5 FMLA Paperwork Fees Facts

Understanding FMLA Paperwork Fees: What You Need to Know

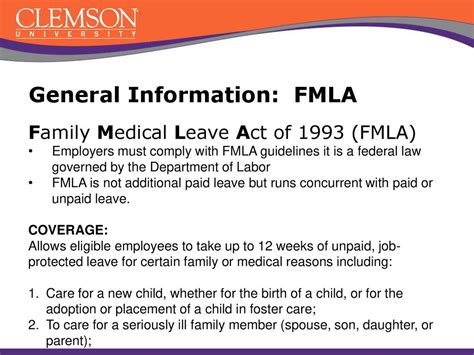

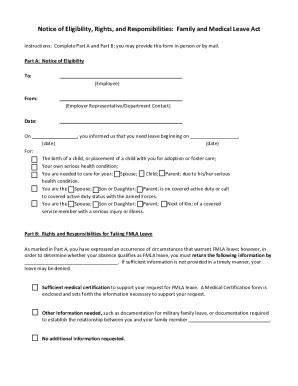

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law is designed to protect employees, it can be complex and administratively burdensome for employers. One aspect of FMLA administration that can be particularly challenging is managing the associated paperwork and fees. In this article, we will delve into the world of FMLA paperwork fees, exploring what they are, how they are calculated, and what employers need to know to comply with the law.

The Basics of FMLA Paperwork Fees

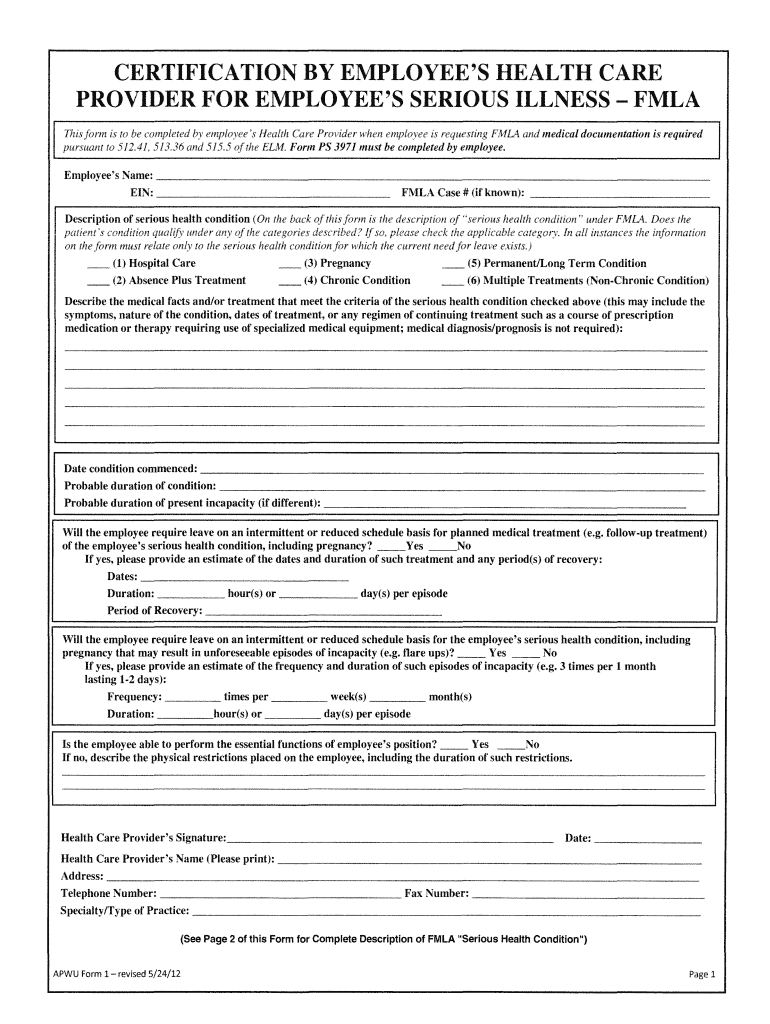

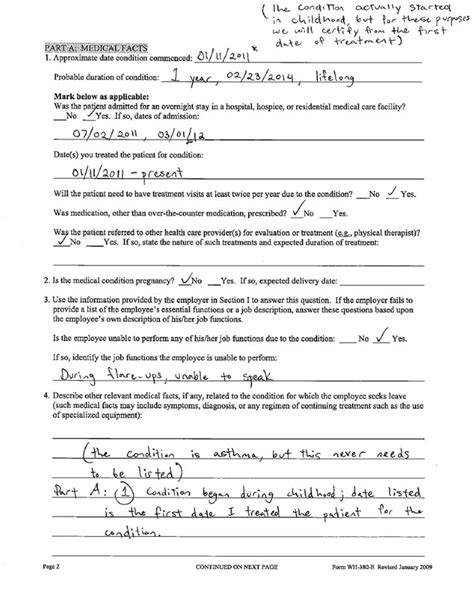

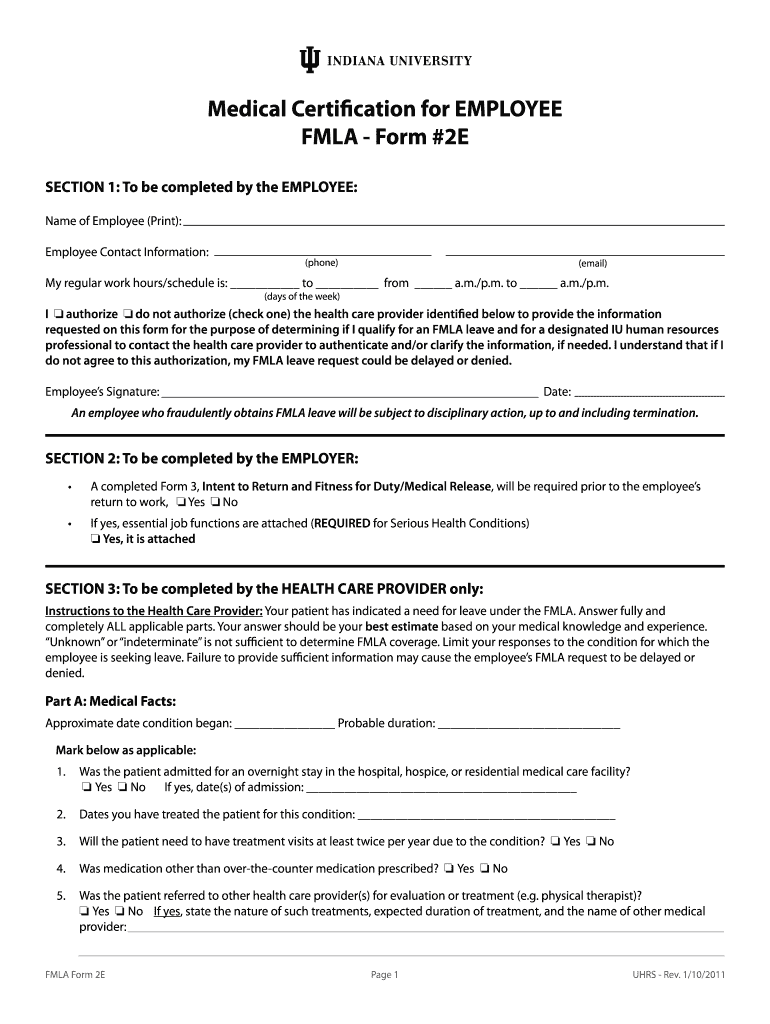

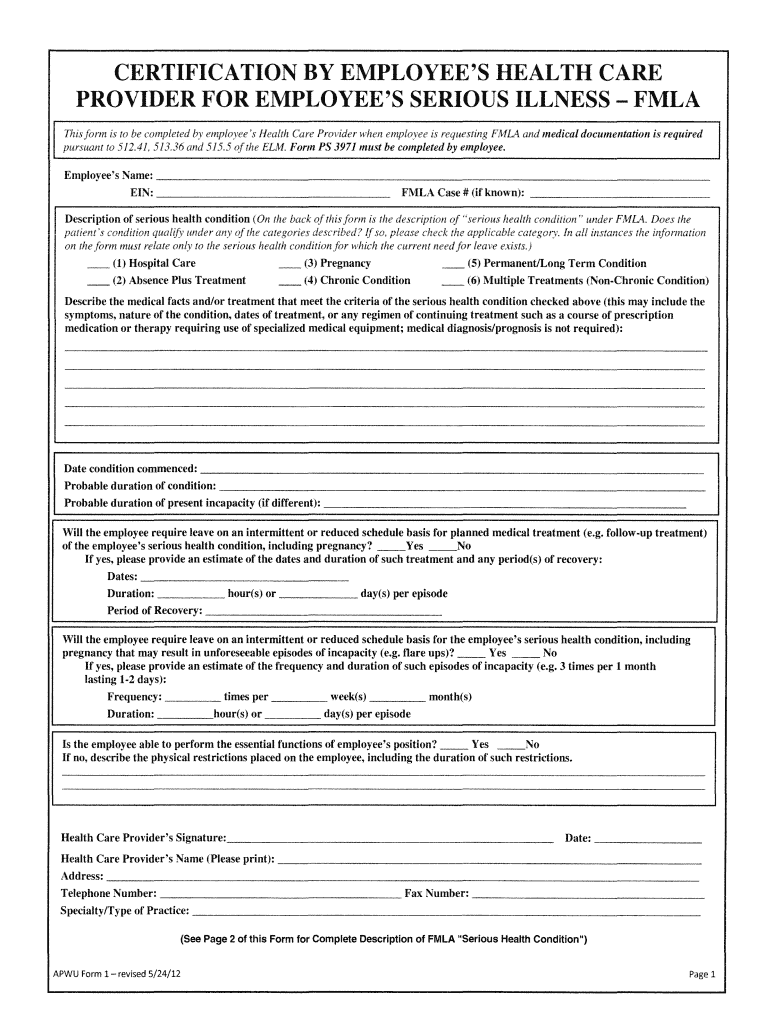

FMLA paperwork fees refer to the costs associated with processing and managing FMLA leave requests. These fees can include the cost of forms, postage, and the time spent by HR staff or other personnel on administering the leave. While the law does not specify a particular fee structure, employers may charge employees for certain costs associated with FMLA leave, such as the cost of obtaining a medical certification. However, employers must be careful not to charge fees that could be seen as discouraging employees from taking FMLA leave.

5 Key Facts About FMLA Paperwork Fees

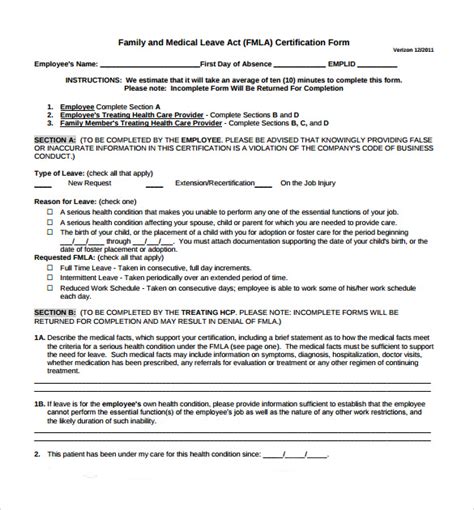

Here are five key facts that employers need to know about FMLA paperwork fees: * Employers may charge for medical certifications: Employers may require employees to provide a medical certification to support their FMLA leave request. The employer may charge the employee for the cost of obtaining this certification, but only if the employer consistently charges employees for similar certifications. * Fees must be reasonable: Any fees charged by the employer must be reasonable and may not be used to discourage employees from taking FMLA leave. Employers should carefully consider the costs associated with FMLA administration and ensure that any fees charged are fair and reasonable. * Employers may not charge for administrative tasks: Employers may not charge employees for the time spent by HR staff or other personnel on administering FMLA leave. This includes tasks such as processing leave requests, maintaining records, and responding to employee inquiries. * Fees may vary by employer: The fees associated with FMLA paperwork can vary significantly from one employer to another. Employers should carefully review their FMLA policies and procedures to ensure that they are compliant with the law and that any fees charged are reasonable and consistent with industry practices. * Employers must maintain accurate records: Employers must maintain accurate and detailed records of all FMLA leave requests, including any fees charged to employees. This includes records of the leave request, the medical certification, and any communication with the employee regarding the leave.

Best Practices for Managing FMLA Paperwork Fees

To manage FMLA paperwork fees effectively, employers should follow these best practices: * Develop a clear and consistent FMLA policy: Employers should have a well-defined FMLA policy that outlines the procedures for requesting leave, obtaining medical certifications, and managing paperwork. * Communicate with employees: Employers should communicate clearly and regularly with employees regarding FMLA leave, including any fees associated with the leave. * Use standardized forms: Employers should use standardized forms for FMLA leave requests and medical certifications to streamline the process and reduce administrative burdens. * Train HR staff: Employers should provide training to HR staff and other personnel on FMLA administration, including the management of paperwork and fees. * Review and update policies regularly: Employers should regularly review and update their FMLA policies and procedures to ensure compliance with the law and to reflect any changes in industry practices or fee structures.

| Fee Type | Description |

|---|---|

| Medical Certification Fee | The cost of obtaining a medical certification to support an FMLA leave request |

| Administrative Fee | The cost of processing and managing FMLA leave requests, including tasks such as record-keeping and communication with employees |

| Record-Keeping Fee | The cost of maintaining accurate and detailed records of FMLA leave requests and associated paperwork |

📝 Note: Employers should carefully review their FMLA policies and procedures to ensure compliance with the law and to reflect any changes in industry practices or fee structures.

In summary, FMLA paperwork fees can be a complex and administratively burdensome aspect of managing employee leave. Employers must carefully consider the costs associated with FMLA administration and ensure that any fees charged are reasonable and consistent with industry practices. By following best practices and maintaining accurate records, employers can effectively manage FMLA paperwork fees and ensure compliance with the law. As the regulatory landscape continues to evolve, employers must remain vigilant and adapt their policies and procedures to reflect any changes in the law or industry practices. Ultimately, effective management of FMLA paperwork fees requires a deep understanding of the law, careful planning, and a commitment to compliance and fairness.

What is the purpose of the Family and Medical Leave Act (FMLA)?

+

The purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, while also protecting their job and benefits.

Can employers charge employees for the cost of obtaining a medical certification?

+

Yes, employers may charge employees for the cost of obtaining a medical certification, but only if the employer consistently charges employees for similar certifications.

What is the difference between a medical certification fee and an administrative fee?

+

A medical certification fee is the cost of obtaining a medical certification to support an FMLA leave request, while an administrative fee is the cost of processing and managing FMLA leave requests, including tasks such as record-keeping and communication with employees.