5 Mortgage Paperwork Tips

Understanding the Mortgage Paperwork Process

When navigating the process of purchasing a home, one of the most daunting tasks can be understanding and completing the mortgage paperwork. This process is complex and involves a significant amount of documentation, which can be overwhelming for first-time homebuyers and experienced buyers alike. However, with the right approach and knowledge, it’s possible to make this process smoother and less stressful. In this article, we’ll delve into the world of mortgage paperwork, exploring what it entails, and most importantly, providing you with 5 mortgage paperwork tips to ensure you’re well-prepared for this critical step in your home buying journey.

The Importance of Mortgage Paperwork

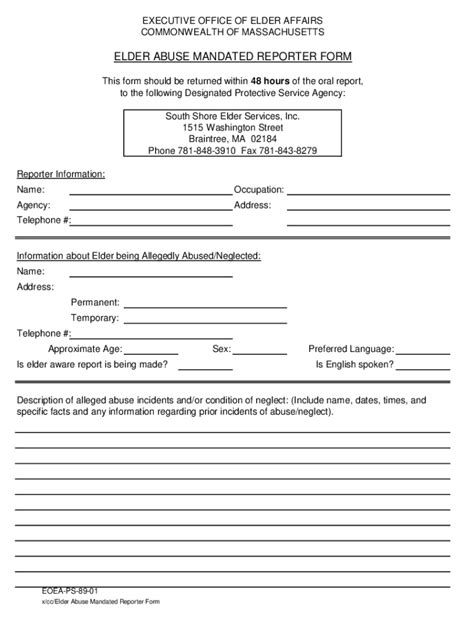

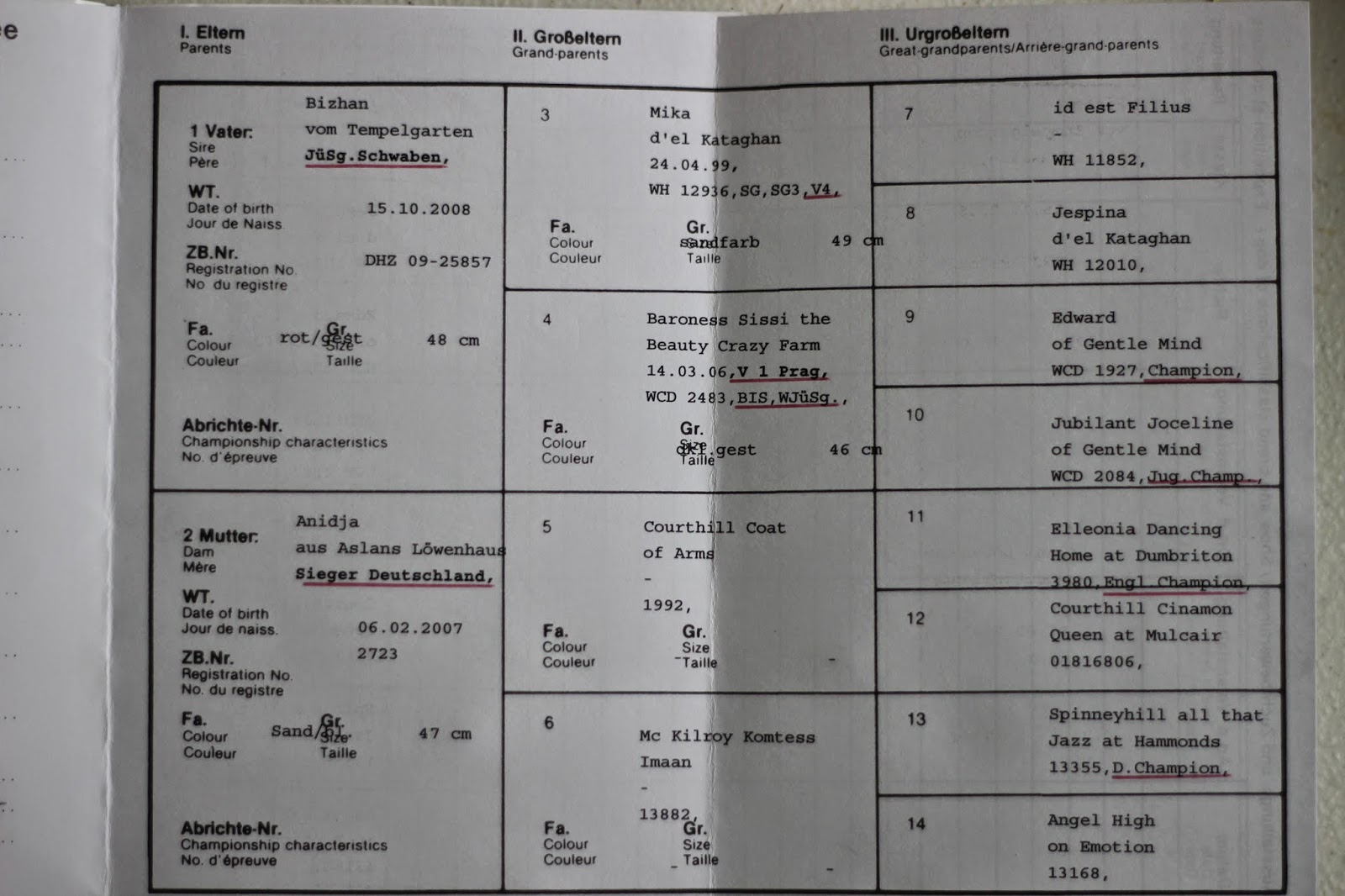

Mortgage paperwork is the backbone of the home buying process. It involves a vast array of documents that verify your identity, income, employment, creditworthiness, and other financial factors. This paperwork is crucial as it helps lenders assess the risk of lending to you and ensures that you’re not taking on more debt than you can handle. The documentation required can vary depending on the lender and the type of mortgage you’re applying for, but common documents include pay stubs, bank statements, tax returns, and identification documents.

Breaking Down the Mortgage Paperwork Process

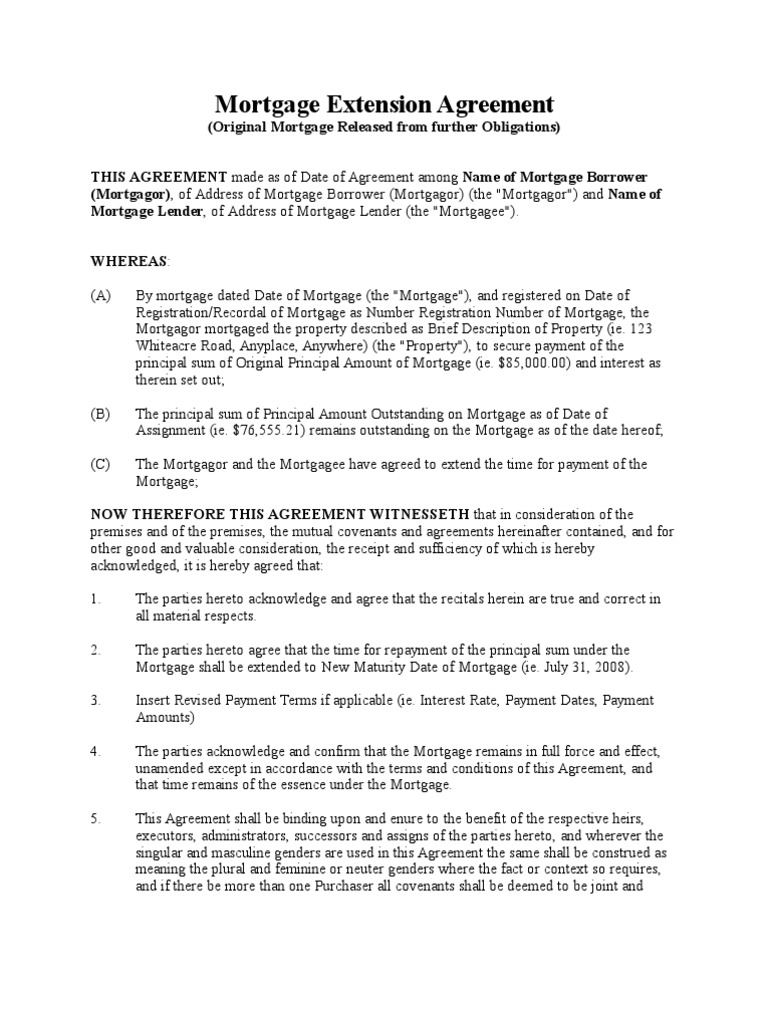

The mortgage paperwork process can be broken down into several key stages: - Pre-approval: This is the initial stage where you provide financial information to a lender to find out how much they are willing to lend you. - Application: After finding a home, you’ll submit a formal mortgage application, which involves providing detailed financial information. - Processing: The lender reviews your application and orders an appraisal of the property. - Underwriting: A thorough review of your creditworthiness and the property’s value. - Closing: The final stage where the mortgage is finalized, and you sign all the necessary documents to complete the purchase.

5 Mortgage Paperwork Tips

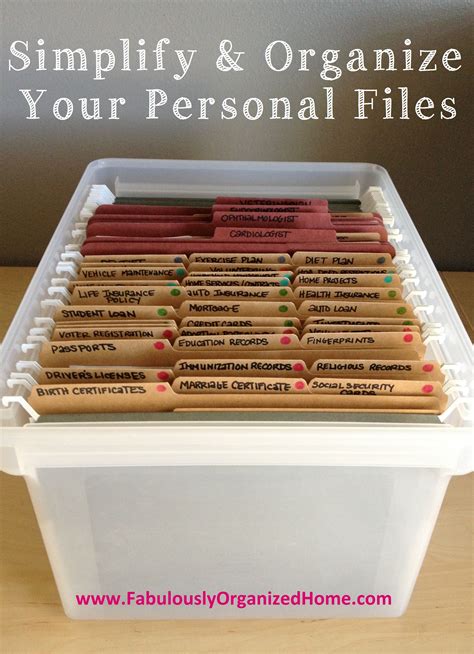

Given the complexity of the mortgage paperwork process, having the right strategies can make a significant difference. Here are five tips to help you navigate this process effectively: - Gather documents in advance: Start collecting the necessary documents early. This includes pay stubs, W-2 forms, bank statements, and any other financial documents that may be required. Having everything ready can speed up the process and reduce last-minute stress. - Understand your credit report: Your credit score plays a crucial role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. Check your credit report for any errors and work on improving your credit score if necessary. - Choose the right lender: Not all lenders are the same. Some may offer more competitive rates or better terms. It’s essential to shop around and compare different lenders to find the one that best suits your needs. - Read and understand the terms: Before signing any documents, make sure you understand all the terms and conditions of your mortgage. This includes the interest rate, repayment terms, and any penalties for early repayment. - Seek professional advice: If you’re unsure about any aspect of the mortgage paperwork process, consider seeking advice from a financial advisor or mortgage broker. They can provide valuable guidance and help you make informed decisions.

Additional Considerations

In addition to the tips above, it’s also important to be aware of the following: - Fees associated with mortgage applications: There are various fees involved in the mortgage application process, including application fees, appraisal fees, and closing costs. Understanding these fees can help you plan your finances more effectively. - Changes in financial situation: If there are any changes in your financial situation during the application process, such as a change in job or a reduction in income, it’s crucial to inform your lender as soon as possible.

💡 Note: Keeping open communication with your lender throughout the process can help prevent delays or complications.

Embracing Technology in Mortgage Applications

The digital age has transformed the way mortgage applications are processed. Many lenders now offer online platforms where you can upload your documents, track the status of your application, and even sign documents electronically. Embracing these technological advancements can make the process more efficient and convenient.

| Document | Description |

|---|---|

| Pay Stubs | Proof of income |

| Bank Statements | Proof of savings and assets |

| Tax Returns | Verification of income and financial status |

In the end, navigating the mortgage paperwork process requires patience, preparation, and a thorough understanding of what’s involved. By following the tips outlined above and staying informed, you can ensure that your journey to homeownership is as smooth and stress-free as possible. Remember, the key to success lies in being proactive, seeking professional advice when needed, and understanding the intricacies of the mortgage paperwork process. With the right mindset and strategies, you’ll be well on your way to securing your dream home.

What documents are typically required for a mortgage application?

+

Typically, you’ll need to provide documents such as pay stubs, bank statements, tax returns, and identification documents. The exact requirements can vary depending on the lender and the type of mortgage.

How long does the mortgage application process usually take?

+

The length of time can vary, but on average, it takes around 30 to 60 days from application to closing. This timeframe can be influenced by the complexity of the application and the efficiency of the lender.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications. This can make the process more convenient and faster, as you can upload your documents and track your application online.