California Liability Insurance Confidentiality

Introduction to California Liability Insurance Confidentiality

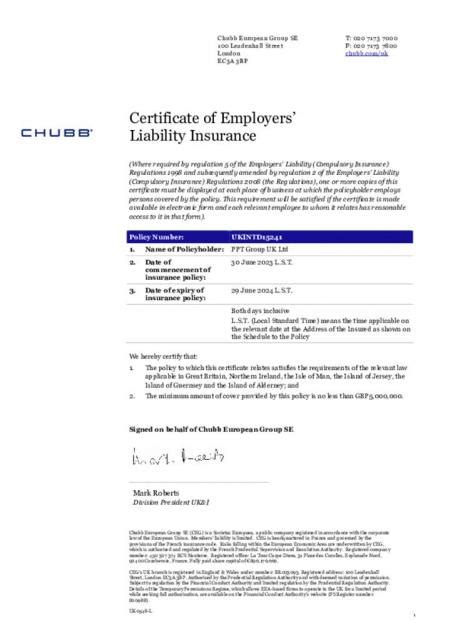

In the state of California, liability insurance plays a crucial role in protecting individuals and businesses from potential lawsuits and financial losses. Liability insurance provides coverage for damages or injuries caused to others, whether it’s in the context of personal relationships, professional services, or business operations. However, the confidentiality of insurance information is equally important, as it involves sensitive personal and financial data. This article delves into the aspects of California liability insurance confidentiality, highlighting the importance of maintaining confidentiality, laws and regulations governing insurance confidentiality, and best practices for insurance companies and policyholders.

Importance of Confidentiality in Liability Insurance

Confidentiality is paramount in the insurance industry, particularly when it comes to liability insurance. Policyholders entrust insurance companies with their personal, financial, and business information, expecting that this information will be handled with utmost care and confidentiality. Breaches in confidentiality can lead to serious consequences, including identity theft, financial fraud, and damage to professional reputation. Moreover, maintaining confidentiality helps in building trust between insurance providers and their clients, which is essential for a successful and long-lasting relationship.

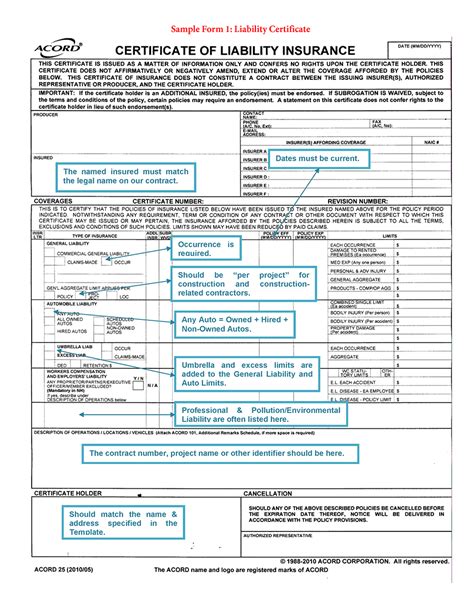

California Laws and Regulations

California has stringent laws and regulations in place to protect the confidentiality of insurance information. The California Insurance Code and the California Consumer Privacy Act (CCPA) are two key pieces of legislation that govern how insurance companies handle personal and financial information. These laws dictate what information can be collected, how it must be stored and protected, and under what circumstances it can be shared. Insurance companies operating in California must comply with these regulations to avoid legal repercussions and to maintain the trust of their policyholders.

Best Practices for Insurance Companies

To ensure confidentiality, insurance companies in California should adopt several best practices: - Implement robust data protection policies: This includes using secure servers, encrypting sensitive data, and limiting access to authorized personnel only. - Train employees: All employees should be trained on the importance of confidentiality and the legal requirements for handling personal and financial information. - Use secure communication channels: When communicating with policyholders or sharing information with third parties, insurance companies should use secure and encrypted channels. - Regularly update security measures: With the evolving nature of cyber threats, it’s crucial for insurance companies to regularly update their security measures to protect against data breaches.

Best Practices for Policyholders

Policyholders also have a role to play in maintaining confidentiality: - Be cautious with personal information: Policyholders should be mindful of the information they share and ensure they are dealing with authorized representatives of the insurance company. - Keep policy documents secure: Physical copies of insurance policies and related documents should be kept in a secure location. - Monitor accounts and communications: Regularly check for any suspicious activity or unauthorized communications from the insurance company.

Consequences of Breaching Confidentiality

Breaching confidentiality can have severe consequences for both insurance companies and policyholders. For insurance companies, a breach can lead to legal action, fines, and damage to their reputation, potentially losing the trust of their clients. For policyholders, a breach can result in identity theft, financial fraud, and other personal and financial losses. It’s essential for both parties to take all necessary measures to prevent such breaches.

Technological Advancements and Confidentiality

With the advancement of technology, insurance companies have more tools at their disposal to enhance confidentiality. Digital platforms and cloud storage offer secure ways to store and manage policyholder information. However, these advancements also introduce new risks, such as cyberattacks and data breaches. Insurance companies must stay ahead of these threats by investing in cybersecurity and regularly updating their digital security protocols.

| Law/Regulation | Purpose |

|---|---|

| California Insurance Code | Regulates insurance practices, including confidentiality and disclosure requirements. |

| California Consumer Privacy Act (CCPA) | Provides consumers with control over their personal information and imposes data protection obligations on businesses, including insurance companies. |

📝 Note: Policyholders should regularly review their policies and understand their rights and obligations regarding confidentiality.

In summary, confidentiality is a critical aspect of liability insurance in California, governed by strict laws and regulations. Both insurance companies and policyholders have roles to play in maintaining confidentiality, through best practices and adherence to legal requirements. By understanding the importance of confidentiality and taking proactive measures, the insurance industry can build trust and protect sensitive information, ultimately benefiting both providers and consumers alike. The future of liability insurance confidentiality will likely be shaped by technological advancements, requiring continuous vigilance and adaptation to ensure the highest standards of data protection and privacy.

What are the main laws governing insurance confidentiality in California?

+

The main laws include the California Insurance Code and the California Consumer Privacy Act (CCPA), which regulate how insurance companies handle personal and financial information.

How can policyholders protect their personal information?

+

Policyholders can protect their information by being cautious with what they share, keeping policy documents secure, and monitoring their accounts and communications for any suspicious activity.

What are the consequences of breaching confidentiality in liability insurance?

+

Consequences can include legal action, fines for insurance companies, and for policyholders, potential identity theft and financial fraud, leading to personal and financial losses.