal Tax Return | Last day of the month following the end of the quarter |

📝 Note: Always check the IRS website for the most current deadlines and any changes to filing requirements.

Technology and Paperwork Management

Leveraging technology can significantly simplify the process of updating 501c7 paperwork. Social clubs can use: - Tax Preparation Software: Designed to help prepare and file tax returns, including forms specific to nonprofits. - Digital Record-Keeping Tools: Cloud-based accounting and record-keeping systems that can automate financial reporting and make it easier to access necessary documents for filing. - Online Filing Platforms: Many tax preparation software and IRS platforms allow for electronic filing of returns, which can expedite the process and reduce errors.

Conclusion

Updating 501c7 paperwork is a critical task for social clubs aiming to maintain their tax-exempt status. By understanding the requirements, following best practices, and leveraging technology, these organizations can navigate the complexities of IRS regulations more efficiently. It’s essential for social clubs to stay informed, seek professional advice when needed, and adopt efficient record-keeping and filing practices to ensure compliance and focus on their core mission of providing social communion and recreational activities for their members.

What is the primary purpose of filing Form 990 for 501©(7) organizations?

+

The primary purpose of filing Form 990 is to provide the IRS and the public with information about the organization’s activities, governance, and financial condition.

How often must 501©(7) social clubs file employment tax returns?

+

Employment tax returns, such as Form 941, must be filed quarterly.

What are the consequences of failing to file annual information returns on time?

+

Failing to file annual information returns on time can result in penalties and potentially lead to the loss of tax-exempt status.