5 Mortgage Tips

Understanding the Mortgage Landscape

Navigating the world of mortgages can be a daunting task, especially for first-time buyers. With so many options available, it’s essential to be well-informed to make the best decision for your financial situation. In this article, we will delve into the intricacies of mortgages, providing you with valuable insights and tips to help you secure the most suitable mortgage for your needs.

Tip 1: Improve Your Credit Score

Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. A good credit score can help you secure a lower interest rate, which can save you thousands of dollars over the life of the loan. To improve your credit score, make sure to:

- Pay your bills on time

- Keep your credit utilization ratio below 30%

- Monitor your credit report for errors

- Avoid applying for multiple credit cards or loans

Tip 2: Get Pre-Approved

Getting pre-approved for a mortgage is a crucial step in the home-buying process. It not only gives you an idea of how much you can afford but also provides you with a competitive edge when making an offer on a house. To get pre-approved, you’ll need to:

- Gather financial documents, such as pay stubs and bank statements

- Choose a lender and submit your application

- Wait for the lender to review your application and provide a pre-approval letter

Tip 3: Consider Your Options

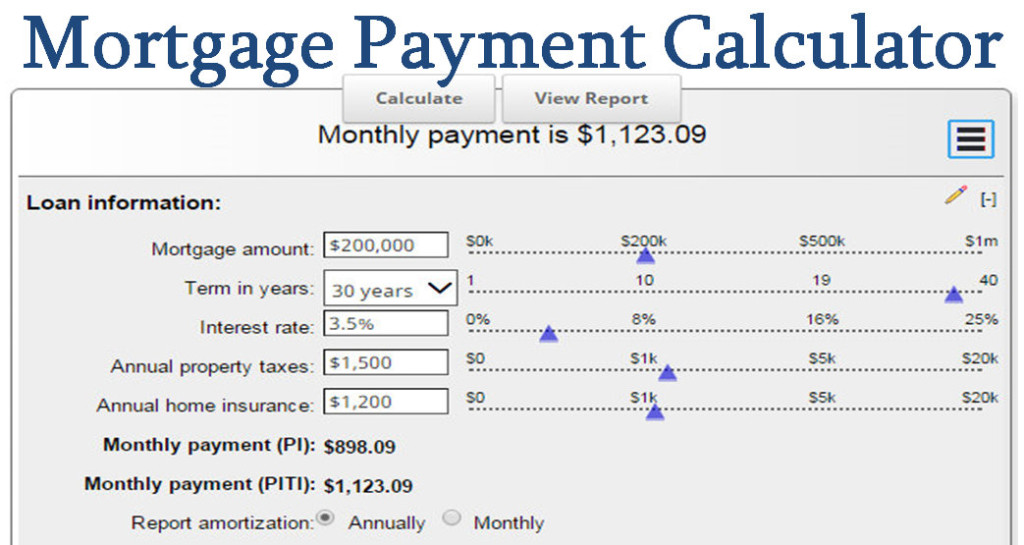

When it comes to mortgages, there are various options to choose from, each with its pros and cons. Some of the most common types of mortgages include:

- Fixed-Rate Mortgage: Offers a fixed interest rate for the life of the loan

- Adjustable-Rate Mortgage: Offers a lower initial interest rate that may adjust over time

- Government-Backed Mortgage: Insured by the government, these mortgages often have more lenient credit score requirements

Tip 4: Don’t Forget About Closing Costs

Closing costs are fees associated with the home-buying process, and they can add up quickly. These costs may include:

- Origination fees

- Appraisal fees

- Inspection fees

- Title insurance and escrow fees

Tip 5: Work with a Reputable Lender

Choosing the right lender can make all the difference in your mortgage experience. A reputable lender will:

- Offer competitive interest rates

- Provide excellent customer service

- Be transparent about fees and terms

📝 Note: When working with a lender, make sure to ask about any additional fees or charges associated with the mortgage.

As you embark on your mortgage journey, remember that knowledge is power. By understanding the mortgage landscape and following these valuable tips, you’ll be well-equipped to make informed decisions and secure the best mortgage for your needs. With patience, persistence, and the right guidance, you’ll be on your way to owning your dream home in no time. The key is to stay informed, plan carefully, and always keep your long-term financial goals in mind.

What is the difference between a fixed-rate and adjustable-rate mortgage?

+

A fixed-rate mortgage offers a fixed interest rate for the life of the loan, while an adjustable-rate mortgage has a lower initial interest rate that may adjust over time.

How do I improve my credit score to qualify for a better mortgage rate?

+

To improve your credit score, pay your bills on time, keep your credit utilization ratio below 30%, monitor your credit report for errors, and avoid applying for multiple credit cards or loans.

What are closing costs, and how much can I expect to pay?

+

Closing costs are fees associated with the home-buying process and can range from 2% to 5% of the purchase price. These costs may include origination fees, appraisal fees, inspection fees, and title insurance and escrow fees.