Paperwork

Rent to Own Home Paperwork

Understanding Rent to Own Home Paperwork

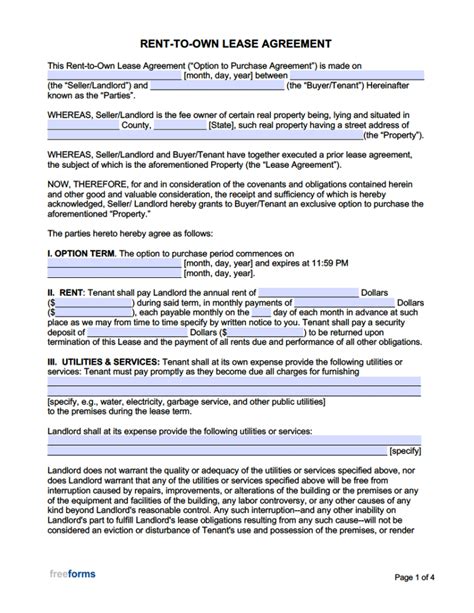

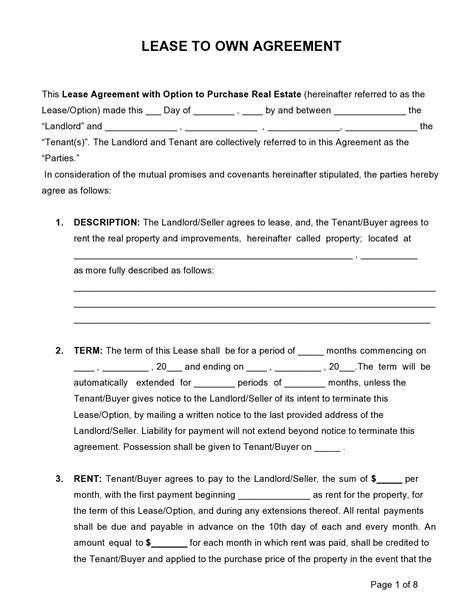

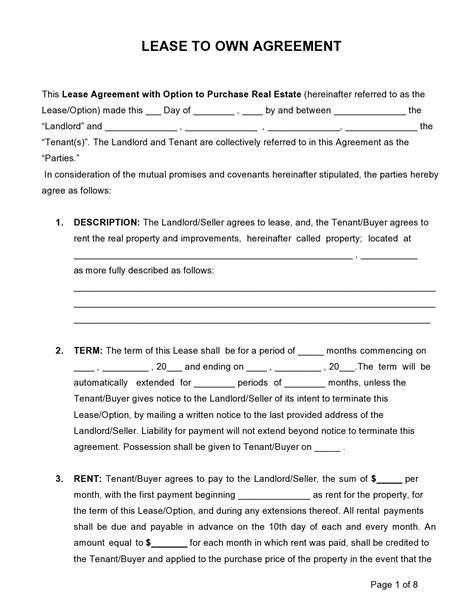

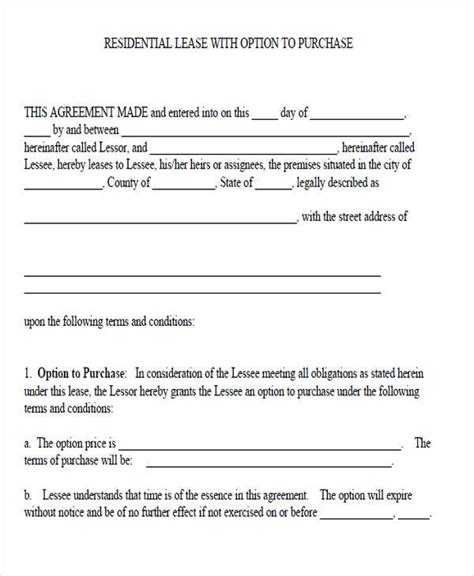

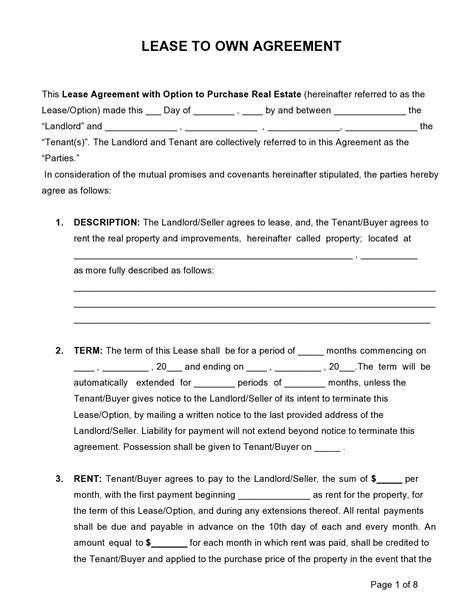

When considering a rent-to-own home agreement, it’s essential to understand the paperwork involved. This type of agreement allows renters to occupy a home with the option to purchase it in the future. The paperwork for a rent-to-own home can be complex, but it’s crucial to review and understand all the documents before signing.

Key Components of Rent to Own Home Paperwork

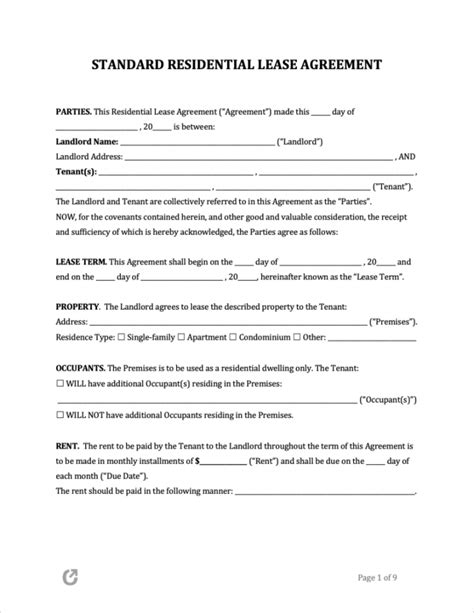

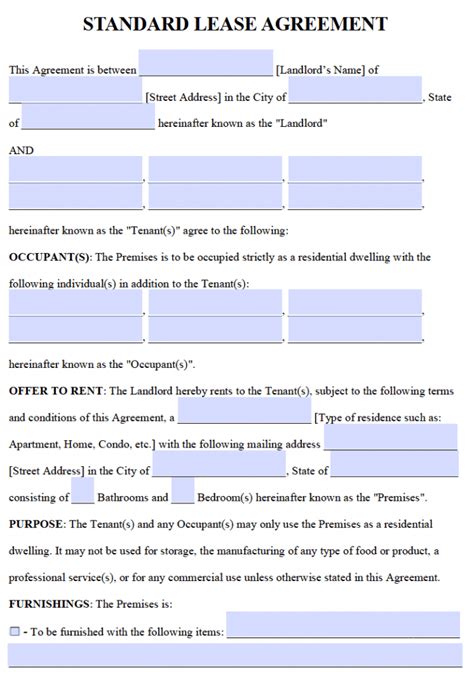

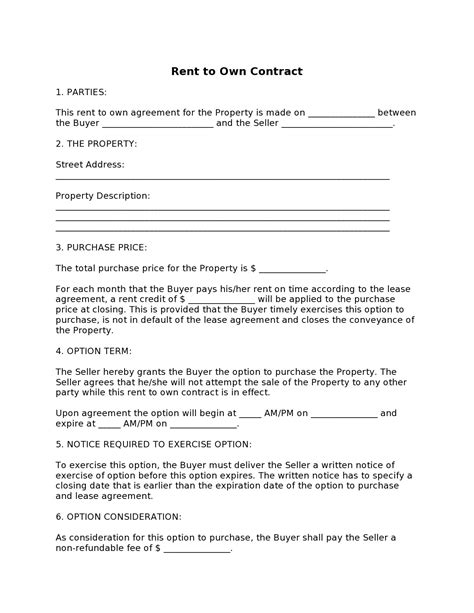

The primary documents involved in a rent-to-own home agreement include: * Lease Agreement: This document outlines the terms of the rental, including the length of the lease, rent amount, and responsibilities of both the landlord and tenant. * Option to Purchase: This document gives the tenant the option to purchase the home at a predetermined price within a specified time frame. * Rent Credit: This document outlines how a portion of the rent payments will be applied to the down payment or purchase price of the home. * Purchase Agreement: This document is used when the tenant decides to exercise their option to purchase the home and outlines the terms of the sale.

Important Clauses to Review

When reviewing the paperwork for a rent-to-own home, there are several important clauses to look out for: * Purchase Price: The purchase price of the home should be clearly stated in the option to purchase document. * Rent Amount: The rent amount and any increases should be outlined in the lease agreement. * Rent Credit: The amount of rent that will be applied to the down payment or purchase price should be clearly stated. * Maintenance and Repairs: The responsibilities for maintenance and repairs should be outlined in the lease agreement. * Inspections and Appraisals: The process for inspections and appraisals should be outlined in the purchase agreement.

Benefits and Drawbacks of Rent to Own Home Paperwork

There are both benefits and drawbacks to consider when reviewing rent-to-own home paperwork: * Benefits: + Allows renters to occupy a home with the option to purchase it in the future + Can be a good option for those who are not yet ready to purchase a home + Can provide a sense of stability and permanence for renters * Drawbacks: + Can be complex and difficult to understand + May require a large upfront payment or deposit + May have strict rules and regulations

📝 Note: It's essential to carefully review all the paperwork and understand the terms and conditions before signing a rent-to-own home agreement.

Table of Typical Rent to Own Home Paperwork Fees

The following table outlines typical fees associated with rent-to-own home paperwork:

| Fee | Description | Typical Cost |

|---|---|---|

| Option Fee | Fee paid to the seller for the option to purchase the home | 1,000 - 5,000 |

| Rent Credit | Portion of rent payments applied to the down payment or purchase price | 10% - 20% of rent payments |

| Inspection and Appraisal Fees | Fees paid for inspections and appraisals | 500 - 2,000 |

Conclusion and Final Thoughts

In conclusion, understanding the paperwork involved in a rent-to-own home agreement is crucial for both renters and sellers. By carefully reviewing all the documents and understanding the terms and conditions, individuals can make informed decisions about their housing options. It’s essential to seek professional advice and carefully consider the benefits and drawbacks before signing a rent-to-own home agreement.

What is a rent-to-own home agreement?

+

A rent-to-own home agreement is a contract that allows renters to occupy a home with the option to purchase it in the future.

What are the key components of rent-to-own home paperwork?

+

The key components of rent-to-own home paperwork include the lease agreement, option to purchase, rent credit, and purchase agreement.

What are the benefits and drawbacks of rent-to-own home paperwork?

+

The benefits of rent-to-own home paperwork include allowing renters to occupy a home with the option to purchase it in the future, while the drawbacks include complexity and potential strict rules and regulations.