5 Ways No Paperwork Loans

No Paperwork Loans: A Convenient Financial Solution

In today’s fast-paced world, individuals often find themselves in need of quick financial solutions to address unexpected expenses or emergencies. Traditional loan applications can be tedious and time-consuming, requiring a plethora of paperwork and documentation. However, with the advent of no paperwork loans, borrowers can now access funds with minimal hassle. This article will delve into the world of no paperwork loans, exploring their benefits, types, and application processes.

Benefits of No Paperwork Loans

No paperwork loans offer several advantages over traditional loan options. Some of the key benefits include: * Fast approval: No paperwork loans are designed to provide quick access to funds, with approval times often ranging from a few minutes to a few hours. * Minimal documentation: As the name suggests, no paperwork loans require minimal documentation, making the application process faster and more convenient. * Flexibility: No paperwork loans can be used to cover a wide range of expenses, from medical bills to car repairs. * Easy repayment: Many no paperwork loan providers offer flexible repayment plans, allowing borrowers to repay the loan in installments.

Types of No Paperwork Loans

There are several types of no paperwork loans available, each with its own unique features and benefits. Some of the most common types include: * Payday loans: Short-term loans that provide quick access to funds, often with high interest rates. * Personal loans: Unsecured loans that can be used for a variety of purposes, often with more favorable interest rates than payday loans. * Line of credit: A type of loan that provides borrowers with access to a revolving credit line, allowing them to borrow and repay funds as needed. * Title loans: Secured loans that use the borrower’s vehicle as collateral, often with lower interest rates than payday loans. * Installment loans: Loans that are repaid in installments, often with more favorable interest rates than payday loans.

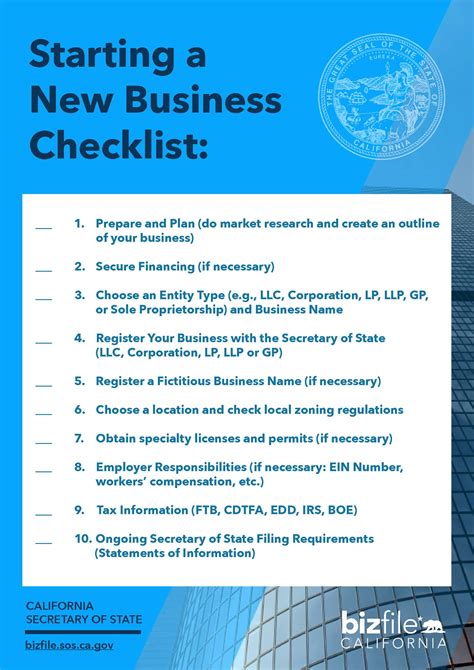

How to Apply for No Paperwork Loans

Applying for no paperwork loans is often a straightforward process. Here are the general steps involved: * Choose a lender: Research and select a reputable lender that offers no paperwork loans. * Check eligibility: Review the lender’s eligibility criteria, which may include age, income, and employment requirements. * Gather required documents: While no paperwork loans require minimal documentation, borrowers may still need to provide some basic information, such as identification and income proof. * Submit application: Submit the application, either online or in-person, and wait for approval. * Receive funds: Once approved, the funds will be disbursed to the borrower’s account, often within a few hours.

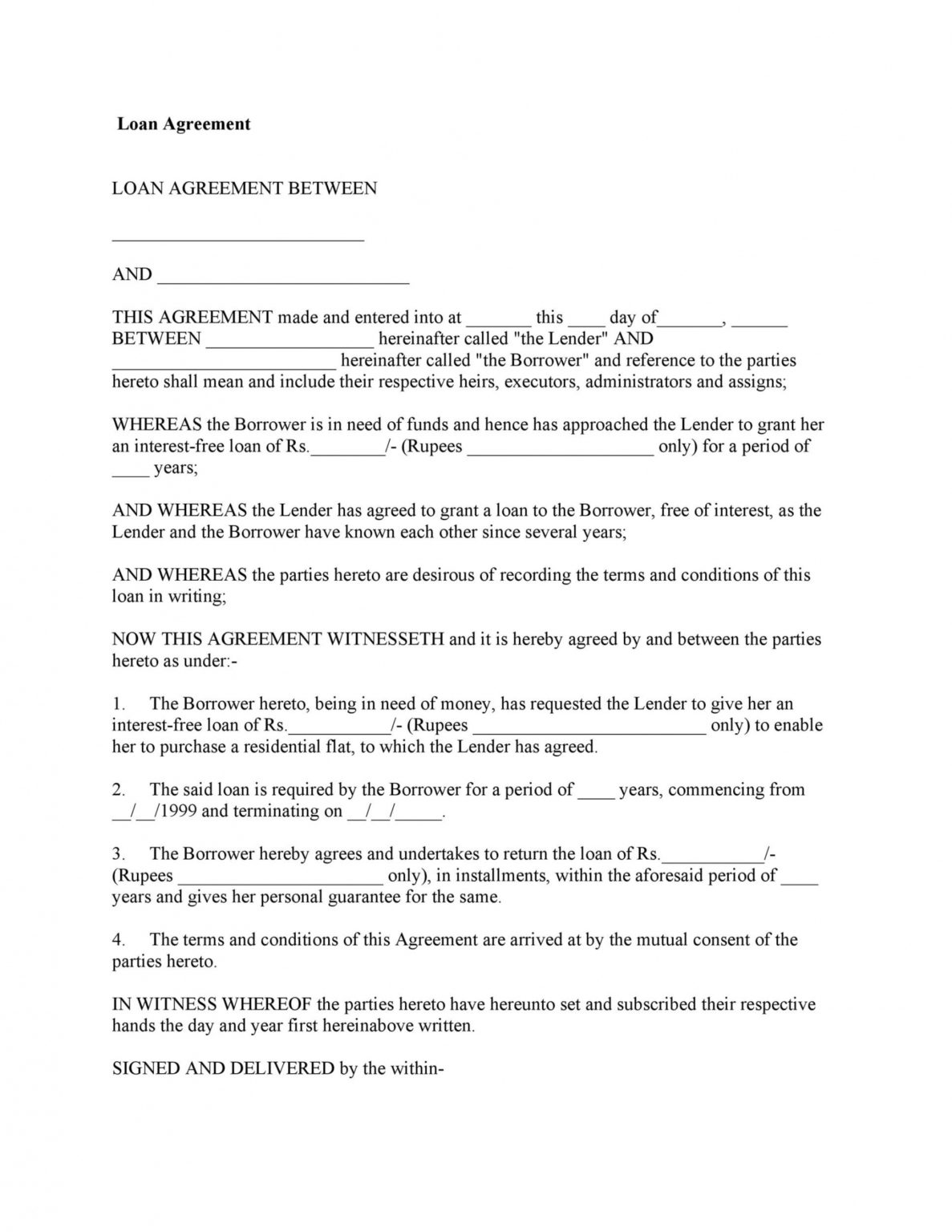

No Paperwork Loan Providers

There are many no paperwork loan providers available, each with its own unique features and benefits. Some of the most popular providers include:

| Provider | Loan Amount | Interest Rate |

|---|---|---|

| Lender A | 100-1,000 | 20%-30% |

| Lender B | 500-5,000 | 15%-25% |

| Lender C | 1,000-10,000 | 10%-20% |

It’s essential to research and compares different providers to find the best option for your financial needs.

💡 Note: Borrowers should carefully review the terms and conditions of no paperwork loans before applying, as high interest rates and fees can apply.

In summary, no paperwork loans offer a convenient and fast financial solution for individuals in need of quick access to funds. With minimal documentation required, flexible repayment plans, and fast approval times, no paperwork loans can be an attractive option for those who need to cover unexpected expenses or emergencies. However, it’s crucial to carefully review the terms and conditions of these loans and choose a reputable lender to avoid high interest rates and fees.

What are no paperwork loans?

+

No paperwork loans are a type of loan that requires minimal documentation and offers fast access to funds.

How do I apply for a no paperwork loan?

+

To apply for a no paperwork loan, choose a reputable lender, check eligibility, gather required documents, submit the application, and wait for approval.

What are the benefits of no paperwork loans?

+

The benefits of no paperwork loans include fast approval, minimal documentation, flexibility, and easy repayment.