Life Insurance Policy Paperwork Needed

Understanding the Requirements for Life Insurance Policy Paperwork

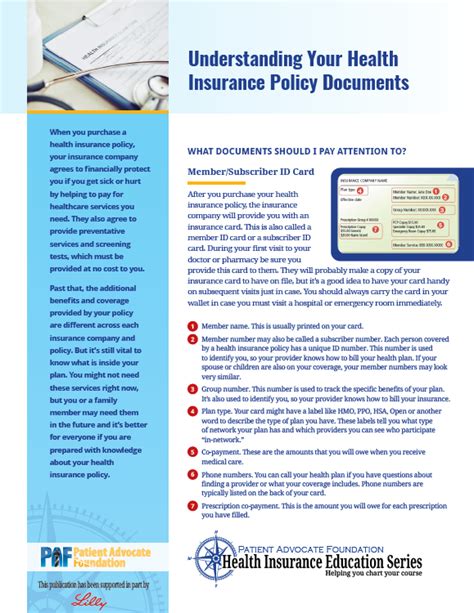

When considering purchasing a life insurance policy, it’s essential to understand the paperwork involved. The process of applying for and maintaining a life insurance policy requires various documents, which can sometimes seem overwhelming. However, being prepared and knowing what to expect can make the process smoother and less stressful. In this article, we will delve into the details of the paperwork needed for a life insurance policy, helping you navigate through the requirements with ease.

Initial Application Process

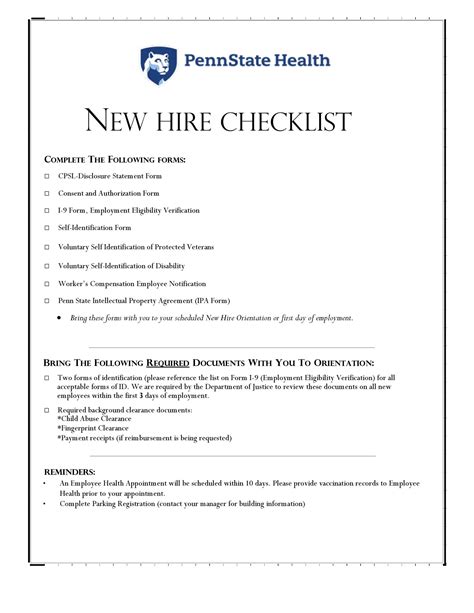

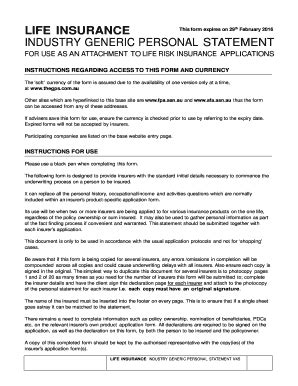

The journey to securing a life insurance policy begins with the initial application. This stage requires potential policyholders to provide personal and medical information to the insurance company. The primary documents needed during this phase include: - Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify the applicant’s identity. - Application Form: The insurance company provides a detailed application form that must be filled out accurately. This form asks for personal details, medical history, lifestyle habits, and other relevant information. - Medical Questionnaire: A comprehensive medical questionnaire is part of the application process, inquiring about the applicant’s health, medical conditions, and family medical history. - Authorizations: Applicants must sign authorizations allowing the insurance company to obtain medical records from healthcare providers and to conduct background checks if necessary.

Medical Requirements

For many life insurance policies, especially those with higher coverage amounts, a medical exam is required. This exam is typically conducted by a paramedical professional at the applicant’s home or office and includes: - Blood Tests: To check for various health indicators, such as blood sugar levels, cholesterol levels, and signs of diseases. - Urinalysis: A urine test to detect substances such as drugs, nicotine, and health anomalies. - Blood Pressure Check: To assess the applicant’s blood pressure. - Height and Weight Measurement: To calculate the body mass index (BMI), which is a factor in determining health risks.

Additional Requirements

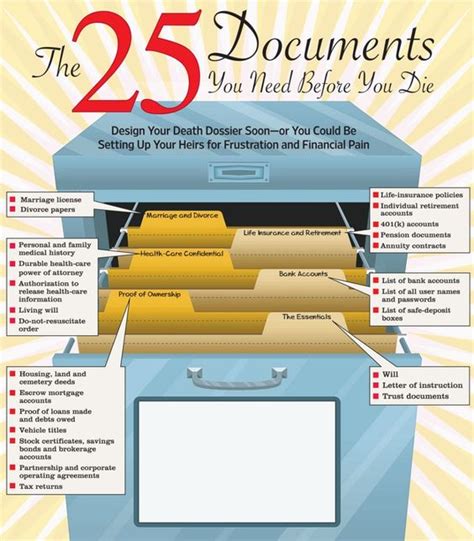

Depending on the type of policy, the applicant’s age, health, and the amount of coverage applied for, additional documentation may be necessary. These can include: - Attending Physician’s Statement (APS): The applicant’s doctor may be asked to provide a statement regarding the applicant’s health conditions, treatments, and medical history. - Medical Records: The insurance company may request access to the applicant’s medical records to assess health risks more accurately. - Financial Information: For high-net-worth individuals or those applying for large policies, financial information may be required to understand the need for the coverage amount applied for.

Policy Issuance and Maintenance

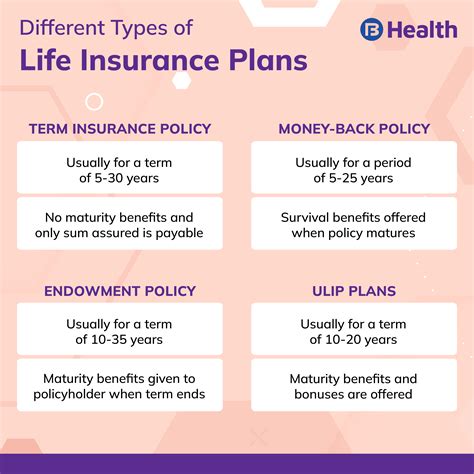

Once the application is approved, the policy is issued, and the paperwork doesn’t end there. Policyholders must maintain their policy by: - Paying Premiums: Timely payment of premiums is crucial to keep the policy in force. - Updating Information: Policyholders should inform the insurance company of any changes in personal details, health status, or lifestyle that could affect the policy. - Renewal or Conversion: Depending on the policy type, there might be options or requirements to renew or convert the policy at certain stages.

📝 Note: It's crucial to review the policy documents carefully before signing, ensuring all information is accurate and understood.

Benefits of Understanding the Paperwork

Having a clear understanding of the paperwork involved in a life insurance policy can significantly benefit the applicant. It allows for a more streamlined application process, reduces the likelihood of delays or complications, and ensures that the policy meets the individual’s needs. Moreover, being informed helps in making better decisions regarding the type of policy and coverage amount, ultimately providing peace of mind for the policyholder and their loved ones.

As we reflect on the process of obtaining and maintaining a life insurance policy, it becomes apparent that while the paperwork might seem daunting, it is a necessary part of ensuring that individuals and families are protected in the event of unforeseen circumstances. By being prepared and knowledgeable about the requirements, individuals can navigate this process with confidence, securing a policy that provides the desired level of protection and peace of mind.

What is the primary purpose of the medical exam in the life insurance application process?

+

The primary purpose of the medical exam is to assess the applicant’s health and determine the risk level for the insurance company, which in turn affects the policy’s premium and terms.

Can I apply for a life insurance policy without a medical exam?

+

Yes, some life insurance policies do not require a medical exam, especially those with lower coverage amounts or simplified issue policies. However, these policies might have higher premiums or stricter eligibility criteria.

How long does it typically take for a life insurance policy to be approved and issued?

+

The approval and issuance time for a life insurance policy can vary significantly depending on the complexity of the application, the need for additional information, and the efficiency of the insurance company’s underwriting process. It can range from a few days for simplified issue policies to several weeks for fully underwritten policies.