Tax Forms for College Withdrawal Payments

Understanding Tax Forms for College Withdrawal Payments

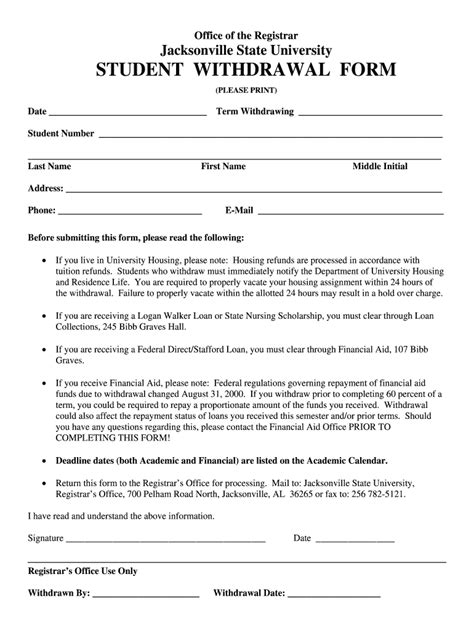

When a student withdraws from college, they may be eligible for a refund of a portion of their tuition and fees. However, these refunds can have tax implications, and it’s essential to understand the tax forms involved in the process. In this article, we will delve into the world of tax forms for college withdrawal payments, exploring the different types of forms, how to report refunds, and the potential tax implications.

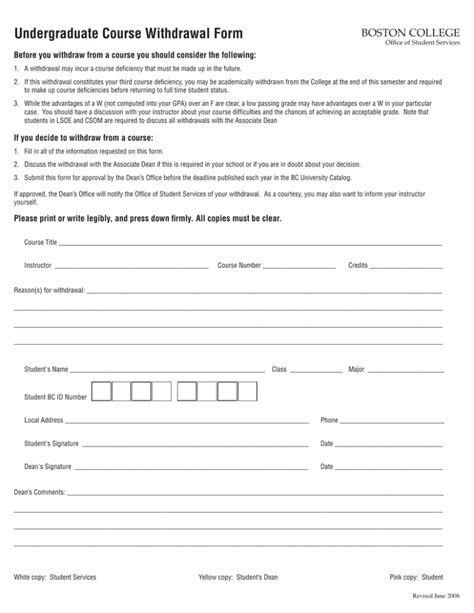

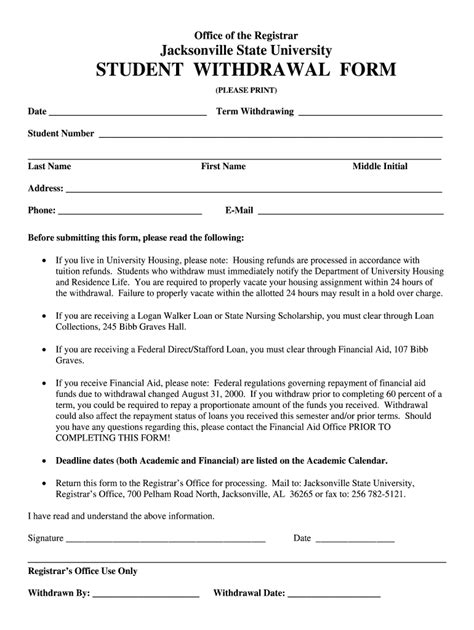

Types of Tax Forms for College Withdrawal Payments

There are several tax forms that may be involved when a student withdraws from college and receives a refund. The most common forms include: * Form 1098-T: This form is used to report tuition payments and refunds. Colleges and universities are required to provide this form to students who paid qualified tuition and related expenses. * Form W-2: If a student received a refund of a payment that was originally made with financial aid, such as a scholarship or grant, they may receive a Form W-2 to report the refund as income. * Form 1040: Students who receive a refund may need to report it on their tax return using Form 1040.

How to Report Refunds on Tax Forms

When reporting a refund on tax forms, it’s essential to understand the specific instructions for each form. Here are some general guidelines: * On Form 1098-T, the college or university will report the amount of tuition paid and any refunds made during the tax year. * On Form W-2, the refund will be reported as income, and the student will need to report it on their tax return. * On Form 1040, the student will need to report the refund as income and claim any applicable deductions or credits.

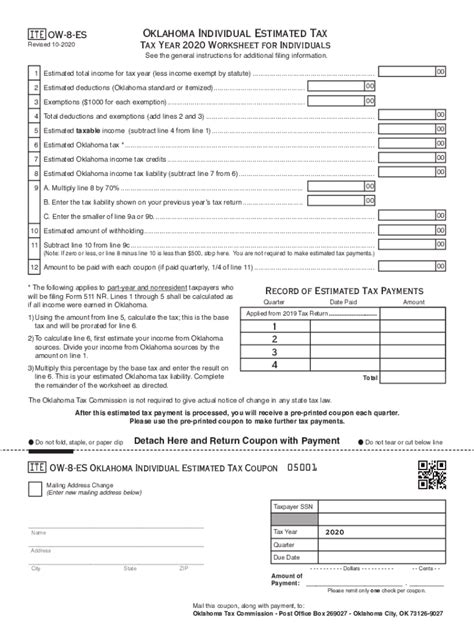

Potential Tax Implications of College Withdrawal Payments

College withdrawal payments can have significant tax implications, and it’s essential to understand the potential consequences. Here are some key points to consider: * Taxable income: Refunds of tuition payments may be considered taxable income, and students may need to report them on their tax return. * Deductions and credits: Students may be eligible for deductions or credits for education expenses, such as the American Opportunity Tax Credit or the Lifetime Learning Credit. * Penalties and interest: If a student fails to report a refund or claims an incorrect deduction or credit, they may be subject to penalties and interest.

📝 Note: It's essential to consult with a tax professional or financial advisor to ensure accurate reporting and minimize potential tax implications.

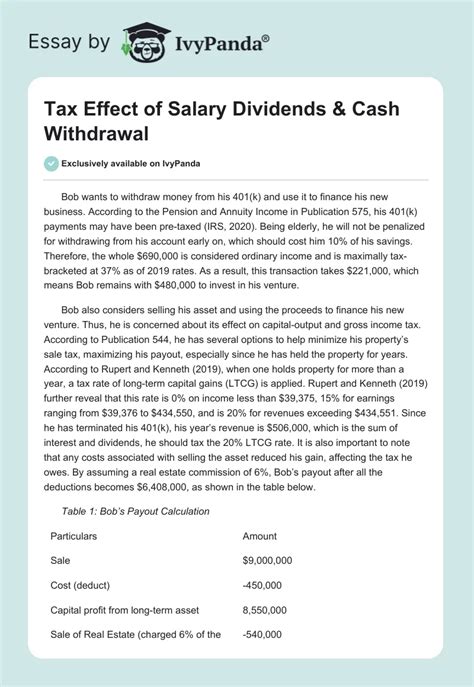

Example Scenarios

To illustrate the tax implications of college withdrawal payments, let’s consider a few example scenarios: * Scenario 1: A student pays 10,000 in tuition and fees for the fall semester but withdraws from college in October. The college refunds 8,000 of the tuition payment. The student will receive a Form 1098-T reporting the 10,000 payment and the 8,000 refund. They will need to report the refund as income on their tax return. * Scenario 2: A student receives a 5,000 scholarship to attend college but withdraws from college after one semester. The college refunds 2,000 of the scholarship amount. The student will receive a Form W-2 reporting the $2,000 refund as income. They will need to report the refund on their tax return and may be eligible for deductions or credits for education expenses.

| Form | Purpose | Reporting Requirements |

|---|---|---|

| Form 1098-T | Tuition payments and refunds | Colleges and universities must provide to students who paid qualified tuition and related expenses |

| Form W-2 | Refunds of financial aid payments | Students who receive a refund of a payment originally made with financial aid |

| Form 1040 | Reporting refunds as income | Students who receive a refund must report it on their tax return |

In summary, tax forms for college withdrawal payments can be complex, and it’s essential to understand the different types of forms, how to report refunds, and the potential tax implications. By consulting with a tax professional or financial advisor, students can ensure accurate reporting and minimize potential tax implications.

What is Form 1098-T, and how is it used to report college withdrawal payments?

+

Form 1098-T is used to report tuition payments and refunds. Colleges and universities are required to provide this form to students who paid qualified tuition and related expenses. The form will report the amount of tuition paid and any refunds made during the tax year.

How do I report a refund of a tuition payment on my tax return?

+

You will need to report the refund as income on your tax return using Form 1040. You may also be eligible for deductions or credits for education expenses, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

What are the potential tax implications of receiving a refund of a tuition payment?

+

The potential tax implications of receiving a refund of a tuition payment include taxable income, deductions, and credits. You may need to report the refund as income on your tax return, and you may be eligible for deductions or credits for education expenses. However, if you fail to report the refund or claim an incorrect deduction or credit, you may be subject to penalties and interest.