LLC Formation Paperwork Filing Requirements

Introduction to LLC Formation

Forming a Limited Liability Company (LLC) is a popular choice for entrepreneurs and small business owners due to its flexibility and liability protection. However, the process of forming an LLC involves several steps, including filing the necessary paperwork with the state. In this article, we will guide you through the LLC formation paperwork filing requirements and provide you with the information you need to get started.

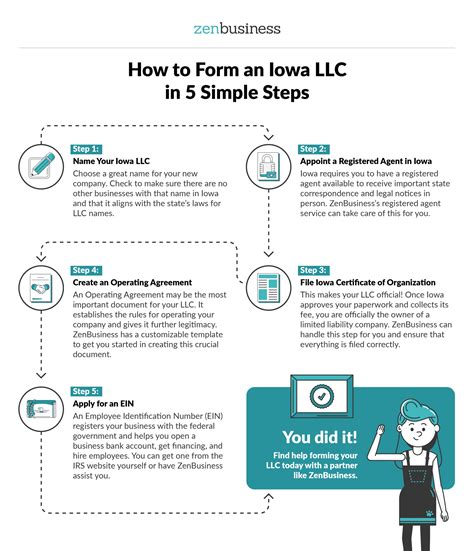

Choose a Business Name

Before filing any paperwork, you need to choose a unique and available business name for your LLC. The name must comply with the state’s naming requirements, which typically include:

- The name must be distinguishable from other business names in the state

- The name must include the words “Limited Liability Company” or the abbreviation “LLC”

- The name must not include certain words or phrases that are prohibited by the state

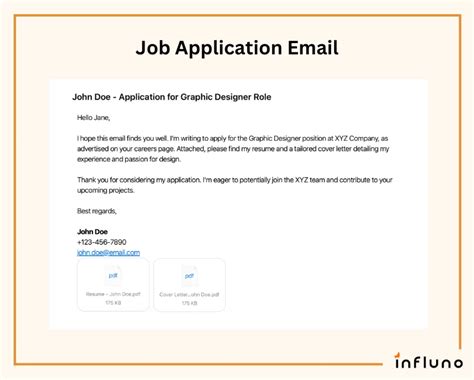

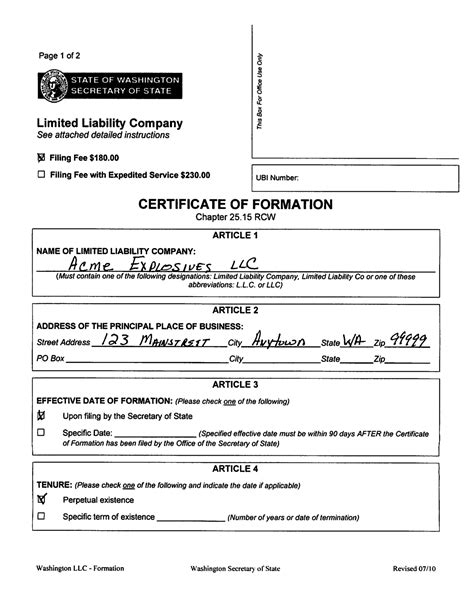

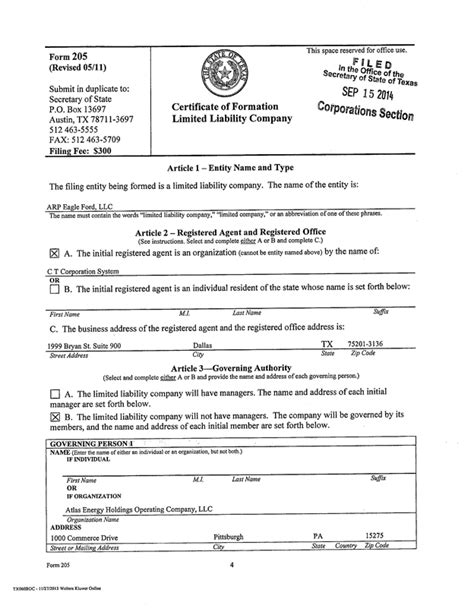

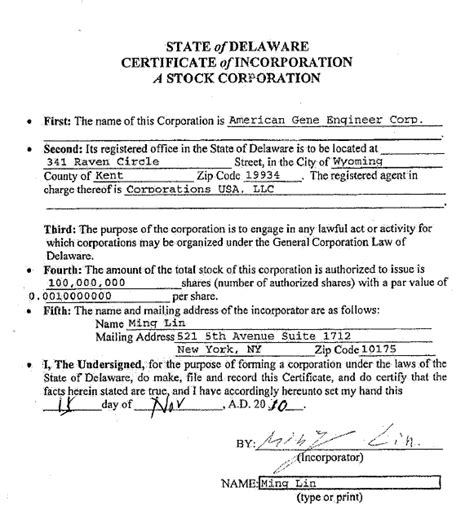

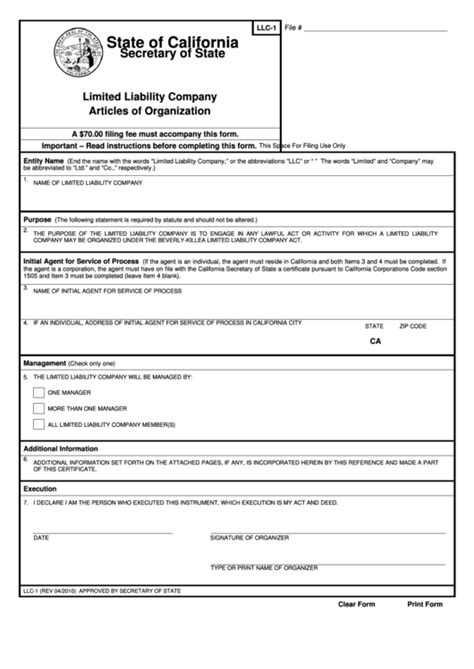

File Articles of Organization

The next step is to file the Articles of Organization with the state. This document provides basic information about your LLC, such as:

- Business name and address

- Purpose of the business

- Management structure (member-managed or manager-managed)

- Registered agent information

Obtain an EIN

An Employer Identification Number (EIN) is a unique nine-digit number assigned to your LLC by the Internal Revenue Service (IRS). You will need an EIN to:

- Open a business bank account

- File tax returns

- Hire employees

File for Licenses and Permits

Depending on the type of business you operate, you may need to obtain licenses and permits from the state, county, or city. These licenses and permits may include:

- Business license

- Sales tax permit

- Employment tax permit

- Environmental permit

Register for Taxes

As an LLC, you will need to register for taxes with the state and federal government. You will need to:

- File a tax return with the IRS (Form 1065 or Form 1120)

- Register for state taxes (sales tax, employment tax, etc.)

- Obtain a tax ID number from the state (if required)

Compliance Requirements

After forming your LLC, you will need to comply with ongoing requirements, such as:

- Filing annual reports with the state

- Maintaining a registered agent

- Updating the state with any changes to your business information

📝 Note: It's essential to keep accurate and detailed records of your LLC's formation and ongoing compliance requirements to avoid any potential issues or penalties.

Conclusion and Next Steps

Forming an LLC requires careful planning and attention to detail. By following the steps outlined in this article, you can ensure that your LLC is properly formed and compliant with all state and federal requirements. Remember to stay organized, keep accurate records, and seek professional advice when needed. With the right guidance and support, you can establish a successful and thriving business.

What is the difference between a member-managed and manager-managed LLC?

+

A member-managed LLC is managed by its members, who make decisions and oversee the business. A manager-managed LLC, on the other hand, is managed by one or more managers who are appointed by the members. The managers are responsible for making decisions and overseeing the business.

Do I need to file annual reports for my LLC?

+

Yes, most states require LLCs to file annual reports, which typically include information about the business, such as its name, address, and management structure. The filing fee and due date vary by state.

Can I form an LLC online?

+

Yes, many states allow you to form an LLC online through their business filing website. You can also use online services, such as LLC formation companies, to help you with the process.