Quarterly Paperwork for Corporations

Introduction to Quarterly Paperwork for Corporations

As a corporation, managing paperwork is an essential part of maintaining compliance with regulatory requirements and ensuring the smooth operation of the business. Quarterly paperwork, in particular, plays a crucial role in this process. In this article, we will delve into the world of quarterly paperwork for corporations, exploring its importance, key components, and best practices for effective management.

Importance of Quarterly Paperwork

Quarterly paperwork is vital for corporations as it helps them stay on top of their financial and operational performance. Regular reviews of financial statements, tax returns, and other essential documents enable businesses to identify areas of improvement, make informed decisions, and avoid potential pitfalls. Moreover, timely submission of quarterly paperwork helps corporations avoid penalties and fines associated with late or incomplete filings.

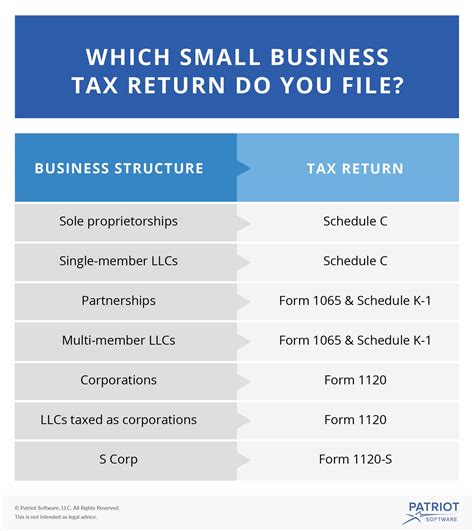

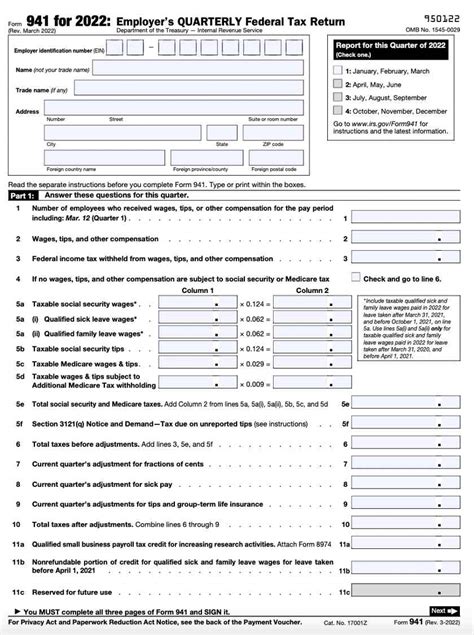

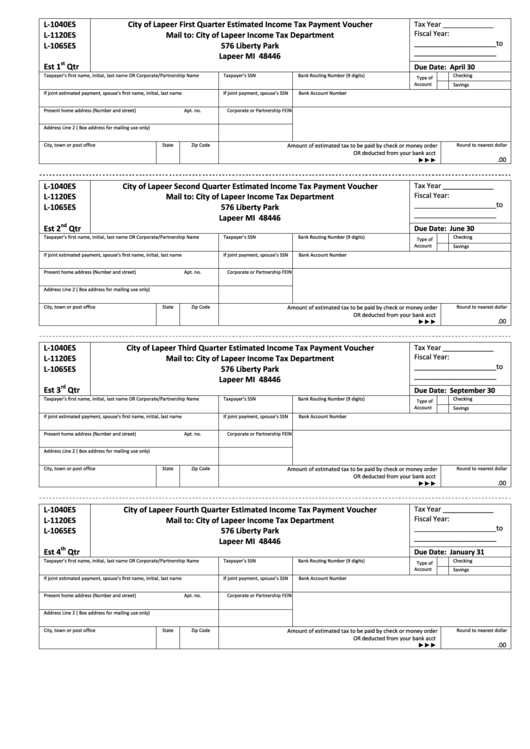

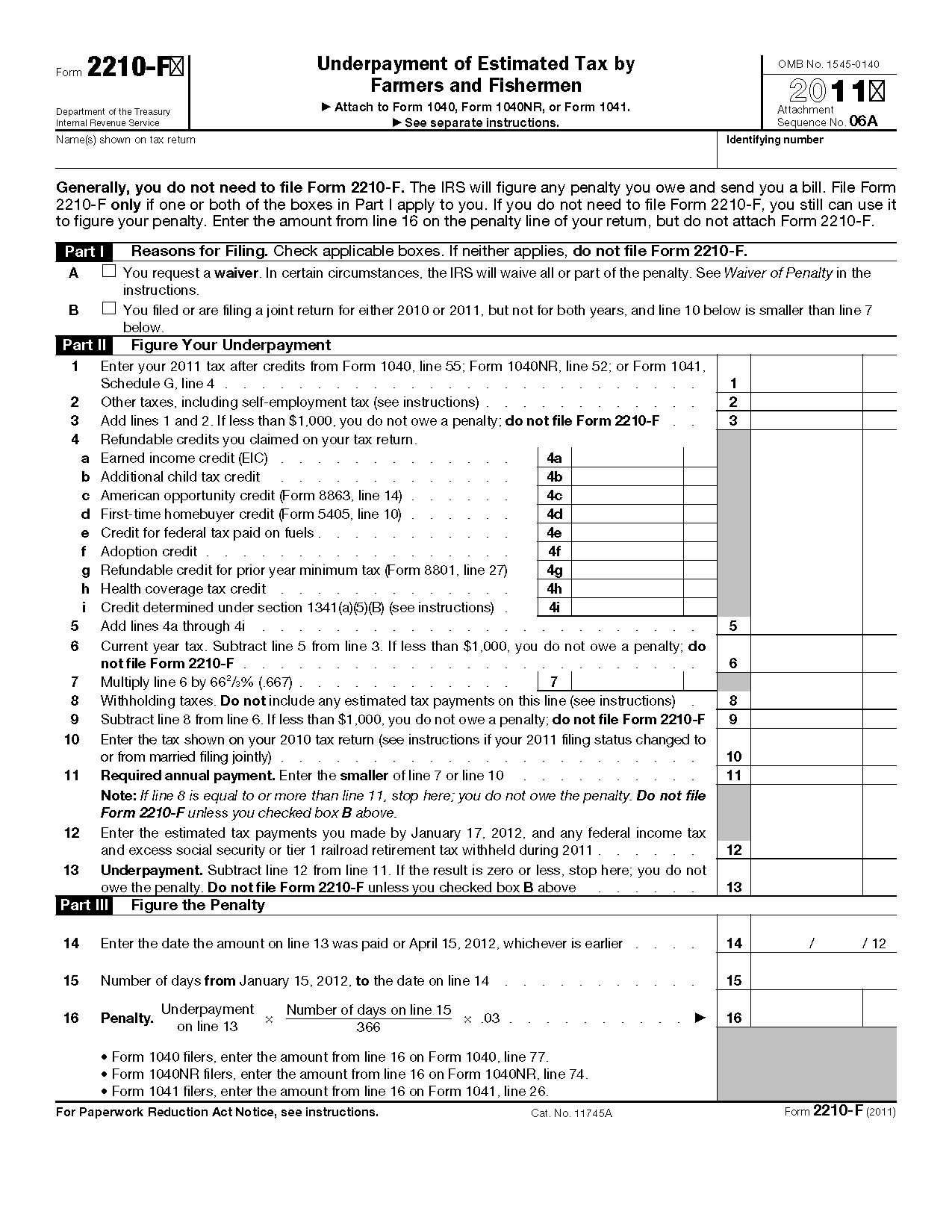

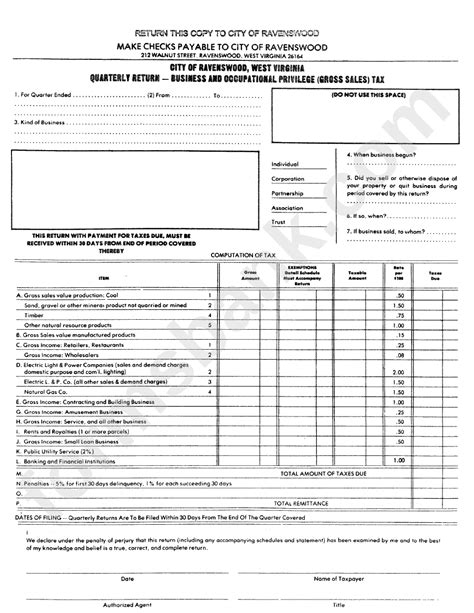

Key Components of Quarterly Paperwork

The key components of quarterly paperwork for corporations typically include: * Financial statements: Balance sheets, income statements, and cash flow statements that provide a snapshot of the company’s financial performance. * Tax returns: Quarterly tax returns, such as Form 941, that report employment taxes and other withholding taxes. * Compliance reports: Reports that demonstrate compliance with regulatory requirements, such as environmental or labor laws. * Board meeting minutes: Records of board meetings that outline discussions, decisions, and actions taken by the board of directors.

Best Practices for Managing Quarterly Paperwork

To effectively manage quarterly paperwork, corporations should adopt the following best practices: * Establish a schedule: Create a calendar that outlines the deadlines for submitting quarterly paperwork. * Designate a responsible person: Assign a specific person or team to oversee the preparation and submission of quarterly paperwork. * Use technology: Leverage software and digital tools to streamline the paperwork process, reduce errors, and improve efficiency. * Review and revise: Regularly review and revise quarterly paperwork to ensure accuracy, completeness, and compliance with regulatory requirements.

Challenges and Opportunities

While quarterly paperwork can be a daunting task, it also presents opportunities for corporations to improve their operations and enhance their compliance. By embracing digital technologies and implementing effective management practices, corporations can reduce the burden of quarterly paperwork and focus on driving growth and innovation.

Tools and Resources

To help corporations manage their quarterly paperwork, there are various tools and resources available, including: * Accounting software: Programs like QuickBooks or Xero that simplify financial statement preparation and tax return filing. * Compliance management software: Solutions like Thomson Reuters or Wolters Kluwer that provide regulatory updates, compliance guidance, and reporting tools. * Consulting services: Professional services firms that offer expertise in financial reporting, tax planning, and compliance management.

| Tool/Resource | Description |

|---|---|

| Accounting software | Streamlines financial statement preparation and tax return filing |

| Compliance management software | Provides regulatory updates, compliance guidance, and reporting tools |

| Consulting services | Offers expertise in financial reporting, tax planning, and compliance management |

📝 Note: Corporations should carefully evaluate their specific needs and select tools and resources that align with their goals and objectives.

As we move forward in the ever-changing landscape of corporate compliance, it is essential for businesses to prioritize effective management of quarterly paperwork. By doing so, they can ensure regulatory compliance, improve their financial performance, and drive growth and innovation. Ultimately, the key to success lies in embracing digital technologies, implementing best practices, and leveraging tools and resources to streamline the quarterly paperwork process.

In wrapping up our discussion on quarterly paperwork for corporations, we can see that it is a critical aspect of maintaining compliance and driving business success. By understanding the importance of quarterly paperwork, key components, and best practices for management, corporations can navigate the complex regulatory landscape with confidence. As the business environment continues to evolve, it is crucial for corporations to stay adaptable, innovative, and focused on effective management of quarterly paperwork.

What is the purpose of quarterly paperwork for corporations?

+

The purpose of quarterly paperwork is to ensure regulatory compliance, review financial performance, and make informed decisions to drive business growth and innovation.

What are the key components of quarterly paperwork for corporations?

+

The key components of quarterly paperwork include financial statements, tax returns, compliance reports, and board meeting minutes.

How can corporations effectively manage quarterly paperwork?

+

Corporations can effectively manage quarterly paperwork by establishing a schedule, designating a responsible person, using technology, and regularly reviewing and revising their paperwork process.