Paperwork

Bankruptcy Signing Requirements

Understanding Bankruptcy Signing Requirements

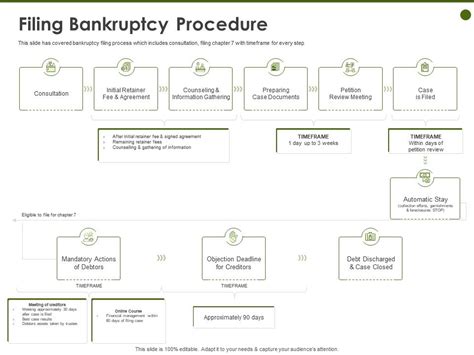

When individuals or businesses face financial difficulties, bankruptcy can be a viable option to explore. However, the process of filing for bankruptcy involves several critical steps, one of which is understanding and meeting the bankruptcy signing requirements. These requirements are designed to ensure that all parties involved are aware of the implications of bankruptcy and that the process is initiated with full knowledge and consent.

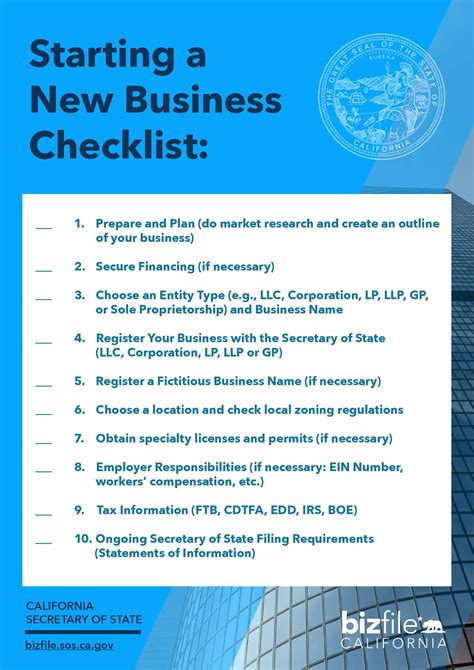

Overview of Bankruptcy Types

Before diving into the signing requirements, it’s essential to have a basic understanding of the main types of bankruptcy. In the United States, the most common types for individuals are Chapter 7 (liquidation bankruptcy) and Chapter 13 (reorganization bankruptcy). Businesses might also consider Chapter 11 (reorganization) or Chapter 7. Each chapter has its own set of rules and requirements, including those related to the signing of documents.

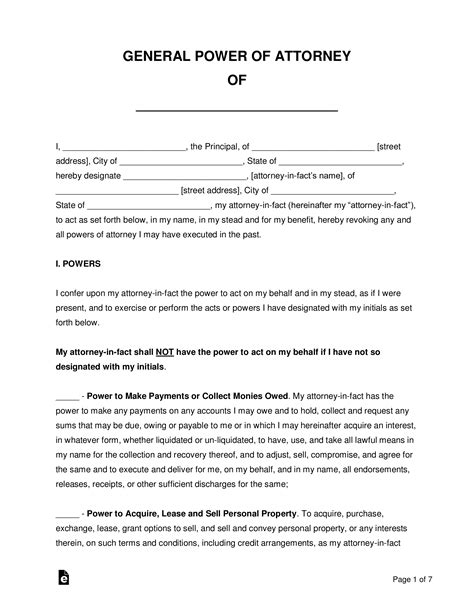

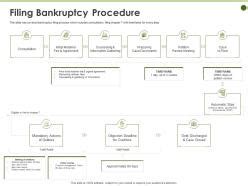

Signing Requirements for Bankruptcy Petitions

The signing of a bankruptcy petition is a crucial step in the bankruptcy process. This document, once signed, is submitted to the bankruptcy court and signifies the official start of the bankruptcy proceedings. The petition must be signed by the debtor(s), which could be an individual or individuals, or an authorized representative of a business. The signature(s) confirm that the information provided in the petition is true and accurate to the best of the debtor’s knowledge.

Electronic Signatures in Bankruptcy Filings

With advancements in technology, the use of electronic signatures has become more prevalent in legal proceedings, including bankruptcy filings. However, the acceptance of electronic signatures can vary depending on the court and the specific circumstances of the case. It’s crucial for debtors to verify with their attorney or the bankruptcy court whether electronic signatures are acceptable for their bankruptcy petition and related documents.

Verification of Bankruptcy Documents

In addition to signing the bankruptcy petition, debtors are required to verify the accuracy of the information contained within it. This is typically done under penalty of perjury, emphasizing the importance of ensuring that all details are correct and complete. The verification process may involve signing a declaration or affidavit that accompanies the petition.

Role of Bankruptcy Attorneys

Given the complexity of bankruptcy laws and the significance of the signing requirements, it’s highly recommended that individuals or businesses considering bankruptcy consult with a bankruptcy attorney. An attorney can provide guidance on the appropriate type of bankruptcy to file, assist in preparing the necessary documents, and ensure that all signing requirements are met. Their expertise can help navigate the bankruptcy process more efficiently and reduce the risk of errors or omissions that could delay or even dismiss the case.

Implications of Inaccurate or Incomplete Signings

Failure to comply with the signing requirements or providing inaccurate information can have severe consequences. These may include the dismissal of the bankruptcy case, fines, or even criminal charges in cases of fraud. It’s essential for debtors to understand the gravity of the signatures they provide and to seek professional advice to avoid any potential pitfalls.

Additional Documentation and Signatures

Beyond the initial petition, there may be additional documents that require signatures throughout the bankruptcy process. These could include plans for reorganization, motions to sell property, or responses to creditor objections. Each of these documents plays a critical role in the progression of the case and must be handled with the same care and attention to detail as the initial petition.

Conclusion and Final Thoughts

In summary, the signing requirements for bankruptcy are a critical aspect of the process, ensuring that debtors are fully aware of the implications of their actions and that the legal system can proceed with confidence in the integrity of the information provided. By understanding these requirements and seeking the advice of a qualified bankruptcy attorney, individuals and businesses can navigate the complex world of bankruptcy with greater ease and assurance.

What are the main types of bankruptcy in the United States?

+

The main types of bankruptcy in the United States are Chapter 7 (liquidation bankruptcy), Chapter 13 (reorganization bankruptcy for individuals), and Chapter 11 (reorganization bankruptcy for businesses).

Do I need an attorney to file for bankruptcy?

+

While it’s possible to file for bankruptcy without an attorney, it’s highly recommended to seek professional advice due to the complexity of bankruptcy laws and the potential consequences of errors or omissions in the filing process.

Can I use an electronic signature for my bankruptcy petition?

+

The acceptance of electronic signatures can vary depending on the court and the specific circumstances of the case. It’s best to verify with your attorney or the bankruptcy court whether electronic signatures are acceptable for your bankruptcy petition and related documents.