5 Steps To File Adoption Tax Credit

Understanding the Adoption Tax Credit

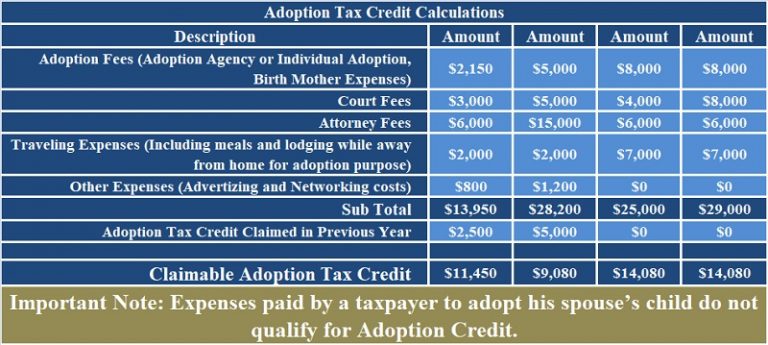

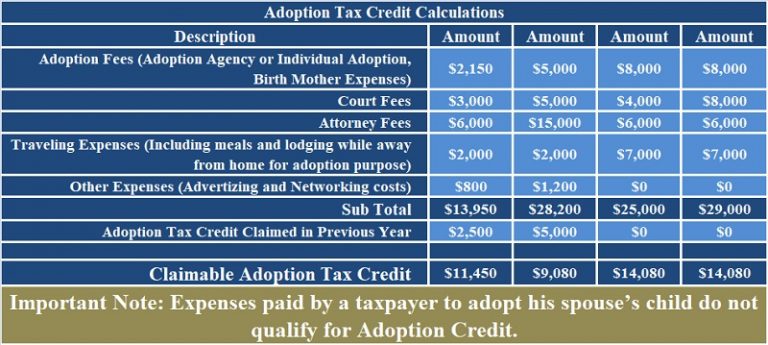

The Adoption Tax Credit is a tax credit provided by the government to help families offset the costs associated with adopting a child. This credit can be claimed for each child adopted, and it includes a wide range of expenses, such as adoption fees, court costs, and travel expenses. The credit is designed to make adoption more affordable for families, and it can be a significant help in reducing the financial burden of the adoption process.

Step 1: Determine Eligibility

To claim the Adoption Tax Credit, families must first determine if they are eligible. Eligibility is based on the type of adoption, the age and special needs of the child, and the family’s income level. International adoptions, domestic private adoptions, and foster care adoptions are all eligible for the credit. However, the credit may be subject to income limits, and families with higher incomes may be phased out of the credit. It’s essential to review the eligibility requirements carefully to ensure that the adoption qualifies for the credit.

Step 2: Gather Required Documents

To claim the Adoption Tax Credit, families will need to gather various documents to support their claim. These documents may include: * Adoption decree or finalization documents * Receipts for adoption-related expenses * Court documents and filings * Travel itineraries and receipts (if applicable) * Agency invoices and payment records It’s crucial to keep accurate and detailed records of all adoption-related expenses, as these will be required to support the credit claim.

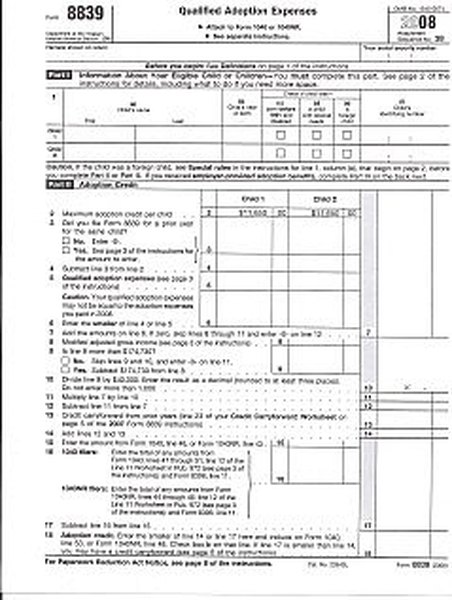

Step 3: Complete Form 8839

To claim the Adoption Tax Credit, families will need to complete Form 8839, which is the Adoption Credit form. This form requires detailed information about the adoption, including the type of adoption, the age and special needs of the child, and the adoption-related expenses incurred. The form also requires documentation to support the credit claim, such as receipts and court documents. It’s essential to complete the form carefully and accurately, as errors or omissions can delay or disallow the credit.

Step 4: Claim the Credit on Tax Return

Once Form 8839 is complete, families can claim the Adoption Tax Credit on their tax return. The credit is claimed on Form 1040, and it’s essential to follow the instructions carefully to ensure that the credit is claimed correctly. The credit can be claimed for the tax year in which the adoption was finalized, and it can be carried forward for up to five years if the credit exceeds the family’s tax liability.

Step 5: Review and Submit

Finally, families should review their tax return and Form 8839 carefully to ensure that all information is accurate and complete. It’s essential to submit the tax return and supporting documents on time to avoid delays or penalties. Families can submit their tax return electronically or by mail, and they should keep a copy of their return and supporting documents for their records.

📝 Note: Families should consult with a tax professional or the IRS directly if they have questions or concerns about claiming the Adoption Tax Credit.

The Adoption Tax Credit can be a significant help to families adopting a child, and following these steps can help ensure that the credit is claimed correctly. By understanding the eligibility requirements, gathering required documents, completing Form 8839, claiming the credit on their tax return, and reviewing and submitting their tax return, families can navigate the process with confidence.

In terms of the benefits of the Adoption Tax Credit, it’s essential to consider the following: * The credit can be up to $14,300 per child for qualified adoption expenses * The credit is refundable, meaning that families can receive a refund even if the credit exceeds their tax liability * The credit can be carried forward for up to five years if it exceeds the family’s tax liability

To illustrate the process, consider the following example:

| Adoption Type | Adoption Expenses | Credit Claimed |

|---|---|---|

| International Adoption | 20,000</td> <td>14,300 | |

| Domestic Private Adoption | 15,000</td> <td>14,300 | |

| Foster Care Adoption | 10,000</td> <td>10,000 |

As families navigate the adoption process, it’s essential to keep in mind the various expenses and costs associated with adoption. The Adoption Tax Credit can help offset these costs, making it more affordable for families to adopt a child. By following the steps outlined above and consulting with a tax professional or the IRS as needed, families can ensure that they claim the credit correctly and receive the benefits they are eligible for.

In the end, the Adoption Tax Credit is an essential resource for families adopting a child, and understanding the process can help make the adoption journey more manageable. By taking the time to review the eligibility requirements, gather required documents, complete Form 8839, claim the credit on their tax return, and review and submit their tax return, families can navigate the process with confidence and receive the benefits they are eligible for.

What is the Adoption Tax Credit?

+

The Adoption Tax Credit is a tax credit provided by the government to help families offset the costs associated with adopting a child.

How do I claim the Adoption Tax Credit?

+

To claim the Adoption Tax Credit, families must complete Form 8839 and claim the credit on their tax return (Form 1040).

What expenses are eligible for the Adoption Tax Credit?

+

Eligible expenses for the Adoption Tax Credit include adoption fees, court costs, travel expenses, and other adoption-related expenses.