File Insurance Paperwork by Year Easily

Introduction to Organizing Insurance Paperwork

When it comes to managing insurance paperwork, many individuals and businesses find themselves overwhelmed by the sheer volume of documents that need to be kept track of. From health insurance to auto insurance, and from homeowners insurance to life insurance, each type of coverage comes with its own set of policies, premiums, and claims documents. Effectively organizing these documents is crucial for ensuring that you can easily access the information you need when you need it, whether it’s for filing a claim, renewing a policy, or simply verifying your coverage. In this article, we’ll explore a straightforward method for filing insurance paperwork by year, making it easier to manage your insurance documents efficiently.

Understanding the Importance of Organized Insurance Documents

Organizing your insurance paperwork by year can have several benefits. Firstly, it helps in reducing clutter, both physical and digital, making your workspace more efficient. Secondly, it saves time when you need to locate a specific document, as you’ll know exactly where to look. Lastly, having your documents in order can reduce stress associated with managing paperwork, especially during critical times like filing a claim or dealing with an audit. By implementing a simple and consistent filing system, you can ensure that all your insurance documents are readily available and easily accessible.

Steps to File Insurance Paperwork by Year

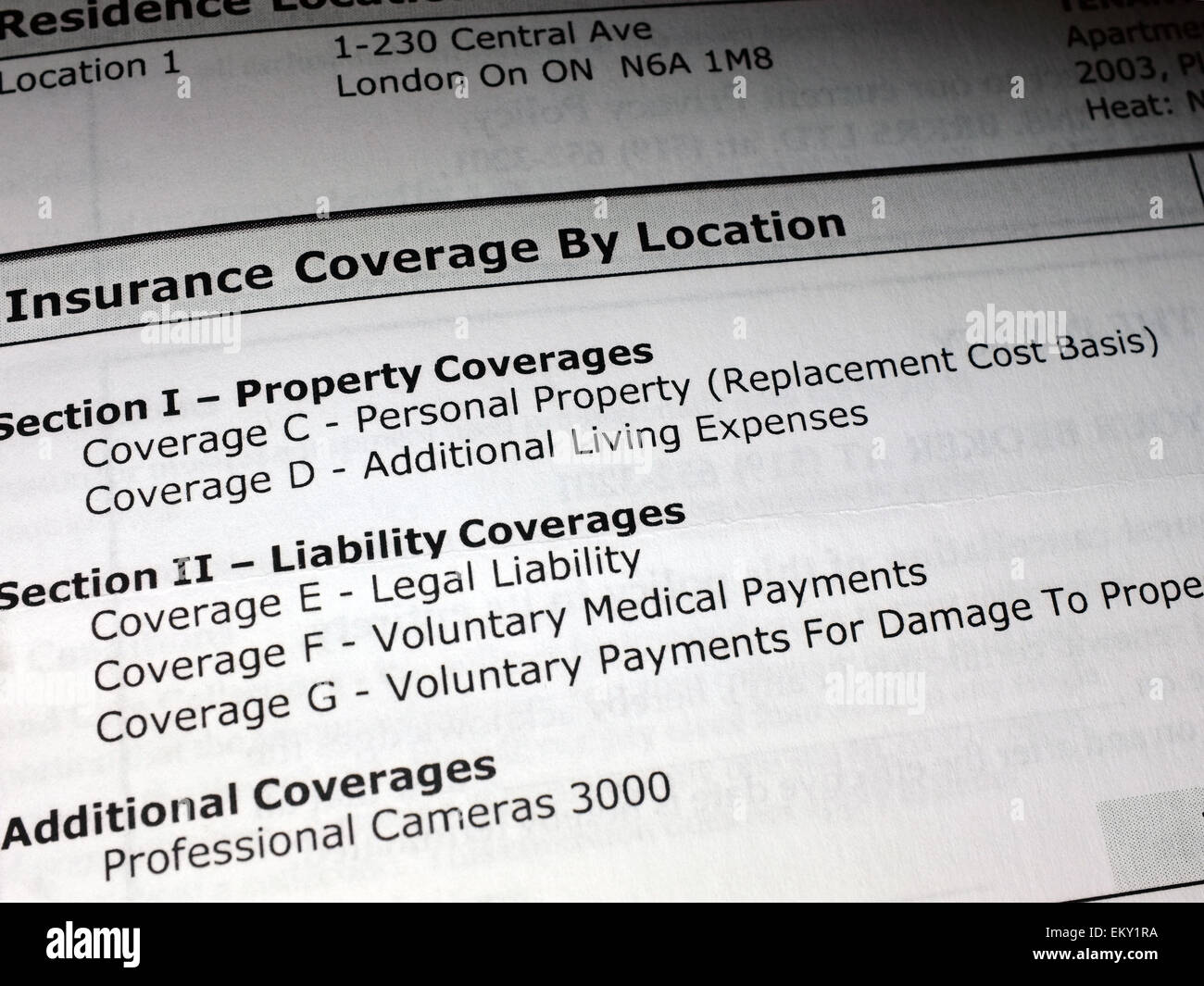

To start organizing your insurance paperwork by year effectively, follow these steps: - Categorize Your Documents: Begin by categorizing your insurance documents into different types, such as health, auto, home, and life insurance. This step helps in creating separate folders or files for each category. - Create Yearly Folders: Once you’ve categorized your documents, create folders or digital files labeled by year (e.g., “2022 Insurance Documents”). This will be the primary way you organize your paperwork. - Sub-Categorize by Month or Event: Within each yearly folder, you can further sub-categorize documents by month or by specific events (like policy renewals, claims, or significant changes to your coverage). - Digital vs. Physical Storage: Decide whether you prefer digital storage, physical storage, or a combination of both. Digital storage can offer easier access and the ability to backup your documents, while physical storage provides a tangible record. Ensure that whichever method you choose, your documents are secure and protected from unauthorized access or damage. - Regular Maintenance: Set aside time regularly (perhaps quarterly or annually) to review your insurance documents, update your files, and ensure that all necessary paperwork is included and easily accessible.

Tips for Effective Insurance Document Management

Here are some additional tips to enhance your insurance document management: - Scan Documents: Consider scanning your physical documents to create digital copies. This can help reduce physical storage needs and make documents easier to share or access remotely. - Backup Your Files: If you’re storing your documents digitally, make sure to backup your files regularly. This can be done using external hard drives, cloud storage services, or both, to protect against data loss. - Secure Your Documents: Whether physical or digital, ensure that your insurance documents are secure. For physical documents, consider using a safe or a locked cabinet. For digital documents, use strong passwords and enable two-factor authentication where possible. - Stay Informed: Keep yourself updated with any changes in insurance laws, policies, or requirements that might affect how you manage your documents.

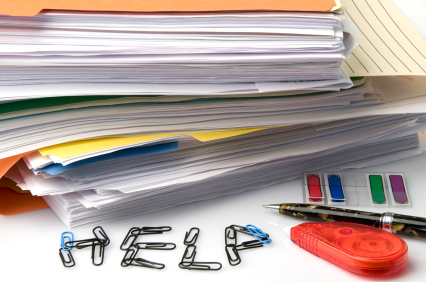

Common Challenges and Solutions

Some common challenges people face when organizing their insurance paperwork include: - Information Overload: Feeling overwhelmed by the amount of paperwork. - Solution: Start with small steps, categorizing and filing one type of insurance at a time. - Lack of Space: Not having enough physical space to store documents. - Solution: Consider digital storage options or investing in a compact storage system. - Difficulty in Locating Documents: Struggling to find specific documents when needed. - Solution: Implement a consistent naming and filing system, and consider creating an index or map of your files.

📝 Note: Regularly reviewing and updating your insurance documents can help prevent errors or gaps in coverage, ensuring you're always protected.

Utilizing Technology for Insurance Document Management

Technology can play a significant role in simplifying the process of managing insurance paperwork. Consider using: - Digital File Cabinets: Online services that allow you to store and organize your documents securely. - Mobile Apps: Applications designed for managing and tracking insurance policies and documents. - Cloud Storage: Services like Google Drive, Dropbox, or OneDrive can provide a secure and accessible place to store your documents.

| Type of Insurance | Documents to Keep |

|---|---|

| Health Insurance | Policies, Premium Payments, Claims |

| Auto Insurance | Policies, Premium Payments, Accident Reports, Claims |

| Homeowners Insurance | Policies, Premium Payments, Property Valuations, Claims |

| Life Insurance | Policies, Premium Payments, Beneficiary Information |

As you work on organizing your insurance paperwork by year, remember that the key to success lies in consistency and regular maintenance. By following the steps outlined and staying committed to your filing system, you’ll find that managing your insurance documents becomes significantly easier, saving you time, reducing stress, and ensuring that you’re always prepared for any situation that may arise.

In summary, organizing your insurance paperwork by year is a simple yet effective way to manage your documents, ensuring they are easily accessible and secure. By implementing a systematic approach to filing and maintaining your insurance documents, you can enjoy peace of mind knowing that your important papers are in order. Whether you’re dealing with a claim, a policy renewal, or simply need to verify your coverage, having your documents organized will make the process smoother and less daunting. With the right approach and tools, you can master the art of insurance document management, making it one less thing to worry about in your busy life.

What is the best way to store insurance documents?

+

The best way to store insurance documents is a method that balances accessibility with security. This can be achieved through a combination of physical storage (like a safe or locked cabinet) for sensitive documents and digital storage (using secure cloud services) for easier access and sharing.

How often should I review my insurance documents?

+

It’s a good practice to review your insurance documents at least once a year. This helps in ensuring that your coverage is up to date, premiums are correctly paid, and all necessary documents are in order. Additionally, reviewing documents after any significant life changes (like moving, getting married, or having children) is also advisable.

Can I digitize all my insurance paperwork?

+